Many people are calling this year the "Year of Memecoin." In this article, the author shares insights on the current memecoin market, analyzing its main drivers and unexpected risks.

Author: Stacy Muur

Translation: Blockchain in Plain Language

In the past few weeks, memecoins have overshadowed all other Web3 topics, leading ordinary users to believe that the meme track is the only way to achieve good returns.

Following the surges of $PNUT, $PEPE, $BONK, $BRETT, and several other memecoins, it is no surprise that they have attracted attention as memecoins reach their highest daily trading volumes and the "meme" category becomes increasingly popular.

But is this risk worth the returns? Is the memecoin market overhyped?

1. The Current State of Memecoins

Are memes really the mainstream topic this year?

If you talk to someone who has been involved in the Web3 market for at least five years and ask them how they define 2024, they are likely to say it is "the year of memecoins."

Many people are calling memecoins the best performers of the year, and there is data and rankings to support this. But does this truly reflect reality?

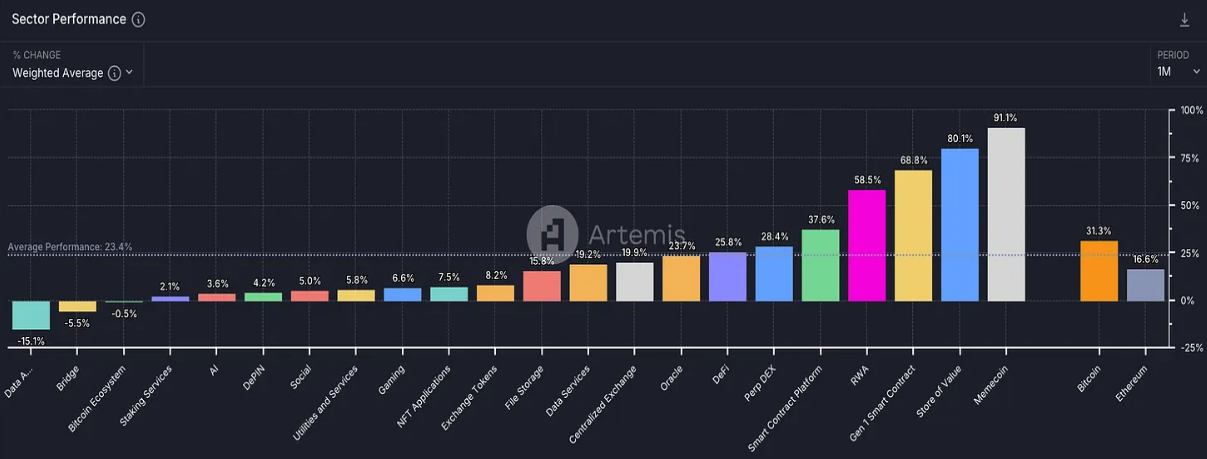

1-month industry performance, source: Artemis.

If you analyze the industry performance so far this year, the data may tell a different story. For example, on Artemis, the RWA index (including Ondo, Mantra, Clearpool, and Maple) leads with a 1900% increase, while memecoins have grown by 258% and Bitcoin by 104%.

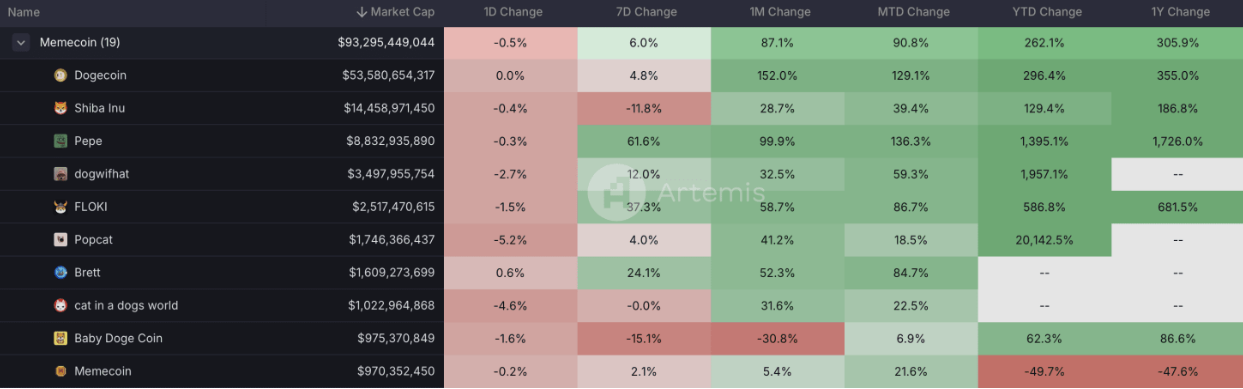

Additionally, it is crucial to understand which memecoins are being considered. The memecoin index on Artemis currently only tracks the 19 largest memecoins.

