Author: 0xkyle

Compiled by: Felix, PANews

Overview

So far, the 2024 cycle has witnessed Solana's dominance, with the main narrative of this cycle—Memecoins—emerging on Solana. In terms of price, Solana is also the best-performing L1 blockchain, having risen approximately 680% year-to-date. While memecoins and Solana are deeply intertwined, since the recovery in 2023, Solana as an ecosystem has generally sparked interest, thriving with protocols like Drift (Perp-DEX), Jito (Liquid stake), and Jupiter (DEX-Aggregator), all boasting billion-dollar token valuations. Solana's active addresses and daily transaction numbers surpass all other chains.

The primary DEX in the Solana ecosystem, Raydium, is at the core of this thriving ecosystem. The old saying "In a gold rush, sell shovels" perfectly encapsulates Raydium's position: powering the liquidity and trading that drives the memecoin craze. Benefiting from the traffic of memecoin trading and broader DeFi activities, Raydium has solidified its status as a crucial infrastructure within the Solana ecosystem.

This article aims to use a data-driven approach to dissect Raydium's position in the Solana ecosystem through first principles.

Introduction to Raydium

Launched in 2021, Raydium is a permissionless automated market maker (AMM) based on Solana, enabling pool creation, lightning-fast transaction speeds, and yield earning opportunities. The key distinction of Raydium lies in its structure: it was the first AMM on Solana and introduced the first order-compatible hybrid AMM in DeFi.

When Raydium launched, it adopted a hybrid AMM model that allowed idle pool liquidity to be shared with central limit orders, while typical DEXs at the time could only access liquidity within their own pools. This meant that Raydium's liquidity also created a market for OpenBook, allowing trading on any OpenBook DEX GUI.

While this was a major distinction in the early days, that feature has since been disabled. Raydium currently offers three different types of pools:

- Standard AMM Pool (AMM v4), officially known as Hybrid AMM

- Constant Product Market Maker (CPMM), supporting Token 2022

- Concentrated Liquidity Market Maker (CLMM)

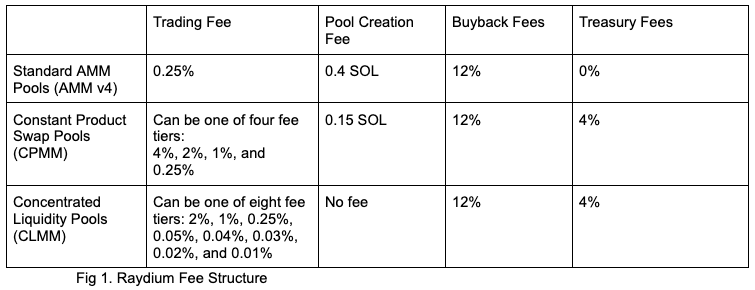

For every swap that occurs on Raydium, a small fee is charged based on the specific pool type and fee level. This fee is divided into two parts, one for incentivizing liquidity providers, and the other for RAY buybacks and the treasury.

Below are the transaction fees, pool creation fees, and protocol fees for different mining pools on Raydium. Here is a brief explanation of each term and their respective fee levels:

- Transaction Fee: The fee charged to traders for swap transactions

- Buyback Fee: The percentage of transaction fees required to buy back Raydium tokens

- Fund Management Fee: The percentage of transaction fees allocated to fund management

- Pool Creation Fee: The fee charged when creating a pool, aimed at preventing pool spam. The pool creation fee is controlled by the protocol's multi-signature and reserved for protocol infrastructure costs.

Overview of Solana Ecosystem DEX

Figure 2: TVL of Solana in DEX

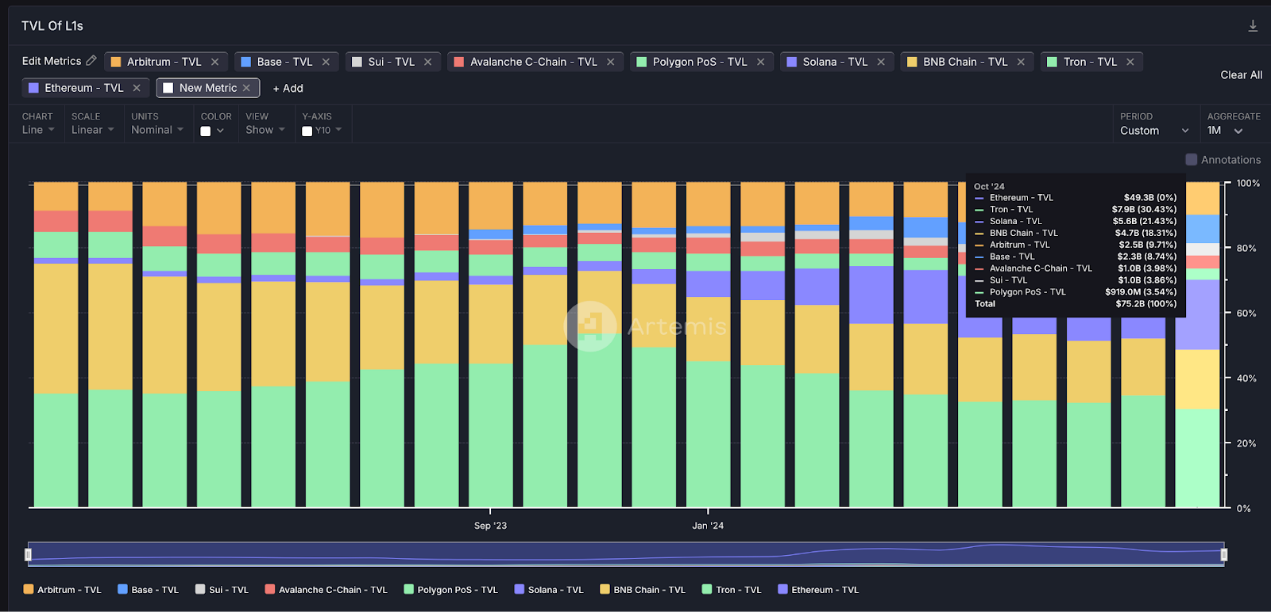

The above primarily analyzes how Raydium works, and below evaluates Raydium's position in the Solana DEX space. Undoubtedly, Solana has successfully positioned itself among the top L1s in the 2024 cycle. Solana's TVL ranks third, behind Tron (second) and Ethereum (first).

