Over $13.1 billion in real-world assets (excluding stablecoins) have now been tokenized on-chain.

Author: OurNetwork

Translation: ShenChao TechFlow

Real World Assets

BUIDL | PAXG | BCAP | Maple

Over $13.1 billion in real-world assets (RWA) — excluding stablecoins — have now been tokenized on-chain.

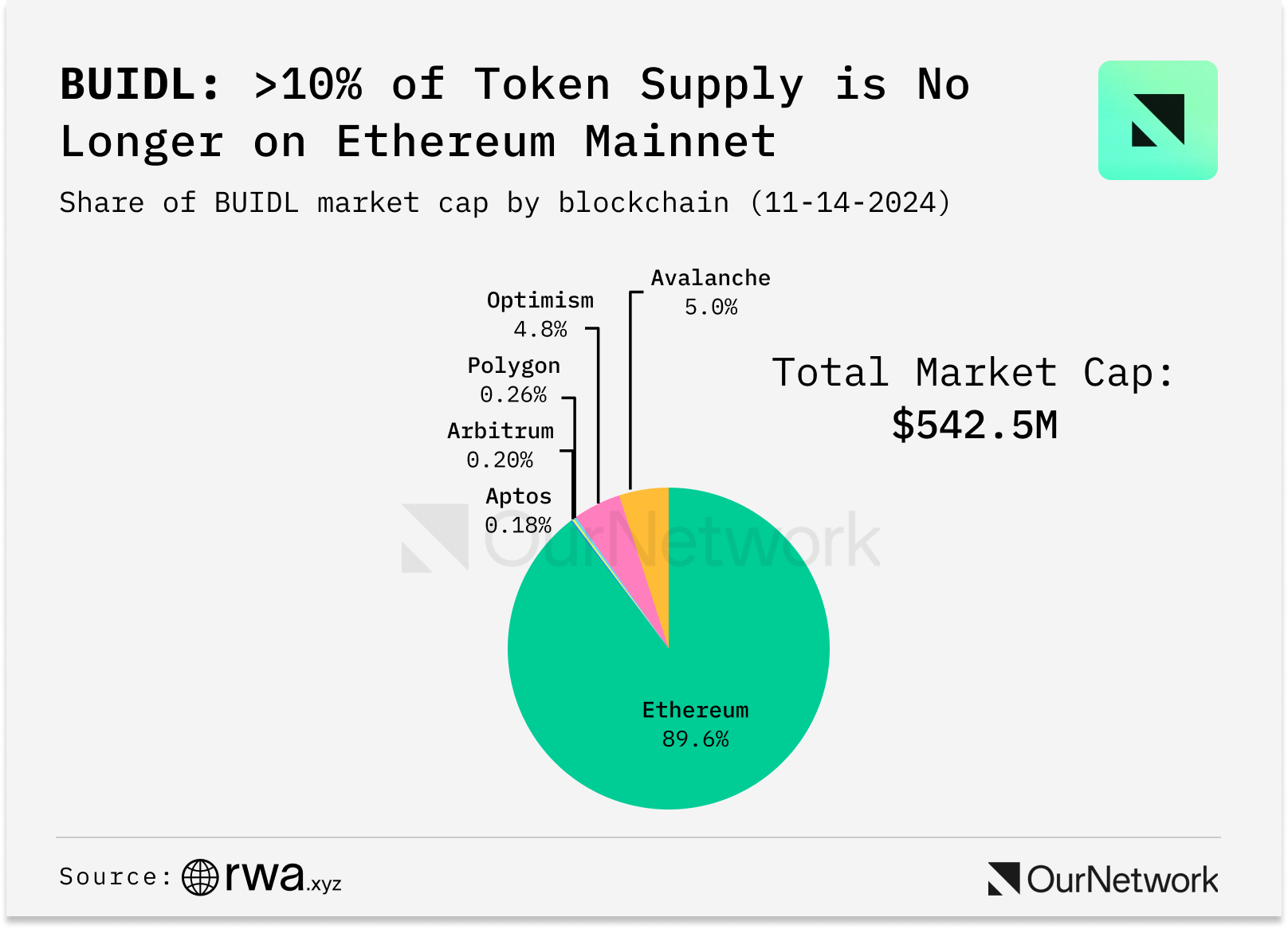

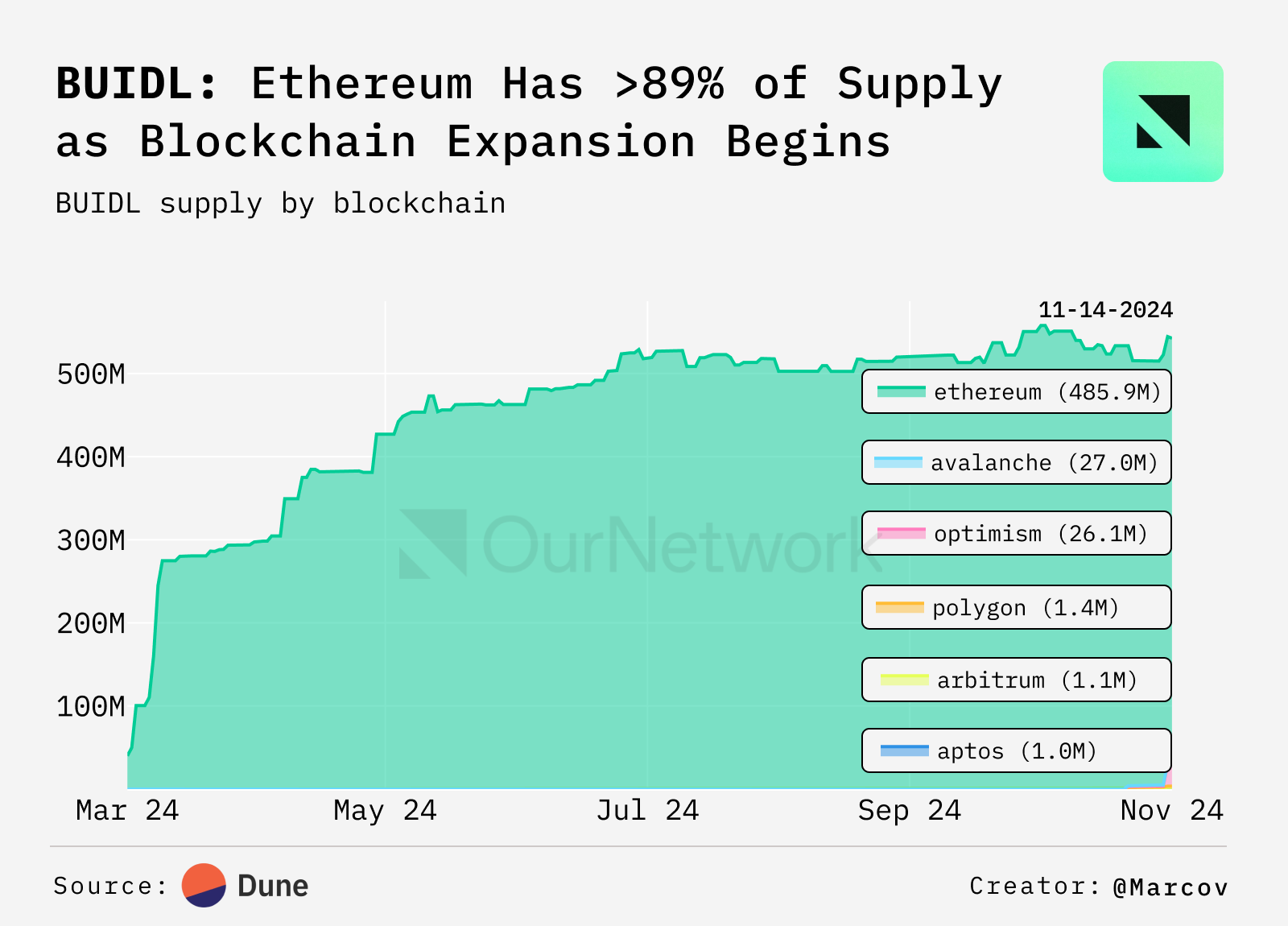

- Protocols typically encourage projects to build within their ecosystems through economic incentives. BUIDL's launch on Aptos, Polygon, Avalanche, Optimism, and Arbitrum has introduced these incentives to the treasury for the first time: Aptos, Polygon, and Avalanche each agreed to pay quarterly fees to BlackRock based on the BUIDL stake value of their networks. It is still too early to determine if this will be successful, but as of November 14, the total minting across all five networks has reached $56.6 million, accounting for 10.4% of the fund.

