Over the past month, bitcoin has held its own, but ethereum (ETH), the second-largest cryptocurrency by market cap, hasn’t kept up. For instance, bitcoin (BTC) climbed 18.8% over the past week, while ETH managed a modest 3.8% rise in the same period. Interestingly, blockchaincenter.net’s “there is no second best” index once highlighted that Microstrategy’s investment would have seen a bigger boost if the company had chosen ETH over BTC.

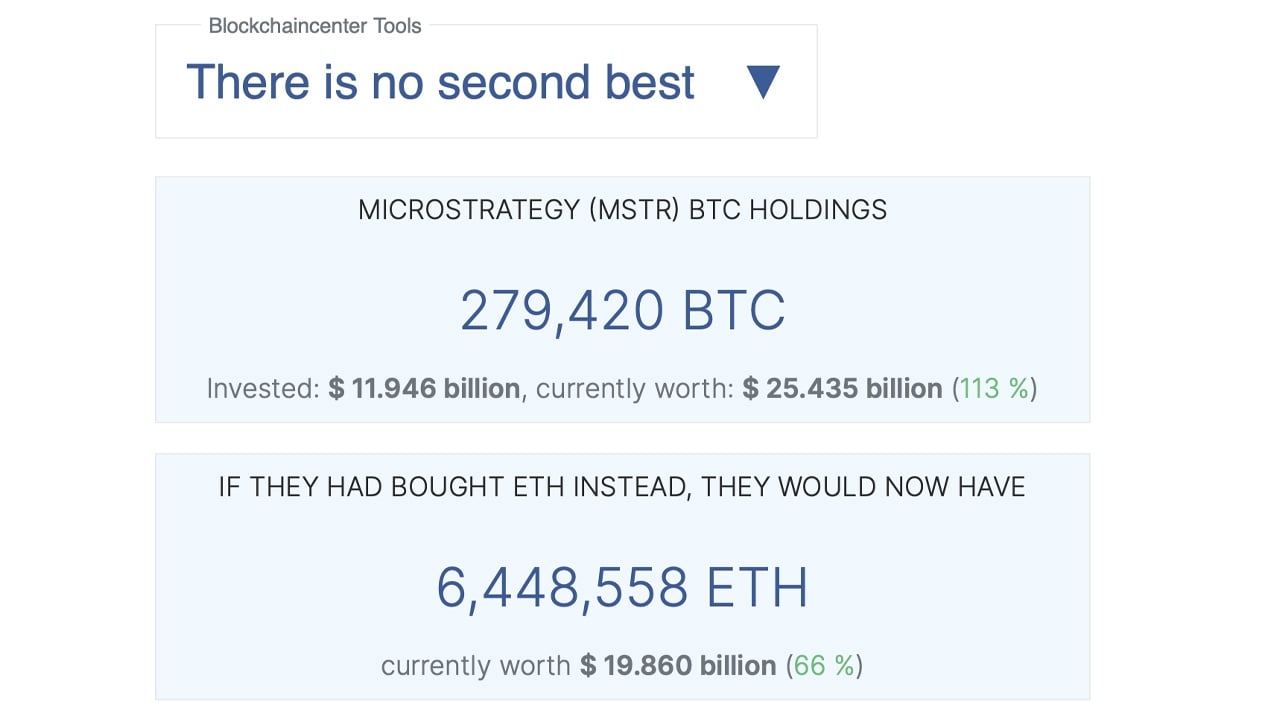

Things have shifted dramatically, with Microstrategy’s trove of 279,420 BTC now far outperforming what it would have if the company had chosen ether instead. The business intelligence giant poured $11.946 billion into its bitcoin holdings, and as of Nov. 16, 2024, that investment is valued at $25.435 billion—an impressive 113% gain in U.S. dollar terms. According to blockchaincenter.net’s index, had the company opted for ETH, it would currently hold 6,448,558 ether.

The value of the ether would be worth $19.86 billion and it would only be up 66% in value compared to 113%. The company’s stock MSTR has also seen a 2,147% rise over the last four years rising from $15.16 per share to the current $340.65. MSTR has outshined the crypto firm Coinbase’s COIN over the last 12 months as MSTR has seen a 589% gain compared to COIN’s 213%. The business intelligence firm’s market capitalization today stands at $69.03 billion.

Microstrategy’s bitcoin holdings are worth more than they would be if the company had bought and staked ETH instead. According to the “there is no second best” index, if Microstrategy had purchased 6.44 million ETH and staked it, the stash would have grown to around 6,966,290 ether. That stake would be valued at $21.454 billion but still falls short of the $25.435 billion worth of BTC the firm currently owns. For now, Microstrategy’s all-in approach to bitcoin has proven successful, though only time will tell if it remains the ultimate winning strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。