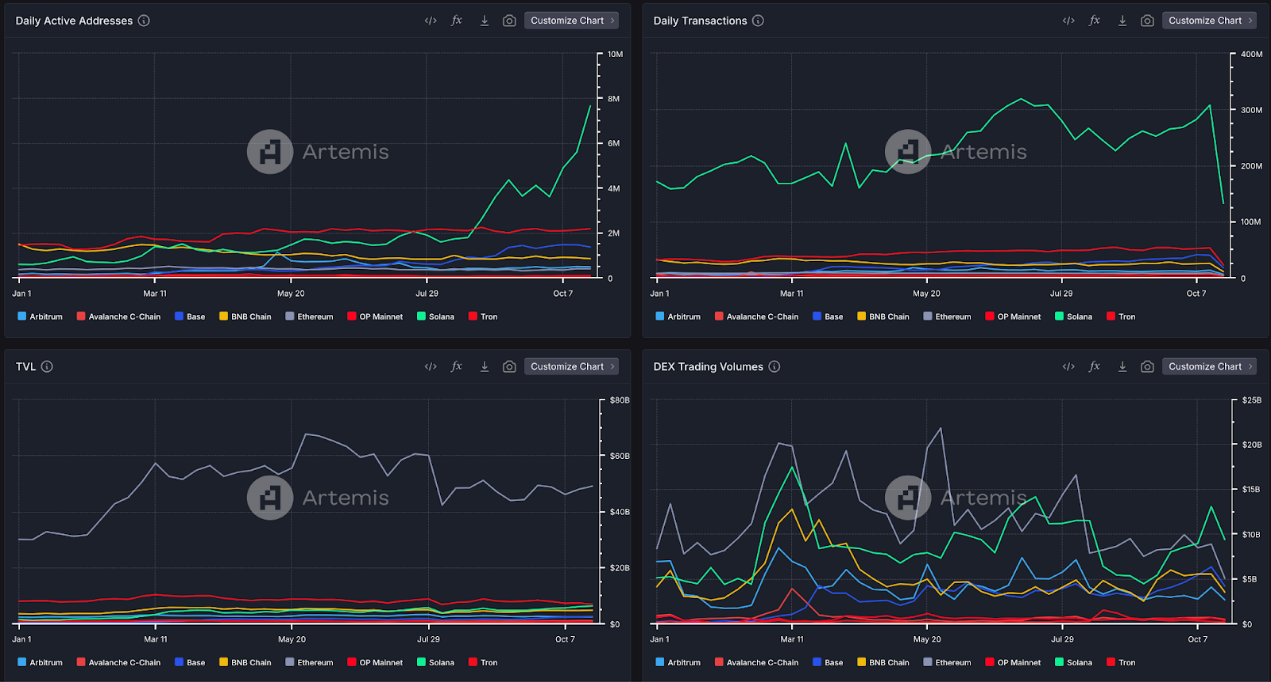

Figure 3: Daily Active Addresses, Daily Transaction Volume, TVL, and DEX Trading Volume

Solana continues to dominate user activity metrics such as daily active addresses, daily transaction volume, and DEX trading volume. The increase in activity and token liquidity on Solana can be attributed to several factors: the memecoin craze on Solana, rapid and low-cost settlements, and a smooth user experience for DApps, all contributing to the growth and prosperity of on-chain trading. With tokens like $BONK and $WIF reaching billion-dollar market capitalizations, along with the emergence of Pump.fun as a memecoin launch platform, Solana has effectively become the hub for memecoin trading.

Currently, Solana remains the most used L1 in this cycle and continues to dominate in trading activity. As a direct beneficiary of increased activity, this means that DEXs on Solana are performing exceptionally well—more traders mean more fees, which translates to more protocol revenue. However, even within DEXs, Raydium has successfully captured a significant market share, as shown in the following figures:

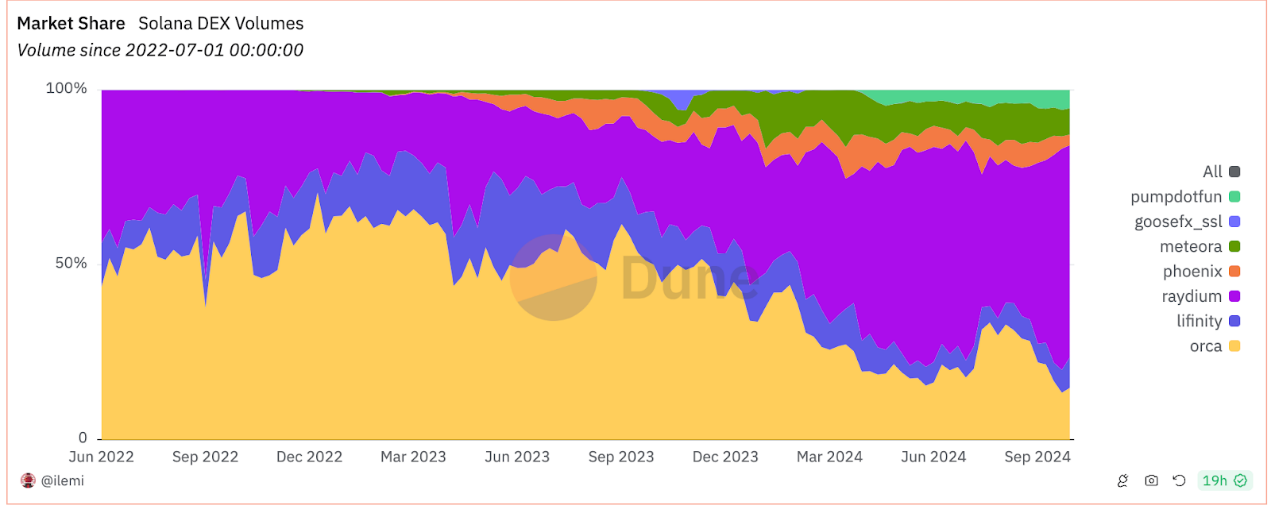

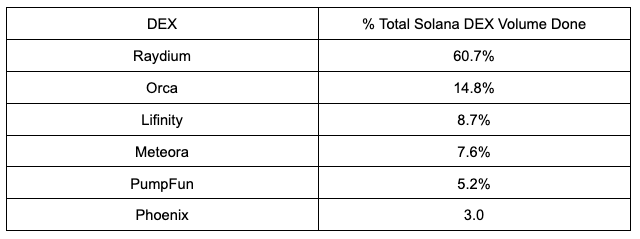

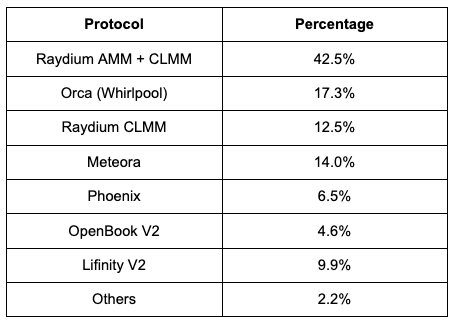

Figure 4: Market Share of Solana Ecosystem DEX Trading Volume Across DEXs

Raydium ranks first among Solana DEXs, with the highest trading volume, capturing 60.7% of the total trading volume of Solana DEXs. This is because Raydium allows for various activities—from memecoins to stablecoins.

