I. Introduction: Ethereum's Lackluster Performance and Future Concerns

Ethereum's recent market performance has been disappointing, raising concerns among many community members. Since the beginning of this year, Ethereum's price growth has significantly lagged behind that of Bitcoin and Solana. Especially after Ethereum decided to adopt a modular architecture strategy, the value growth of its network seems to have fallen short of expectations. In this context, many are left wondering: Is Ethereum's strategic choice correct? Does the future direction need adjustment? This article will delve into the current situation, the Beam Chain proposal, the modular strategy, and the challenges and opportunities ahead.

II. Current Situation Analysis: Ethereum's Market Performance

2.1 Price Performance Comparison

When comparing Ethereum's market performance with that of Bitcoin and Solana, it is evident that Ethereum has significantly underperformed in this cycle. According to data from TradingView, Ethereum's price has increased by 150% from the beginning of 2023 to the present, while Bitcoin has risen by 422%, and Solana has skyrocketed by 1629%. It is widely believed that Ethereum's choice of a modular architecture is a significant reason for its poor price performance.

Data Source: https://www.tradingview.com/x/zfBGgFQv/

2.2 Short-term Impact of Modular Architecture

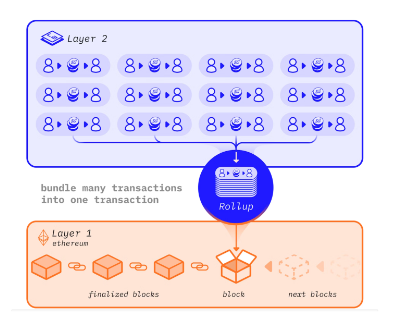

The modular strategy has led Ethereum to relinquish some infrastructure services, delegating functions such as execution, settlement, and data availability to Layer 2 (L2) or other independent projects. This means that Ethereum's core revenue source—network transaction fees—has decreased. The EIP-1559 mechanism introduced by Ethereum aims to support prices by reducing supply through the burning of a portion of transaction fees, but as Layer 2 rises, the effectiveness of this strategy has gradually diminished. In other words, while the modular strategy has enhanced the flexibility and scalability of the Ethereum ecosystem, it has had a negative impact on ETH prices in the short term.

2.3 Overall Ecosystem Value

From the perspective of the overall market value of the ecosystem, Ethereum and its modular infrastructure tokens created a value comparable to Solana in 2023, totaling approximately $50 billion. However, in 2024, this performance has declined, partly due to wavering market confidence in the modular strategy, as investors gradually become confused about the decentralized infrastructure tokens and struggle to grasp the growth potential of the entire ecosystem.

III. Beam Chain Proposal: Opportunities and Challenges in Redesigning the Consensus Layer

3.1 Core Content of the Beam Chain Proposal

At the Devcon conference, Ethereum Foundation researcher Justin Drake proposed a consensus layer upgrade called "Beam Chain," referred to as "Ethereum 3.0." The Beam Chain aims to significantly enhance Ethereum's performance and security through a large-scale upgrade.

The goals of Beam Chain include:

- Accelerating block production speed, reducing block time from the current 12 seconds to 4 seconds

- Achieving a lower validator staking threshold, decreasing from 32 ETH to 1 ETH, to attract more new users to participate in staking

- Utilizing SNARK technology to achieve "chain SNARKification," enhancing efficiency and security

Justin Drake views this proposal as a sign of Ethereum entering the "ZK era," ensuring that Ethereum remains secure in the face of quantum computing threats by using post-quantum cryptographic hashing and signature schemes.

3.2 Bulk Upgrades and Accelerated Fossilization

The Beam Chain proposal plans to implement multiple significant changes at once. While this can accelerate Ethereum's transition to maintenance mode and reduce long-term uncertainty, it also increases systemic risk. Péter Szilágyi has expressed concerns, believing that large-scale bundled upgrades may lead to some potential issues going unnoticed, and the community and system will need time to gradually adapt to these changes; iterative upgrades may be more prudent.

IV. Reflection on Ethereum's Modular Strategy

4.1 Advantages of the Modular Strategy

Since Ethereum decided to adopt a modular architecture in 2020, its impact has gradually become apparent. The modular strategy aims to decompose different functions and delegate them to multiple projects, such as Layer 2 handling execution and projects like Celestia managing data availability. This architecture has endowed Ethereum with greater adaptability and scalability. Through this approach, Ethereum can maintain the flexibility of its ecosystem and adapt to unpredictable technological changes in the future.

- Flexibility: Modularity allows Ethereum to quickly adapt to new technologies, such as the integration of SNARK and zkEVM.

- Scalability: By expanding the surface area through Layer 2, it reduces the costs for developers and users.

Reference: https://ethereum.org/zh/layer-2/

4.2 Disadvantages of Modularity

However, this strategy also brings short-term economic and technical negative impacts:

- Decreased transaction fees: The rise of Layer 2 has diverted transaction fees that originally belonged to the Ethereum mainnet, affecting the price of ETH.

- Deteriorating user experience: The complexity of modularity may lead ordinary users to face issues such as complicated operations and limited liquidity when using Layer 2.

