Bitcoin (BTC) and everything else tied to cryptocurrency have been on fire since Donald Trump won the U.S. presidential election on Nov. 5. Those looking to board the crypto freight train now should be ready for potential twists and turns in the wild rise as data tracked by JPMorgan and other analysts shows things are getting frenzied out there.

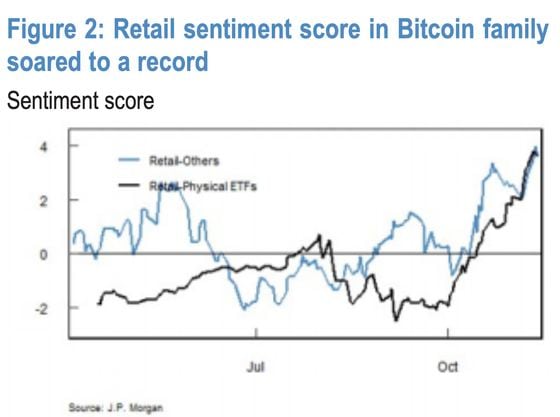

As BTC rose past the $93,000 mark last week and inflows into the U.S.-listed spot ETFs and crypto stocks surged, JPMorgan's retail sentiment score rose to a record high of 4. The measure is designed to gauge the sentiment of retail investors toward cryptocurrencies, especially bitcoin, based on the activity in the family of BTC products, including spot ETFs.

"Within ETF space, demand for Bitcoin ETFs was particularly strong (IBIT +3.4z) following the election results. The demand for Bitcoin was also reflected in COIN (+6z). In fact, their sentiment score for the Bitcoin family (for both physical ETFs and others) soared to a multi-sigma high," JPMorgan's equity research team said in a note to clients last week, discussing the retail order imbalance.

The z score of 3.4 and higher indicates a substantial and positive deviation from the average, indicating strong demand.

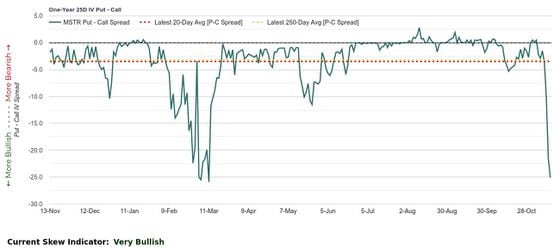

Meanwhile, the options market tied to shares in bitcoin-holder MicroStrategy (MSTR) exhibited a record bullish sentiment, also pointing to frenzied trading often observed at market peaks.

The one-year 25-delta put-call skew nosedived to -26.7% on Wednesday. It meant that call options used to hedge against or profit from price rallies traded at a significantly higher premium to puts offering downside, according to chart from Market Chameleon shared by pseudonymous analyst Markets&Mayhem on X.

The skew recovered somewhat to -11.8% on Friday, still exhibiting a solid bias for upside bets. BTC calls have been consistently pricier than puts, but the differential has been notably narrower than MSTR.

"Call skew in MSTR is so wildly euphoric that it is hard to imagine we don't see a more meaningful drawdown unless bitcoin continues to move in a parabolic fashion higher. For now, it appears to be cooling off just a little bit from its highs," Markets&Mayhem said.

Authors of TheMarketEar analytics service referred to the skew as something "beyond extreme upside fear."

So, while BTC and other crypto-linked assets may be solid long-term investments, the surging retail investor sentiment can be unpredictable, potentially leading to a sharp and painful market reversal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。