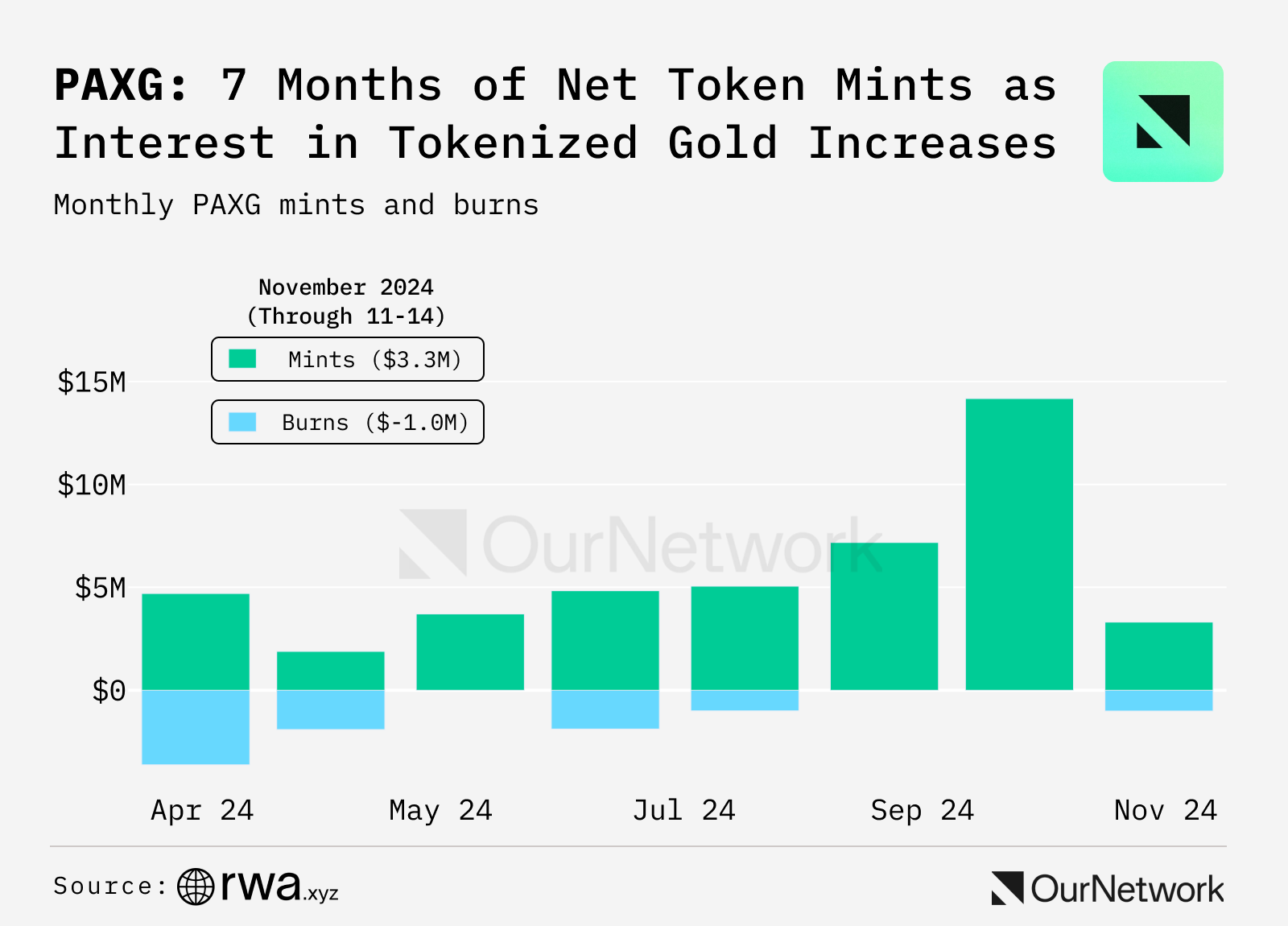

- As investors seek ways to invest in gold, the demand for tokenized gold continues to rise. Since the beginning of 2024, the scale of this asset class has grown by over 20%. Paxos Gold (PAXG) is the most widely held, with 52,522 wallets holding the asset. PAXG has also seen net token minting for seven consecutive months, reflecting ongoing interest in the product.

