Author: Lawrence Lee

After securing two rounds of financing, including a $12 million round led by Polychain and funding from Binance Labs, the restaking project Solayer on the Solana chain has become one of the few highlights in the DeFi sector of the recent market, with its TVL continuing to rise. It has now surpassed Orca, ranking twelfth in TVL on the Solana chain.

TVL rankings of Solana projects Source: DeFillama

The staking track, as a native segment of crypto, is also the largest crypto track by TVL. However, its representative tokens such as LDO, EIGEN, and ETHFI have struggled significantly in this cycle. Aside from the Ethereum network they are part of, are there other reasons?

- How competitive are the staking and restaking protocols surrounding user staking behavior within the entire staking ecosystem?

- How does Solayer's restaking differ from Eigenlayer's restaking?

- Is Solayer's restaking a good business?

This article aims to answer the above questions, starting with the staking and restaking on the Ethereum network.

Competitive Landscape and Development Pattern of Liquid Staking, Restaking, and Liquid Restaking on the Ethereum Network

In this section, we will mainly discuss and analyze the following projects:

The leading liquid staking project on the Ethereum network, Lido; the leading restaking project, Eigenlayer; and the leading liquid restaking project, Etherfi.

Lido's Business Logic and Revenue Composition

The business logic of Lido can be summarized as follows:

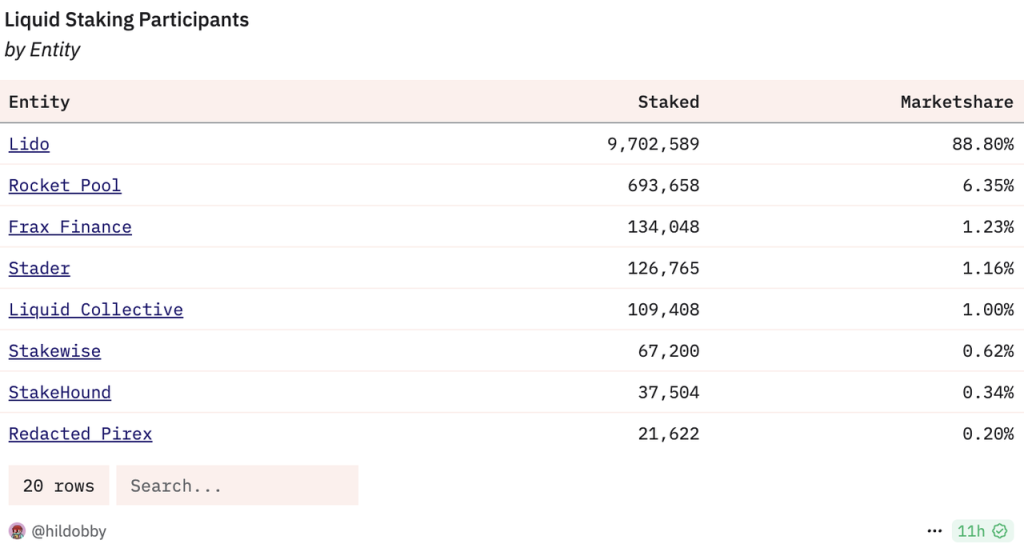

Due to Ethereum's commitment to decentralization, the PoS mechanism soft limits the staking cap for single nodes. A single node can only deploy a maximum of 32 ETH to achieve higher capital efficiency, while staking requires relatively high hardware, network, and knowledge requirements, making it difficult for ordinary users to participate in ETH staking. In this context, Lido has popularized the concept of LST. Although the liquidity advantage of LST has been weakened after the Shapella upgrade opened withdrawals, its advantages in capital efficiency and composability remain solid, forming the basic business logic of LST protocols represented by Lido. Lido holds nearly 90% market share among liquid staking projects, leading the market.

Liquid staking participants and market share Source: Dune

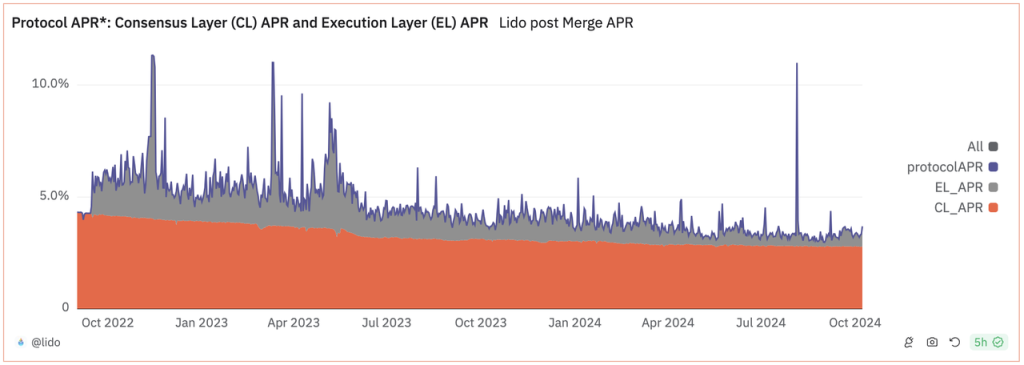

Lido's revenue mainly comes from two parts: consensus layer revenue and execution layer revenue. The so-called consensus layer revenue refers to the PoS issuance rewards of the Ethereum network. For the Ethereum network, this expenditure is paid to maintain network consensus, hence it is called consensus layer revenue, which is relatively fixed (orange part in the chart below); while execution layer revenue includes priority fees paid by users and MEV (for an analysis of execution layer revenue, readers can refer to previous articles by Mint Ventures). This part of the revenue is not paid by the Ethereum network but is paid (or indirectly paid) by users during the execution of transactions, and it varies significantly with on-chain activity.