One way Raydium achieves this is by providing pool creators and liquidity providers with multiple options when creating new markets. Users can choose to select a fixed product pool for price discovery at the initial launch or opt for a narrower range in concentrated liquidity pools for LP: allowing for initial price discovery on Raydium while remaining competitive in SOL-USDC, stablecoins, LST, and other markets.

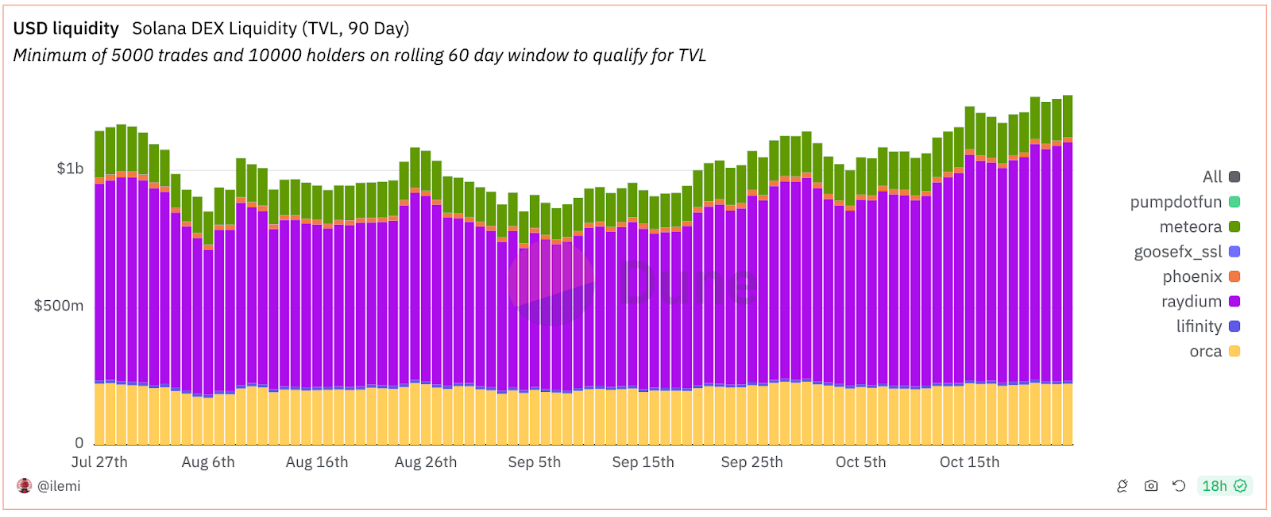

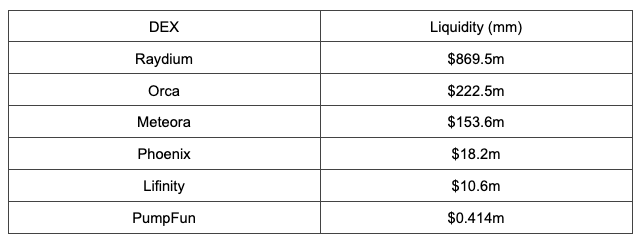

Figure 5: Liquidity in Solana DEX

Most importantly, Raydium remains the most liquid DEX. Notably, trading is often a matter of economies of scale, as traders flock to the exchanges with the most liquidity to avoid slippage. Liquidity generates liquidity: when the largest DEX attracts the most traders, it becomes a positive flywheel, drawing in LPs who earn from fees, thereby attracting more traders eager to avoid slippage.

When comparing DEXs, liquidity is often an overlooked factor, but it is crucial when evaluating the best-performing DEXs (especially considering that traders on Solana are trading memecoins). The fragmentation of liquidity between different DEXs can lead to a poor user experience, and purchasing different memecoins across various DEXs can lead to dissatisfaction.

The Relationship Between Memecoins and Raydium

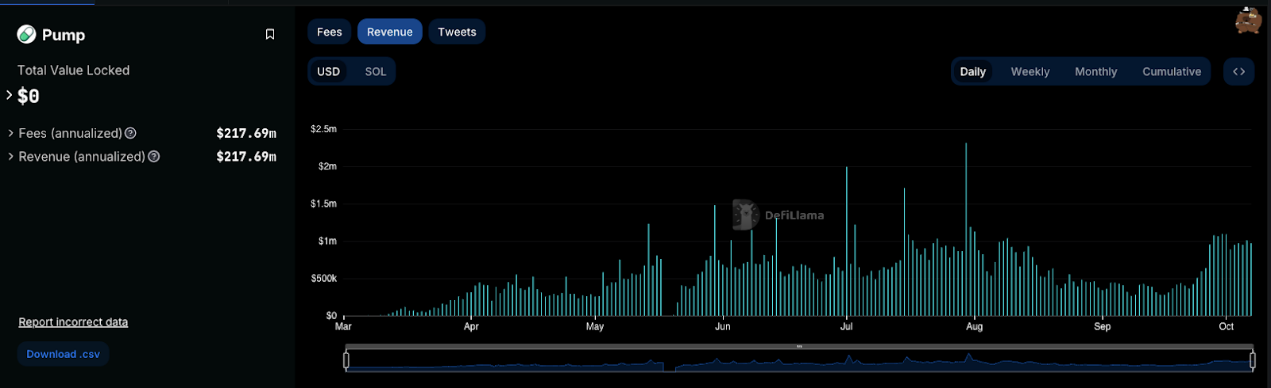

Raydium's popularity can also be attributed to the resurgence of memecoins on Solana, particularly Pump.fun, a memecoin launch platform that has generated over $100 million in fees since its inception earlier this year.

Pump.fun memecoins have a direct connection to Raydium; when tokens launched on Pump.fun reach a market cap of $69,000, Pump.fun automatically deposits $12,000 worth of liquidity into Raydium. Continuing the earlier point about liquidity, this means that Raydium is effectively the most liquid platform for trading memecoins. It creates a virtuous cycle: pump.fun and Raydium combine—> memecoins are launched there—> people trade there—> liquidity is obtained—> more memecoins are launched there—> more liquidity is obtained, and the cycle continues.