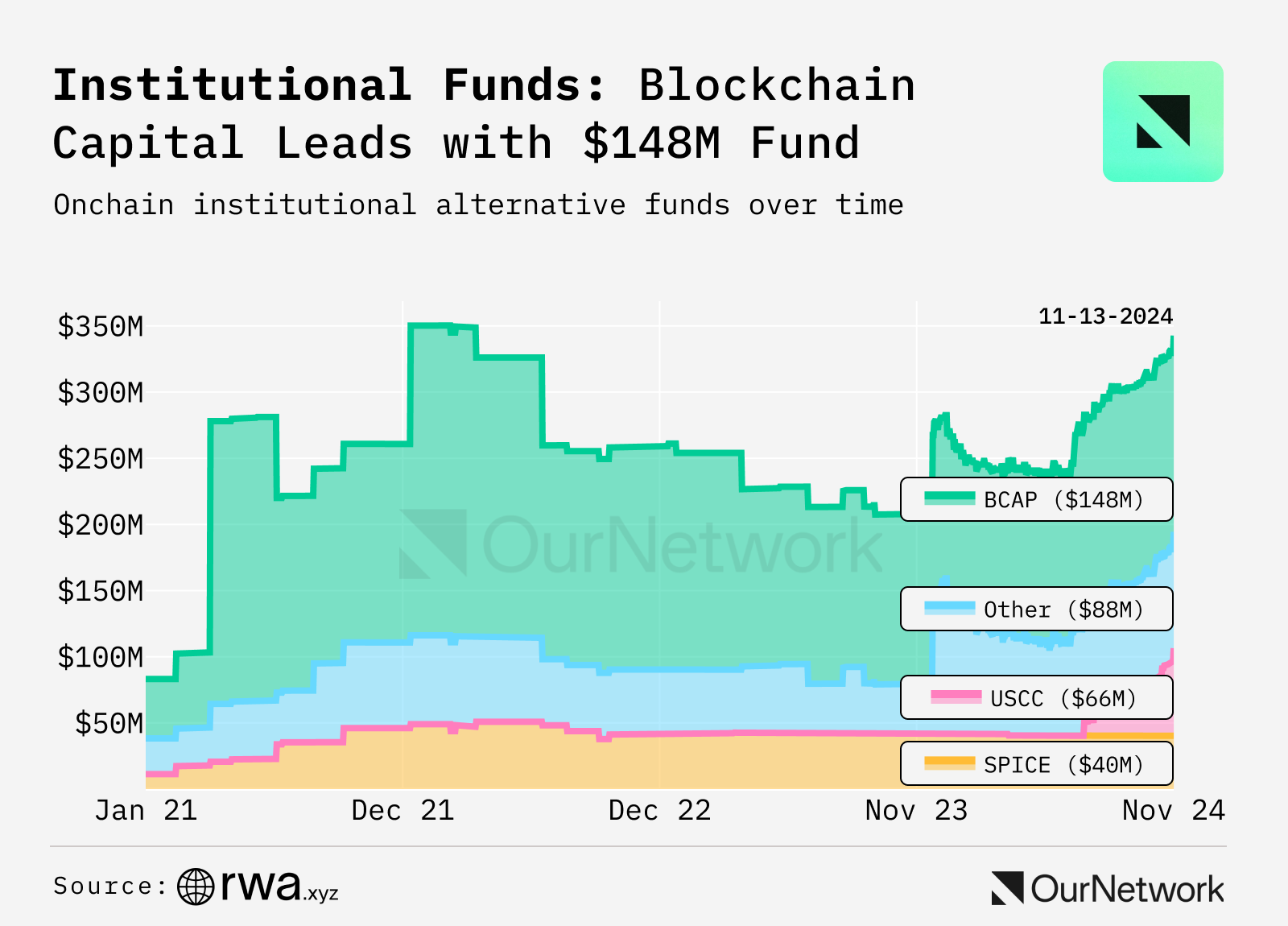

- The new institutional fund dashboard on RWA.xyz is tracking $330 million in alternative fund assets under management, led by Blockchain Capital ($148 million) and Superstate's Crypto Carry Fund ($58 million). Since the launch of the Securitize Fund Services platform on October 31, we expect to see more asset managers exploring tokenized funds to address issues such as slow investor onboarding, delayed net asset value reporting, and other operational inefficiencies in traditional funds.

- Trading Focus: Now that the BUIDL fund has achieved multi-chain operation, users can transfer capital to three networks (Aptos, Avalanche, Polygon) that charge lower management fees. Existing accounts have transferred $25.6 million from Ethereum to Avalanche. During the transfer, 250,000 BUIDL tokens and 25,364,613.13 BUIDL tokens were transferred and burned on the morning of November 15, after which an equivalent amount of tokens was minted on Avalanche.

