On November 13, Bitcoin surged to $92,000, and the total market capitalization of cryptocurrencies reached $3.2 trillion, both breaking historical highs. This round has only seen Bitcoin and meme coins celebrating, while altcoins have not followed suit.

The reasons for the lackluster performance of altcoins can be summarized as follows:

- The market is not buying into the token economic models of new projects with low market cap and high fully diluted valuation, instead opting to invest in meme coins.

- There have been no killer applications in this round.

The chart below shows Bitcoin's market dominance (BTC.D), which currently stands at 61%, a new high in three and a half years. Will BTC.D continue to rise? Can the aforementioned lackluster reasons be resolved in this cycle? Is there still an altcoin season? Let's take a look with WOO X Research.

Reference: Trading View

Logic Behind Altcoin Price Increases

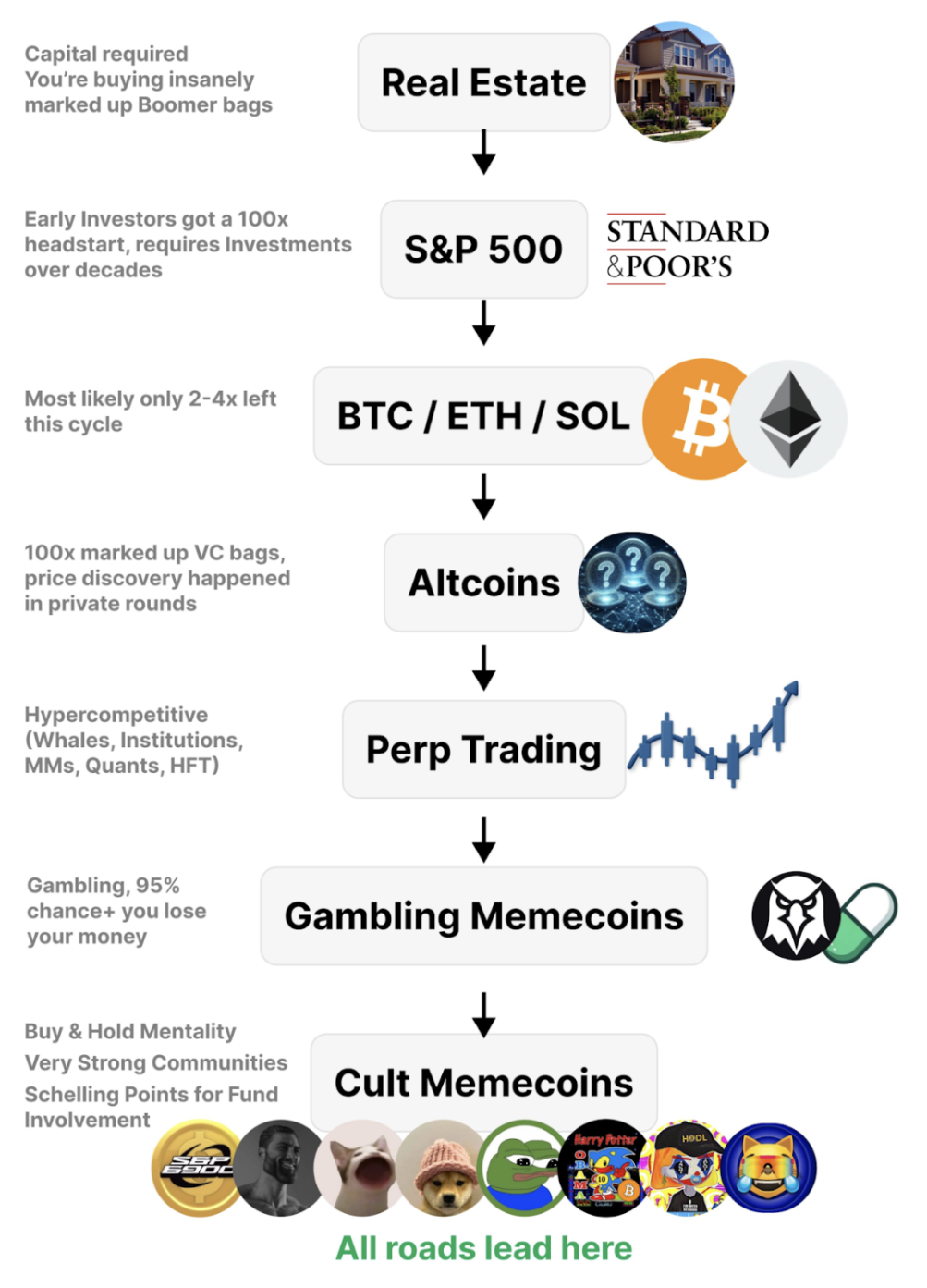

We are currently in the early stages of a rate-cutting cycle, which means the U.S. is releasing more liquidity into the risk market. The flow of funds has a directional path: starting from the traditional real estate market, funds overflow into the stock market, and when the stock market reaches a certain market cap, excess funds will flow into mainstream crypto assets (BTC/ETH/SOL). When mainstream crypto assets rise and meet market cap standards, funds will then flow into the smaller market cap altcoin market, thereby driving up altcoin prices.

