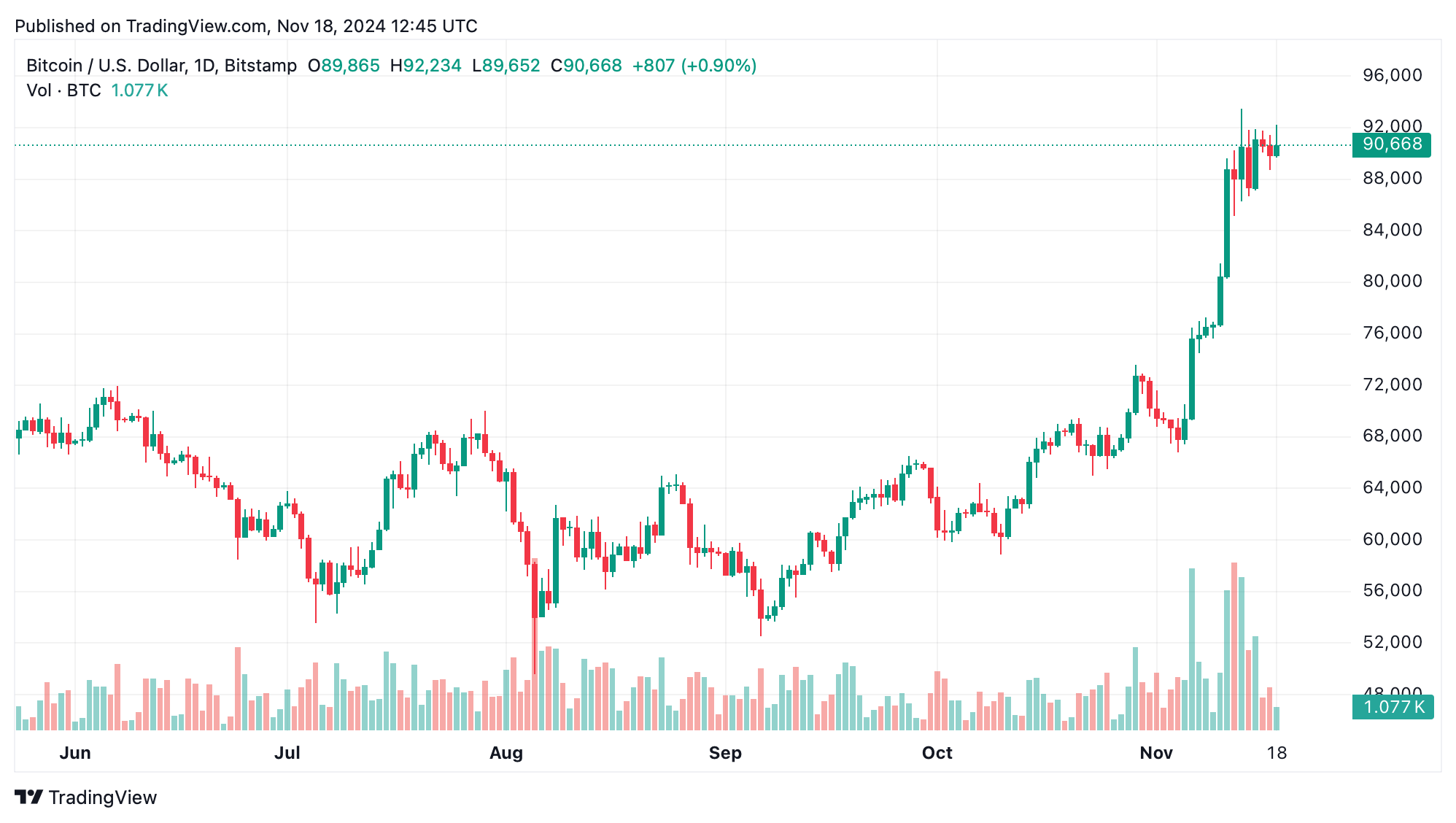

On the daily chart, bitcoin’s rally from $64,802 to $93,483 has shifted into a consolidation phase within the $90,000–$92,000 range. Candlestick patterns reflect uncertainty, with small bodies and long wicks on either side. Trading volume, which spiked during the breakout, has since tapered off, signaling a more cautious sentiment. Breaking above $93,500 could reignite the bullish trend, while falling below $88,000 may suggest a deeper correction ahead.

BTC/USD daily chart via Bitstamp on Nov. 18, 2024.