Maple & Syrup

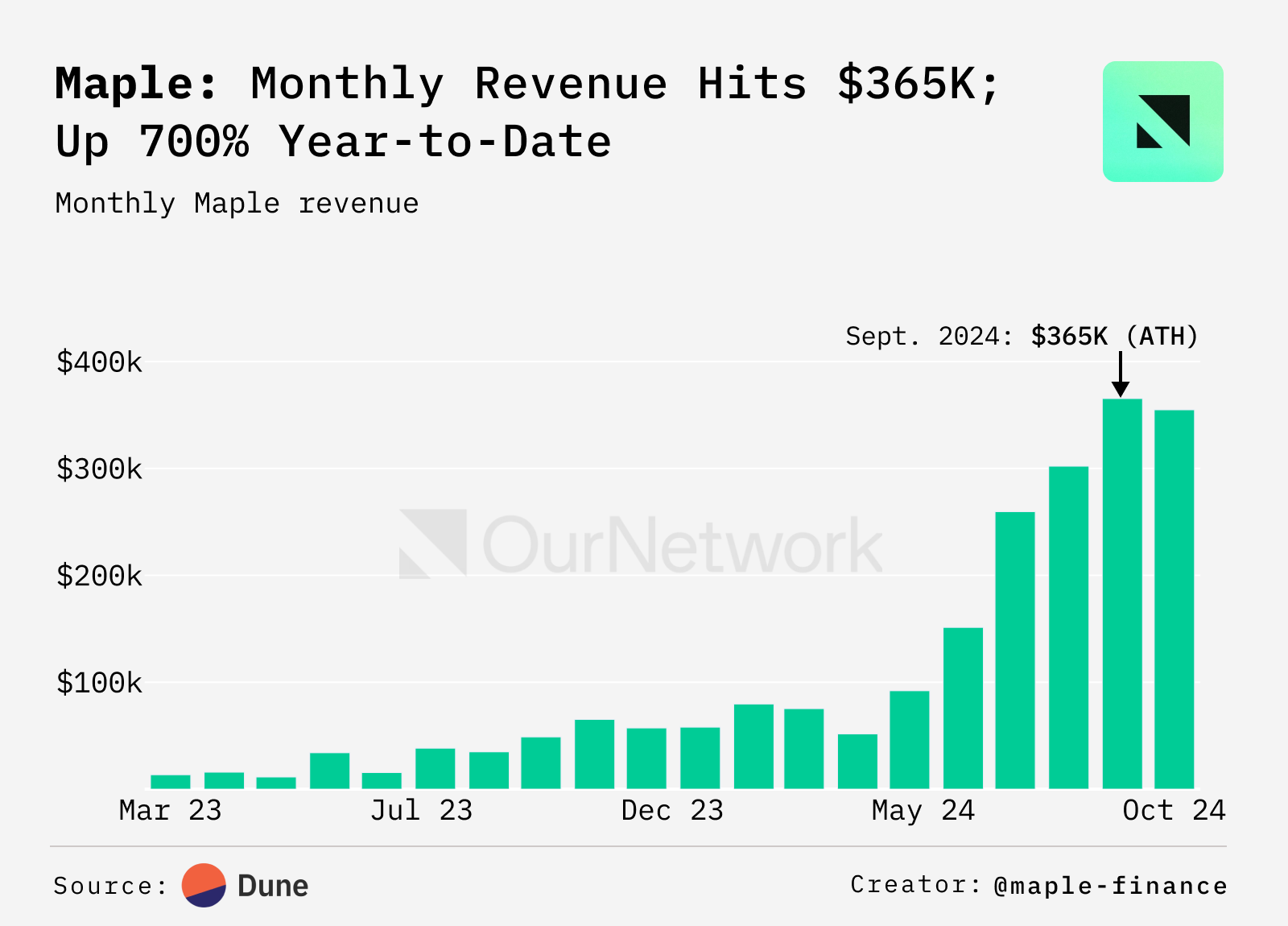

Maple & Syrup continue to show strong growth with total locked value (TVL) exceeding $600 million

- Maple Finance and Syrup provide corporate credit returns to lenders by issuing loans to institutional borrowers; these loans are always over-collateralized with liquid digital assets (such as BTC, ETH, and SOL). Since the launch of high-yield collateral pools in March and Syrup in June, the TVL on the platform has grown by over 700%, recently surpassing the $600 million mark. Protocol revenue has also shown a similar growth trend, with October revenue increasing by over 700% compared to the beginning of the year.