Lido protocol APR Source: Dune

Eigenlayer's Business Logic and Revenue Composition

The concept of restaking was proposed by Eigenlayer last year and has become a rare new narrative in the DeFi sector and the entire market over the past year, giving rise to a series of projects with an FDV exceeding $1 billion at launch (besides EIGEN, there are ETHFI, REZ, and PENDLE), as well as many yet-to-launch restaking projects (Babylon, Symbiotic, and the Solayer we will focus on later). The market's enthusiasm is evident (Mint Ventures previously conducted research on Eigenlayer, interested readers can check it out).

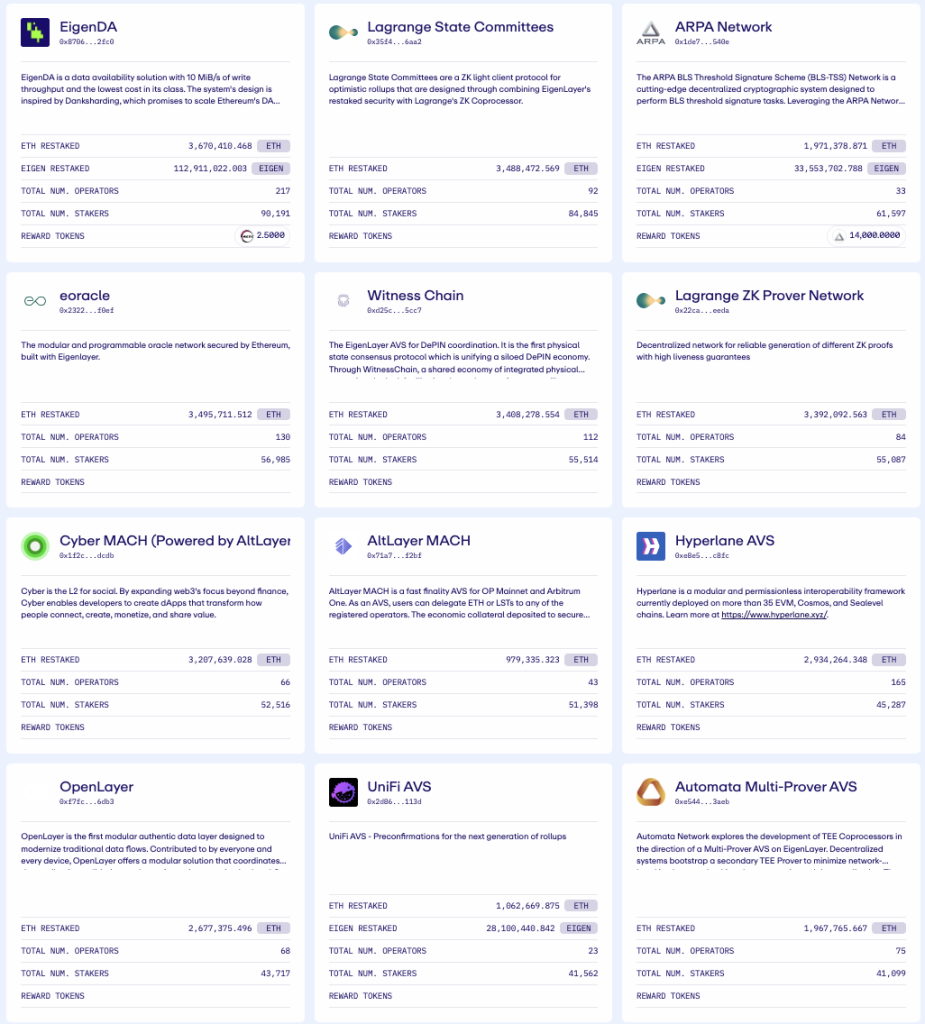

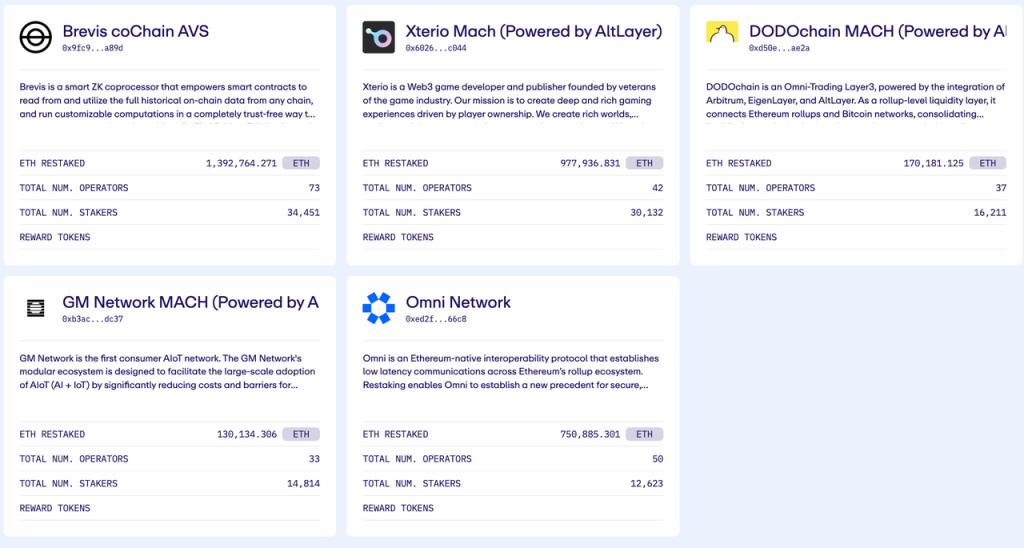

Eigenlayer's restaking, as defined, allows users who have already staked ETH to restake their staked ETH on Eigenlayer (thus obtaining additional rewards), hence the name 'Re'Staking. Eigenlayer refers to its services as AVS (Actively Validated Services), which can provide services for various protocols that require security, including sidechains, DA layers, virtual machines, oracles, bridges, threshold encryption schemes, and trusted execution environments. EigenDA is a typical representative using Eigenlayer AVS services.

Current protocols using Eigenlayer AVS Source: Eigenlayer official website

Eigenlayer's business logic is also quite simple. On the supply side, they raise assets from ETH stakers and pay fees; on the demand side, protocols that require AVS pay to use their services, with Eigenlayer acting as a "protocol security market" to facilitate and earn certain fees.

However, looking at all current restaking projects, the only real yield remains the tokens (or points) of the related protocols. We cannot yet determine if restaking has achieved PMF: on the supply side, everyone likes the extra rewards brought by restaking; however, the demand side remains a mystery: are there really protocols that will purchase protocol economic security services? If so, how many?

Kyle Samani, founder of Multicoin, questions the restaking business model Source: X

From the target users of Eigenlayer who have already issued tokens: oracles (LINK, PYTH), bridges (AXL, ZRO), DA (TIA, AVAIL), staking tokens to maintain protocol security is a core use case of their tokens. Choosing to purchase security services from Eigenlayer would greatly undermine the rationale for issuing their tokens. Even Eigenlayer itself, when explaining the EIGEN token, uses very abstract and obscure language to express the view that "using EIGEN to maintain protocol security" is the main use case.