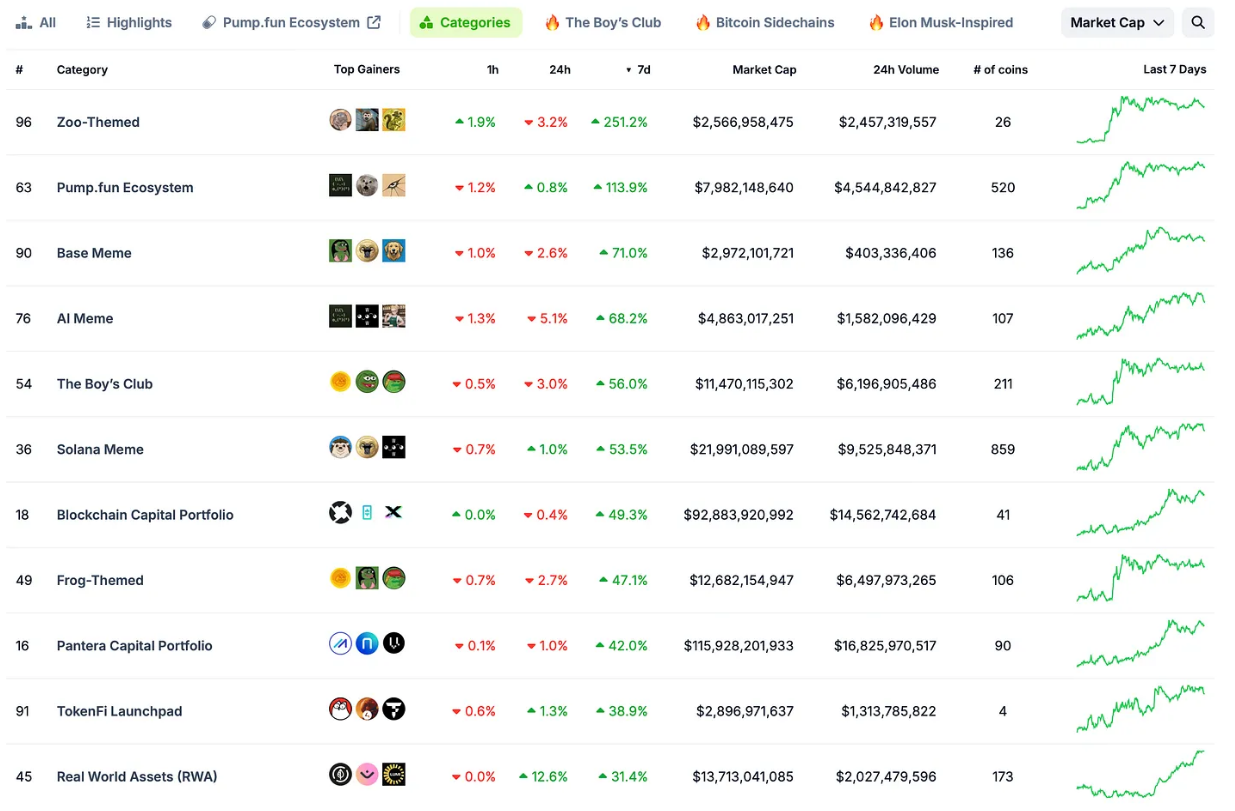

The category rankings on CoinGecko face another issue: many memes belong to multiple categories, so some strong performers may significantly exaggerate the 7-day performance across multiple categories.

Source: CoinGecko Categories

To understand why I see this as a problem, consider the Pump.fun ecosystem, which tracks 520 coins. It looks very strong, being the second-largest gainer this week, generating significant FOMO.

However, when you look at the rankings, you will find that fewer than 20 tokens have a 7-day increase exceeding 110% (the average for the category), which is only 3.8%. Moreover, fewer than 60 tokens (11.5%) have positive weekly gains.

This is no longer WAGMI (We All Gonna Make It), right?

From a performance tracking perspective, the main issue with memecoins is that their industry performance is often measured by the largest or most popular assets in the category.

This creates an illusion that memecoins are outperforming all other Web3 sectors. However, a more accurate statement is that leading memecoins are outperforming other categories.

This raises an important point: distinguishing between mature memecoins and new memecoins, as they represent two completely different markets.