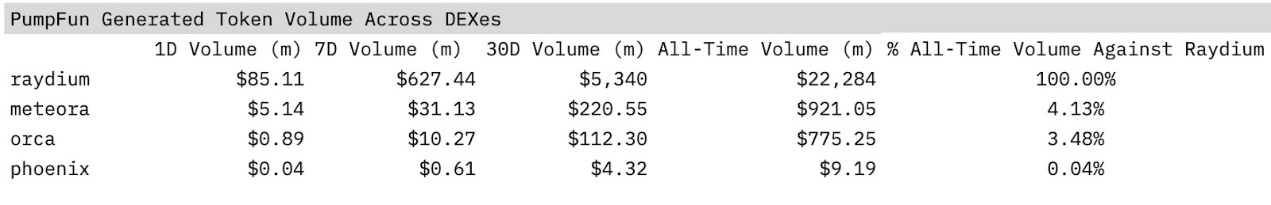

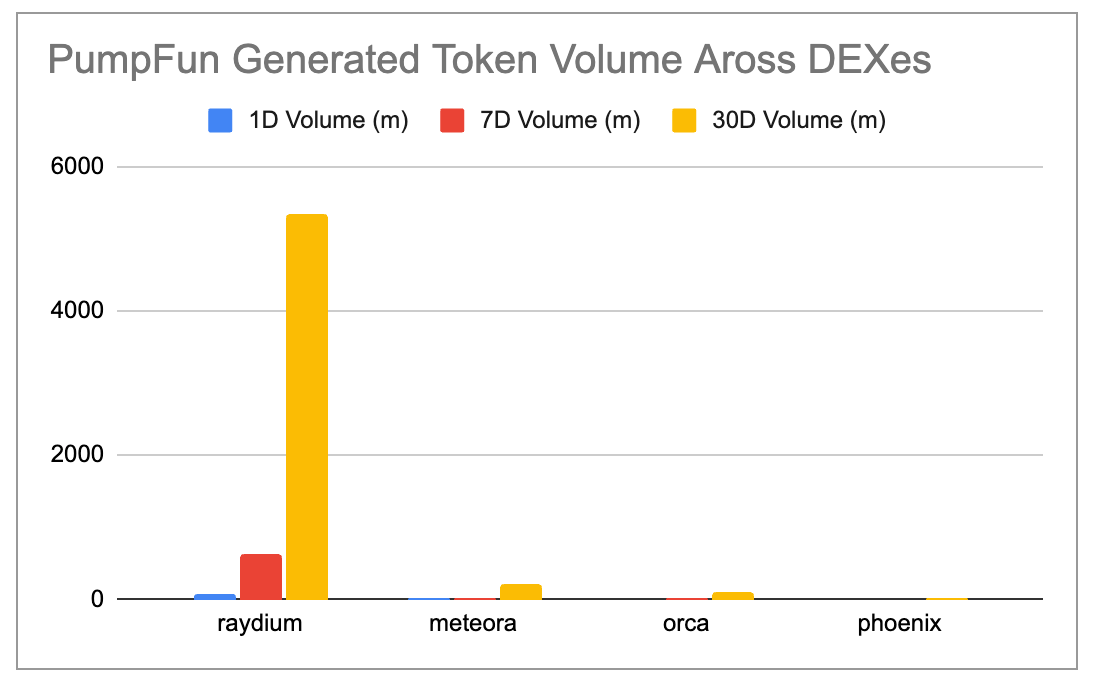

Figure 6: Number of Tokens Generated by Pump.Fun on DEX

Therefore, Pump.fun is attributed to Raydium, with nearly 90% of the memecoins generated by Pump.fun being traded on Raydium. Like a shopping mall in a city, Raydium is the largest "shopping center" on Solana, where most people go to "shop," and most "businesses" (tokens) want to "set up shop" there.

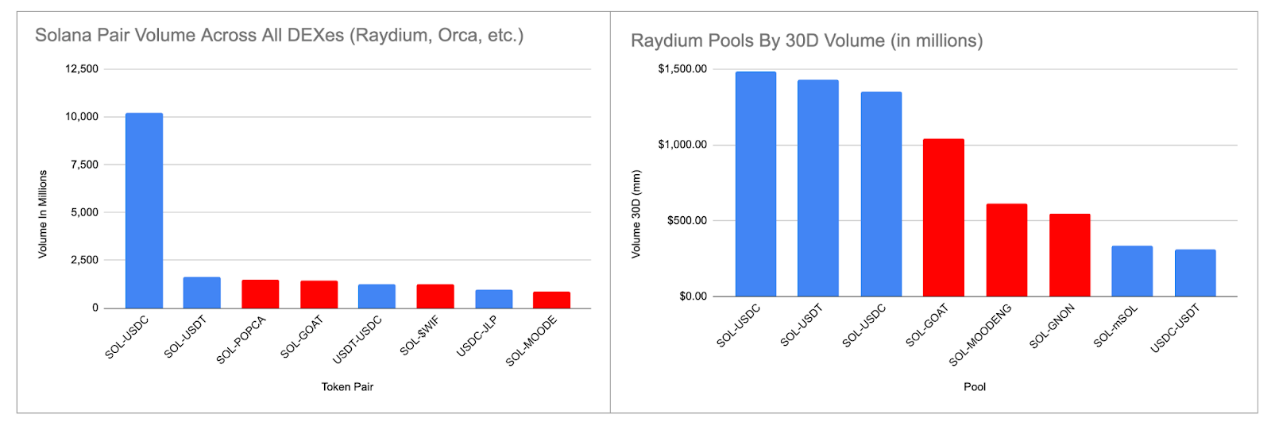

Figure 7. Trading Volume of DEX Token Pairs on Solana vs. Trading Volume of Token Pairs on Raydium