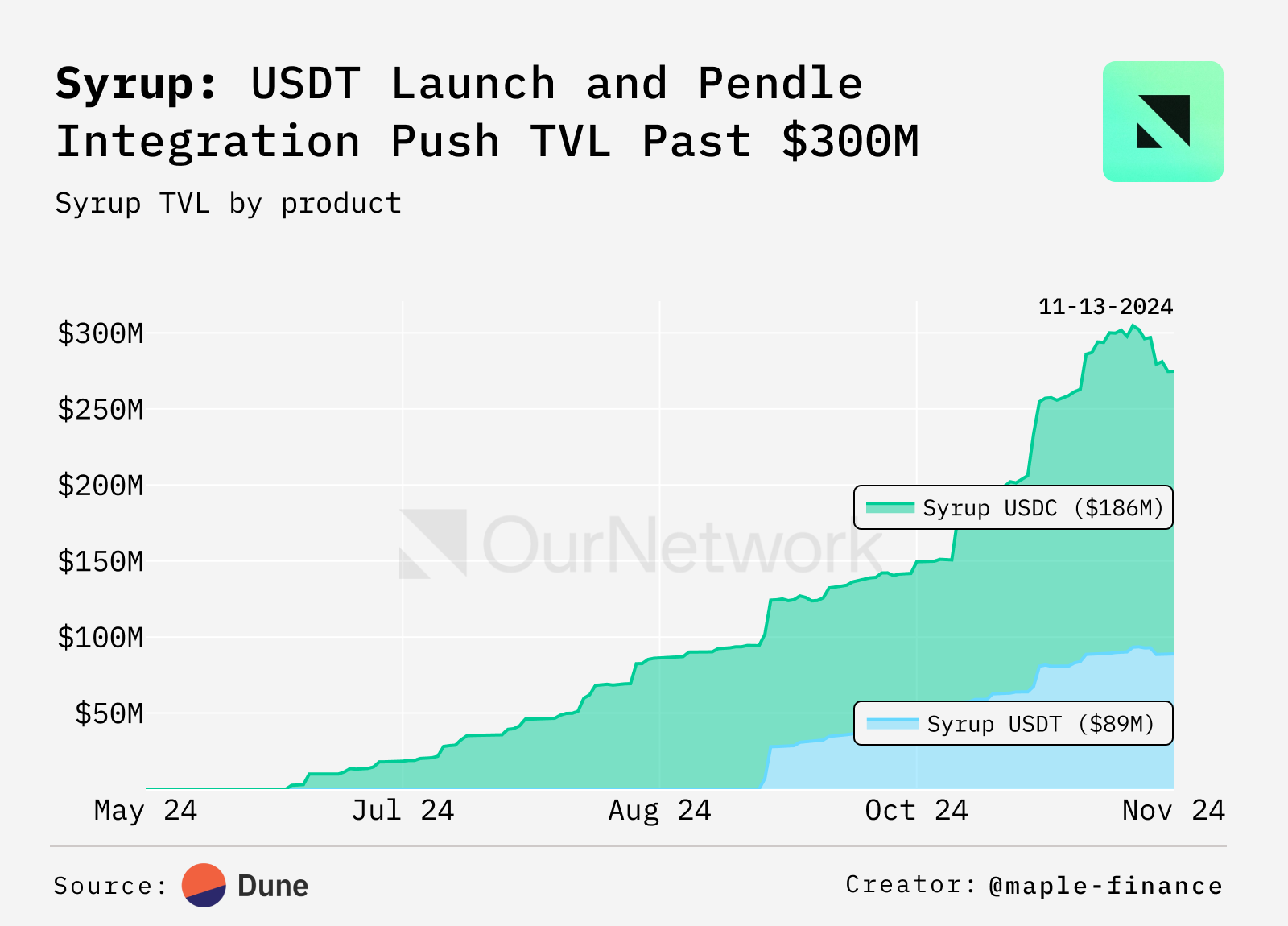

- Syrup.fi is the fastest-growing product of the protocol to date. Syrup's returns also come from fixed-rate, over-collateralized loans provided to institutional borrowers. The launch of USDT and integration with leading DeFi applications like Pendle have caused the TVL to surge to over $300 million in just a few months.