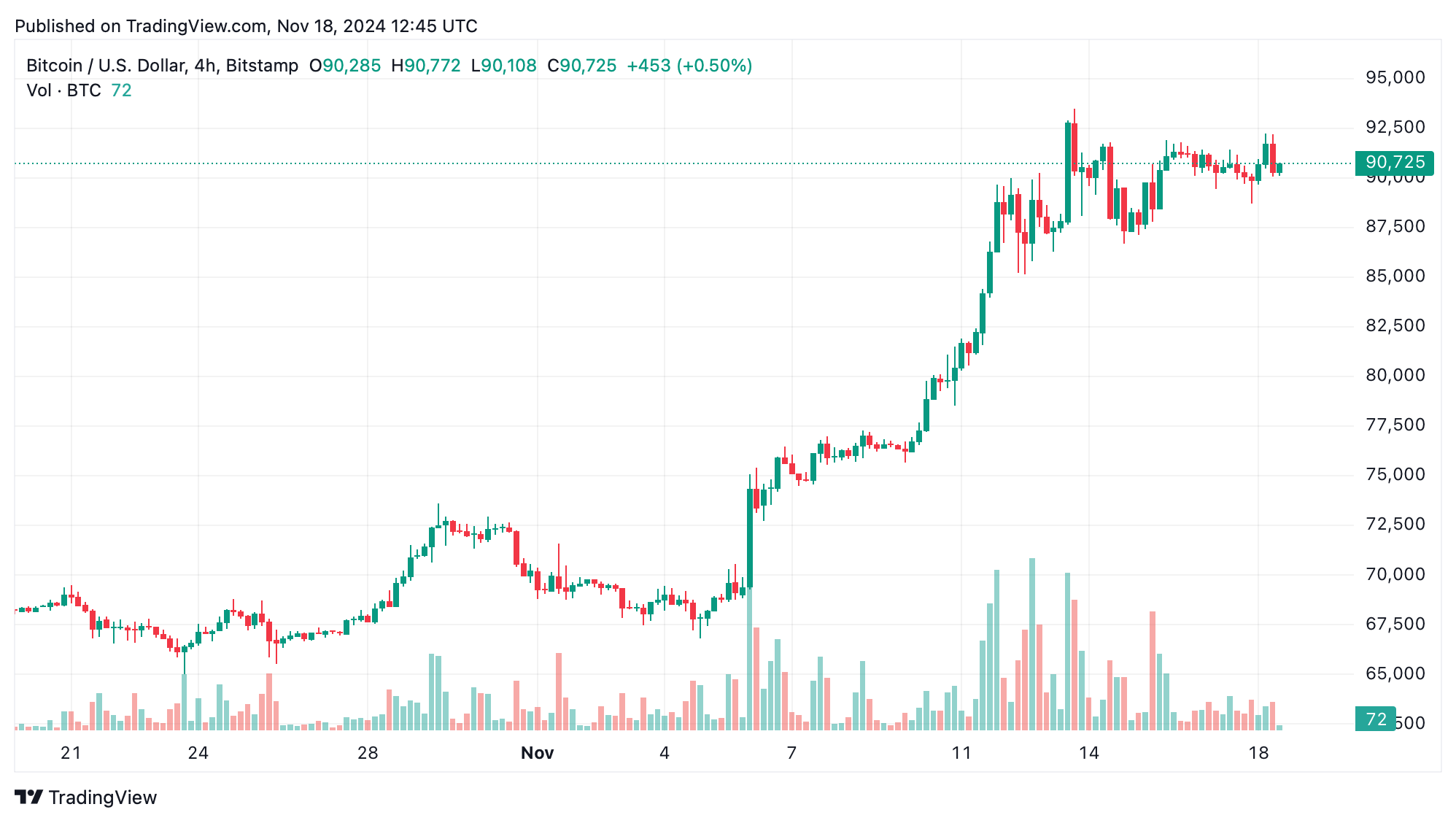

The four-hour chart shows bitcoin bouncing between $90,000 and $93,500. A pattern of lower highs indicates short-term bearish momentum, but support at $90,000 has remained steadfast. Profit-taking during pullbacks and renewed buying interest highlight active market participation. Traders could consider long positions near $90,000 with tight stop-losses, while resistance at $93,500 acts as a critical threshold for upward movement.

BTC/USD 4-hour chart via Bitstamp on Nov. 18, 2024.

