BTC dominance has experienced a significant decline, although the extent is not as severe as the declines in the previous two rounds. The question arises: will this time be different? Or is it just a temporary pullback? This is crucial for determining whether the altcoin season has arrived.

Let's first review this rise:

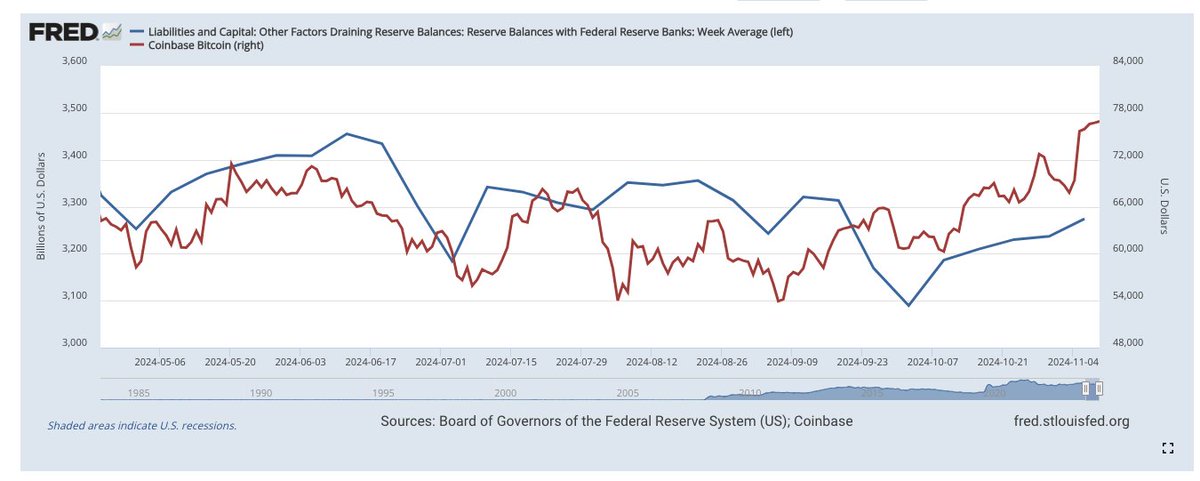

October 2 was a liquidity bottom, but this time the liquidity bottom for Bitcoin did not drop to the 50k range like in previous fluctuations; instead, it bottomed out at 60k and then stopped. After that, liquidity began to recover, and Bitcoin continued to rise.

Before the election results were announced on November 6, the price of Bitcoin had already reached the 70k level. It can be said that the rise in October was mainly driven by liquidity. After Trump's election, Bitcoin rose by about 2-3k, which is not a lot, and it only continued to rise in the last couple of days. However, BTC dominance peaked on November 6 and began to decline.

Conclusion 1: The main reason for this rise in BTC is liquidity-driven, with the secondary reason being Trump's election.

Conclusion 2: Trump's election has a greater impact on altcoins.

It can also be said that liquidity determines the total market value, and the regulatory environment changes brought about by Trump's election have influenced preference changes.

Looking ahead, the three main components of liquidity: total assets are still continuing to decline, and this is likely to stop at least until Q1 of next year. OnRRP has actually been the main driver of liquidity increase in the past month, but this has already reached 164b, getting closer to the bottom. TGA is currently at 842b, which has a high overall potential, but it is uncertain whether the Democrats will start spending before January. However, regardless, the debt ceiling will expire in January, and TGA will begin to decline (injecting liquidity). But there is another issue: the Republican Party controls Congress, which means the debt discussions may not last long. After all this, the core point is to pay attention to TGA; the future leans towards injection but also carries a lot of uncertainty.

Conclusion:

I will probably stick to my previous script: there are not many overall issues in November, with an upward trend; in December, it depends on the situation. If the Democrats are stingy and do not spend TGA, there will be a pullback; the probability of an upward trend in January is greater.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。