One can imagine that these asset categories are like a series of basins, from large to small. When enough water is poured in to fill the upper basins, it will naturally overflow into the smaller basins below. This flow of funds indicates that capital will follow the characteristics of market liquidity, moving from relatively low-risk, larger assets to higher-risk, smaller assets.

Therefore, the prerequisite for altcoin price increases is: Bitcoin must rise first, until it can no longer do so, at which point funds will be willing to move out of Bitcoin to purchase altcoins.

Reference: @MustStopMurad

Current Market Cycle: The Eve of Altcoin Explosion

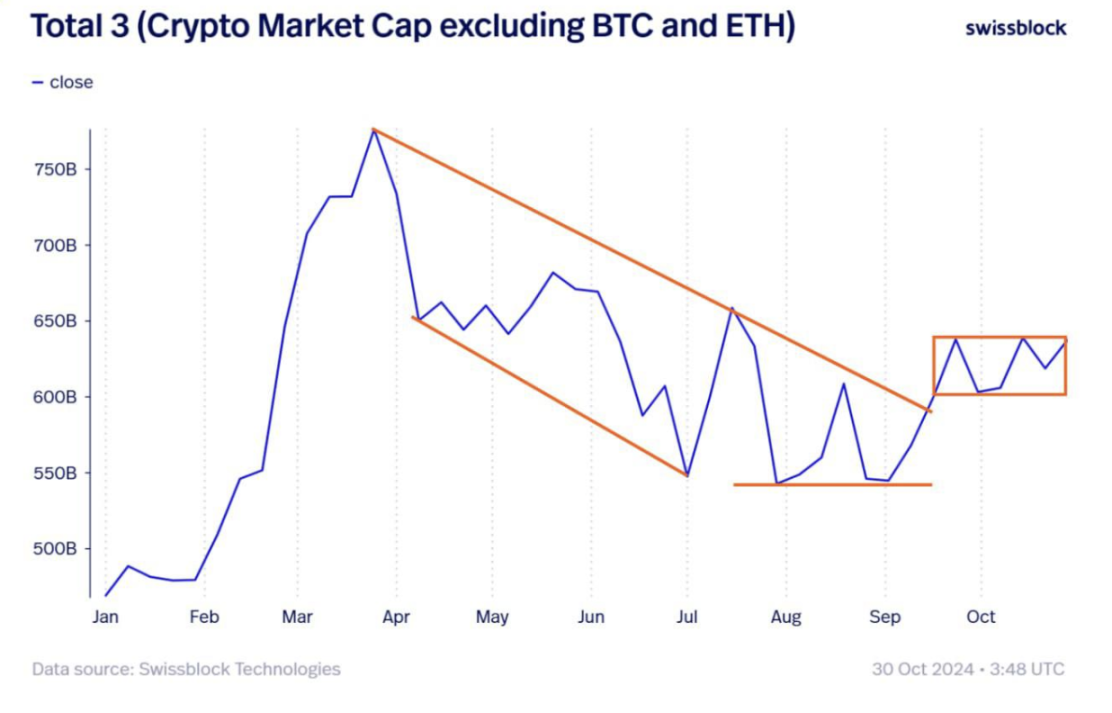

The chart below shows the change in total market capitalization of cryptocurrencies, excluding Bitcoin and Ethereum, since the beginning of this year (Total 3). This chart also represents whether altcoins can explode. It can be seen that from April to September this year, the overall market cap of altcoins showed a significant downward trend, dropping from $75 billion to $55 billion. However, starting in September, the chart shows a rebound in market cap, rising from $55 billion to the $60 billion to $65 billion range, breaking the downward trend, which indicates that we have passed the lowest point for altcoins.

