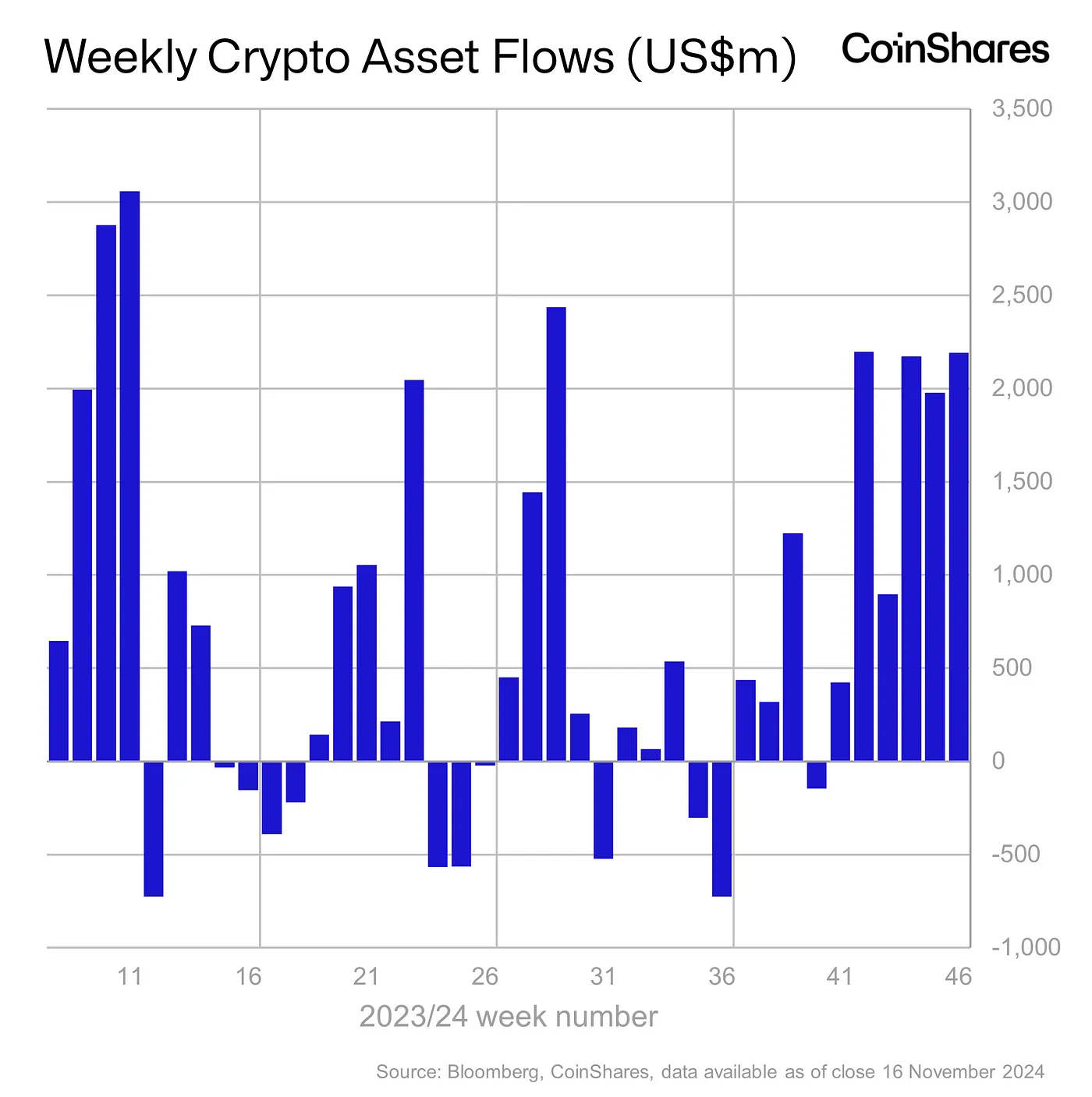

The latest exchange-traded product (ETP) surge was analyzed in the latest report led by James Butterfill, Coinshares’ head of research. The data from the digital asset fund flows weekly report highlighted mixed investor sentiment, shaped by recent market conditions and geopolitical events.

Bitcoin (BTC) played a dominant role, contributing $1.48 billion to the total inflows. However, its recent price rally to all-time highs prompted a mixed investor response. Coinshares observed that $49 million flowed into short bitcoin investment products, while outflows of $866 million in the latter part of the week suggested profit-taking as some investors responded to market volatility.

Ethereum (ETH) demonstrated a strong recovery, attracting $646 million in inflows, representing 5% of its total assets under management (AuM). Butterfill attributed Ethereum’s resurgence to optimism following Justin Drake’s Beam Chain network upgrade proposal and clarity from the recent U.S. elections. Coinshares noted that this renewed confidence in ethereum points to strengthening sentiment in the altcoin market.

Regional investment patterns revealed varying trends. The United States led inflows, accounting for $2.2 billion, followed by Hong Kong, Australia, and Canada, which brought in $27 million, $18 million, and $13 million, respectively. On the other hand, outflows in Sweden and Germany totaled $58 million and $6.8 million, reflecting profit-taking strategies in those markets.

Coinshares reported that total assets under management in digital asset investment products reached a new peak of $138 billion. This milestone was supported by a combination of looser monetary policy and the Republican Party’s success in the recent U.S. elections, which collectively bolstered investor confidence. These broader market conditions were cited as key drivers of the week’s activity.

Other altcoins, such as solana (SOL), also saw modest gains. Solana attracted $24 million in inflows, indicating increasing institutional interest. While bitcoin and ether continued to dominate the market, Coinshares emphasized that alternative assets are gradually establishing their presence within the digital asset landscape.

The report, anchored by Butterfill’s analysis, underscores the complex interplay between geopolitical factors and market behavior shaping digital asset fund flows. As the sector continues to grow, Coinshares suggested that evolving investor sentiment will remain a critical factor in defining the trajectory of this emerging market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。