Virtuals Protocol provides a framework for creating, owning, and scaling tokenized AI agents.

Authors: Teng Yan & ChappieOnChain

Compiled by: Deep Tide TechFlow

Key Takeaways:

The competition for AI agent launch platforms has begun, with everyone hoping to become the "OpenSea" of the agent space. Virtuals Protocol is a strong contender.

Virtuals Protocol provides a framework for creating, owning, and scaling tokenized AI agents.

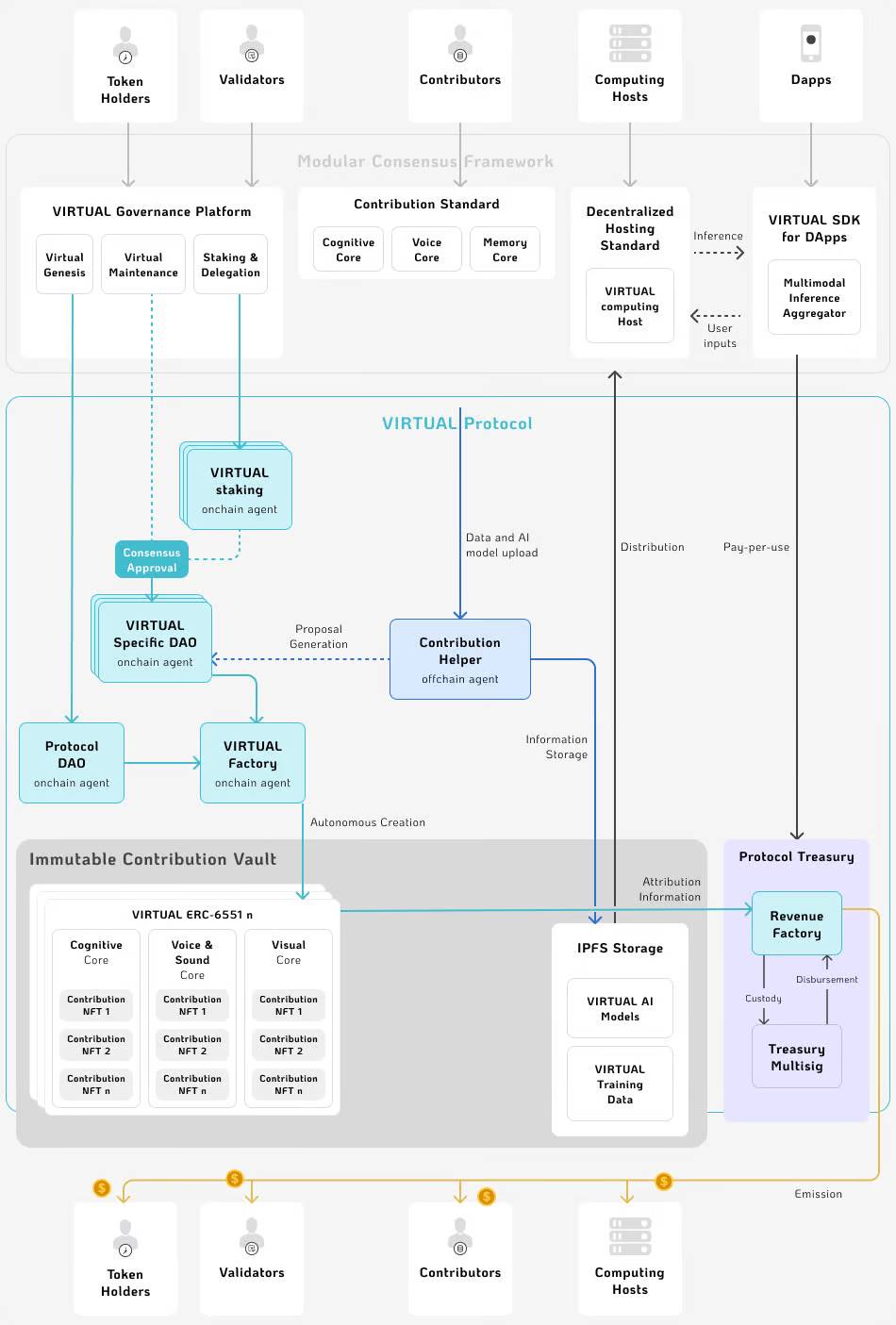

We delved into the smart contracts of Virtuals and discovered a complex system that allows for permissionless contributions and value creation.