The Survival Path of Liquid Restaking (Etherfi)

Eigenlayer supports two ways to participate in restaking: using LST and native restaking. Participating in Eigenlayer Restaking using LST is relatively simple; users deposit ETH in the LST protocol to obtain LST, and then deposit LST into Eigenlayer. However, the LST pool has a long-term cap, and users who want to participate in restaking during the cap period need to perform native restaking as follows:

- Users must first complete the entire staking process on the Ethereum network, including preparing funds, configuring execution layer and consensus layer clients, and setting up withdrawal credentials.

- Users create a contract account named Eigenpod on Eigenlayer.

- Users set the withdrawal private key of their Ethereum staking node to the Eigenpod contract account.

It can be seen that Eigenlayer's restaking is a relatively standard 're'staking. Whether users deposit other LSTs into Eigenlayer or perform native restaking, Eigenlayer does not directly "touch" the ETH that users stake (Eigenlayer also does not issue any LRT). The process of native restaking is a "complex version" of ETH's native staking, implying similar financial, hardware, network, and knowledge barriers.

Thus, projects like Etherfi quickly provided Liquid Restaking Tokens (LRTs) to address this issue. The operational process of Etherfi's eETH is as follows:

- Users deposit ETH into Etherfi, and Etherfi issues eETH to the users.

- Etherfi stakes the received ETH to earn the basic rewards from ETH staking;

- At the same time, they set the withdrawal private key of the node to the Eigenpod contract account according to Eigenlayer's native restaking process, allowing them to earn restaking rewards from Eigenlayer (as well as $EIGEN and $ETHFI).

Clearly, the services provided by Etherfi are the optimal solution for users holding ETH who want to earn rewards: on one hand, the operation of eETH is simple and liquid, providing an experience similar to Lido's stETH; on the other hand, users depositing ETH into Etherfi's eETH pool can earn approximately 3% in basic ETH staking rewards, potential AVS rewards from Eigenlayer, token incentives (points) from Eigenlayer, and token incentives (points) from Etherfi.