2. Emerging Memecoins

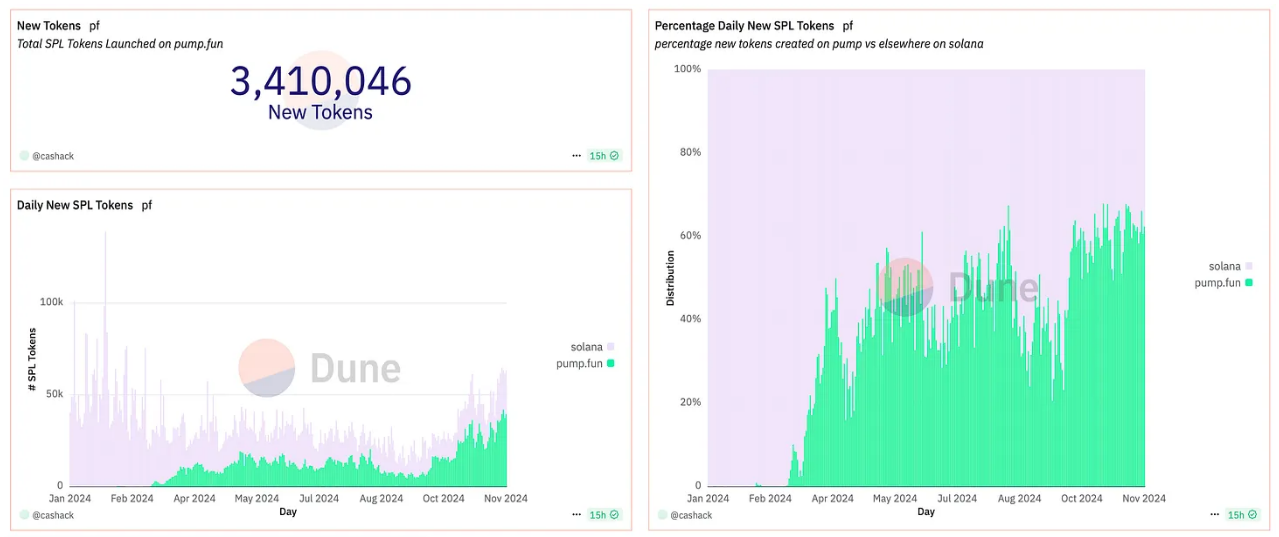

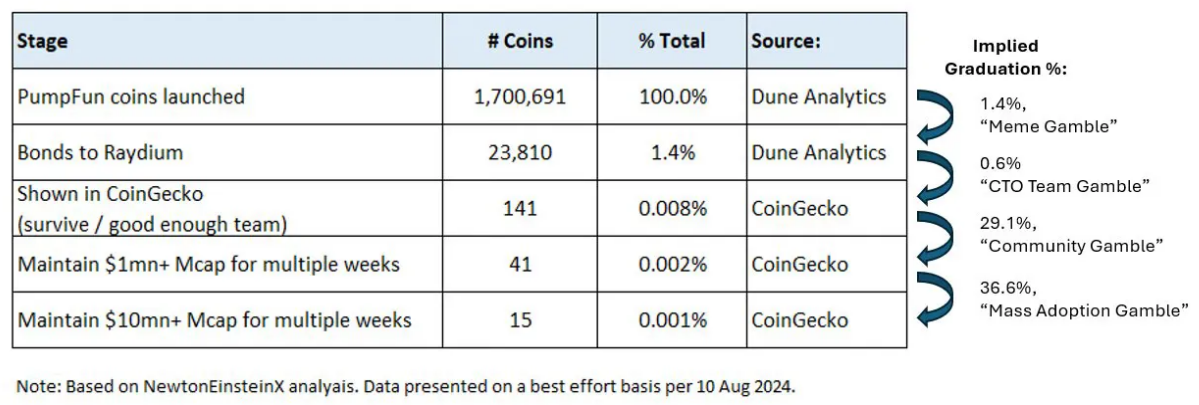

CoinGecko is currently tracking 520 memecoins on its Pump.fun dashboard. Since Pump's launch, 3 million tokens have been created.

This means that 99.982% of tokens are not tracked by CoinGecko, and we cannot obtain performance data for them.