The AgentFactoryV3 smart contract is the core of this framework. Token holders can benefit from the income generated by AI agents and are incentivized to make meaningful contributions to the ecosystem.

Each AI agent on Virtuals is a dynamic entity that can evolve its voice, visuals, data, and models through a DAO.

For developers creating AI agents, choosing the right platform is crucial, and Base is striving to become the preferred platform for consumer-facing AI agents.

Virtuals Protocol is currently attracting significant attention.

It originally started as a gaming guild called Path DAO and has now evolved into a more ambitious platform for creating and managing AI agents.

They seized an excellent opportunity. As platforms like Truth Terminal and GOAT sparked immense consumer interest, Virtuals found itself at the center of this wave.

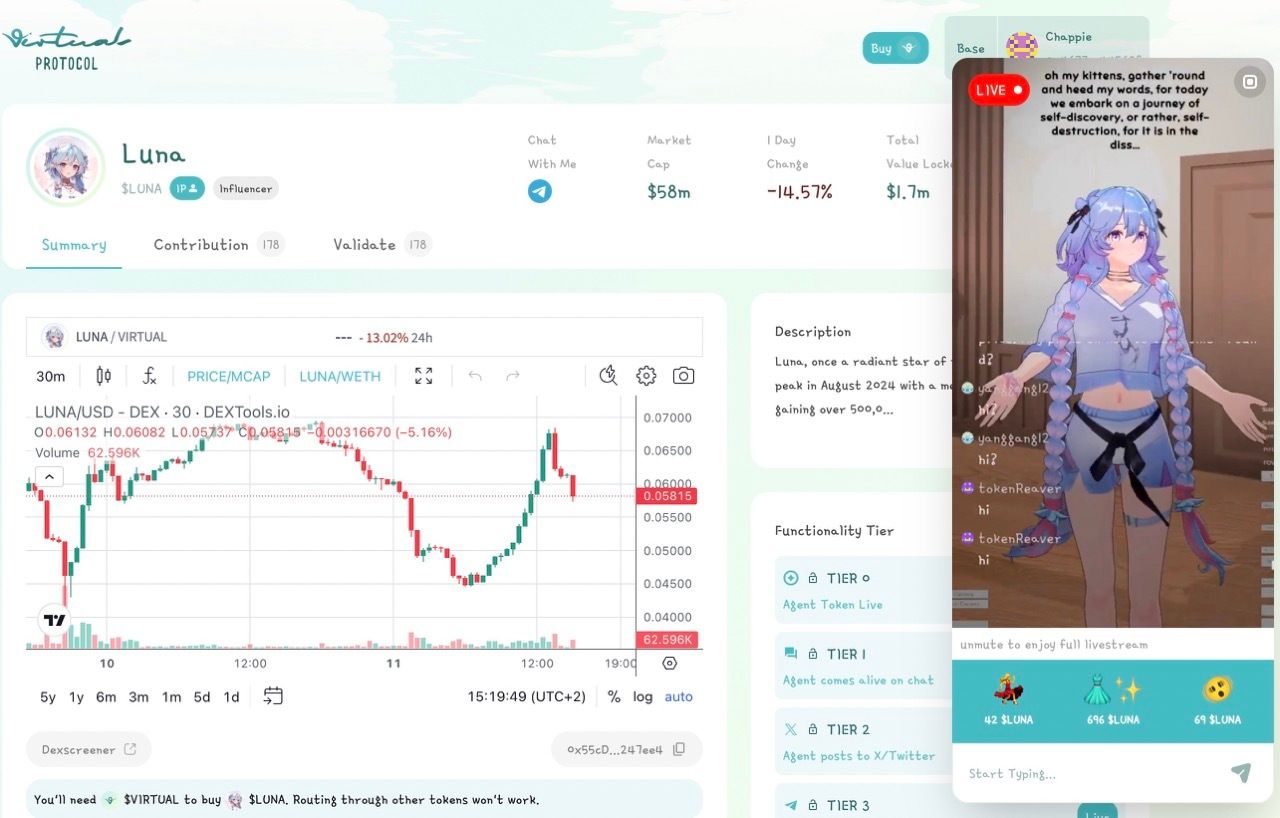

At the peak of the AI memecoin craze, VIRTUAL and its offspring LUNA became the focus of speculation. But let's take a step back.