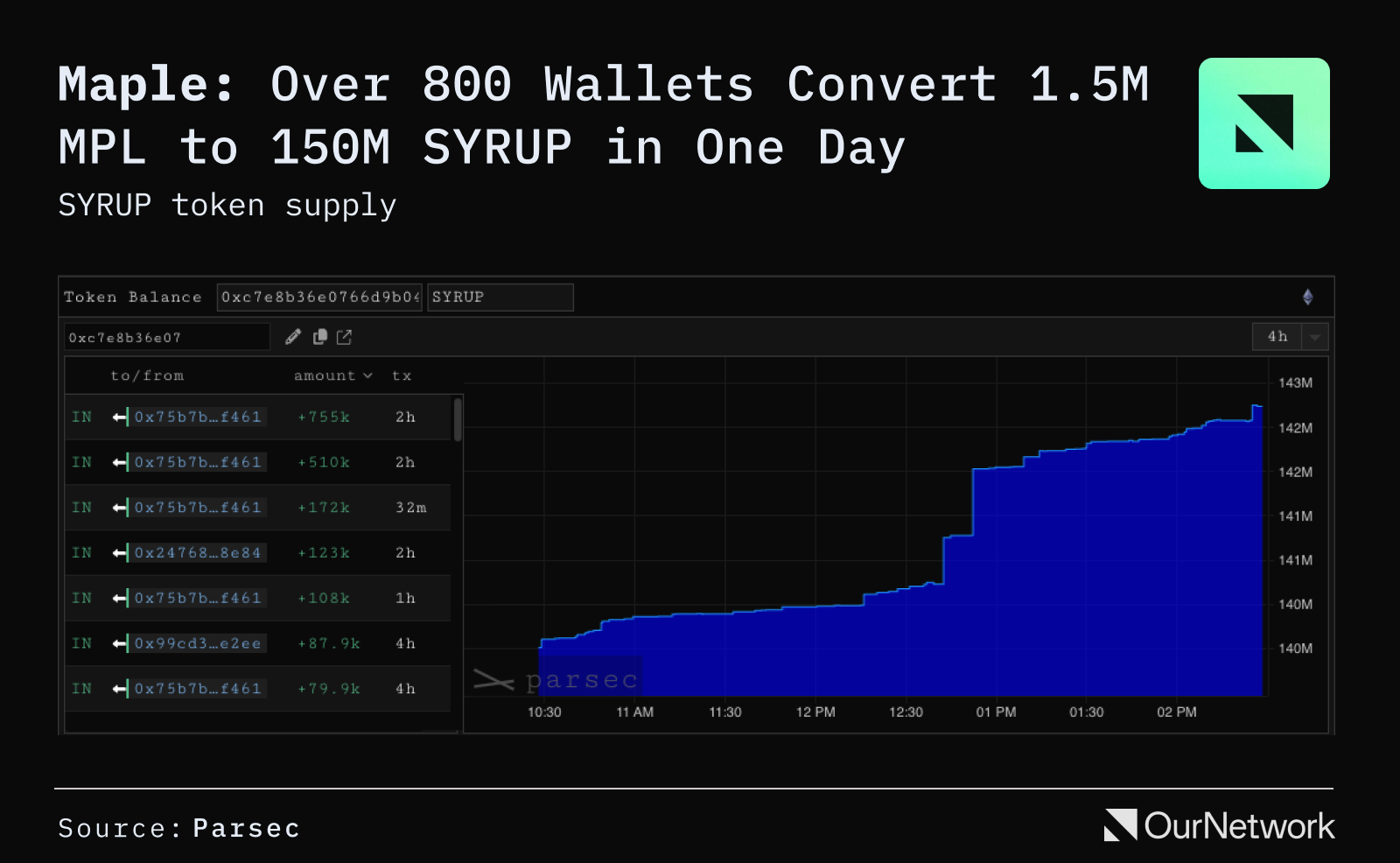

- To unify Maple and Syrup under joint governance and share the ecosystem's growth with the community, Maple DAO has introduced the SYRUP token. One MPL token can be converted into 100 SYRUP. In just one day, over 800 wallets have converted more than 1.5 million MPL into nearly 150 million SYRUP.

BUIDL

The BUIDL fund achieves multi-chain operation, with total value exceeding $543 million

- This week, the BUIDL fund launched by Securitize and BlackRock expanded beyond Ethereum, landing on the Aptos, Optimism, Avalanche, Polygon, and Arbitrum blockchains. The BUIDL supply on Ethereum decreased from $557 million to $513 million, but with the addition of these chains, the total supply increased by $30 million to $543 million as of November 14.