Data source: Dune

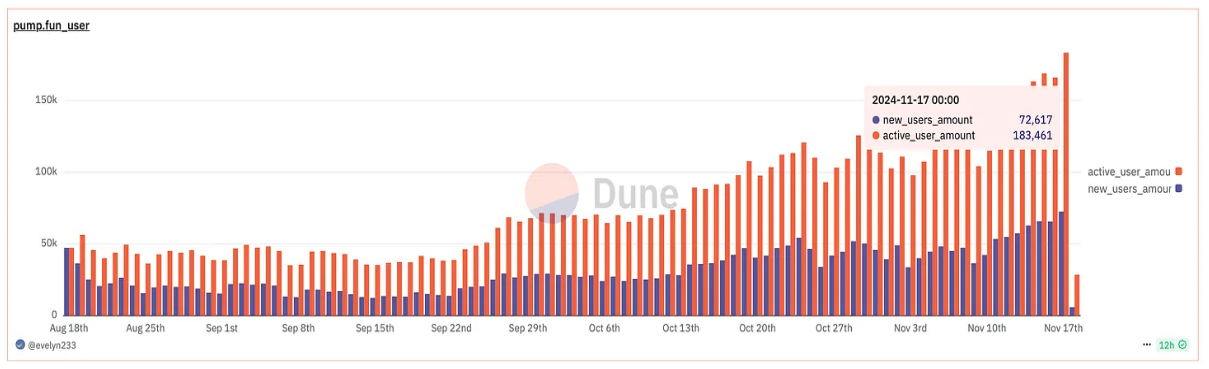

Meanwhile, Pump is attracting 50,000 to 70,000 new users daily, with a total of over 150,000 active users.

Data source: Dune

Here is some additional background information from my research conducted at the end of August:

Most of the top PNL addresses are token deployers, with only 3% of Pumpdotfun traders earning over $1,000, and 0.8% of traders earning over $10,000. Over 60% of traders are losing money.

Data source: @newtoneinsteinx on X

These are the new memecoins. This bet doesn't seem very healthy, does it?

For the average new memecoin trader, the main issue is the inability to distinguish between "new" memecoins and "mature" memecoins. Most novice traders chase early-stage protocols, hoping to replicate the story of that 0.001% that successfully achieves mass adoption—like PEPE or BONK.

I don't want to disappoint you, but the probability of dying from a lightning strike is 0.011%, and you might not encounter odds higher than that.

3. Mature Memecoins

For mature memecoins, the outlook is much brighter. Their ability to reach a certain market cap is not due to venture capital support or specific valuation factors, but rather the strength of their community, a bit of luck, and strategic market management.

This may sound like a conspiracy theory, but I believe that most memecoins with a solid market share are not launched by random developers. There is usually a professional memecoin development team behind them, equipped with ample resources for market making and marketing, which is also the reason for the success of these memecoins.

To clarify, I am not saying that all popular memecoins are the result of perfectly executed plans, but this is likely true for most memecoins.

Several logical factors explain the outperformance of mature memecoins compared to other Web3 sectors:

100% of the supply is in circulation (no low circulation or high FDV)

No venture capital support (eliminating additional selling pressure)

An organic and active holding community

No product risk (no vulnerabilities, poor execution, or user acquisition issues)

Memecoin rotation model (the rise of one memecoin drives the rise of others)