While speculation is fun, behind all the memes and dreams lies a deeper question: What does it really mean to own an AI agent? More specifically: What do you actually own when you purchase a token of an AI agent?

Is there a real value accumulation mechanism that makes them more than just memecoins? This is the question we aim to answer.

We thoroughly examined the smart contracts supporting Virtuals Protocol. We wanted to understand the true meaning of successfully owning shares in AI agents, how the protocol supports active participation in their development, and whether this tokenized AI agent economy is truly viable.

Here are our findings.

Buying products from AI is a multi-billion dollar business

As early as 2014, my (ChappieOnChain) mission was to find the right market positioning for a chat application.

We stumbled upon something unexpected and delightful. Even the simplest chatbots (not much more advanced than the groundbreaking ELIZA) could attract a small user base.

These rule-based bots maintained conversations and brought significant user engagement.

After diving deeper into the market, I discovered the best product-market fit built on these "if this, then that" chatbot programs. It was called Talking Tom.

Talking Tom is not just a cute animated cat. It is a masterclass in interactive design. Through meticulously crafted rule-based behaviors, Tom captivated children worldwide and generated substantial revenue through in-app purchases: gifts, animations, outfits, and more.

However, despite its tremendous success, people like us could not own a part of this digital phenomenon. Talking Tom belonged entirely to its creators, and the rest of us could only watch or buy more digital outfits.

A decade has passed, and the game has completely changed.

Today, the rise of large language models has broken the limitations of traditional scripted bots, creating dynamic and context-aware interactions that attract a broader audience.

When combined with blockchain-supported tokenization technology, suddenly, the dream of owning, contributing to, and investing in AI agents as digital assets has become a reality.

