In today’s issue, Paul Veradittakit from Pantera Capital reviews bitcoin’s price and the optimism around regulations since the U.S. election.

Then, Eric Tomaszewski from Verde Capital Management answers questions about how these changes could impact advisors in Ask an Expert.

Thank you to our sponsors of this week's newsletter, L1 Advisors.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

A week after the election, crypto sentiment remains strong. Polymarket, bitcoin and a possibly more efficient and crypto-positive government are all tailwinds to look forward to.

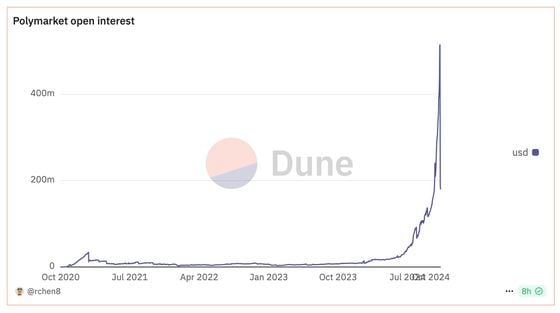

Polymarket, a predictions market built on the Polygon blockchain, saw an explosion of usage leading up to the election, peaking at over $3.2 billion bet on the election, orders of magnitude more than pre-election volumes. Compared to other prediction markets, Polymarket charges no fees, allows seamless trading in and out of positions and is decentralized, meaning anyone can trade directly with the underlying contracts on-chain via the API (allowing for anyone to make trading bots) and anyone from a non-blacklisted geography can access the website frontend.

Though open interest has dramatically fallen post-election, there is a belief that mainstream users have both tried and enjoyed using Polymarket over any centralized entities. One definite win post-election is the discussion of Polymarket’s accuracy by the mainstream media. The Economist, The Wall Street Journal, Forbes, and more have cited Polymarket as the largest prediction market and have used it to judge discrepancies between polls and voting sentiment before and after the election.

Hopefully, Polymarket’s enthusiasm permeates into the broader crypto ecosystem and also inspires more crypto apps to take from Polymarket’s playbook in the pursuit of better usability, abstraction and marketing.

Bitcoin is at an all-time high of over $87,000, pumping to $77,000 right after the election and rising ever since. Altcoins tangentially related to the election also surged, like those on Solana. The Trump Presidency does not directly lead to greater bitcoin buy pressure, but his public support of it was enough to cause a rally in these coins.

Positive headwinds in crypto caused by the election itself may not be as sticky in a month. However, the ramifications of a unified Republican House and Senate majority may mean a more productive government, and one that passes more legislation surrounding crypto.

Crypto election updates from StandWithCrypto

Significantly more pro-crypto than anti-crypto representatives across both sides of the aisle have been elected (266 vs. 120 in the house, 18 vs. 12 in the senate). And pro-crypto Trump may be lighter on crypto regulation or will push crypto-supporting regulation. World Liberty Financial is a crypto project being promoted by Trump and says it will run as an Aave instance (one of the largest DeFi protocols).

What does this mean going forward? First, it may mean lobbying efforts, like those from Ripple and Coinbase, may increase in order to push the wording of crypto regulation in one direction or another.

It is believed that U.S. regulation has been unclear, and clarity would drastically change the thinking around operating in the U.S. The largest crypto venture capital firms are largely still based in the U.S., so allowing the companies that are funded to operate in the country could supercharge the industry, supporting the domestic crypto market.

There has also been excitement from top DeFi protocols like Compound and Uniswap surrounding previously “off-limit” protocol features, like staking, fee-switches and more. Adding regulatory clarity around these features may cause firms to innovate on DeFi protocols.

Overall, I am very optimistic about the direction the crypto industry is heading, especially post-election. A unified House and Senate may bring unexpected wins in an ever-changing industry.

- Paul Veradittakit, managing partner, Pantera

Q: Could blockchain-based prediction markets redefine participation in elections?

Yes. Many people are frustrated with the media’s pageantry, preferring straightforward results.

Prediction markets could increase engagement, particularly among younger, tech-savvy individuals who prefer data-driven insights similar to stock market updates, without media-driven narratives.

Q: What does the election mean for crypto and blockchain tech?

Bitcoin’s rise past $80K reflects optimism and a renewed excitement for the USA to lead the evolution of the space.

A Republican-led Congress could advance pro-crypto legislation. Beyond that, we could see shifts in regulatory oversight, executive actions that create leadership changes and strategic initiatives, etc.

Q: How does a financial advisor view prediction markets?

Prediction markets provide diverse, aggregated opinions and constantly updated probabilities, enhancing information efficiency. This can support decision-making for clients by offering timely insights. The benefits of information are more opportunities to simplify messages for clients while adding value.

- Eric Tomaszewski, financial advisor, Verde Capital Management

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。