As mentioned earlier, BTC.D is now close to 61%, a new high for this cycle and in three and a half years. Based on past experience, the start of an altcoin season is usually preceded by a rise in Bitcoin that drains altcoins, causing BTC.D to soar. When it rises to a certain level, BTC.D will drop from the high point to the 50%-55% range, allowing altcoins to catch up. We are currently in a cycle where BTC.D is soaring to its peak.

The current total market capitalization of cryptocurrencies is approximately $3.2 trillion. If BTC.D drops from 61% to 50% while the total market cap remains unchanged, it is expected that $320 billion will flow into the altcoin market, which also means Total 2 (excluding Bitcoin's market cap) will grow by 28%!

- Calculation formula: [3.2T(61-50%)] / [3.2T(1-61%)] = 28%

Future Outlook from a Financing Perspective: Focus on DeFi and Applications

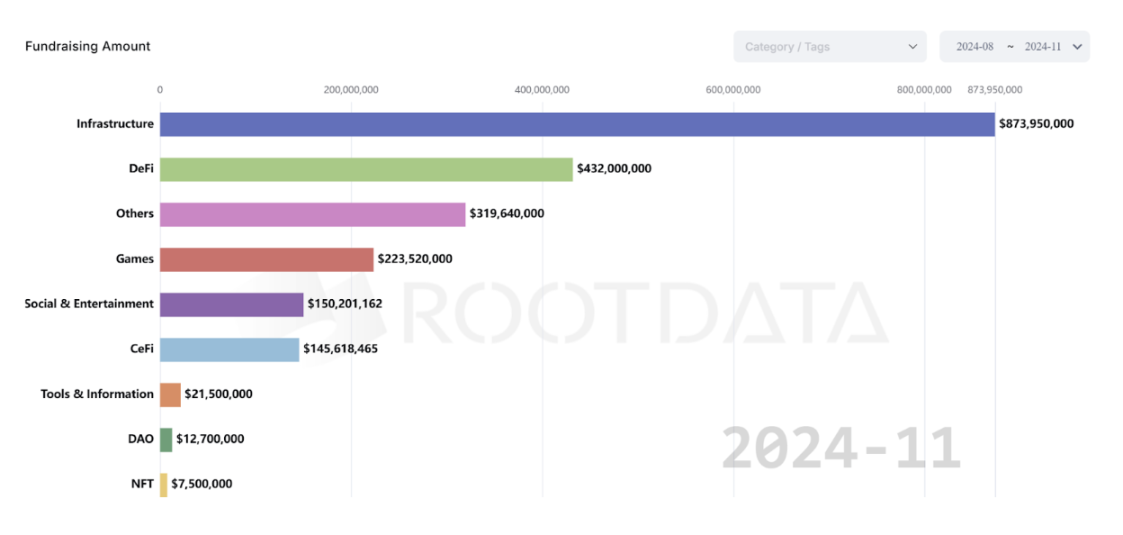

We have just assessed the current market level based on various market cap data, and the future outlook needs to consider the current financing situation. Financing represents confidence in the crypto market for the next 6 to 12 months and is a leading indicator of the development of altcoins in this cycle.

In the past three months, financing amounts have revolved around infrastructure, with a total of $870 million raised. Infrastructure is a key track in the crypto market's financing landscape, as blockchain is still in its early development stage, and investors are quite interested in securing positions in infrastructure. We should pay close attention to the second and third tracks, which are DeFi and others (usually referring to application DApps). The former has raised a total of $430 million, while the latter has raised $310 million, significantly outpacing other tracks.

The essence of financing is to invest in early potential projects. While many criticize the poor price performance of altcoins, investment institutions are beginning to position themselves in early DeFi and application projects, expecting a new wave of explosions in 2025.

Reference: Rootdata

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。