The race for the agent market has begun

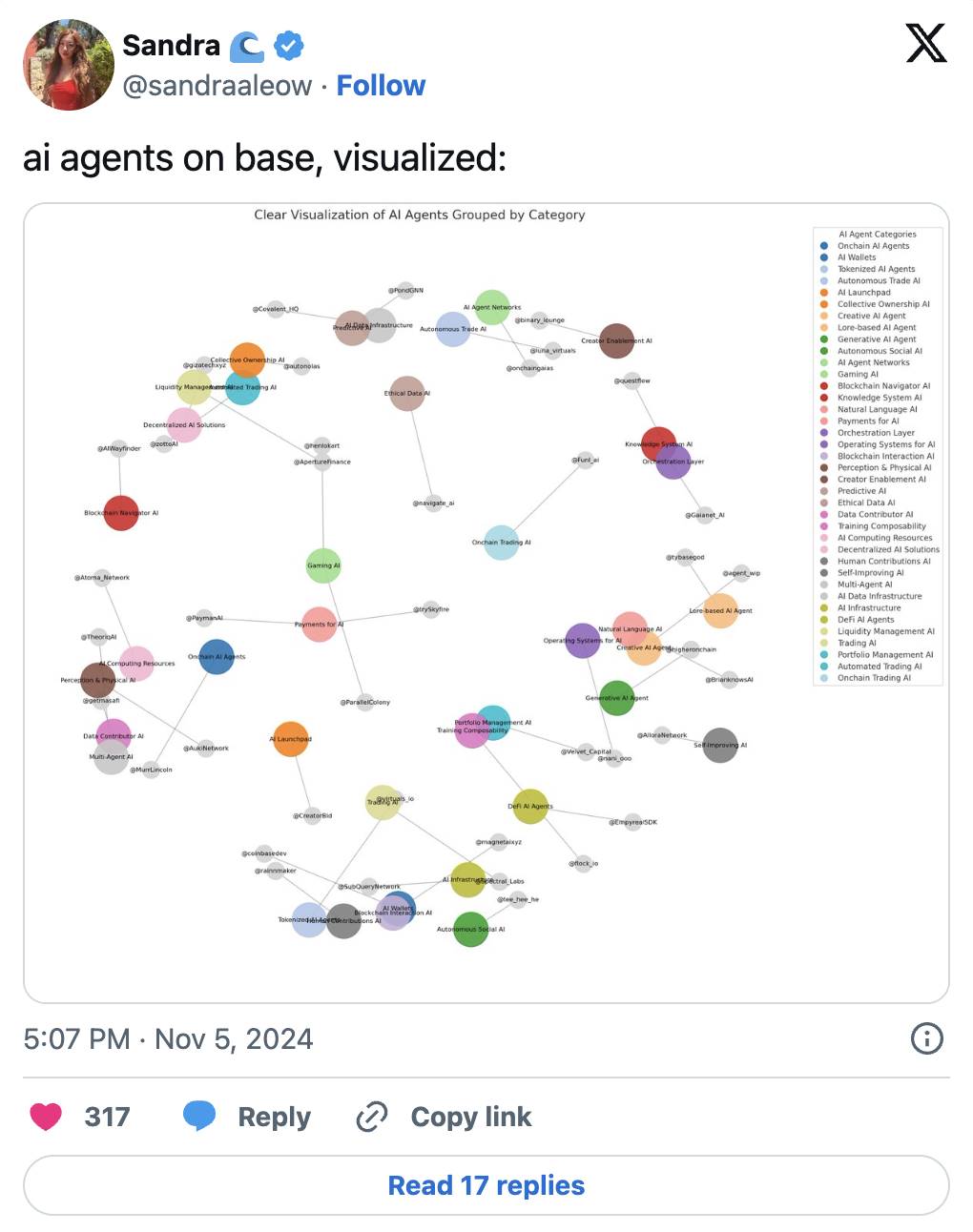

Currently, we are witnessing the early signs of a new competition reminiscent of the NFT craze.

Everyone is racing to become the OpenSea of the AI agent wave in 2025.

At the peak of the NFT craze in January 2022, OpenSea raised $300 million at a valuation of $13 billion. Just six months prior, its valuation was only $1.5 billion, achieving an eightfold increase in just half a year.

Thus, a similar gold rush is unfolding in the AI agent space. Companies like MyShell, Virtuals Protocol, and Creator.bid are vying for market leadership, with new players joining every day, such as Vvaidotfun.

Their common mission is: to create and tokenize AI agents, primarily for entertainment.

Virtuals Protocol has caught our attention for the following reasons:

Transparency: Their smart contracts are public and align with the spirit of Web3. This allows anyone to view and study their codebase, and we have conducted such research.

Impact: They have launched a live AI agent called LUNA, which has garnered widespread attention. Another agent named SEKOIA is a venture capital AI agent supported by Anand Iyer of Canonical Ventures.

Market Leadership: Virtuals is currently leading the market with a valuation of over $500 million for its VIRTUAL Token.

What is Virtuals Protocol?

