Bitcoin (BTC) keeps hitting new highs, propelled above $77,000 on Nov. 8 for the first time ever by crypto industry optimism about Donald Trump winning the U.S. presidential election.

Other cryptocurrencies are soaring, too. Ethereum's ether (ETH), for instance, just surpassed $3,000 for the first time since August.

What's intriguing is that instead of selling off, bitcoin plowed through prior highs on Nov. 6 ($76,400), Nov. 7 ($76,900) and Nov. 8 ($77,200). Gold and U.S. equities are doing the same thing, hitting highs and then breaking them.

This illustrates how strong the current rally is — and how likely it is to continue.

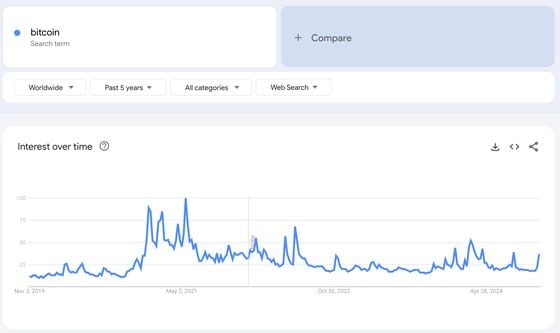

The bitcoin rally can keep going due to several factors. First, Google searchers' interest in the term is still relatively low. Searches were considerably higher in November 2021 and March 2024, so, even though search interest has perked up in the past week, this suggests we are far away from market euphoria.

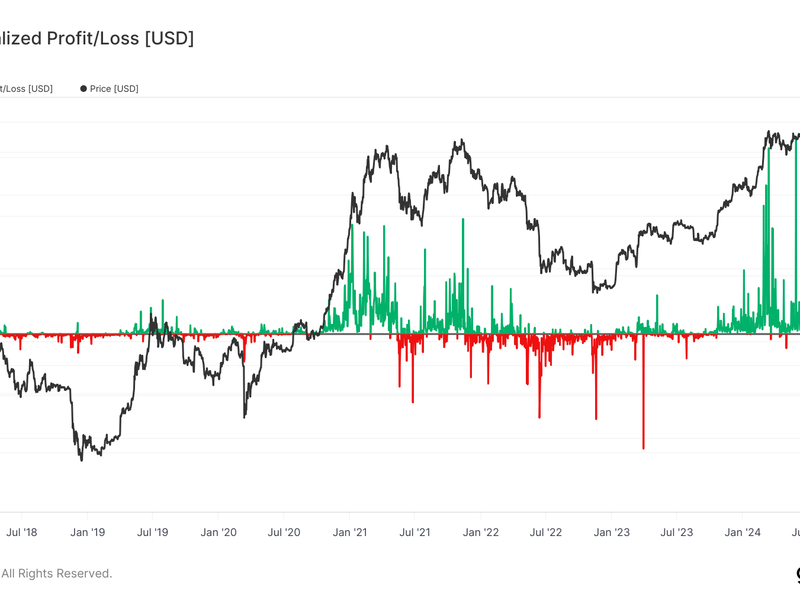

CoinDesk has been monitoring profit-taking over the past few weeks. Are investors cashing in as bitcoin soars?

They are. Glassnode data shows that on Nov. 6, the day after the U.S. election, $3.5 billion of profit was realized as bitcoin jumped from $68,000 to $76,000, while the total for the next two days was $3.2 billion.

However, even though this may seem like a lot, it's tiny compared with prior all-time highs. In March, when bitcoin finally rose above its 2021 record, profit-taking soared to $10 billion. Throughout the 2021 bull run, it got as high as $6 billion.

It was even higher in 2017 — sometimes around $4.6 billion — when bitcoin records were around $20,000. Current profit-taking isn't even topping that despite bitcoin's price being far higher.

Bitcoin has been stuck between $50,000 and $70,000 for seven months. Despite breaking out of that range, investors are patiently waiting for higher prices.

Using inflation from the U.S. Bureau of Labor Statistics, you can measure how much purchasing power has been lost versus previous years. Bitcoin's November 2021 record of around $69,000 converts to about $78,000 in today's U.S. dollars, barely above its current price.

Investors may want more for their bitcoin on an inflation-adjusted basis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。