This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 2,691.86 +0.76%

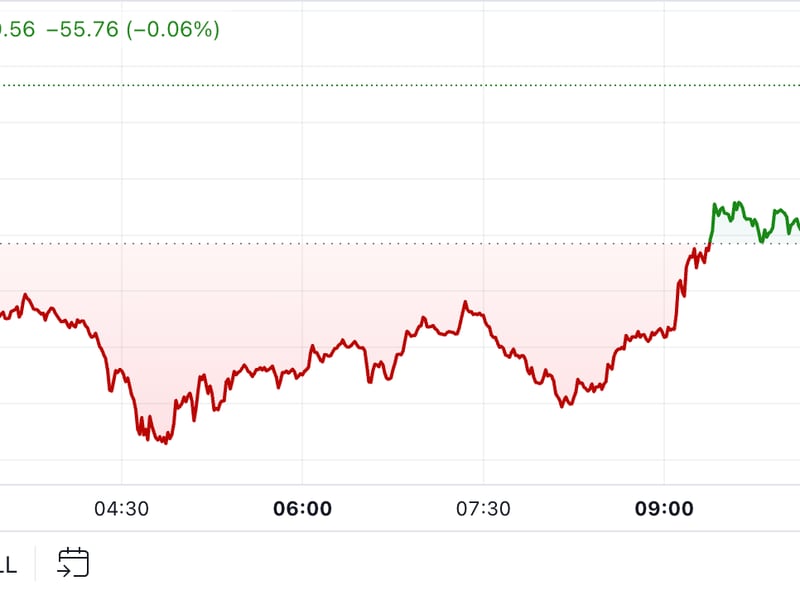

Bitcoin (BTC): $90,386.53 -1.21%

Ether (ETH): $3,107.30 -2.48%

S&P 500: 5,949.17 -0.6%

Gold: $2,568.54 +0.01%

Nikkei 225: 38,642.91 +0.28%

Bitcoin pared some of Thursday's losses during the European morning to trade above $90,000. BTC remains over 1% lower in the last 24 hours, a possible sign of profit-taking following its surge above $93,000 earlier in the week. The drop was catalyzed by Fed Chair Jerome Powell's hawkish comments that damped hopes of swifter interest-rate cuts. "The economy is not sending any signals that we need to be in a hurry to lower rates," Powell said in prepared remarks at a Dallas conference. As of Friday, the market is pricing in a 66% chance of a 25 basis-point cut at the December FOMC meeting, down from Thursday’s 83%. The CoinDesk 20 Index (CD20), a measure of the broader crypto market, is 0.66% higher.

Bitcoin ETFs saw $400 million of net outflows on Thursday, their third-highest loss since they listed in January. Fidelity's FBTC saw outflows of $179.2 million, Bitwise BITB saw $113.9 million being drained, Ark's ARKB bled $161. 7 million, while Grayscale's two products notched combined outflows of $74.9 million. Similar to the dip in the underlying asset, ETF outflows may be a sign of investors taking profits. BlackRock's IBIT saw inflows, gaining $126.5 million, continuing the trend of strong interest since Nov. 7. The only days to have seen larger bitcoin ETF outflows — May 1 and Nov. 4 — both signaled local bottoms before BTC returned to an upward trend.

XRP zoomed 17% in 24 hours to outperform bitcoin and other majors as the shifting U.S. regulatory climate supported growth in tokens previously hampered by the SEC's actions. XRP traded above 82 cents in early Asian trading hours Friday, extending seven-day gains to 50% and reaching levels last seen in June 2023. The jump came as 18 U.S. states filed to sue the SEC and commissioners, including Chairman Gary Gensler, accusing them of unconstitutional overreach of the crypto industry. The speculative optimism among traders is that a crypto-friendly Trump administration could benefit tokens linked to U.S.-based companies, such as Ripple Labs and Uniswap, as the firms are more involved in boosting value for token holders.

- Omkar Godbole

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。