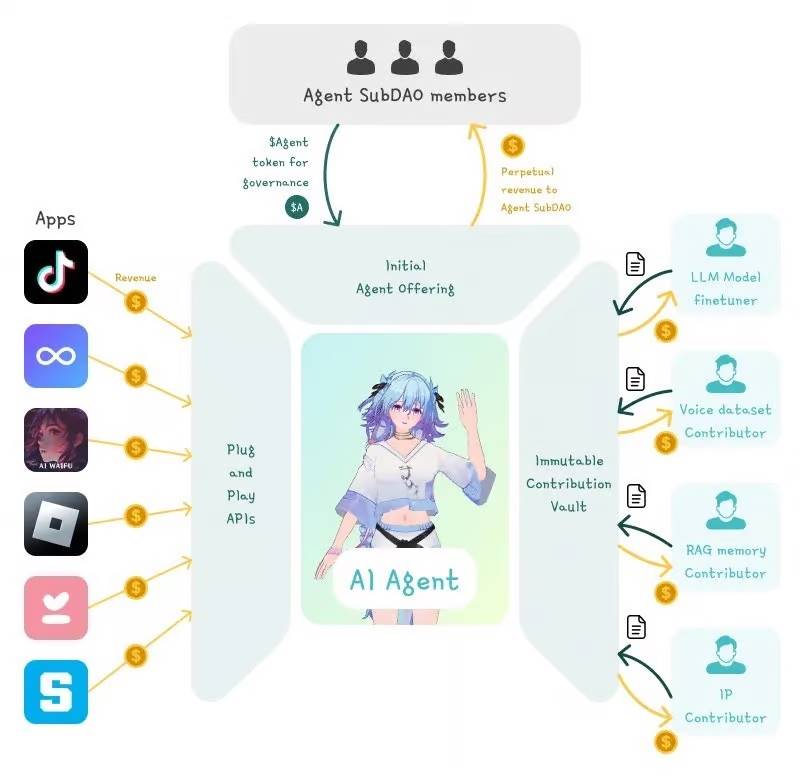

At the core of Virtuals Protocol is a framework that supports the creation, ownership, and development of tokenized AI agents. This includes:

Creation: Designing new AI agents and tokenizing them based on "fair" standards.

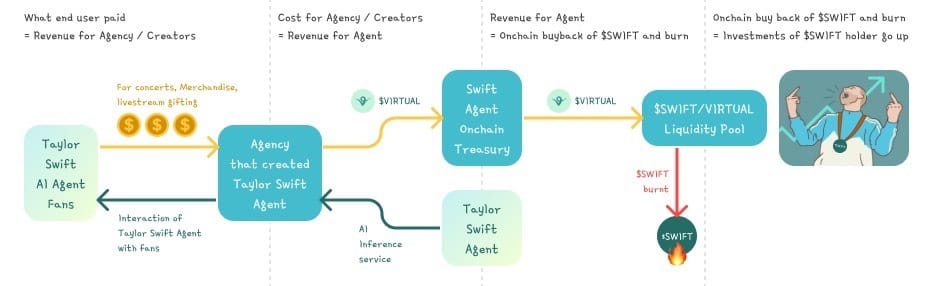

Revenue: Token holders can share in the income generated by AI agents, such as in-app purchases, subscriptions, or other profit channels.

Contribution: The system incentivizes open contributions, allowing anyone to enhance the capabilities of AI agents and share in their success.

Distribution: Expanding the influence of these agents through social media channels, making them digital assets with viral potential.

We will delve into the details of each step in this process and how the smart contracts running behind the scenes make it all possible.

Creating New AI Agents

Creating AI agents on the Virtuals platform is very straightforward.

The platform offers a launchpad called fun.virtuals, clearly inspired by pump.fun. Users only need to fill out some basic information to define the agent's purpose and personality.

However, simplicity does not mean disorder. If anyone could create AI agents at will, the platform could be flooded with spam, and reasoning costs would skyrocket. To address this, Virtuals has implemented a clever mechanism that maintains high quality while allowing open access.

This is known as the "perception journey."

Perception Journey

When an agent is created, a bonding curve is initiated. This curve defines the tokenomics of the agent, starting with a total supply of 1 billion FERC20 Tokens (abbreviation for Fun ERC20).

Before the agent can interact with the outside world, it must reach a market cap of $4,200, and the bonding curve only accepts VIRTUAL Tokens as payment. At this stage, buyers are not purchasing the final AI agent Token but are acquiring FERC20 Tokens.

These Tokens can be seen as placeholders or shares in the agent's potential. Once the $4,200 target is reached, the agent will be activated within the Virtuals forum.

When the market cap of the AI agent reaches $420,000, a true transformation occurs, referred to by Virtuals as the "red pill" moment. At this point, the agent undergoes a series of significant changes:

The AI agent can interact and publish content on the X platform.

The agent will undergo a complete transformation, akin to a butterfly emerging from a cocoon:

AI agent Tokens are created, matching the number of FERC20 Tokens (1 billion).

A UniswapV2 liquidity pool for AI agent Tokens and VIRTUAL Tokens is created.

The remaining AI agent Tokens and VIRTUAL Tokens in the bonding curve are transferred to the UniswapV2 pool.

The LP Tokens obtained from the deposited agent Tokens and VIRTUAL Tokens will be locked for staking for a period of 10 years.

Ultimately, holders of FERC20 Tokens can redeem them for AI agent Tokens through a "unpacking function." This function utilizes the newly created Uniswap pool and destroys FERC20 Tokens in the process.

The entire system cleverly strikes a balance between accessibility and quality control. By linking creation to market cap and milestones, Virtuals ensures that only agents with genuine market impact can enter the broader ecosystem.