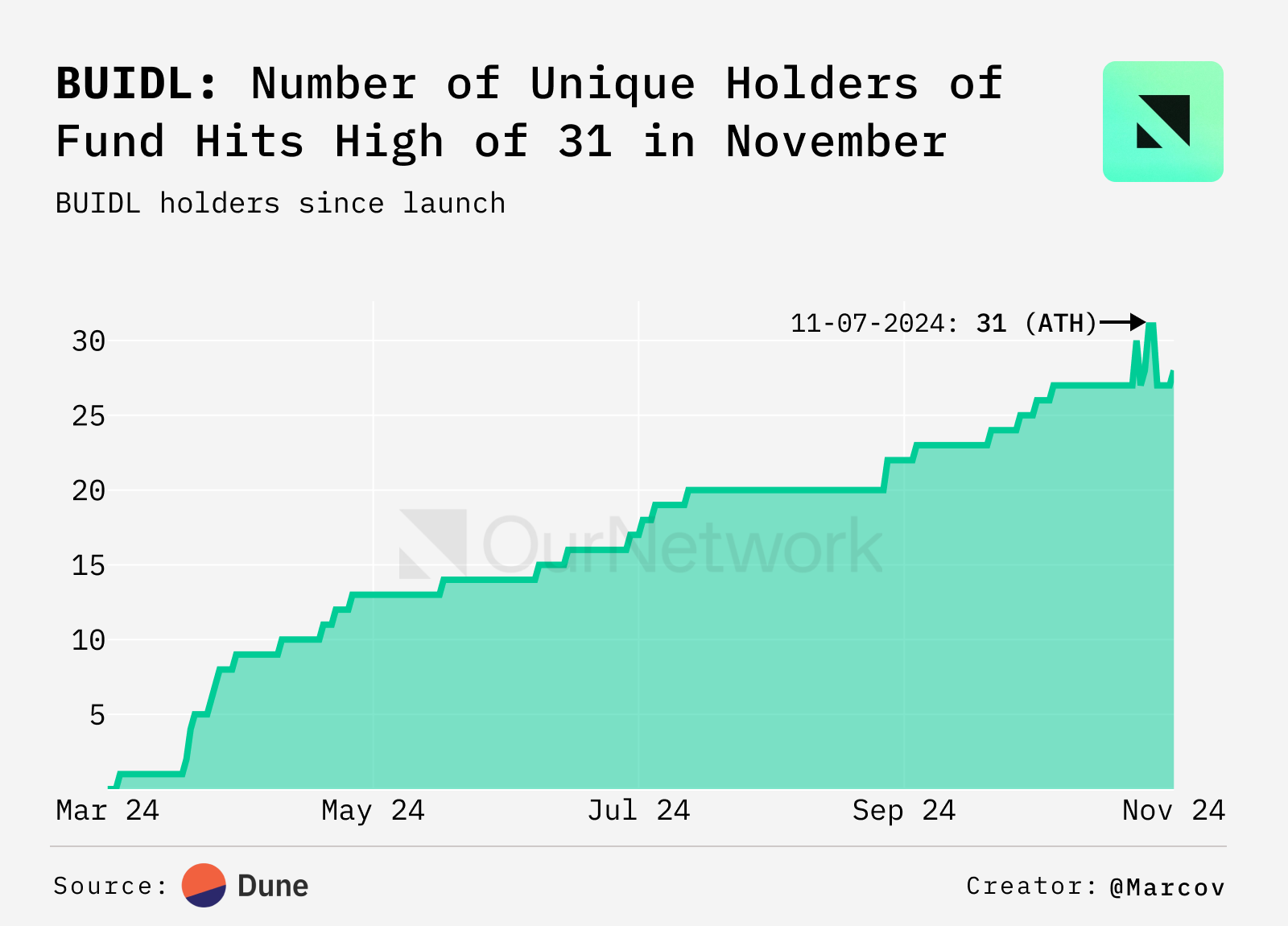

- The number of independent holders of the BUIDL fund has slowly increased over time, with currently 28 holders. The recent expansion to other chains has not increased the number of holders due to overlapping wallets.

- As shown above, as of November 14, 89.6% of the BUIDL supply is on Ethereum, followed by 5.0% on Avalanche, 4.8% on Optimism, 0.3% on Polygon, and 0.3% on Aptos and Arbitrum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。