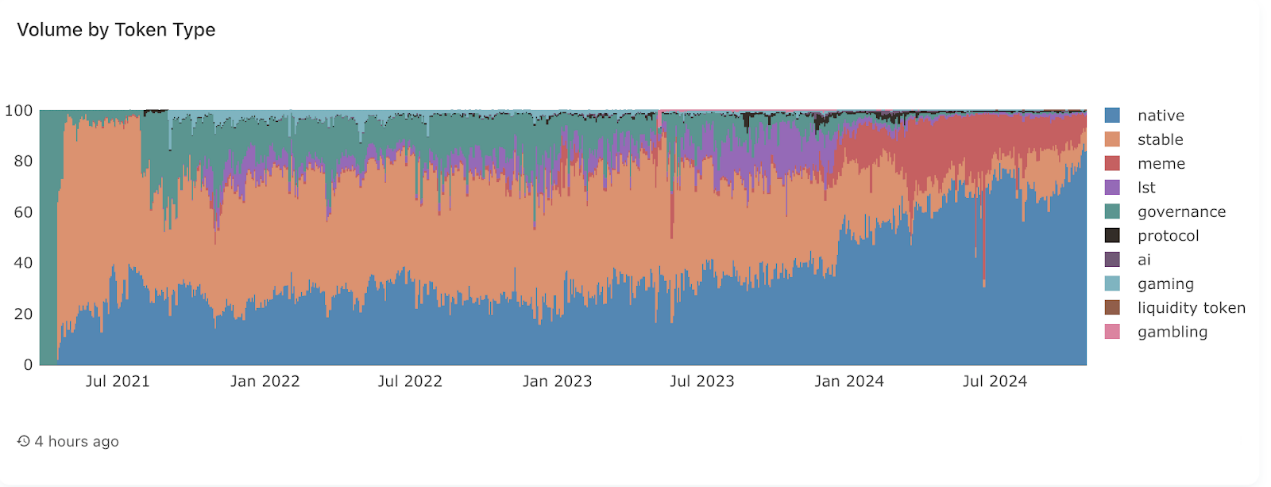

Figure 8: Raydium Trading Volume (by Token Type)

It is worth noting that while Pump.fun relies on Raydium, the reverse is not true; Raydium does not solely depend on memecoins. In fact, according to Figure 8, the three token pairs with the highest trading volume in the past 30 days are SOL-USDT/USDC, accounting for over 50% of the total trading volume. (Note: The two SOL-USDC pairs are two different pools with different fee structures).

Figures 7 and 9 also confirm this, with Figure 7 showing that SOL-USDC far exceeds all other DEX pairs in trading volume. Figure 7 represents the trading volume across all DEXs, indicating that the overall ecosystem's trading volume is not necessarily driven solely by memecoins. Figure 9 further illustrates Raydium's trading volume by token type. It can be seen that "native" tokens occupy the largest market share, exceeding 70%. Therefore, while memecoins are an important component of Raydium, they are not everything.

Figure 9: PumpFun Revenue

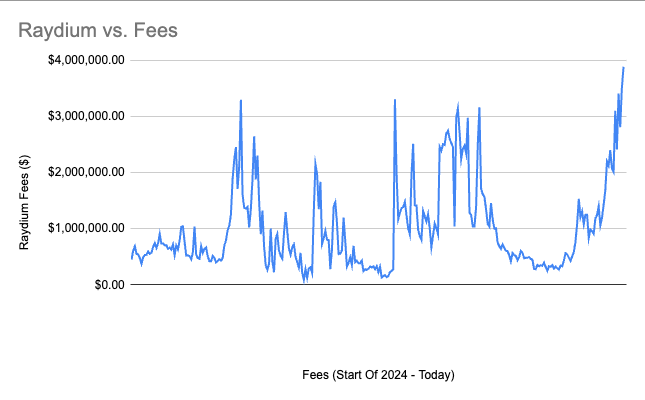

Figure 10: Raydium Revenue

That said, memecoins are highly volatile, and pools with high volatility typically charge higher fees. Therefore, while the contribution of memecoins to trading volume may not be as significant as that of Solana pools, their contribution to Raydium's revenue and fees is substantial. This can be seen from the situation in September, as memecoins are cyclical assets that tend to perform significantly below expectations during "bad markets" when risk appetite diminishes. Subsequently, Pump.Fun's revenue dropped by 67% from an average of $800,000 per day in July/August to about $350,000 in September; Raydium's fees also declined during this period.

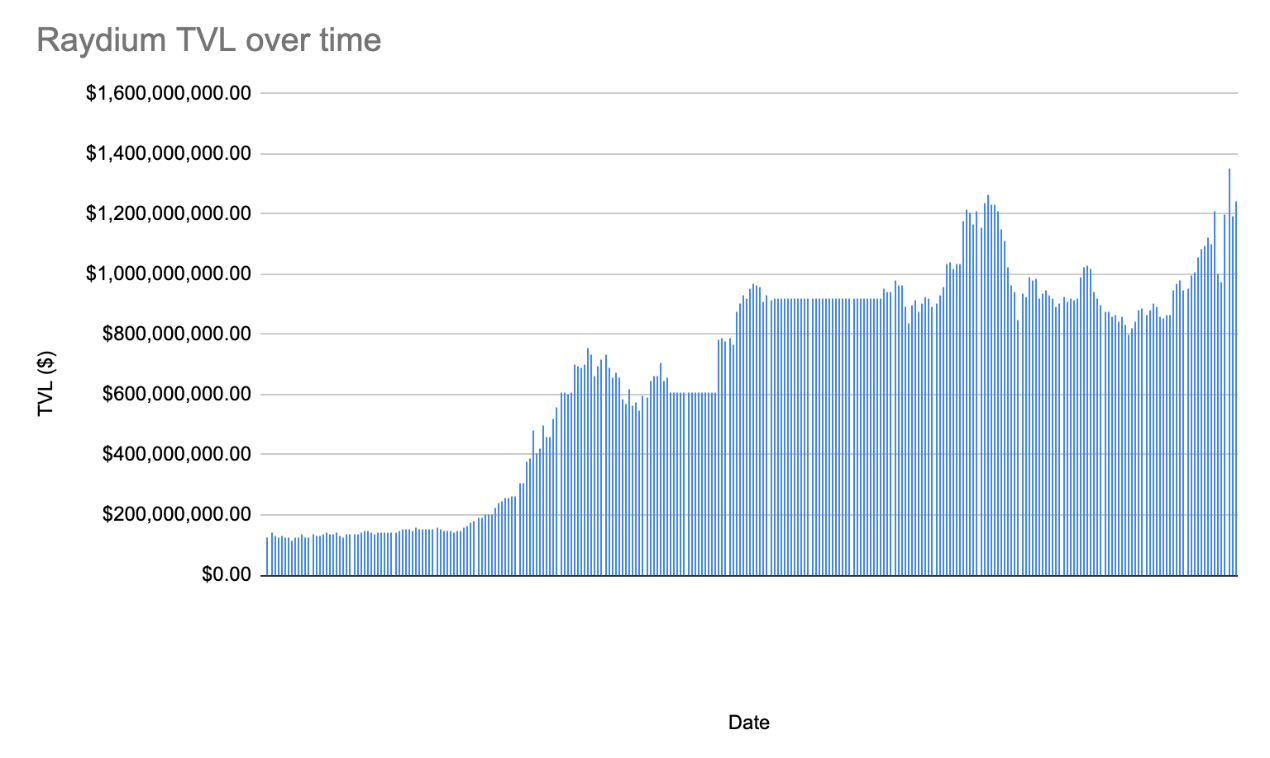

Figure 11: Raydium TVL

But like other areas of the crypto industry, this sector is highly cyclical, and it is normal to see metrics decline during bear markets as risk dissipates. Conversely, TVL can be viewed as a measure of a protocol's true resilience. While revenue is highly cyclical, fluctuating with the arrival or departure of speculators, TVL is an indicator of a DEX's sustainability and how it withstands the test of time. TVL is akin to a shopping mall's "occupancy rate"; the usage rate of shops may vary with the seasons, just as in real life, as long as the mall's occupancy rate is above average, it can be deemed successful.