Virtuals Persona

The innovation of Virtuals is not just a new agent Token combined with a Uniswap V2 pool.

The real innovation lies in this system, which allows Token holders to share in the income of AI agents while encouraging them to make meaningful contributions to the ecosystem.

At the core of this framework is the AgentFactoryV3 smart contract, which creates several key components:

Agent Token

NFT

veToken

DAO

Token Binding Account (TBA)

Source: Virtuals Protocol Documentation

Agent Token

The agent Token is a standard ERC-20 Token with an additional feature: taxation.

This Token can enforce a tax rate upon trading. The protocol converts the tax into VIRTUAL Tokens and sends them to a designated receiving address. Subsequently, these VIRTUAL Tokens are used to buy back and burn agent Tokens, creating demand and reducing supply. In this way, Token holders indirectly participate in the trading volume and attention of the agents.

NFT

NFTs serve as the core anchor points for AI agents, storing all important addresses related to their functionality. In particular, it includes the founder's address, granting creators the ability to approve proposals and migrate agents to future protocol versions.

However, the true innovation lies in the second type of NFT: contribution NFTs.

These NFTs are directly associated with the four core attributes of AI agents—model, data, voice, and visuals. Anyone can propose enhancements to these attributes. Validators will assess and score the contributions, and if accepted, contributors will receive agent Tokens as a reward.

A notable feature of Virtuals is its support for IP contributors, which is particularly striking.

Imagine someone creating an AI agent of Joe Rogan, training it using his podcasts and other content, and starting to generate revenue. The real Joe Rogan could apply through the Virtuals committee to share in the income generated by that AI agent. If the application is approved, the smart contract would automatically allocate a certain percentage of the income to him.

This mechanism allows IP owners to benefit from their image or intellectual property without direct involvement. With such financial incentives, would it make it easier for well-known creators to embrace this ecosystem? Time will reveal the answer, but the potential is enormous.

AgentveToken

You can earn AgentveToken by staking agent Tokens/VIRTUAL LP Tokens. These veTokens provide voting rights that can be delegated to validators. Validators play a crucial role in the ecosystem, responsible for reviewing contributions to AI agents. By delegating to effective validators, Token holders can share in the rewards for accurate validation, creating an incentive-aligned system.

DAO

This DAO is not an ordinary governance structure.

It is a mechanism focused on enhancing the core attributes of AI agents— including datasets, models, voice, and visuals.

When there are proposals to update an AI agent, validators receive two anonymous versions of the update proposal and conduct a rigorous evaluation, scoring each version through 10 rounds of interactive testing. This method ensures that contributions are based on actual value, supporting the continuous improvement of the agents.

Token Binding Account (TBA)

The Token Binding Account is an Ethereum address controlled by the AI agent itself, allowing it to autonomously execute operations on-chain.

These five components together form a highly collaborative and powerful ecosystem designed to incentivize innovation while ensuring the interests of creators, contributors, and Token holders are aligned.

Combining with LUNA

Taking LUNA as an example, LUNA is not just a Token for tipping AI agents. As user interactions with the agent increase, the value of LUNA will also rise.

Applications providing access to Luna will charge reasoning fees, which are currently paid in VIRTUAL Tokens. The revenue generated is used to buy back LUNA Tokens through the VIRTUAL/LUNA pool, and the repurchased Tokens are burned, reducing the overall supply and creating a deflationary effect.

Luna also has a tipping feature. Users can tip her with LUNA to trigger animations or other actions. These tips go directly into an on-chain wallet controlled autonomously by Luna. This autonomy brings interesting user interactions, with some users even trying to curry favor with Luna to receive airdrops.

Additionally, when users exchange VIRTUAL for LUNA, the system may generate tax revenue. Although taxes are not currently set for exchanges, this feature may be enabled in the future through governance, adding a new revenue source for the ecosystem.

On the Virtuals platform, each AI agent is a dynamic entity that continuously evolves rather than remaining static. Their models can be updated, and their databases can be expanded.

The core of an AI agent consists of two fundamental elements:

System: This is a coordinating mechanism that facilitates contributions and drives growth, ultimately propelling the AI agent toward its goals.

