As of this writing, bitcoin (BTC) is holding steady just above $90,000 per coin, accounting for a solid 59% share of the entire $3.02 trillion crypto market economy. Once dismissed by skeptics, bitcoin has now earned respect from some of the world’s biggest financial institutions and is even being eyed as a potential addition to national reserves.

Beyond its soaring value, Bitcoin’s proof-of-work (PoW) network boasts impressive power, with more than 700 exahash per second (EH/s) supporting the chain. Despite its throne as the king of cryptocurrencies, BTC still has room to grow and maintain its dominance in the years ahead. The following is an exploration of three potential ways to improve the Bitcoin network as it moves into the future.

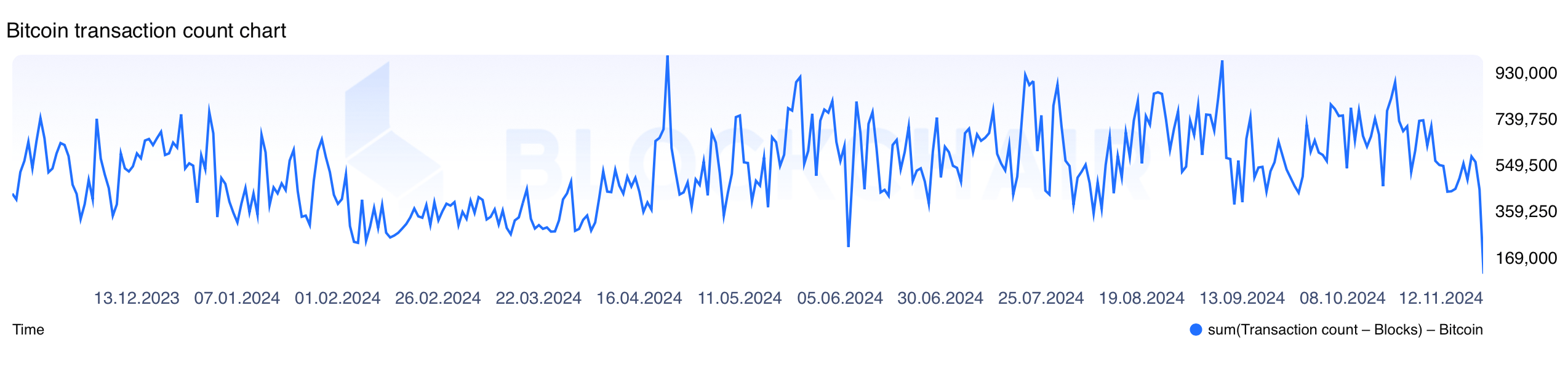

Discussing Bitcoin’s scaling challenges might feel like tiptoeing through a minefield in some circles, but plenty of enthusiasts argue the network must evolve to support billions of users while staying true to its decentralized, censorship-resistant ethos. For context, over the past 24 hours, BTC handled 581,039 transactions, averaging 6.72 transactions per second (tps). The network has yet to surpass the milestone of 1 million transactions in a single day. Its record came on April 23, when miners confirmed 927,010 transactions, achieving a throughput of about 10.73 tps.

This year, Bitcoin processed a record 927,010 transactions in 24 hours.

By comparison, Visa operates on an entirely different level, handling roughly 757 million transactions daily, according to its last fiscal year report. While no blockchain currently rivals Visa’s speed, some, like Solana, are making significant strides. For instance, on Dec. 24, 2021, Solana processed an eye-popping 57 million transactions, averaging 659.72 tps. With thoughtful innovation, Bitcoin could one day rival Visa’s speed—a possibility even Satoshi Nakamoto envisioned.

Currently, the Bitcoin blockchain struggles to handle high volumes of transactions when demand spikes. When the network becomes overloaded, transaction fees climb, and low-fee transfers can languish in the mempool for extended periods. Right now, there are 238,922 unconfirmed transactions waiting in the queue, and this number has previously soared past 700,000. During such congestion, fees have reached as high as $240 per transfer, especially following the halving. On a day like that, anyone with less than $240 worth of BTC couldn’t use their funds onchain, leaving many users stuck in limbo.