Similar to a crowded shopping mall, Raydium's TVL remains consistent over time, indicating that while revenue may fluctuate with market prices and sentiment, it has proven capable of becoming a major product in the Solana ecosystem and the best, most liquid DEX on Solana. Therefore, while memecoins do contribute to its revenue, the trading volume of memecoins is not always the case, and liquidity continues to flow to Raydium regardless of market conditions.

Raydium and Aggregators

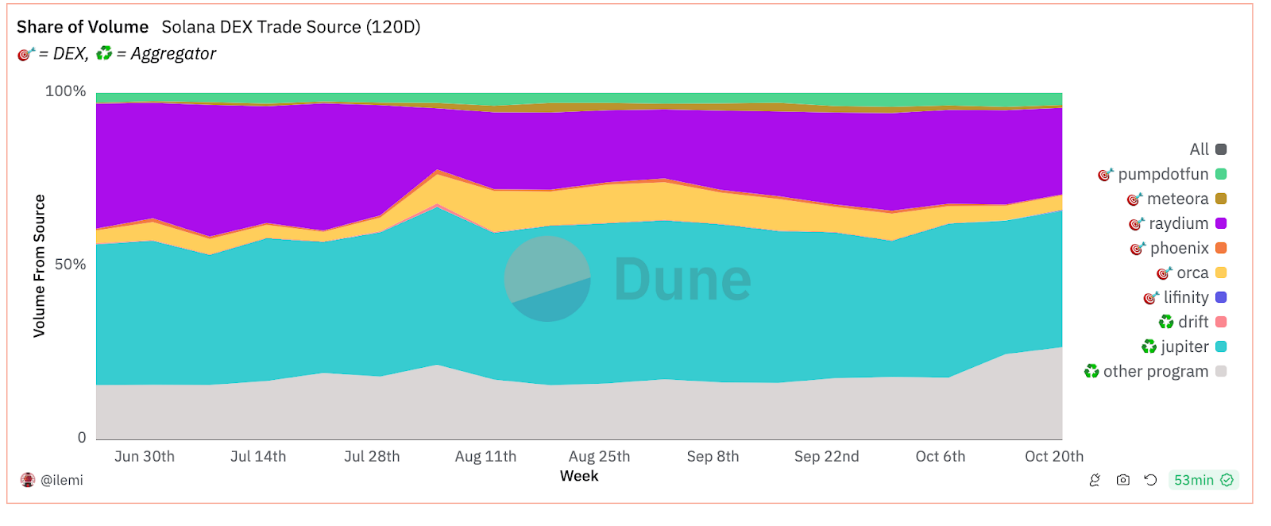

Figure 12: Sources of Solana DEX Trading

While Jupiter and Raydium do not directly compete, Jupiter is a key aggregator in the Solana ecosystem, facilitating trades through the most efficient paths across multiple DEXs, including Raydium. Essentially, Jupiter acts as a meta-level platform, ensuring users get the best prices by sourcing liquidity from various DEXs (such as Orca, Phoenix, Raydium, etc.). On the other hand, Raydium serves as a liquidity provider, supporting many of Jupiter's trades by offering deep liquidity pools for Solana-based tokens.

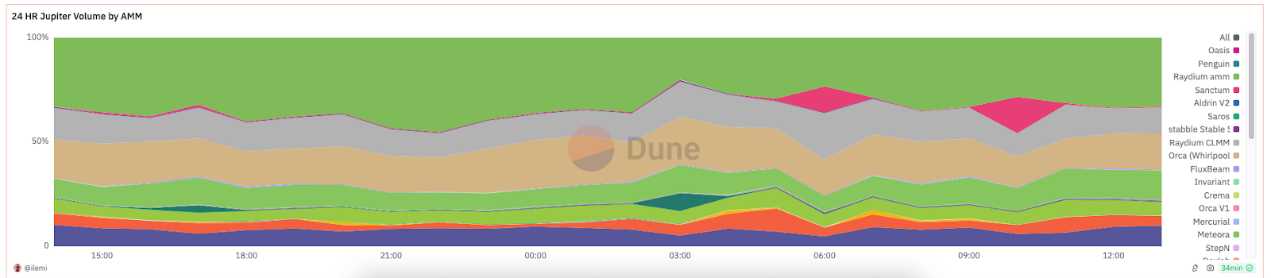

Figure 13: 24-Hour Jupiter AMM Trading Volume

While both protocols are on par, the organic trading volume share directly generated by Raydium is slowly increasing, while Jupiter's share is gradually decreasing. Meanwhile, Raydium accounts for nearly 50% of all order book trading volume on Jupiter.

This indicates that Raydium has successfully built a more robust and self-sufficient platform that can directly attract users rather than relying on third-party aggregators like Jupiter.

The increase in direct trading volume suggests that as users seek the most efficient and comprehensive DeFi experience without going through an aggregator, traders are discovering the value of interacting with Raydium's native interface and liquidity pools. Ultimately, this trend highlights Raydium's capability as a liquidity provider in the Solana ecosystem.