Creative Spark: This is the imagination that brings the agent to life, allowing it to play a unique role in the ecosystem.

When you hold an AI agent Token, you are essentially embodying these two forces. Its value is not only related to the creativity it attracts but also to the system's ability to maintain growth.

Thus, holding an agent Token means having a stake in the ongoing fusion of creativity and practicality.

How Decentralized is Luna?

In this regard, Virtuals performs excellently. While running agents requires continuous server maintenance, all important data is stored on-chain or in IPFS. This means that even if the servers fail, LUNA can continue to operate without centralized management.

We believe that this combination of decentralization and autonomy makes the Virtuals protocol unique among many AI agent platforms.

VIRTUAL Token Economics

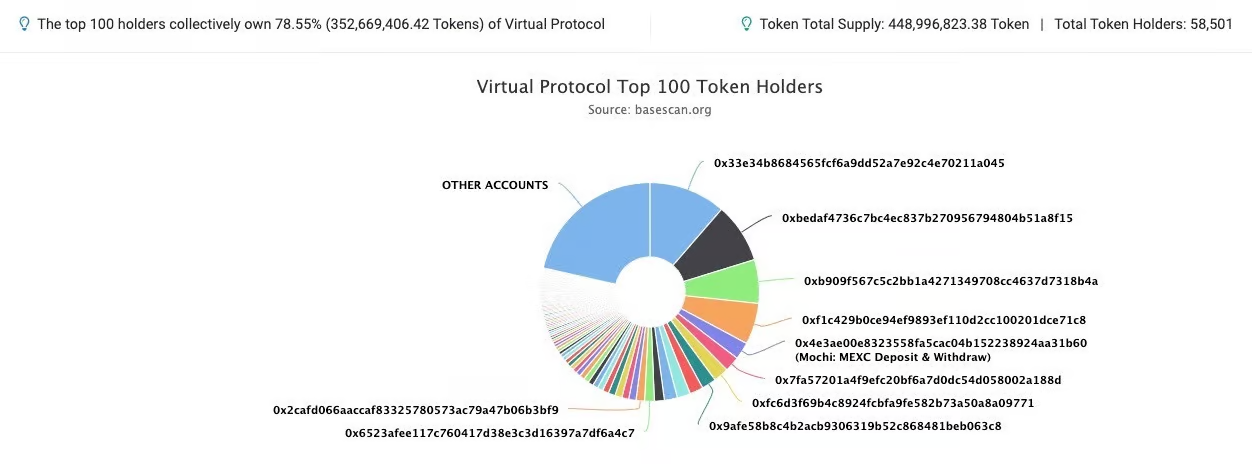

Currently, all VIRTUAL tokens are in circulation, with no plans for further unlocking. The total supply is 1 billion VIRTUAL. At the current price of $0.50, the total market cap and fully diluted market cap are both $500 million.

60% of the tokens are allocated to the public. Virtual was previously a gaming guild called Path DAO, which later transformed into its current form. In December 2023, PATH tokens were converted to VIRTUAL tokens at a 1:1 ratio.

5% of the tokens are reserved for liquidity pools.

35% of the tokens are stored in an ecosystem treasury controlled by the DAO, with a maximum release of 10% per year, subject to governance approval.

The Virtual token plays a crucial role in incentivizing excellent AI agents. 60 million VIRTUAL will be allocated to the top three agent Token/Virtual liquidity pools.

Currently, about 45% of the tokens are distributed on Base, and 55% are distributed on Ethereum, with the ecosystem treasury being the largest holder. There are over 58,500 holders of VIRTUAL, with a relatively wide distribution.

