🧐 Trend Report | The Rise of Performance L1: Performance L1 Strongly Pressures ETH-based L2, Aptos' Golden Opportunity and Ecological Potential!

If everyone has a keen sense, they will notice that Aptos $APT has recently been experiencing many significant events worth paying attention to—

For example, the launch of native USDT on the Aptos mainnet; the launch of the on-chain currency fund FOBXX by Franklin on Aptos;

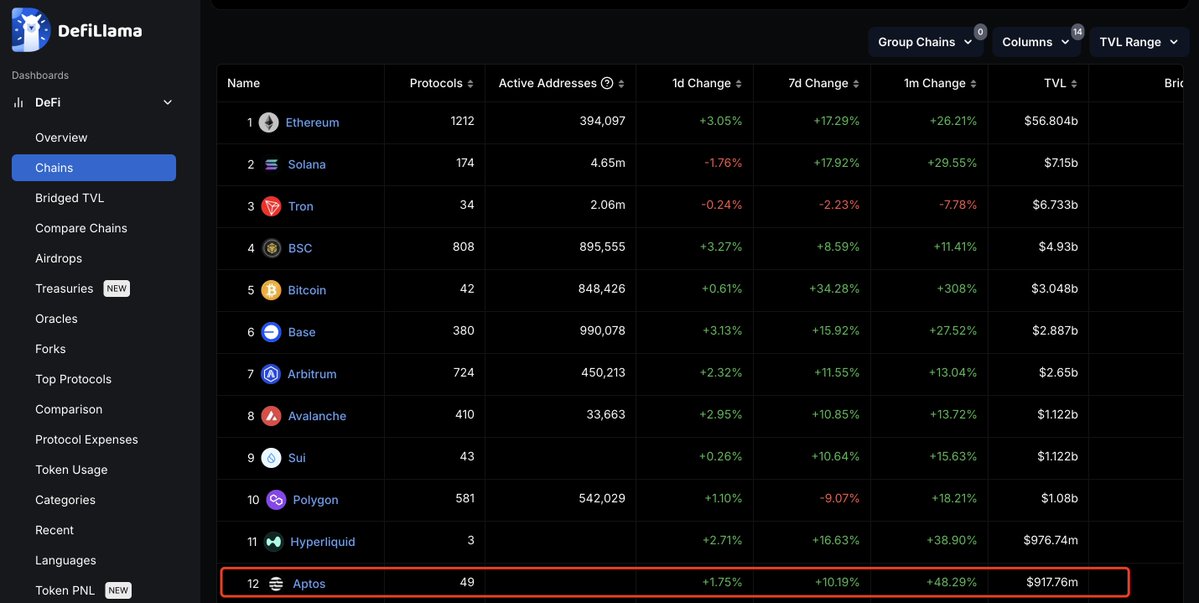

Moreover, according to Defillama data, Aptos' TVL is rapidly growing. I also saw a point mentioned by @cmdefi yesterday, which I personally agree with—this round of DeFi revival will bring a reshuffle of public chain TVL patterns:

“It is evident that Aptos' DeFi is awakening. From April to October, TVL grew from 500 million to 900 million, ranking 12th overall, just one step away from the top 10 public chains in TVL, soon to surpass the established public chains of the last cycle, Polygon and Avalanche. This round of DeFi revival will bring a reshuffle of public chain TVL patterns.”

1️⃣ I believe this new DeFi landscape is about to create greatness for the Apt public chain—

First, we can observe the TVL growth of this round of chains, and there is an interesting phenomenon—several leading L2s, such as Base, Arb, and Op, have seen growth rates far lower than high-performance L1s: Sol, Sui, and Apt;

Let’s look at the monthly TVL growth rate data:

Leading L2 chains:

Base 21.71%

Arb 8.97%

Op 10.65%

Leading performance L1 chains:

Sol 28.46%

Sui 8.51% (Sui had a previous surge, so this month is not significant)

Apt 32.02%

From the intuitive performance of market heat, leading performance L1 chains are indeed much stronger this round compared to leading L2 chains. This is a trend that deserves attention. In the past, other L1s were merely competitive chains to ETH L2, but they clearly struggled to compete, and even Sol has begun to rival ETH itself;

Although I am a super bull on ETH, I do not reject the rise of non-ETH chains. Market competition is always a good thing; at worst, it just means more pressure. Both certain and uncertain opportunities are opportunities worth pursuing; it all depends on your understanding of different opportunities.

2️⃣ The potential lies in performance and narrative; Apt has the capability that just needs the right wind.

Returning to the main topic, back to high-performance L1 chains, Sol has proven to the market that performance L1 chains have the strength to compete with ETH itself.

Following closely are the Move-based chains, with Sui and its ecological DEX Cetus performing exceptionally well, but currently showing some fatigue. The next most promising one is Apt;

Let’s look at some data:

Apt Market Cap: 5 billion, FDV: 10.9 billion, TVL: 890 million

Sui Market Cap: 6.4 billion, FDV: 22.7 billion, TVL: 1.1 billion

Apt's TVL is very close to Sui's, but the FDV differs by a factor of two. Thanks to the rise of performance L1 chains and the temporary decline of ETH-based chains, Apt has entered a golden stage of development.

Let’s mention a few Apt-related events:

Franklin launched the on-chain currency fund FOBXX on Aptos;

Native USDT launched on the Aptos mainnet;

The most important point is Aptos' ecological subsidy policy, which subsidizes ecological DeFi projects, such as the leading lending platform Aries on the Apt chain, where the annualized returns for USDT and USDC deposits after subsidies have reached 11%;

This will attract a large amount of capital into the Apt chain.

Why do I say this is important? Because the Sui chain has run this way by continuously improving capital activity through DeFi ecological subsidies, attracting hot money, and reviving lending and DEX. Once liquidity becomes active, it can cultivate fertile ground for the birth of some opportunities, such as Meme. The importance of Meme to Sol in this round goes without saying.

3️⃣ Conclusion—The Rise of Move-based Chains, Competition is a Good Thing

Compared to Sui's FDV, Apt has greater potential space, and Sui has shown signs of fatigue after a strong breakout. The rise of Apt is not a bad thing for Sui, as both are born from the Move ecosystem and are strongly correlated. Mutual competition within the same system can better promote the prosperity of the Move ecosystem.

Personal suggestion: Pay attention not only to Apt's native token but also to its ecosystem, which has excellent value. For example, Binance recently launched the leading DEX Cetus on Sui, while Apt's ecosystem has not yet received widespread market attention, and the Apt chain's ecological subsidy policy presents a large yield space for DeFi investment users.

I will continue to pay attention to this cycle and study the Move ecosystem and Apt more!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。