While layer two (L2) solutions offer alternatives, scaling must be approached with care. If billions of users could transact onchain with minimal barriers, even microtransactions—like pennies multiplied across billions—could generate significant fee revenue for miners. However, as Ethereum users have discovered, L2 solutions can siphon activity away from the layer one (L1) chain, despite their original intent to pay rent. Although L2s can help achieve Visa-level transaction speeds, they, along with sidechains and alternative networks, may not match Bitcoin’s security. This ongoing debate has simmered for nearly a decade and, while not as prominent now, is likely to resurface in the future.

Many believe quantum computing poses significant future risks to Bitcoin, primarily by threatening the cryptographic foundations that secure its transactions and ledger. Bitcoin relies on elliptic curve digital signature algorithms (ECDSA) to authenticate transactions and secure wallets. It has been said that theoretically, quantum computers, leveraging Shor’s algorithm, could possibly solve the mathematical problems underpinning ECDSA, enabling malicious actors to derive private keys from public keys.

Quantum computing is evolving at breakneck speed, fueled by exciting breakthroughs in hardware and real-world applications. Innovators like IBM and Quantinuum are pushing the boundaries with processors boasting higher qubit counts and reduced error rates, paving the way for more powerful computations.

To mitigate these risks, developers could eventually implement several strategies to enhance Bitcoin’s quantum resistance. One approach is to transition from ECDSA to post-quantum cryptographic algorithms, such as lattice-based or hash-based signatures, which are considered secure against quantum attacks. Integrating quantum-resistant key exchange protocols could also protect the confidentiality of communications between nodes. Another measure involves increasing the key sizes of symmetric encryption algorithms, as larger keys offer greater resistance to quantum decryption attempts.

Developers might also consider implementing hybrid cryptographic systems that combine classical and quantum-resistant algorithms, providing layered security during the transition period. With the speed of quantum computing accelerating every day alongside artificial intelligence (AI), regularly updating the Bitcoin protocol to incorporate the latest advancements in post-quantum cryptography will be essential to maintaining the network’s security in the quantum era.

The Bitcoin blockchain’s dependence on electricity and internet connectivity introduces two major vulnerabilities. Large-scale power outages or internet disruptions could halt miners and nodes from validating transactions or maintaining consensus, creating temporary delays in processing and potentially shaking trust in the network’s reliability. Additionally, events like cyberattacks or natural disasters targeting essential infrastructure could devastate power grids and communication systems in affected regions, posing a significant threat to Bitcoin’s stability over extended periods.

The power grid and internet systems face vulnerabilities from a host of threats. Extreme weather events—hurricanes, ice storms, and heat waves—can wreak havoc on transmission lines and substations, plunging vast areas into darkness. Even cosmic events like solar flares and coronal mass ejections (CMEs) pose a serious risk, potentially causing massive interruptions to both electricity and connectivity on Earth.

While a collapse of the grid or internet would impact global finance, commerce, and communication, Bitcoin’s decentralized nature presents unique challenges. Operations could become fragmented, and the hashrate would drop as fewer miners remain active. Though Bitcoin’s design is inherently resilient, prolonged outages might delay recovery. Network isolation during such periods could also lead to inconsistencies or temporary security risks until connectivity is restored.

To address these vulnerabilities, Bitcoin developers and the broader community are exploring innovative solutions. Technologies like mesh networks, HAM radio, and satellite-based systems provide alternative ways to transmit and validate transactions. Blockstream, for example, already offers satellite services to ensure global Bitcoin network access, even in areas with unreliable internet. Developers are also considering protocols that enable offline transaction signing and batch broadcasting, allowing users to transact even during significant infrastructure disruptions.

While the idea of a grid or internet collapse is alarming, history shows that critical systems are often restored swiftly after disasters. Efforts to rebuild power grids and set up alternative communication tools like HAM radio or satellite internet would likely start immediately. Bitcoin could benefit from these recovery efforts, allowing miners and nodes to reconnect. Using portable renewable energy sources, Bitcoin mining could adapt to operate in low-resource environments, ensuring the network remains functional even in the face of major challenges.

While Bitcoin’s evolution is marked by innovation and resilience, its future rests on a delicate balance between scaling, security, and adaptation. The network’s survival depends on collaborative efforts to uphold its foundational principles while embracing change. Bitcoin must remain both a technological and social contract, continually reaffirming its relevance as a global, decentralized financial system for generations to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。