This ongoing bitcoin (BTC) rally highlights a clear favoring of spot purchases over perpetual futures, according to Glassnode‘s recent Week Onchain report. Researchers observed a noticeable boost in spot buying, especially on major platforms like Coinbase, where buy-side volume has been consistently climbing—suggesting increasing interest from investors.

Source: Glassnode’s Week Onchain #46

Meanwhile, institutional funds are flowing in through U.S. spot exchange-traded funds (ETFs), where assets under management climbed by a significant $6.8 billion, outpacing inflows to CME futures. This pattern points to a market preference for direct spot exposure, with ETFs emerging as an attractive means for capturing bitcoin’s price changes.

“Following the solid buyer-side pressure observed on Coinbase’s spot market, the recent rally saw substantial inflows into U.S. spot ETFs, with assets under management rising by $6.8 billion in the last 30 days,” the Glassnode report details.

The report adds:

This growth outpaced the $7.6 billion increase in CME futures open interest, indicating a pronounced preference for spot-driven exposure via ETFs.

The report connects this upward trend to a boost in optimism following the recent U.S. presidential election, with a crypto-friendly administration anticipated to introduce supportive regulatory policies. This political change has sparked greater institutional interest in crypto, especially bitcoin, evident in the increased open interest in CME futures and ETF markets. Cryptovizart and Ukuria OC noted that this aligns with the rising appeal of cash-and-carry strategies among institutions, which lean toward investments combining short-term stability with long-term growth potential.

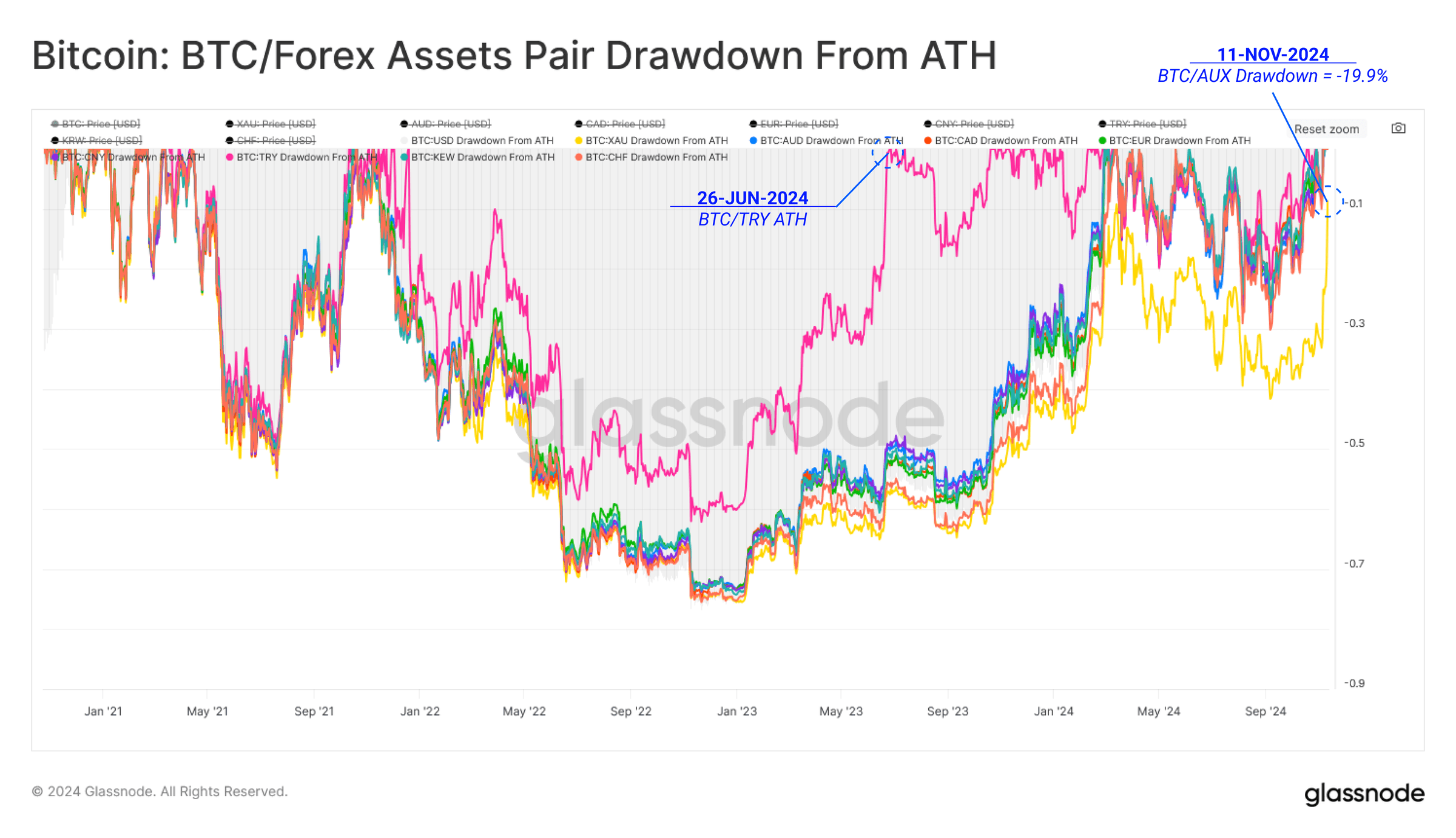

Glassnode’s analysis further reveals that bitcoin just saw its biggest weekly gain to date, climbing by $11,600 in a single week—a leap well beyond typical historical trends. This surge of activity reflects the excitement surrounding Bitcoin’s new ATH phase, a feeling further validated by data showing that more than 95% of the circulating Bitcoin supply is now profitable.

“Historically, these euphoric phases have persisted for around 22 days before a correction occurs, pushing more than 5% of the supply below the original acquisition price,” Cryptovizart and Ukuria OC state. “The current rally has maintained this high-profit level for 12 consecutive days, underscoring strong market sentiment but also hinting at the possibility of a correction ahead based on past patterns.”

Glassnode researchers highlight that even with a significant wave of profit-taking, realized profits are still below the highs reached in previous ATH phases—suggesting room for continued growth if demand stays strong. The report also points to bitcoin’s proximity to crucial price bands, with the current spot price near $87,900 and upper resistance around $94,900. These indicators hint at the potential for further gains, though Cryptovizart and Ukuria OC note that this will hinge on ongoing investor enthusiasm and economic conditions favorable to high-risk assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。