Original Author: BitMEX

gm, welcome back to our periodic options alpha series. Last week, we discussed the potential undervaluation of Bitcoin options compared to the 2020-2021 bull market. We mentioned that traders could capture potential volatility increases by setting up straddle strategies.

In this article, we will introduce you to a clever method to take advantage of significant price fluctuations in ETH without using options—this method allows traders to capture both the performance boost of BTC and the significant volatility of ETH simultaneously. This strategy is more effective in some ways than setting up straddle strategies!

Let’s dive in.

BitMEX's Quanto Perpetual Contracts: Unique Derivatives

Quanto perpetual contracts, such as the ETHUSD quanto perpetual contract on BitMEX, provide a unique opportunity for traders in the crypto market. These contracts are settled in BTC, meaning that profits and losses are paid in Bitcoin rather than USDT or ETH.

How is it similar to options?

The unique settlement mechanism of Quanto, combined with the historical strong correlation between BTC and ETH, introduces a "convexity element" to trading. Similar to options, this convexity allows traders to potentially profit from significant price movements in any direction. By strategically combining two perpetual contract positions, traders can gain convexity exposure, potentially benefiting from large upward or downward movements. This feature distinguishes quanto perpetual contracts from traditional delta-1 perpetual contracts, which typically offer linear returns. By using quanto perpetual contracts, traders can create portfolios that may be profitable in volatile markets, regardless of the direction of price movements, as long as the movements are large enough to overcome costs.

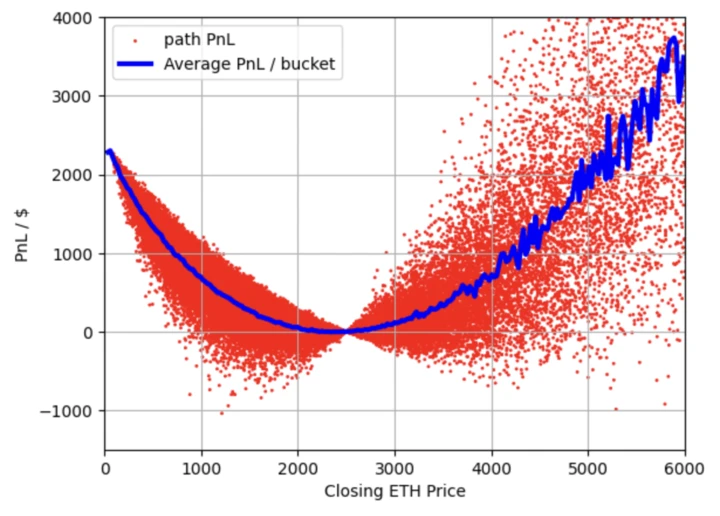

To illustrate the unique profit structure of this trade, let’s look at a simulation:

Open a position of 1 ETH in a quanto contract and combine it with a short position of 1 ETH in a USDT settled ETH perpetual contract:

If the ETH price remains relatively stable, the overall profit and loss trend will be low.

However, if ETH experiences significant price movements in either direction, the potential for substantial profits will greatly increase.

Please note that the simulation was created when the ETH trading price was around $2500, with an ETH/BTC correlation of 0.6.

This trading strategy offers traders a nice opportunity:

It can capture market movements both upward and downward, potentially making money regardless of the direction of significant price fluctuations.

Particularly suitable for use during times of high market uncertainty or anticipated increased volatility.

However, this strategy also has a major risk to be aware of:

Trading Risks

The biggest challenge comes from funding rates.

Typically, a short position in ETHUSDT can earn about 0.01% in funding fees per period.

However, the funding fees paid on the ETHUSD quanto side often exceed 0.01% (it was 0.05% at the time of writing this article).

The difference between these two rates is the "cost" of holding the position.

Given this cost structure, the timing of entry becomes particularly critical:

The ideal entry time is just before you expect the market to make a significant move.

Remember, as long as there is significant volatility, whether up or down, there is an opportunity to make money.

If traders can master these points, they can fully utilize the characteristics of quanto contracts to profit from market volatility while managing risk.

How to Operate

Specific Trading Steps:

Go long 1 ETH in the ETHUSD quanto perpetual contract on the BitMEX platform.

Simultaneously, go short 1 ETH in the ETHUSDT perpetual contract on BitMEX.

Performance in Different Scenarios:

1. If ETH/USD rises by 10%:

Quanto long: Earn 10% in Bitcoin terms.

USDT perpetual short: Lose 10% in USDT terms.

Final result: If BTC/USDT also rises, you can make a profit because the Bitcoin-denominated gains will exceed the USDT losses.

2. If ETH/USD falls by 10%:

Quanto long: Lose 10% in Bitcoin terms.

USDT perpetual short: Earn 10% in USDT terms.

Final result: If BTC/USDT also falls, you can make a profit because the USDT gains will exceed the Bitcoin-denominated losses.

Main Risks:

Funding rate expenses: The funding rate for ETHUSD quanto is usually higher than that for ETHUSDT. For long-term positions, the annual cost could exceed 20%.

ETH/BTC correlation: Changes in the ETH/BTC ratio will significantly impact profitability. A strengthening BTC price is favorable for this strategy, and vice versa.

Summary

Using BitMEX's quanto and USDT perpetual contracts is more cost-effective than directly trading options. If you believe ETH may experience significant volatility in the short term but are uncertain about whether it will rise or fall, this strategy is particularly suitable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。