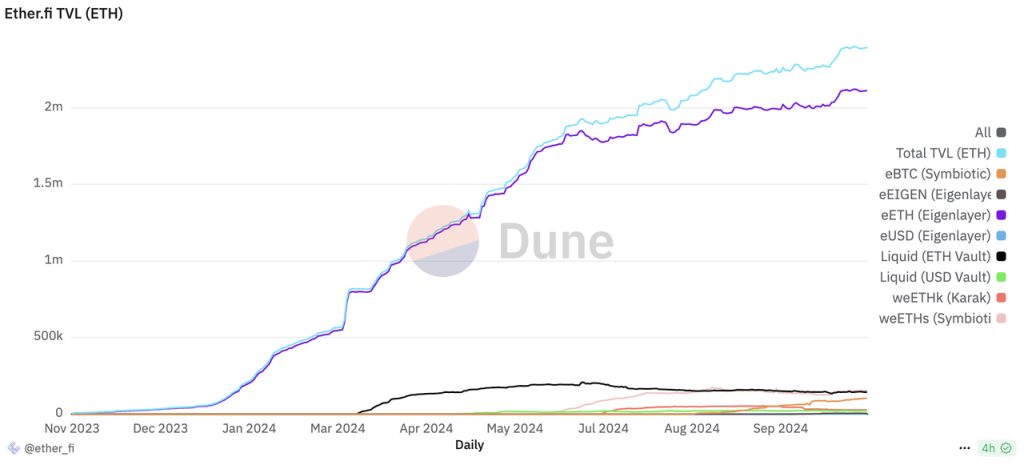

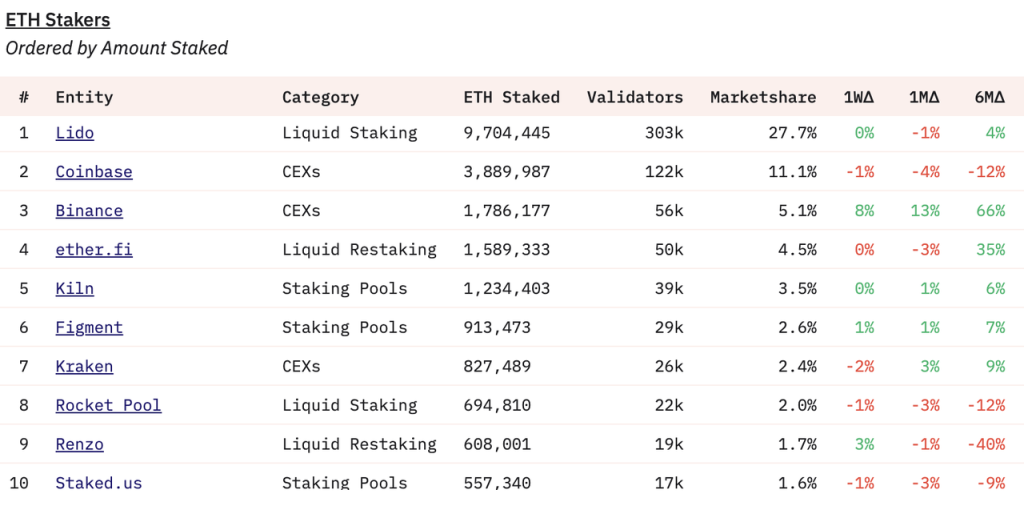

eETH accounts for 90% of Etherfi's TVL, contributing to a peak TVL of over $6 billion and a maximum FDV of $8 billion, making Etherfi the fourth-largest staking entity in just six months.

Etherfi TVL Distribution Source: Dune

Staking Volume Rankings Source: Dune

The long-term business logic of the LRT protocol lies in helping users participate in both staking and restaking in a simpler and easier way to achieve higher returns. Since it does not generate any revenue (other than its own token), the overall business logic of the LRT protocol is more akin to a specific yield aggregator for ETH. Upon closer analysis, we find that its business logic relies on the following two premises:

- Lido cannot provide liquid restaking services. If Lido were willing to "emulate" eETH with its stETH, it would be very difficult for Etherfi to match its long-term brand advantages, security backing, and liquidity advantages.

- Eigenlayer cannot provide liquid staking services. If Eigenlayer were willing to directly accept users' ETH for staking, it would greatly undermine Etherfi's value proposition.

From a purely commercial logic perspective, as the leading liquid staking provider, Lido providing liquid restaking services would offer users a broader range of revenue sources, while Eigenlayer directly accepting user funds for easier staking & restaking is entirely feasible. So why doesn't Lido do liquid restaking, and why doesn't Eigenlayer do liquid staking?

I believe this is determined by the unique situation of Ethereum. In May 2023, when Eigenlayer had just completed a new round of $50 million financing, sparking numerous discussions in the market, Vitalik specifically wrote an article titled "Don’t overload Ethereum’s consensus," detailing his views on how Ethereum's consensus should be reused (i.e., "how should we restake").

Regarding Lido, due to its long-term market share of about 30% of Ethereum staking, there have been ongoing voices within the Ethereum Foundation to constrain it. Vitalik has also repeatedly written about the issue of staking centralization, which has forced Lido to prioritize "alignment with Ethereum." It has gradually shut down operations on all chains other than Ethereum, including Solana. Its de facto leader, Hasu, confirmed in a May article the possibility of abandoning its own restaking business, limiting Lido's operations to staking, while investing in and supporting the restaking protocol Symbiotic and establishing the Lido Alliance to respond to competition from LRT protocols like Eigenlayer and Etherfi.

Reaffirm that stETH should stay an LST, not become an LRT.

Support Ethereum-aligned validator services, starting with preconfirmations, without exposing stakers to additional risk.

Make stETH the #1 collateral in the restaking market, allowing stakers to opt into additional points on the risk and reward spectrum.

Lido's stance on restaking-related matters Source

On the Eigenlayer side, Ethereum Foundation researchers Justin Drake and Dankrad Feist were hired as consultants early on. Dankrad Feist stated that his main purpose for joining was to ensure "Eigenlayer aligns with Ethereum," which may also explain why Eigenlayer's native restaking process is quite contrary to user experience.