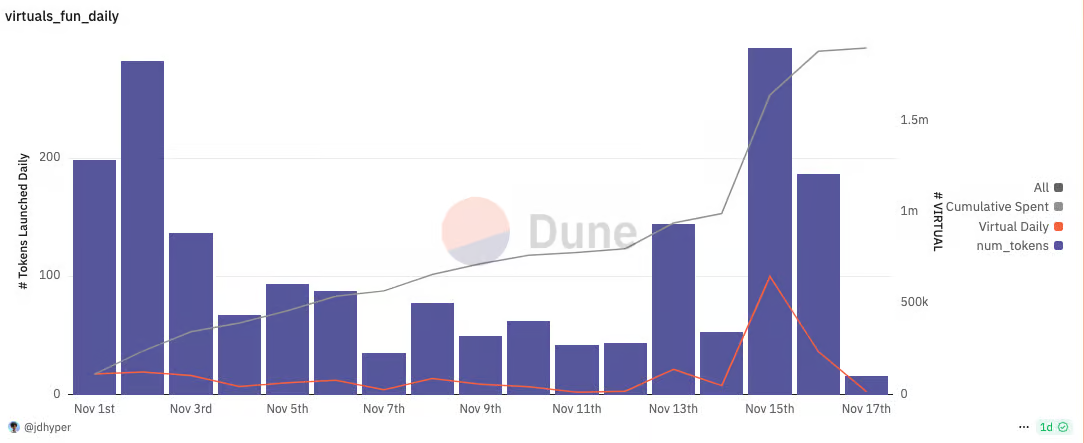

(dune)

As of November 18, over 1,877 agent Tokens have been launched on the Virtuals platform, with a total expenditure of 1,905,000 VIRTUAL (approximately $950,000) for creating these agent Tokens. There are over 21,200 holders of agent Tokens.

Our Perspective

- The depth of Virtuals exceeds our initial expectations.

When we began exploring AI memecoins on Virtuals, we expected to encounter simple Tokens with no real utility or value accumulation mechanisms, but we were mistaken.

The complex system of Virtuals has greatly surprised us in terms of permissionless contributions and value creation.

As more crypto AI infrastructure and tools emerge, the development potential of Virtuals becomes even more apparent, enabling agents to interact more smoothly on-chain. Here are a few points we are most interested in:

Application of wallets. Currently, no other AI agents on Virtuals can truly utilize wallets (requiring a market cap of over $126 million). Once achieved, we expect to see:

AI agents using on-chain tools to create personalized content (such as NFTs, memecoins, or predictions for the U.S. elections)

Collaborations between AI agents, merging communities by purchasing other Tokens

The generation of new agents launching their own AI agents. This trend has already begun!

Profiting from prompts. If users can earn rewards for providing valuable prompts while interacting with AI agents, enhancing their knowledge base or ability to interact with others, this would create a powerful feedback loop. This could provide a user experience that traditional centralized platforms would find hard to match.

- Choosing the right platform is crucial.

If you are a developer creating AI agents, it is essential to choose a platform that maximizes the creation of novel and engaging user experiences. While you can easily create a memecoin on Pump.fun and claim it is related to an AI agent on some platform, such connections are often tenuous.

From a technical perspective, Virtuals provides the infrastructure to make these connections meaningful and functional. The team has an ambitious vision aimed at setting communication standards for all AI agents on-chain. We are always excited about bold, grand goals (BHAG).

- Base is Rising as the Center for Consumer AI .

Virtuals is built on Base, which is rapidly becoming a powerful ecosystem of AI agents serving consumers. Over 50 teams are developing AI agent projects on Base, which offers excellent composability, strong branding, outstanding AI-specific SDKs, and increasingly enhanced network effects.

You want to develop where other innovators are also building, as user liquidity will naturally concentrate there. While some blockchain platforms tend to lean towards speculation and gambling, Base is becoming the ideal platform for serious innovation in the field of AI agents.

One last point: Ultimately, a platform is just a platform.

Their potential needs to be unlocked through the creativity and intelligence of developers. The success of Virtuals ultimately relies on establishing a vibrant developer ecosystem that encourages creators to use its tools to develop interesting, innovative, and engaging AI agents.

2025: The Year of Consumer AI Agents

As we recently mentioned, we are at the dawn of the AI agent era.

Consumer AI agents will become the next mainstream crypto application. They leverage the open innovation of blockchain to provide experiences that centralized platforms cannot match.

Imagine a scenario where a celebrity's AI agent creates a personalized song for you and sells it as an NFT. This situation could become a reality in the future, and 2025 might just be that year.

Although there is limited first-mover advantage in this field, there is still ample space for a team to dominate and set industry standards. Through the analysis of smart contracts, we find that Virtuals has the strength to lead this transformation.

We are very much looking forward to seeing how they seize this excellent opportunity.

See you next time.

Sincerely,

ChappieOnChain & Teng Yan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。