Now is a great time to seize opportunities.

Author: The Black Swan

Translation: Deep Tide TechFlow

I used to be a corporate engineer, spending my days commuting, always dreaming of breaking free from the 9-to-5 shackles. I often spent time fantasizing about my ideal future—lying on a beach, free from financial worries, fully pursuing my interests.

I encourage everyone to do the same: vividly picture your dreams, whether it's starting a business or spending more time with family.

Now is a great time to seize opportunities, especially as the crypto market is about to experience growth. Every challenge you've faced has prepared you for this moment. Believe in yourself and bravely pursue your dreams.

My Personal Journey

You might not believe it, but I used to be an ordinary engineer with a modest net worth. I was the typical high-achieving corporate employee, commuting an hour to the office every day and pretending to work. To be honest, I did complete many tasks, but that wasn't the life I was pursuing. I didn't like being directed by an employer, told what to do and where to work, and having to work weekends for bonuses. However, I always envisioned my ideal life in my mind. It's no exaggeration to say that I spent about a quarter of my waking hours fantasizing about future success. This wasn't a task; it was my default state of mind.

In your daily activities—whether walking, exercising, or commuting—vividly imagine your ideal life:

Picture yourself relaxing on the beach

With an endless ocean view in front of you

Holding a refreshing cocktail in your hand

With a beautiful partner by your side

Feeling free from financial worries. Most importantly, imagine being able to reclaim all the time you originally spent working for others.

So, you don't necessarily have to have a beach scene. Maybe you just dream of quitting your 9-to-5 job. But imagine what you truly want to do. Who will you spend time with? Perhaps you want to start a business? Or just want to engage more in sports, spend time with your kids, or invest more in hobbies.

Make these imaginations a daily practice and do it often. While it can't guarantee success, the potential benefits it brings are worth a try. Who knows? It might work for you too.

Get ready for the challenges ahead, as next year could be the most important year of your life. A bull market is on the horizon, and venture capitalists, ordinary traders, entrepreneurs, and regular investors are preparing to invest significant resources in our industry. This is your moment to seize opportunities and create a bright future for yourself and your family.

Over the past two years, you've worked hard in a bear market, facing challenges and setbacks, navigating the difficult environment of crypto trading. Although some made you beautiful promises, you experienced some tough losses. But remember, every effort has prepared you for this moment.

Sometimes, making money seems effortless, while other times it requires courage and determination. You've just gone through a challenging phase, and now you're entering a period full of potential. It's time to set higher goals and pursue your financial milestones. Now is the time to focus your energy and determination on achieving your main goal—success. I believe in you!

Now, let's talk about the issues in this industry and why ordinary investors and traders have consistently struggled to succeed in this cycle.

Industry Issues

There is a recurring phenomenon in the crypto industry: DeFi protocol projects raise large amounts of funds and then disappear after a brief operation. This phenomenon is not limited to a few projects but unfortunately is widespread throughout the crypto space.

At the core of the problem is the utility token model, which has become standard for many crypto projects. While this model benefits founders, it can adversely affect ordinary investors, angel investors, and hedge funds.

Key characteristics of the utility token model:

No equity distribution (unlike stock equity granted through SAFE agreements in companies)

The tokens themselves have no intrinsic value (surprisingly, 98% of tokens are like this)

Tokens are assigned arbitrary "utility"

Founders and the projects themselves have limited liability

Comparison with Traditional Startups

Unlike traditional startups, where investors typically receive equity and certain shareholder rights, crypto projects often operate in a regulatory gray area. This lack of regulation can lead to:

Reduced accountability for project teams

Limited legal recourse for token holders

Higher risks for investors

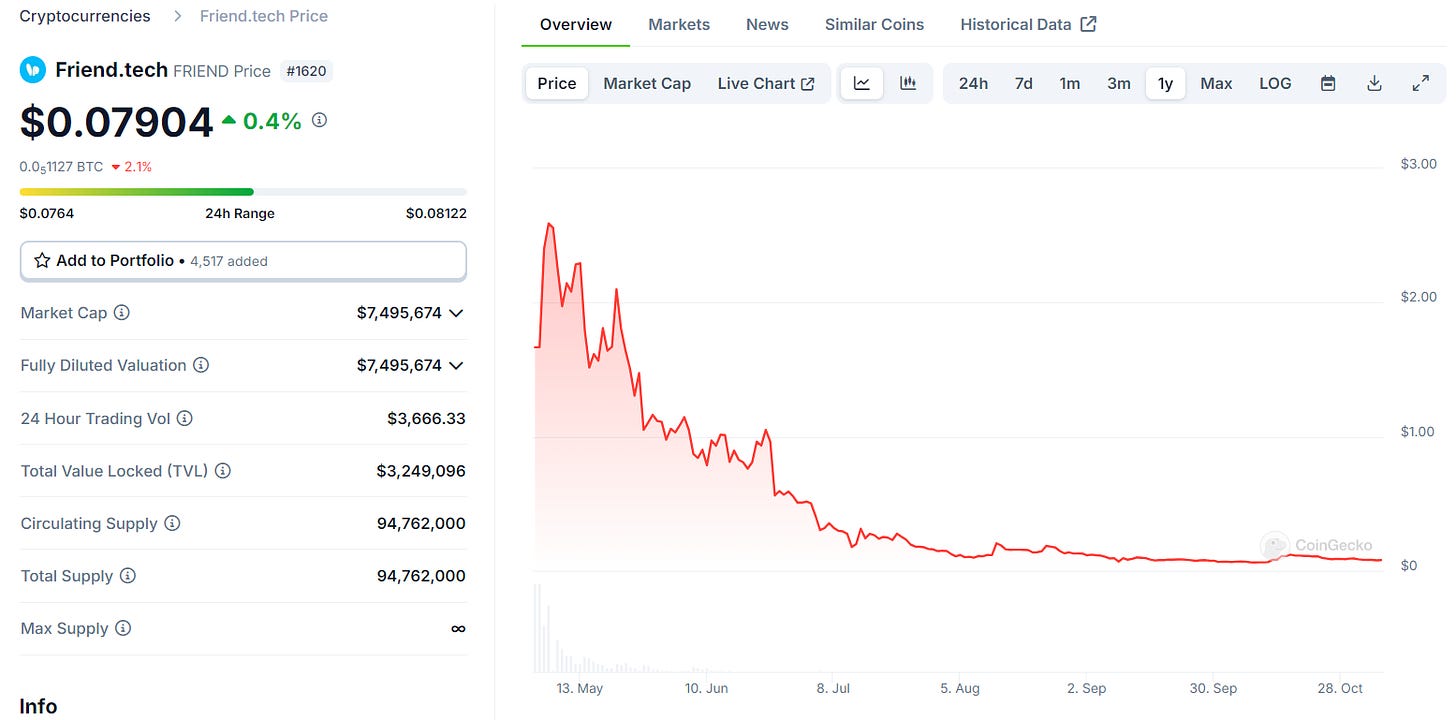

The crypto space has seen several high-profile cases of projects disappearing after raising large amounts of funds. Recently, Friend.Tech was completely abandoned after the founder made a fortune in a short time. Do you remember how hot the $FRIEND token was in early May?

The chart shows a 97.5% decline since its issuance. The remaining holders may have simply forgotten they held the tokens. Besides the concerning token distribution model, there are other issues worth noting. Many projects have received over $1 billion in high valuations from venture capital firms, which significantly limits the opportunity for ordinary users or investors to achieve substantial profits.

Cobie wrote a detailed article on this, and I briefly mentioned it in my April newsletter. It's important to understand that early investors, like the venture capital firms that supported Ethena's initial $20 million funding, have seen their investments multiply by 500 times.

This raises an important question: will these early investors continue to hold in hopes of higher returns, or will they gradually sell to lock in profits? (The answer is: they will sell!)

Many projects with low circulation and high FDV seem structured to transfer wealth from ordinary users to venture capital firms and project team members. This arrangement may undermine the decentralization and democratization principles that blockchain technology originally promised.

Almost all tokens can be seen as meme coins to some extent. Their value relies more on collective belief and speculation rather than intrinsic utility. Take the AAVE token as an example. While it is associated with the popular AAVE lending decentralized exchange, the main function of AAVE is for governance voting. It does not directly reflect AAVE's economic value nor does it generate fee income for holders.

However, its market cap has reached billions because it is perceived as important. OP, the token of Optimism, is a typical example. Although Optimism is the main Layer 2 scaling solution for Ethereum, the OP token is primarily used for governance. Most voting power is concentrated in the hands of the team and venture investors, raising questions about its decentralization.

Even so, OP has achieved a valuation of billions. Aside from gas tokens of Layer 1 blockchains, most tokens derive their value from collective belief rather than actual utility.

Their value depends on a shared belief that they represent the growth and success of their associated protocols or projects. This phenomenon highlights the speculative nature of the cryptocurrency market.

Conclusion

In the crypto industry, we often see DeFi projects raising large amounts of funds only to disappear after a short period, primarily due to issues with the utility token model.

Unlike traditional startups, these crypto projects typically lack accountability mechanisms and investor protections, operating in a regulatory gray area.

High-profile cases like Friend.Tech being abandoned highlight the significant risks faced by token holders and investors.

Additionally, early investors and venture capital firms often gain excessive benefits from these projects, which may undermine the democratization principles that blockchain technology originally promised.

Ultimately, most tokens resemble meme coins, with their value stemming more from collective belief than from intrinsic utility or economic returns.

That's all for today.

See you on the order book, anonymous.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。