In a sense, Etherfi's market space is brought about by the "distrust" of the Ethereum Foundation towards Lido and Eigenlayer.

Analysis of Ethereum Staking Ecosystem Protocols

Combining Lido and Eigenlayer, we can see that in the current PoS chains, there are three long-term sources of revenue surrounding staking behavior, aside from associated token incentives:

- PoS base rewards, which are the native tokens paid by the PoS network to maintain network consensus. The yield of this part mainly depends on the chain's inflation plan; for example, Ethereum's inflation plan is linked to the staking ratio: the higher the staking ratio, the slower the inflation rate.

- Transaction ordering rewards, which are the fees that nodes can earn during the transaction packaging and ordering process, including priority fees given by users and MEV earnings obtained during transaction packaging and ordering. The yield of this part mainly depends on the activity level of the chain.

- Staked asset rental income, which involves lending users' staked assets to other protocols in need, thus earning fees paid by these protocols. This income depends on how many protocols with AVS needs are willing to pay for protocol security.

Currently, there are three types of protocols surrounding staking behavior on the Ethereum network:

- Liquid staking protocols represented by Lido and Rocket Pool. They can only earn the first two types of rewards mentioned above. Of course, users can take their LST to participate in restaking, but as protocols, they can only take a cut from the aforementioned 1 and 2.

- Restaking protocols represented by Eigenlayer and Symbiotic. These protocols can only earn the third type of reward mentioned above.

- Liquid restaking protocols represented by Etherfi and Puffer. They theoretically can earn all three types of rewards mentioned above, but they are more like "aggregators of restaking rewards for LST."

Currently, the ETH PoS base yield is around 2.8% annually, which gradually decreases as the ETH staking ratio increases;

Transaction ordering rewards have significantly decreased with the launch of EIP-4844, recently hovering around 0.5%.

The base for staked asset rental income is still small and cannot be annualized; it relies more on EIGEN and the token incentives of associated LRT protocols to make this part of the incentive substantial.

For LST protocols, their income base is the amount staked * staking yield. The amount of ETH staked is approaching 30%, and although this figure is still significantly lower than that of other PoS public chains, from the perspective of the Ethereum Foundation's decentralization and economic bandwidth, they do not wish for too much ETH to flow into staking (refer to Vitalik's recent blog post; the Ethereum Foundation once discussed whether to set the upper limit for ETH staking at 25% of the total supply); while the staking yield has been continuously declining, stabilizing at around 6% at the end of 2022, often achieving around 10% short-term APR, and now it has dropped to only 3%, with no reason for recovery in the foreseeable future.

For the aforementioned protocol tokens, in addition to being constrained by the overall downturn of ETH itself:

The market ceiling for LST on the Ethereum network is gradually becoming visible, which may also explain the poor price performance of governance tokens for LST protocols like LDO and RPL;

For EIGEN, various restaking protocols on other PoS chains, including those on the BTC chain, are continuously emerging, which has essentially limited Eigenlayer's business to the Ethereum ecosystem, further reducing the potential upper limit of its already unclear AVS market size.

The unexpected emergence of LRT protocols (with ETHFI's peak FDV exceeding $8 billion, surpassing the historical highs of LDO and EIGEN) has further "diluted" the value of the latter two in the staking ecosystem;

For ETHFI and REZ, aside from the aforementioned factors, the excessively high initial valuations brought about by launching during market booms are more significant influences on their token prices.

Staking and Restaking on Solana

The operational mechanism of liquid staking protocols on the Solana network, represented by Jito, is fundamentally no different from that of the Ethereum network. However, Solayer's restaking differs from Eigenlayer's restaking. To understand Solayer's restaking, we first need to grasp Solana's swQoS mechanism.

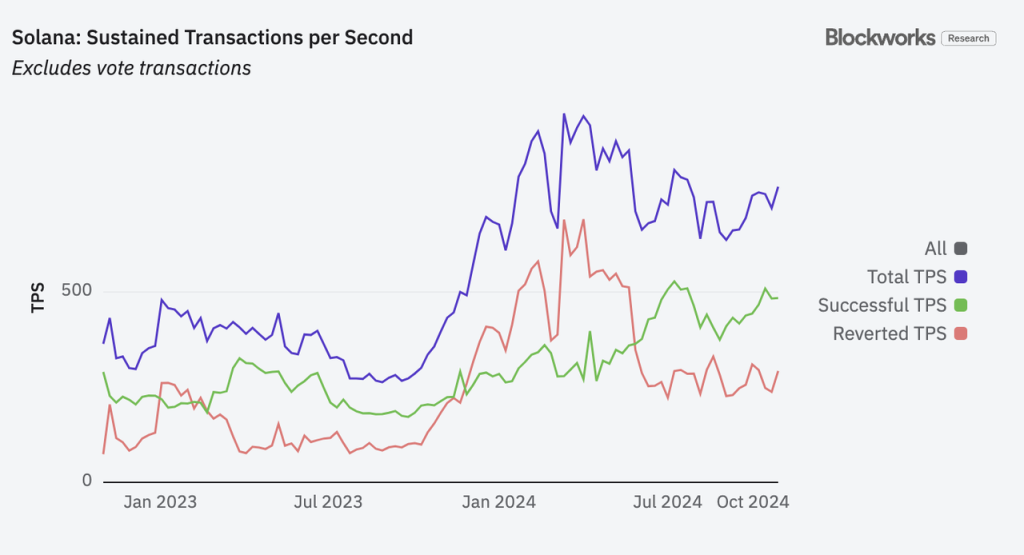

The swQoS (stake-weighted Quality of Service) mechanism on the Solana network officially came into effect after a client version upgrade in April this year. The purpose of the swQoS mechanism is to enhance the overall efficiency of the network, as the Solana network experienced prolonged network congestion during the meme craze in March.

