Bitcoin (BTC) achieved a record high of $93.4K during the New York trading session, according to the market update from QCP Capital. QCP analysts noted that the rally occurred following U.S. inflation data meeting expectations at 2.6% for headline inflation and 3.3% for core inflation. This triggered market speculation, pricing in an 82.5% probability of a 25 basis point rate cut at the December Federal Reserve meeting. QCP highlighted how the crypto market capitalization surpassed $3 trillion, eclipsing its previous 2021 peak of $2.77 trillion.

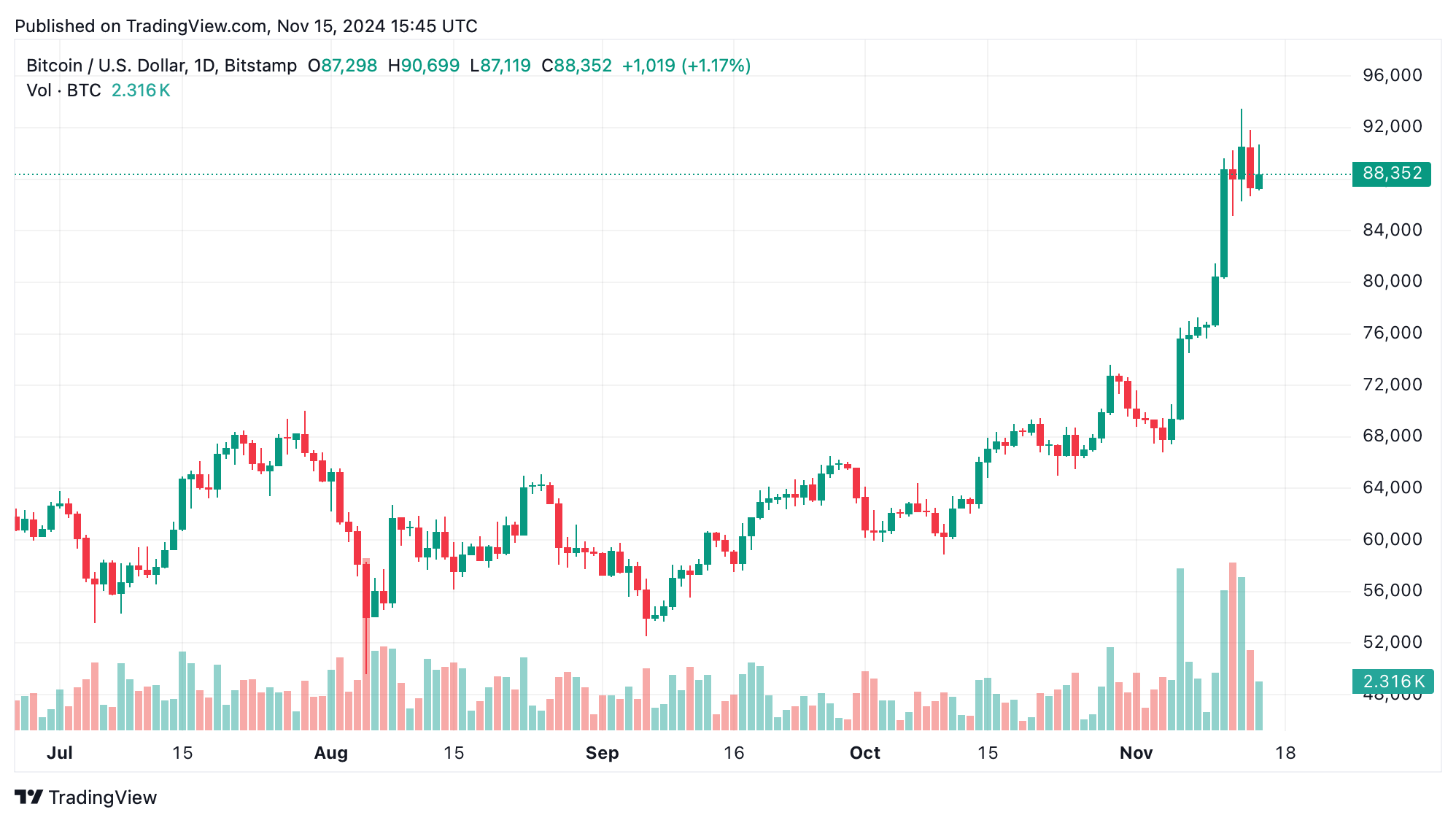

BTC/USD price on Friday, Nov. 15, 2024.

QCP’s analysts believe that bitcoin’s recent rally is part of a broader systematic market shift, with projections suggesting a potential rise to $100,000–$120,000. The market strategists attributed this strength to expectations surrounding President-elect Donald Trump’s return to office and his proposed policies, including a strategic bitcoin reserve and a shift from gold to the leading crypto asset.

QCP strategists further highlighted a notable trend of falling implied volatility during the rally. Market participants, particularly institutional players, have been selling calls and purchasing puts, indicating caution and hedging against potential downside risks. Additionally, QCP said that excessive leverage in alternative cryptocurrencies (altcoins) poses a risk of market deleveraging. Perpetual funding rates for altcoins have spiked to 50–100%, underlining the speculative nature of recent investments, according to QCP’s market update.

QCP’s analysis points to a crypto market currently underpinned by both optimism and structural risks. While bitcoin’s strength signals a bullish narrative, especially in light of macroeconomic developments, the potential for sharp corrections due to leverage remains a critical factor for investors. BTC may bask in glory for an extended stretch, only to take a sudden tumble when unexpected macroeconomic shifts come into play. Still, QCP is optimistic, suggesting that hitting six-figure valuations isn’t out of reach, given the current momentum in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。