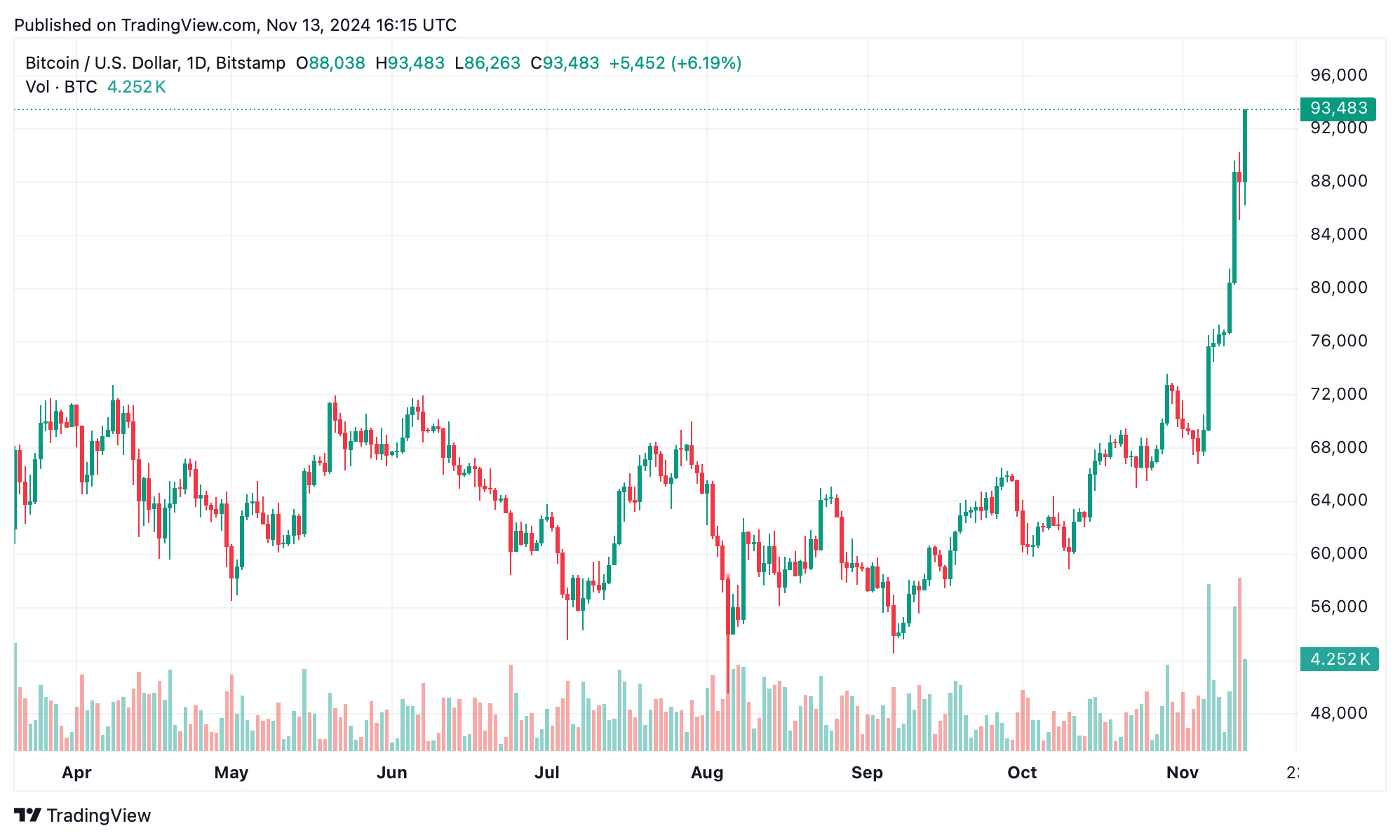

The price of bitcoin (BTC) surged to a record high of $93,481 today, marking a new milestone for the cryptocurrency. This recent increase pushes BTC up 7% in the last 24 hours and a notable 25% gain over the past week. With bitcoin’s impressive rise, its market cap has reached $1.83 trillion, cementing its dominant role in the larger $3.04 trillion crypto economy, a significant milestone for the digital asset space.

As bitcoin reaches new heights, market statistics highlight the strong trading activity supporting this surge. Over the past 24 hours, BTC trading volume soared to $130.11 billion, reflecting the heightened interest and volatility in the market. BTC dominance has also increased, accounting for 59% of the total cryptocurrency market valuation. The broader cryptocurrency market is experiencing unprecedented levels of investor engagement and asset trading, further solidifying the significance of today’s $3 trillion market cap milestone.

Despite the enthusiasm, market volatility remains intense, especially for traders holding short positions. Over the past day, $115 million in bitcoin short positions were liquidated as the cryptocurrency continued its upward trajectory. Across the entire crypto sector, a total of $668.38 million in liquidations was recorded, affecting approximately 214,076 traders. These liquidations underscore the high-risk environment that traders navigate, as many bet against bitcoin and other digital assets only to face significant losses when markets move contrary to their positions.

Bitcoin’s new all-time high puts it within reach of surpassing some of the world’s largest companies by market capitalization. Specifically, bitcoin’s current market valuation places it only $370 billion shy of overtaking Google’s market cap. BTC is now the seventh largest asset by market cap globally. This development highlights how digital assets are increasingly positioned alongside traditional financial giants, further indicating the growing influence and acceptance of cryptocurrencies in global finance.

As BTC continues its climb, investors and market analysts are closely watching for what may come next. For some, bitcoin’s ascent is a sign of shifting economic sentiment, as institutional and retail investors alike seek alternatives to traditional assets. For others, this surge could be a catalyst for increased regulatory scrutiny and potential challenges ahead. In any case, bitcoin’s new all-time high reflects the resilience and growth of the digital asset, establishing yet another benchmark in its journey as a key player in the evolving financial landscape.

Today’s record underscores the transformation underway in the global economy as bitcoin and other digital assets gain prominence, offering a view of the crypto market’s potential to shape the future of finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。