In simple terms, after swQoS is enabled, block producers determine the priority of transactions based on the amount staked by stakers. A staker holding x% of the total stake in the network can submit up to x% of the transactions (for a detailed explanation of the swQoS mechanism and its profound impact on Solana, readers can refer to Helius's article). After swQoS was enabled, the transaction success rate on the Solana network rapidly increased.

Sources of successful and failed TPS on the Solana network: Blockworks

swQoS prioritizes the rights of larger stakers by "drowning" the transactions of smaller stakers when network resources are limited, thus avoiding malicious attacks on the system. To some extent, the logic of "the more you stake, the more network privileges you enjoy" aligns with the PoS blockchain logic: staking a larger proportion of the native chain token contributes more to the stability of the chain and the native token, justifying the enjoyment of more privileges. Of course, the centralization issues of this mechanism are also very apparent: larger stakers can naturally obtain more priority transaction rights, and priority transaction rights will attract more stakers, thereby reinforcing the advantages of top stakers and further leaning towards oligopoly or even monopoly. This seems to contradict the decentralization advocated by blockchain; however, this is not the focus of this article. We can clearly see from Solana's consistent development trajectory that Solana adopts a pragmatic attitude of "performance first" regarding decentralization issues.

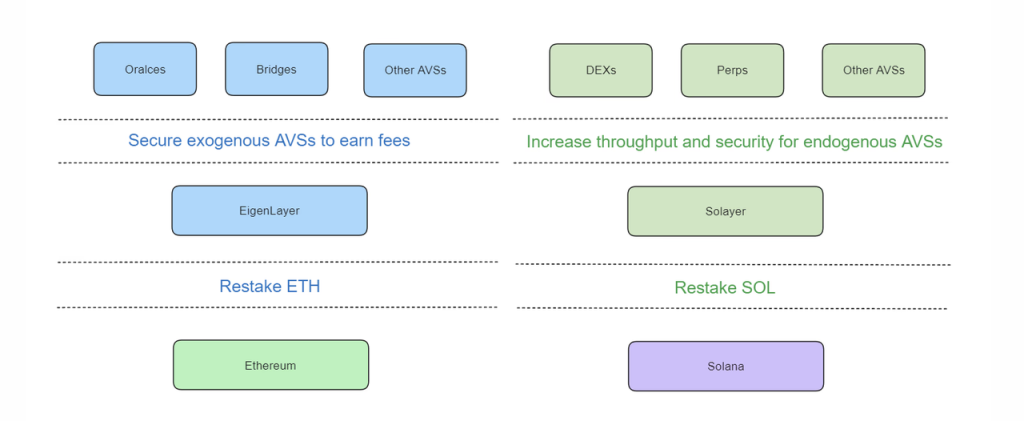

Against the backdrop of swQoS, the target users of Solayer's restaking are not oracles or bridges, but protocols that require transaction throughput/reliability, typically DEXs. Therefore, Solayer refers to the AVS services provided by Eigenlayer as exogenous AVS, as these systems typically reside outside the Ethereum main chain. In contrast, the services it provides are termed endogenous AVS, as their service targets are located within the Solana main chain.

Differences between Solayer and Eigenlayer

It can be seen that although both lease staked assets to other protocols in need for 're-staking', the core services provided by Solayer's endogenous AVS and Eigenlayer's exogenous AVS are different. Solayer's endogenous AVS is essentially a "transaction throughput leasing platform," with demand users being platforms (or their users) that require transaction throughput, while Eigenlayer is a "protocol security leasing platform." The core support for its endogenous AVS is Solana's swQoS mechanism. As Solayer states in its documentation:

We did not fundamentally agree with EigenLayer’s technical architecture. So we re-architected, in a sense, restandardized restaking in the Solana ecosystem. Reusing stake as a way of securing network bandwidth for apps. We aim to become the de facto infrastructure for stake-weighted quality of service, and eventually, a core primitive of the Solana blockchain/consensus.

"We fundamentally disagree with EigenLayer's technical architecture. Therefore, in a sense, we have restructured restaking in the Solana ecosystem. Reusing stake as a means of securing network bandwidth for applications. Our goal is to become the de facto infrastructure for swQoS and eventually a core primitive of the Solana blockchain/consensus."

Of course, if there are other protocols on the Solana chain that require staked assets, such as those needing protocol security, Solayer can also lend its SOL to these protocols. In fact, by definition, any lending/reutilization of staked assets can be referred to as re-staking, not limited to security needs. Due to the existence of the swQoS mechanism on the Solana chain, the scope of restaking business on the Solana chain is broader than that on the Ethereum chain, and based on Solana's recent surge in on-chain activity, the demand for transaction throughput is more rigid than the demand for security.