Raydium and The World

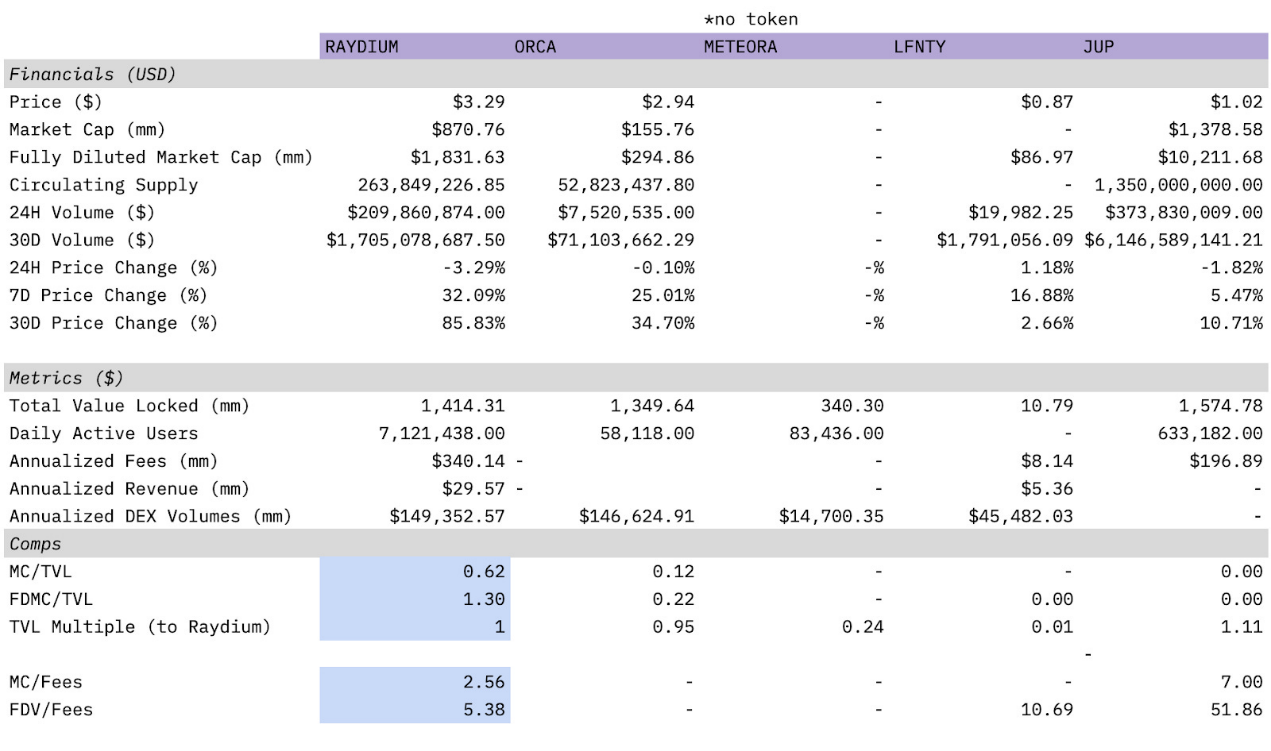

Finally, below is a comparison table built for Raydium using the Artemis plugin, comparing it with other DEXs on Solana, including aggregators.

Figure 14: Raydium vs. Solana DEX

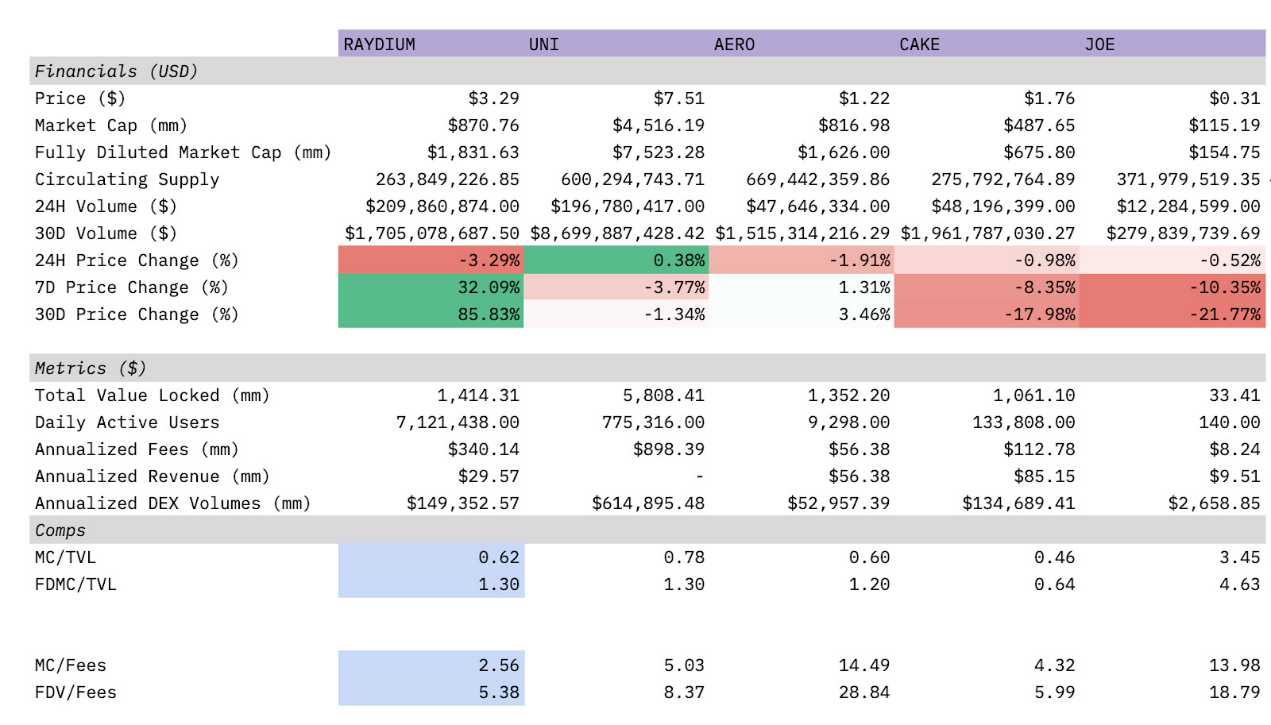

Figure 15: Raydium vs. Popular DEXs

In Figure 13, Raydium is compared with the most popular DEXs on Solana, namely Orca, Meteora, and Lifinity, which together account for 90% of the total Solana DEX volume. Jupiter is also listed as an aggregator. Meteora does not have a token, but it is still included for comparison purposes.

It can be seen that among all DEXs, Raydium has the lowest MC/Fees and FDV/Fees. Raydium also has the highest daily active users, with all other DEXs' TVL being over 80% lower than Raydium—except for Jupiter.

In Figure 14, Raydium is compared with other more traditional DEXs on other chains. Raydium's annualized DEX trading volume is more than double that of Aerodrome, but it has a lower MC/Earnings ratio.

Raydium Token

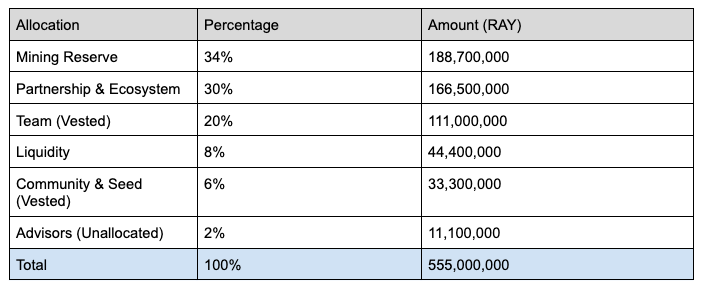

The tokenomics of Raydium are as follows:

Note: The team and seed (accounting for 25.9% of the total) are fully locked for the first 12 months post-TGE and will be unlocked linearly on a daily basis from months 13 to 36. This will end on February 21, 2024.