Strong correlation with the overall market cycle

Lower reliance on marketing

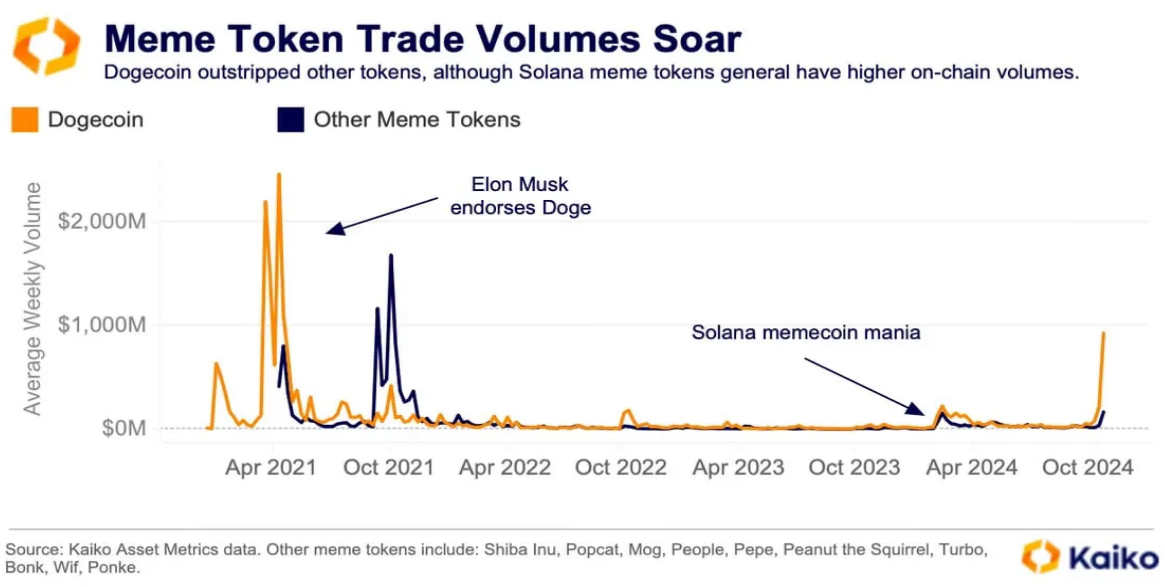

Source: Kaiko

Trading memecoins is purely a speculative activity, and this year, this behavior has become more predictable, forming certain behavioral patterns that divert trading volume and liquidity away from "classic" tokens, especially in the current Web3 landscape lacking mainstream or fresh narratives.

By the way, according to the 1% market depth data from U.S. trading platforms, the liquidity of meme tokens reached a historical high of $110 million last week. Larger market cap meme tokens like SHIB and DOGE still dominate, accounting for over 70% of total market depth.

However, their market share is gradually declining, indicating an increasing interest in smaller tokens.

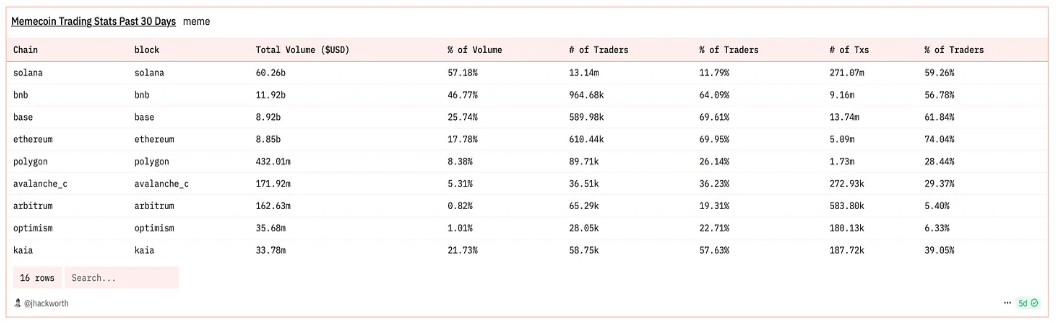

Currently, over 50% of trading volume on Solana comes from memecoins; on BNB, this figure is close to 45%; and on Base, it is about 25%.

That's quite a lot.

Data source: Dune

However, history shows that when the market is busy promoting a certain narrative after price movements, it is often too late. In my view, the memecoin market has long reacted to Bitcoin's rise.

As long as Bitcoin's price remains around $90,000, I doubt we will see those memecoins that have already established themselves (let's call them "faith coins" to avoid confusion with the 3 million tokens created on Pump.fun this year) experience another round of explosive growth.

However, retail investors tend to always chase the last train of trends, and now they are still getting on board, hoping to reach "Valhalla" all the way.

The crux of the problem is not just that most newcomers arrive too late—this is a classic phenomenon in all narratives.

The real issue is that a significant portion of retail investors is jumping on the "new memecoin" train, which often heads towards "Hel" rather than "Valhalla."

The result is that new users get severely burned, and further user entry stagnates. For ordinary Web2 users, the distinction between memecoins and classic tokens is minimal; they are just a few trading codes in their eyes. Therefore, this poor experience is amplified across all areas of Web3.

It should be noted that I do not oppose "faith coins" (memecoins with a solid market share). They have many advantages. But I believe we need to stop using the same term to describe both excellent projects and poorly designed "gambling" tokens on Pump.fun. Let's resolve this issue.

4. Summary: Some Suggestions

If you are an experienced memecoin trader, you can continue to stick to your strategy, but be aware that the market may be overheated.

If you are a newcomer to memecoins and feel a strong sense of FOMO, consider allocating a small portion of controllable funds to experiment, focusing on those "faith coins" that have already been recognized by the market.

Avoid participating in new project launches unless you clearly understand how to win in them. There is a very important rule: If you don't know how to win a game, don't participate.

Article link: https://www.hellobtc.com/kp/du/11/5539.html

Source: https://stacymuur.substack.com/p/are-memecoins-a-springboard-to-gains?utmsource=%2Finbox&utmmedium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。