- Centralization risk: The concentration of holdings in some infrastructure tokens may adversely affect the decentralization of the network.

V. Historical Summary: From "The Merge" to Now

5.1 Review of the 2022 "Merge"

The "Merge" in 2022 was one of the most significant upgrades in Ethereum's history, marking its transition from proof-of-work (PoW) to proof-of-stake (PoS), significantly reducing the network's energy consumption and laying the foundation for future scalability improvements.

The Merge not only enhanced the network's energy efficiency but also paved the way for future scaling solutions, such as sharding technology. With the introduction of the Beam Chain proposal, Ethereum is gradually moving towards a more efficient and sustainable blockchain ecosystem, with the Merge being a key step in this journey.

5.2 Developments After the Merge

- Enhanced energy efficiency: The introduction of PoS has reduced the network's energy consumption by 99.5%.

- Rise of staking: Validators have replaced miners, making the network more decentralized and efficient.

- Future scalability foundation: The Merge has laid the technical groundwork for scaling solutions like sharding and Beam Chain.

VI. Future Plans and Challenges

6.1 Implementation Roadmap

The implementation of Beam Chain is divided into several phases:

- 2025: Specification development phase

- 2026: Official development phase

- 2027 and beyond: A testing phase lasting at least two years to ensure the safety of new technologies before deployment on the mainnet

6.2 Technical and Governance Challenges

This lengthy timeline also reflects the complexity of technical implementation and the difficulties of governance coordination. Additionally, how modularity and Beam Chain will work together is a significant challenge for the future. Modularity expands Ethereum's "surface area" through Layer 2, while Beam Chain aims to enhance the core performance of the consensus layer. The combination of these two will determine Ethereum's future balance between scalability and security.

6.3 Key Issues to Address

- Technical complexity: The integration of technologies such as real-time SNARKification and post-quantum encryption is extremely challenging.

- Governance coordination: Broad community support and close collaboration among multiple development teams are needed.

- System security: New vulnerabilities must be avoided when introducing new technologies to ensure the long-term security of the network.

VII. Rebuttals and Critical Thinking

7.1 Advantages of Phased Upgrades

Regarding the Beam Chain proposal, Péter Szilágyi has raised some critical points. He believes that Beam Chain's attempt to radically overhaul the consensus layer by introducing multiple changes at once may increase systemic risk, especially without sufficient time for testing and evaluation. In contrast, gradually implementing low-difficulty improvements and then considering a comprehensive reconstruction when necessary may be more prudent and align better with Ethereum's gradual evolution philosophy.

7.2 Centralization Issues in the Modular Ecosystem

The complexity of modularity and the risk of centralization also need to be taken seriously. While modularity enhances the flexibility of the Ethereum network, it also increases the complexity of user operations, particularly when transferring between multiple Layer 2s, which may significantly degrade the user experience. Additionally, the concentration of holdings in some Layer 2 development teams and infrastructure tokens may adversely affect the decentralization of the network.

VIII. Competitive Analysis: Solana and Other L1 Blockchains

8.1 Solana's "Single-Shard" Structure

In contrast to Ethereum's modular strategy, Solana has chosen a "single-shard" blockchain development path, achieving high throughput and low latency directly at Layer 1, attracting a large number of users and developers. This gives Solana a certain advantage in user experience, especially as users do not have to worry about the complexities of cross-layer operations.

- High throughput: Solana achieves significant performance advantages through parallel processing and an efficient consensus mechanism.

- User-friendliness: Since cross-chain operations are not required, the user experience is relatively simple and intuitive.

8.2 Scalability and Future Challenges

However, this "single-shard" structure also has inherent scalability bottlenecks. Once system demand exceeds its design capacity, Solana may need to rely on external scaling solutions, which contradicts its current design philosophy. In contrast, Ethereum's scalability achieved through modularity and Layer 2 solutions allows it to respond more flexibly to future technological challenges and market demands.

Scalability limitations: The scalability of a single-shard structure is limited, and future breakthroughs may be needed to overcome existing architectural constraints.

Insufficient flexibility: Solana's flexibility in technological innovation is not as strong as Ethereum's, making it unable to quickly integrate new technologies through modularity like Ethereum can.

IX. Conclusion: How Will Ethereum Evolve in the Future?

9.1 The Combination of Modularity and Beam Chain

The combination of Beam Chain and the modular architecture represents an important attempt by Ethereum in scalability and technological innovation. In the coming years, the success or failure of Beam Chain will determine whether Ethereum can continue to maintain its leading position as a smart contract platform. At the same time, while enhancing the network's adaptability, Ethereum's modular strategy also needs to address issues of centralization and user experience.

9.2 Ecosystem Activity and Innovation

Overall, Ethereum's future depends on the activity and innovation capacity of its ecosystem, as well as community support and consensus on the technological roadmap. In a constantly changing technological and market environment, Ethereum can only truly realize its vision of being a "world computer" through continuous innovation and iteration, maintaining its lead in the next wave of blockchain technology.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidance for investors at different levels. Our professional content includes the "Play-to-Earn Web3" tutorial series, in-depth analysis of cryptocurrency industry trends, detailed analyses of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。