Is Solayer's Restaking a Good Business?

The business process for users participating in Solayer's restaking is as follows:

- Users deposit SOL directly into Solayer, and Solayer issues sSOL to the users.

- Solayer stakes the received SOL to earn basic staking rewards.

- At the same time, users can delegate sSOL to protocols that require transaction throughput, thus earning fees paid by these protocols.

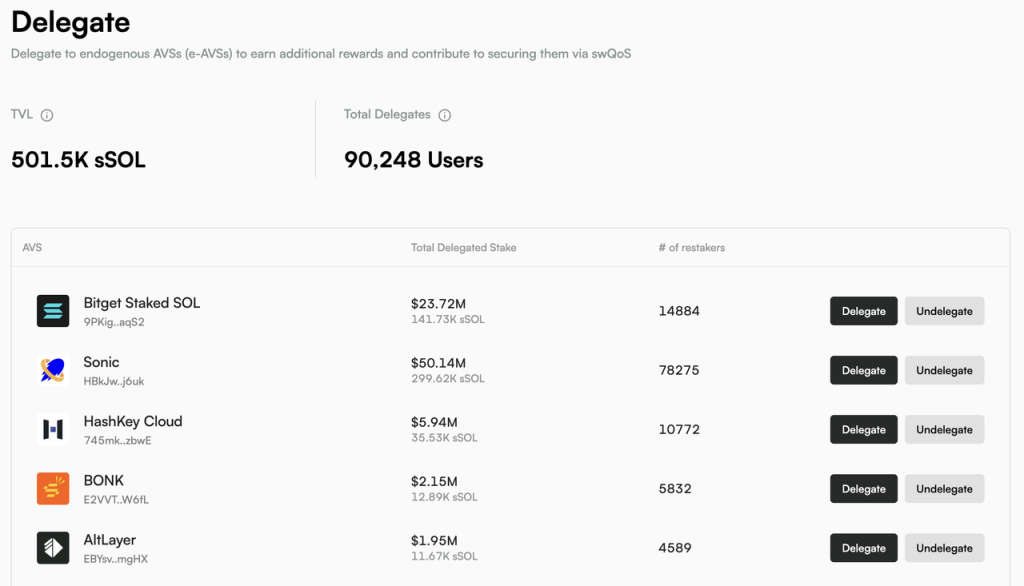

Current sources of Solayer's AVS

It can be seen that Solayer is not only a restaking platform but also a restaking platform that directly issues LSTs. From the business process perspective, it resembles Lido, which supports native restaking on the Ethereum network.

As mentioned earlier, there are three sources of revenue surrounding staking behavior, and the situation of these three revenues on the Solana network is as follows:

- PoS base rewards: Solana pays SOL to maintain network consensus, with this annual yield around 6.5%, which is relatively stable.

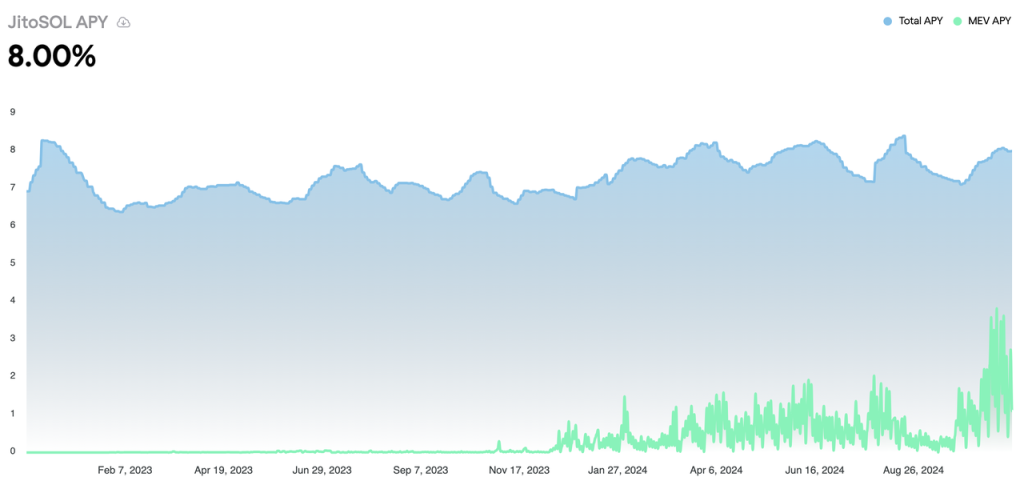

- Transaction ordering rewards: Fees that nodes can earn during the transaction packaging and ordering process, including priority fees given by users for expedited transactions and tips paid by MEV searchers, totaling approximately 1.5% annually, though this varies significantly depending on on-chain activity.

- Staked asset rental income: Lending users' staked assets to other protocols in need (transaction throughput, protocol security, or others), which has not yet scaled.