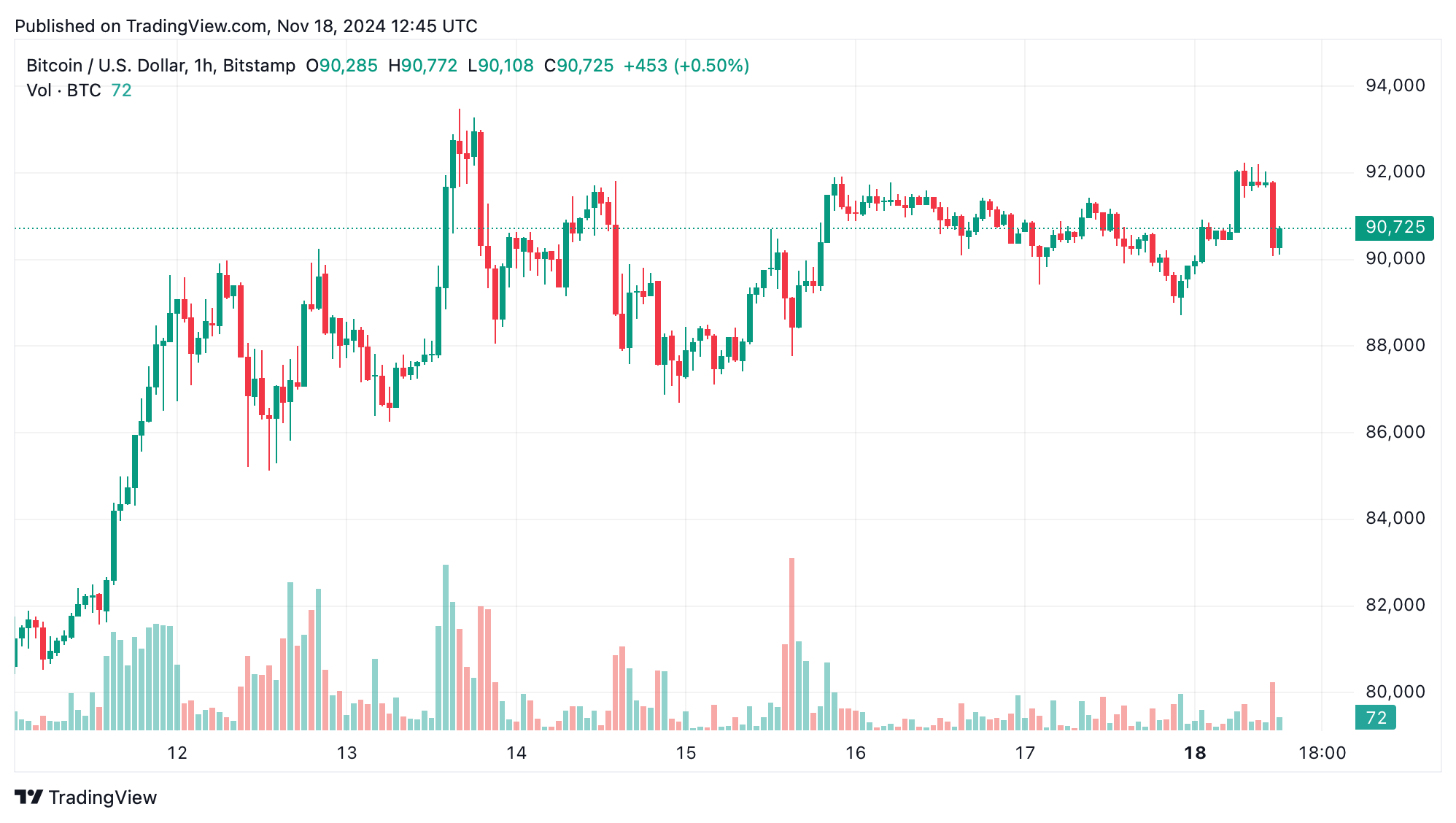

On the 1-hour chart, bitcoin repeatedly tests the $90,000 support level, rebounding from $88,709 to peak around $92,234 before pulling back. Declining volume during retracements suggests limited selling pressure, though caution remains as the price edges toward key levels. Scalpers and short-term traders may aim for gains in the $90,000–$92,500 range, placing stop-losses below $89,000 to manage downside risks.

BTC/USD 1-hour chart via Bitstamp on Nov. 18, 2024.

Technical indicators provide mixed signals, emphasizing the market’s indecisiveness. Oscillators like the relative strength index (RSI) and stochastic oscillator (SO) are neutral at 74 and 88, respectively. Meanwhile, the moving average convergence divergence (MACD) shows a buy signal at 6,147. The commodity channel index (CCI) at 95 points to consolidation, adds to the complex picture. Moving averages remain bullish across timeframes, with short-term averages above $86,000 and long-term averages near $64,652 offering solid support.

Bull Verdict:

If bitcoin breaks above $93,500 with sustained momentum, the bullish trend is likely to continue, potentially targeting $95,000 or higher. Traders with long positions should monitor these resistance levels for opportunities to capitalize on upside potential.

Bear Verdict:

If bitcoin falls below the $90,000 support and breaches $88,000, a deeper correction could unfold, with targets in the mid-$80,000s. Traders should exercise caution and consider tighter risk controls to navigate this potential downturn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。