Raydium tokens have multiple use cases: $RAY holders can stake their tokens to earn additional $RAY. Most importantly, $RAY serves as a mining reward to attract liquidity providers to join Raydium, thereby increasing the depth of liquidity pools. Although Raydium tokens are not governance tokens, a governance mechanism is being developed.

While issued tokens are not favored in the market after the DeFi summer, Raydium's annual inflation rate is extremely low, and its annual buyback is one of the best among DeFi tokens. The annual issuance is currently about 1.9 million RAY, with 1.65 million RAY staked out of the total issuance, which is negligible compared to the issuance of other popular DEXs at peak times. At current prices, the annual issuance of RAY is worth about $5.1 million. This is very low compared to Uniswap, which has a daily issuance of $1.45 million before full unlocking, amounting to $529.25 million annually.

A small transaction fee is charged for each swap in every pool on Raydium. As stated in the documentation, "Depending on the specific fees of a given pool, this fee is divided among incentivizing liquidity providers, RAY buybacks, and the treasury. In summary, regardless of the fee level of a given pool, 12% of all transaction fees are used for RAY buybacks."

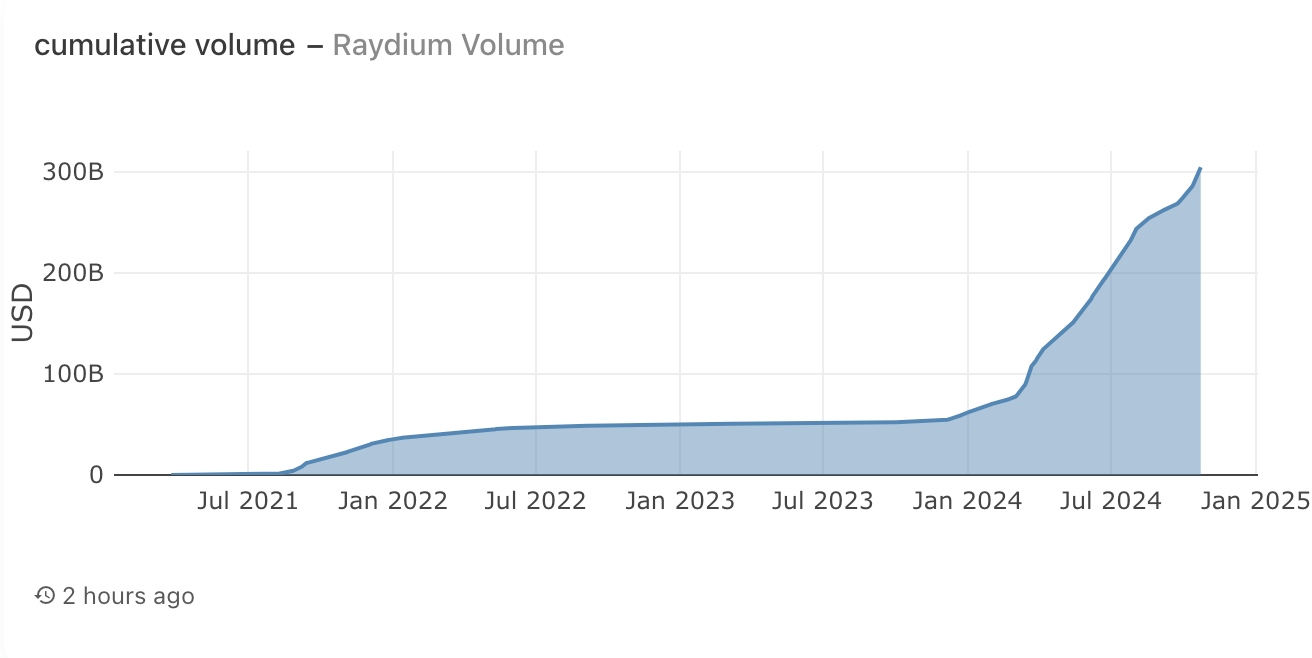

Figure 16: Cumulative Trading Volume of Raydium

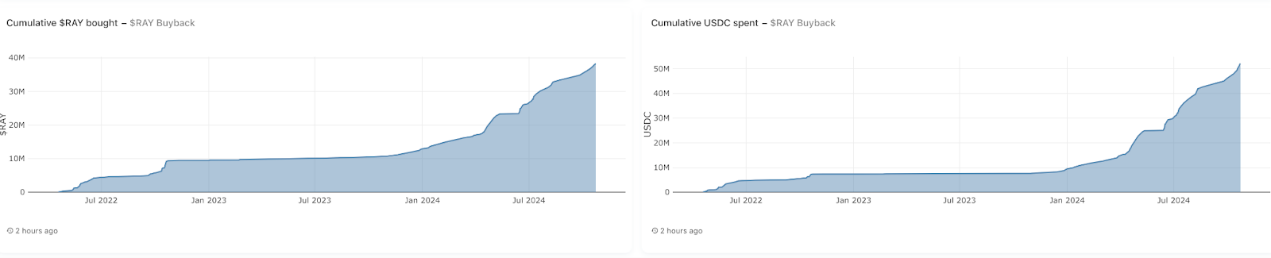

Figure 17: Raydium Buyback Data

Raydium's cumulative trading volume has exceeded $300 billion, successfully repurchasing approximately 38 million RAY tokens, equivalent to a value of $52 million. Raydium's buyback program is the most impressive among all DeFi projects, helping to propel Raydium to the forefront of all DEXs on Solana.

Raydium's Case

In summary, Raydium is essentially ahead of all DEXs on Solana and is positioned for success as Solana continues to grow. Raydium has experienced growth over the past year and shows no signs of stopping soon, as the memecoin craze persists, with the latest memecoin trend revolving around artificial intelligence (such as $GOAT).

As a major liquidity provider and AMM on Solana, Raydium's unique position gives it a strategic advantage in capturing market share from emerging trends. Most importantly, Raydium's commitment to innovation and ecosystem growth is reflected in its frequent upgrades, incentives for liquidity providers, and active engagement with the community. These factors indicate that Raydium is not only ready to adapt to the ever-changing DeFi landscape but is also prepared to lead in DeFi.

Related Reading: In-Depth Exploration of the Liquidity Engine Aerodrome on Base Chain

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。