Total yield and MEV revenue sources for SOL liquid staking (using JitoSOL as an example)

If we carefully compare the three types of revenue from Ethereum and Solana, we find that although SOL's market capitalization is still only 1/4 of ETH's, and the market capitalization of staked SOL is only about 60% of that of staked ETH, the staking-related protocols on the Solana chain have a factually larger market and greater potential market than those on the Ethereum chain because:

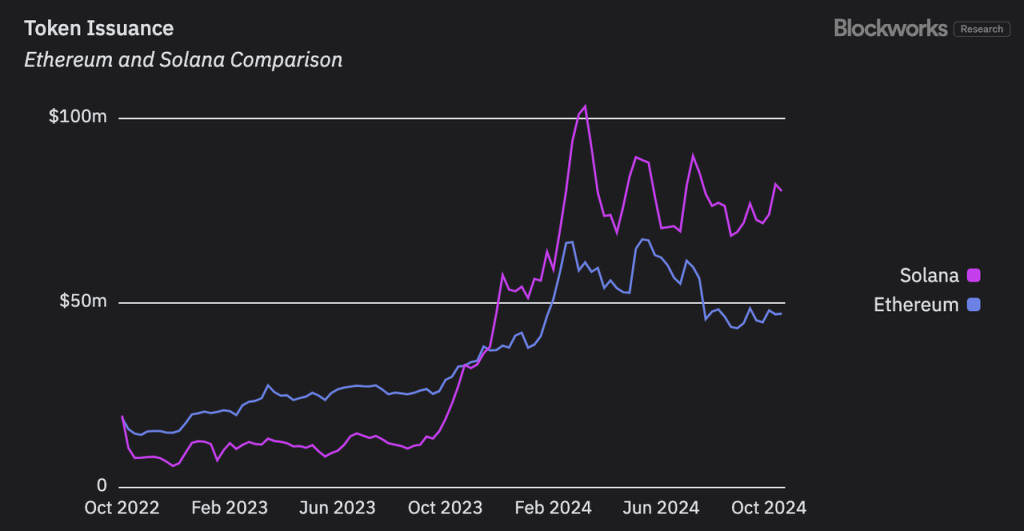

- In terms of PoS base rewards: The network inflation rewards that SOL is willing to pay have been higher than ETH since December 2023, and the gap between the two continues to widen. Whether for ETH or SOL staking, this accounts for over 80% of their yield, determining the income baseline for all staking-related protocols.

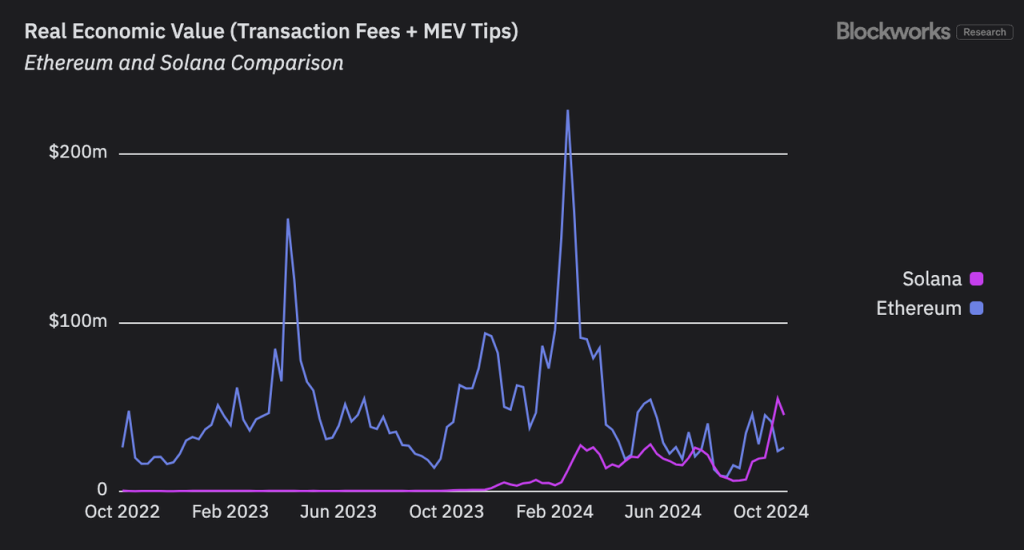

- In terms of transaction ordering revenue: Blockworks uses transaction fees and MEV tips to reflect the real economic value (REV) of a chain. This metric approximately indicates the maximum transaction ordering revenue a chain can achieve. We can see that although the REV fluctuations of both chains are significant, Ethereum's REV sharply declined after the Cancun upgrade, while Solana's REV has shown an overall upward trend and recently successfully surpassed Ethereum.

Sources of REV for Solana and Ethereum: Blockworks

In terms of rental income from staked assets, compared to the Ethereum network, which currently only has security revenue, Solana's swQoS mechanism can generate additional leasing demand for transaction throughput.

Moreover, Solana's staking-related protocols can expand their business according to commercial logic; any liquid staking protocol can engage in restaking business, such as Jito; any restaking protocol can also issue LSTs, like Solayer and Fragmetric.

More importantly, we currently do not see any possibility of reversal in the above trends, meaning that the advantages of Solana's staking protocols relative to Ethereum's staking protocols may continue to expand in the future.

From this perspective, although we still cannot say that Solana's restaking has found its PMF, it is clear that Solana's staking and restaking represent a better business than that on Ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。