Special thanks to Robin Hanson and Alex Tabarrok for feedback andreview

One of the Ethereum applications that has always excited me the mostare prediction markets. I wroteabout futarchy, a model of prediction-based governance conceived by RobinHanson, in 2014. I was an active user and supporter of Augur back in 2015 (look, mommy, myname is in the Wikipediaarticle!). I earned $58,000 bettingon the election in 2020. And this year, I have been a closesupporter and follower of Polymarket.

To many people, prediction markets are about betting on elections,and betting on elections is gambling - nice if it helps people enjoythemselves, but fundamentally not more interesting than buying randomcoins on pump.fun. From this perspective, my interest in predictionmarkets may seem confusing. And so in this post I aim to explain what itis about the concept that excites me. In short, I believe that (i)prediction markets even as they exist today are a very usefultool for the world, but furthermore (ii) predictionmarkets are only one example of a much larger incredibly powerfulcategory, with potential to create better implementations ofsocial media, science, news, governance, and other fields. I shall labelthis category "info finance".

Thetwo faces of Polymarket: a betting site for the participants, a newssite for everyone else

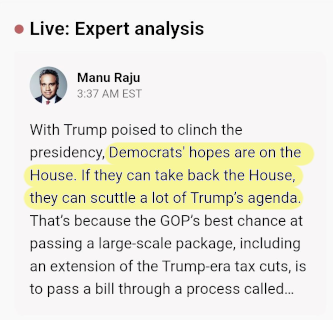

In the past week, Polymarket has been a veryeffective source of information about the US election. Not only didPolymarket predict Trump would win with 60/40 odds while other sourcespredicted 50/50 (nottoo impressive by itself), it also showed other virtues: when theresults were coming out, while many pundits and news sources keptstringing viewers along with hope of some kind of favorable news forKamala, Polymarket showed the direct truth: Trump had a greater than 95%chance of victory, and a greater than 90% chance of seizing control ofall branches of government at the same time.

Two screenshots both taken at 3:40 AM EST, Nov 6

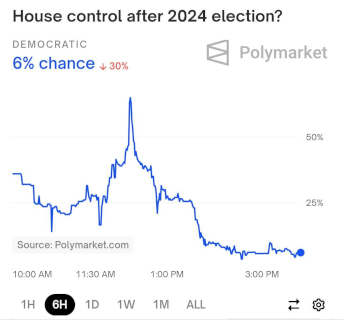

But to me this is not even the best example of why Polymarket isinteresting. So let us go to a different example: theelections in Venezuela in July. The day after the election happened,I remember seeing out of the corner of my eye something about peopleprotesting a highlymanipulated election result in Venezuela. At first, I thoughtnothing of it. I knew that Maduro was one of those "basically adictator" figures already, and so I figured, of course he wouldfake every election outcome to keep himself in power, of coursesome people would protest, and of course the protest would fail- as, unfortunately, so many others do. But then I was scrollingPolymarket, and I saw this:

People were willing to put over a hundred thousand dollars on theline, betting that there is a 23% chance that this electionwould be the one where Maduro would actually get struck down.Now I was paying attention.

Of course, we know the unfortunate result of this situation.Ultimately, Maduro did stay in power. However, the markets cluedme in to the fact that this time, the attempt to unseat Madurowas serious. There were huge protests, and the opposition playeda surprisingly well-executed strategy to prove to the world just howfraudulent the elections were. Had I not received the initial signalfrom Polymarket that "this time, there is something to pay attentionto", I would not have even started paying that much attention.

You should never trust the charts entirely: if everyonetrusts the charts, then anyone with money can manipulate the charts andno one will dare to bet against them. On the other hand, trusting thenews entirely is also a bad idea. News has an incentive to besensational, and play up the consequences of anything for clicks.Sometimes, this is justified, sometimes it's not. If you see asensational article, but then you go to the market and you see thatprobabilities on relevant events have not changed at all, it makes senseto be suspicious. Alternatively, if you see an unexpectedly high or lowprobability on the market, or an unexpectedly sudden change, that's asignal to read through the news and see what might have caused it.Conclusion: you can be more informed by reading the newsand the charts, than by reading either one alone.

