Quickly take a look at $aave, mainly focusing on valuation. I won't elaborate much on the protocol itself, it's one of the three old staples in DeFi. It holds a 66% market share among lending protocols, making it an absolutely high-quality asset.

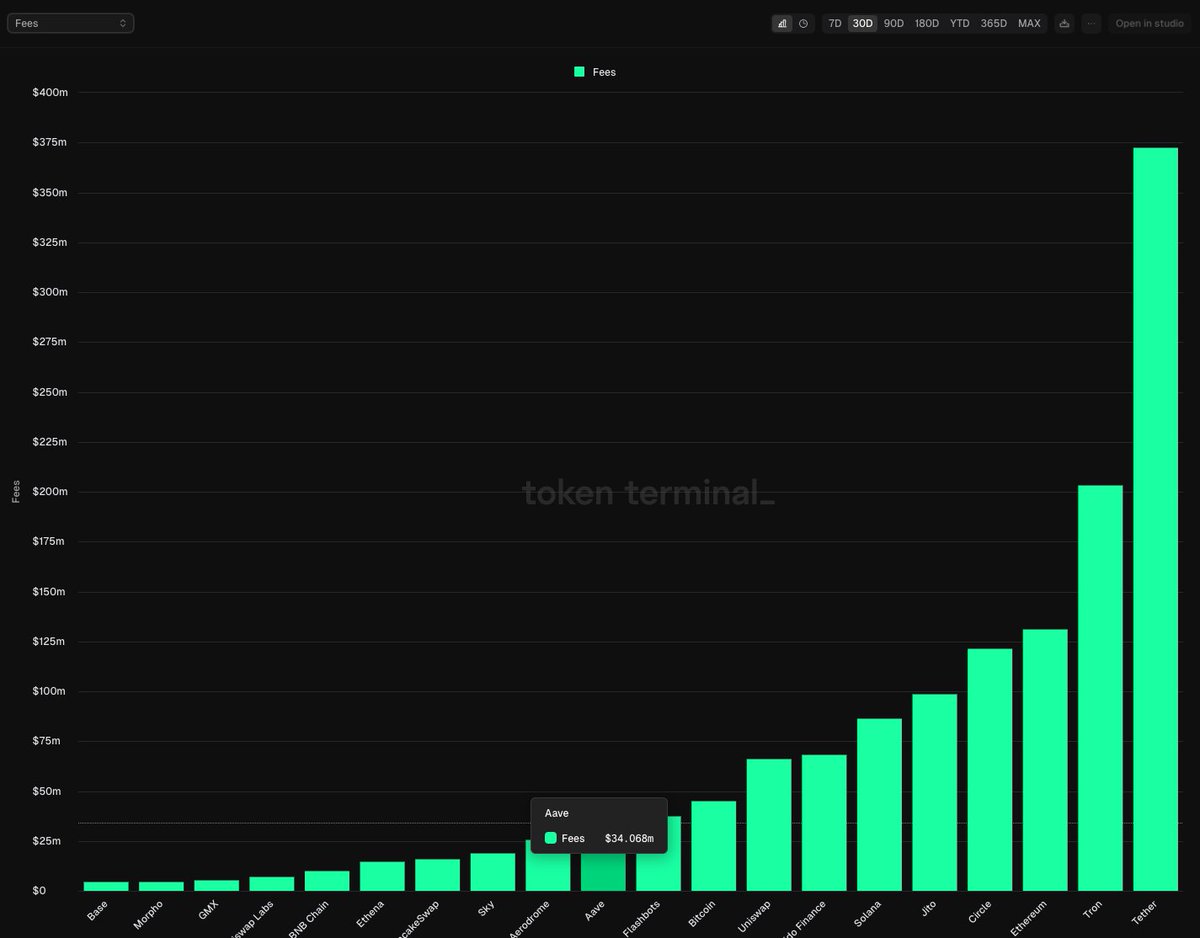

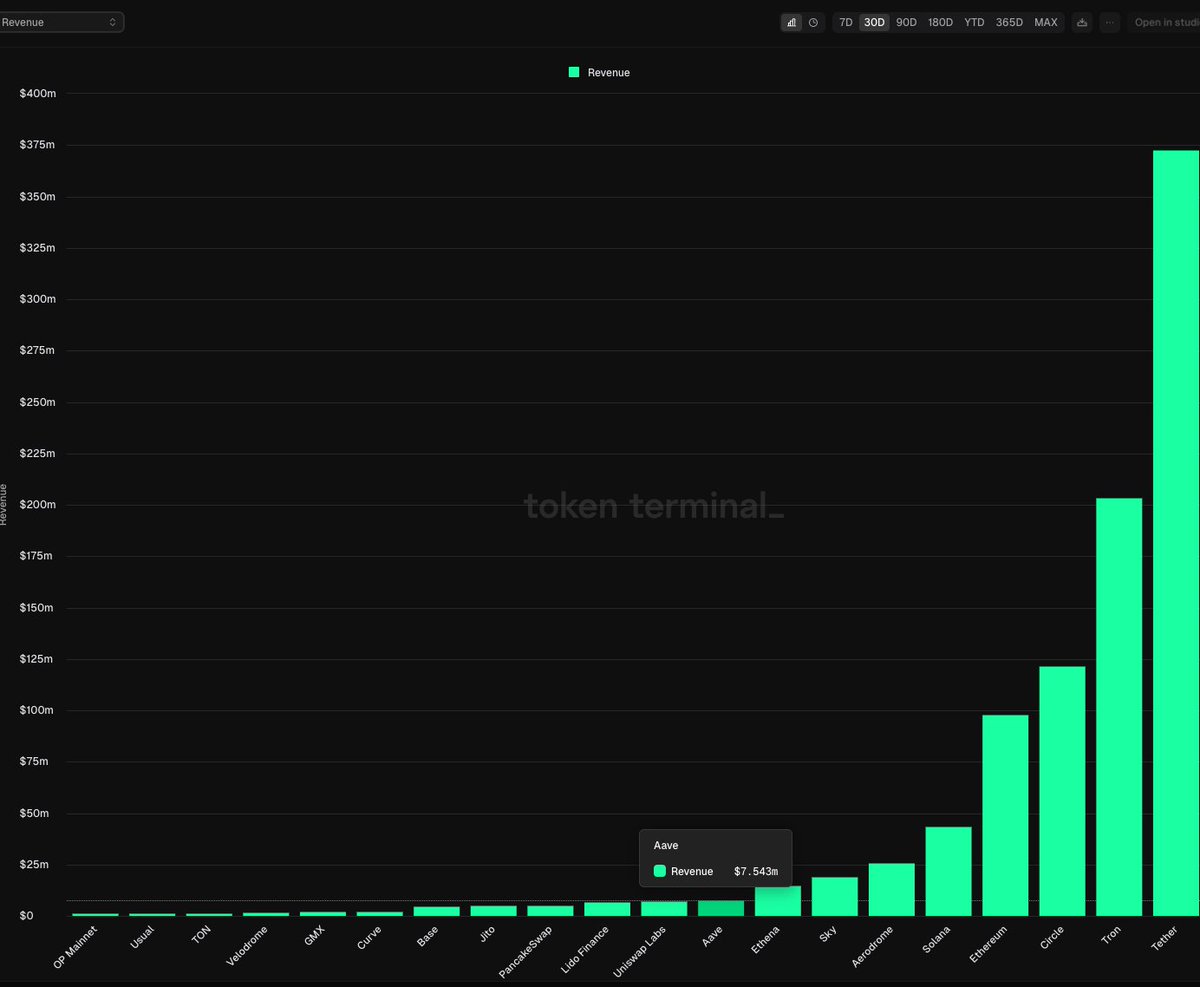

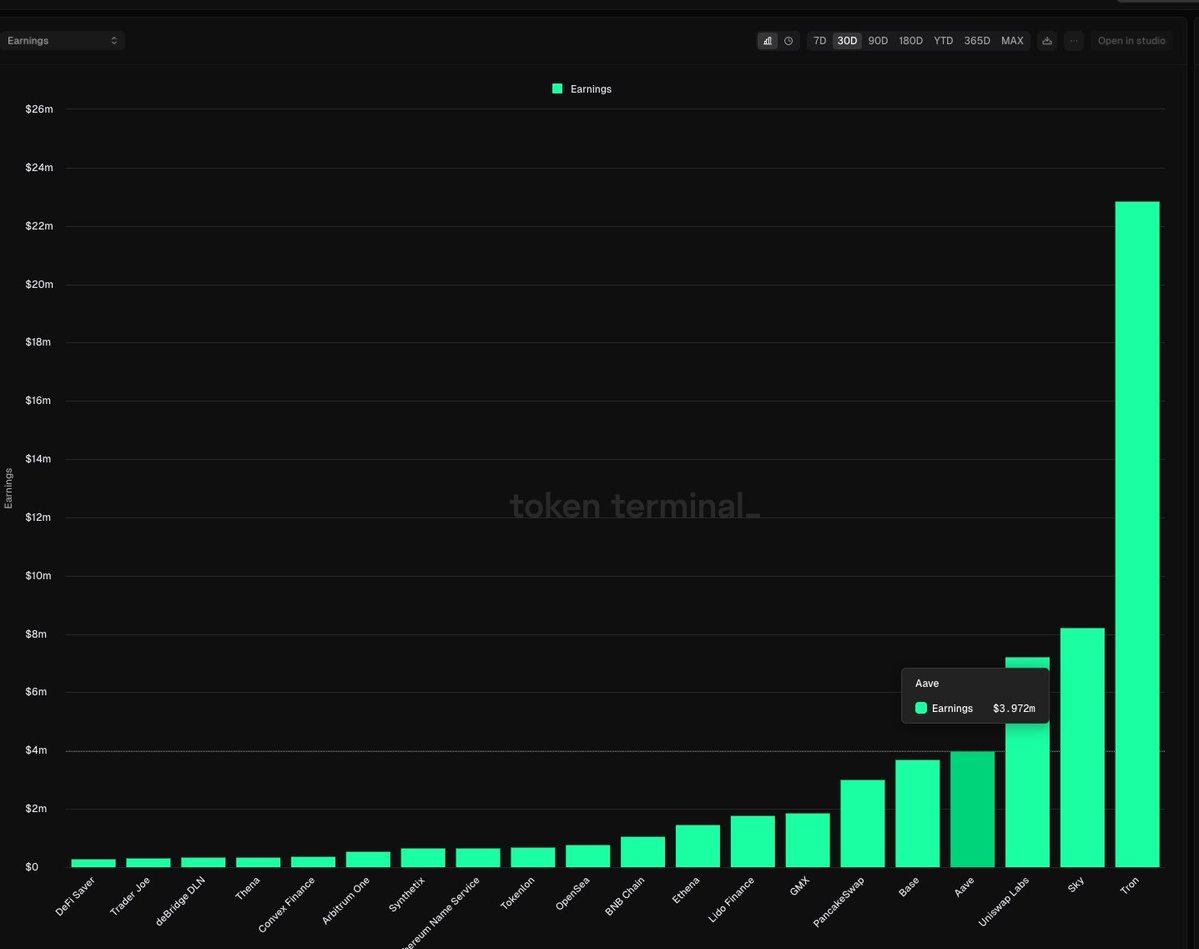

Data source: tokenterminal, let's define the data clearly:

Fees: Fees are total fees paid by users.

Revenue: Revenue is the share of fees that goes to the protocol.

Earnings: Earnings are revenue minus token incentives.

Aave's fee ranking is not very high, still acceptable, lower than Lido and Uniswap, at 34m/30 days.

Revenue is higher than Lido and Uniswap, at 7.5m/30 days.

Earnings ranking is very high, at 3.97m/30 days.

Aave's market cap is 2.84b, FDV 3.05, almost the same, so we will use market cap to calculate valuation:

P/S = 2.84b / 7.5m * 12 = 32x

P/E = 2.84b / 3.97 * 12 = 60x

Calculating as a high-growth + cyclical stock, the overall valuation is not considered high, it can be regarded as value investment.

Of course, this is the valuation logic, and prices in the crypto space do not necessarily follow this. But having this valuation provides some reassurance.

Additionally, Aave's previous proposal opened up the empowerment of the $aave token.

References:

https://x.com/Arthur_0x/status/1825595598609023039

https://www.theblockbeats.info/news/54383

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。