Let's recap that's going on here. If you are a bettor, thenyou can deposit to Polymarket, and for you it's a betting site. If youare not a bettor, then you can read the charts, and for you it's a newssite. You should never trust the charts entirely, but Ipersonally have already incorporated reading the charts as one step inmy information-gathering workflow (alongside traditional media andsocial media), and it has helped me become more informed moreefficiently.

Info finance, more broadly

Now, we get to the important part: predicting the election isjust the first app. The broader concept is that you canuse finance as a way to align incentives in order to provideviewers with valuable information. Now, one natural responseis: isn't all finance fundamentally about information?Different actors make different buy and sell decisions because ofdifferent opinions about what will happen in the future (in addition topersonal needs like risk preferences and desire to hedge), and you canread market prices to infer a lot of knowledge about the world.

To me, info finance is that, but correctby construction. Similar to the concept of correct-by-constructionin software engineering, info finance is a discipline where you(i) start from a fact that you want to know, and then (ii)deliberately design a market to optimally elicit that information frommarket participants.

Info finance as a three-sided market: bettors makepredictions, readers read predictions. The market outputs predictionsabout the future as a public good (because that's what it was designedto do).

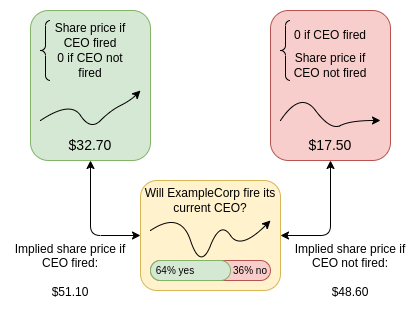

One example of this is prediction markets: you wantto know a specific fact that will take place in the future, and so youset up a market for people to bet on that fact. Another example isdecision markets: you want to know whether decision Aor decision B will produce a better outcome according to some metric M.To achieve this, you set up conditional markets: you ask peopleto bet on (i) which decision will be chosen, (ii) value of M if decisionA is chosen, otherwise zero, (iii) value of M if decision B is chosen,otherwise zero. Given these three variables, you can figure out if themarket thinks decision A or decision B is more bullish for the value ofM.

One technology that I expect will turbocharge info finance inthe next decade is AI (whether LLMs or some future technology).This is because many of the most interesting applications of infofinance are on "micro" questions: millions of mini-markets for decisionsthat individually have relatively low consequence. In practice, marketswith low volume often do not work effectively: it does not make sensefor a sophisticated participant to spend the time to make a detailedanalysis just for the sake of a few hundred dollars of profit, and manyhave even argued that without subsidies suchmarkets won't work at all because on all but the most large andsensational questions, there are not enough naive traders forsophisticated traders to take profit from. AI changes that equationcompletely, and means that we could potentially get reasonablyhigh-quality info elicited even on markets with $10 of volume. Even ifsubsidies are required, the size of the subsidy per questionbecomes extremely affordable.

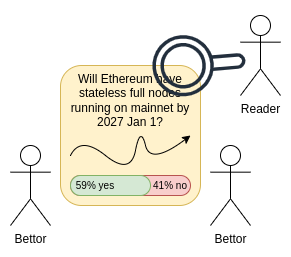

Info finance fordistilled human judgement

Suppose that you have a human judgement mechanism that you trust, andthat has the legitimacyof a whole community trusting it, but which takes a long time and a highcost to make a judgement. However, you want access to at least anapproximate copy of that "costly mechanism" cheaply and in realtime. Here is Robin Hanson'sidea for what you can do: every time you need to make a decision,you set up a prediction market on what outcome the costly mechanismwould make on the decision if it was called. You let theprediction market run, and put in a small amount of money to subsidizemarket makers.

99.99% of the time, you don't actually call the costly mechanism:perhaps you "revert the trades" and give everyone back what they put in,or you just give everyone zero, or you see if the average price wascloser to 0 or 1 and treat that as the ground truth. 0.01% of the time -perhaps randomly, perhaps for the highest-volume markets, perhaps somecombination of both - you actually run the costly mechanism, andcompensate participants based on that.

This gives you a credibly neutralfast and cheap "distilled version" of your original highly trustworthybut highly costly mechanism (using the word "distilled" as an analogy toLLMdistillation). Over time, this distilled mechanism roughly mirrorsthe original mechanism's behavior - because only the participants thathelp it have that outcome make money, and the others lose money.

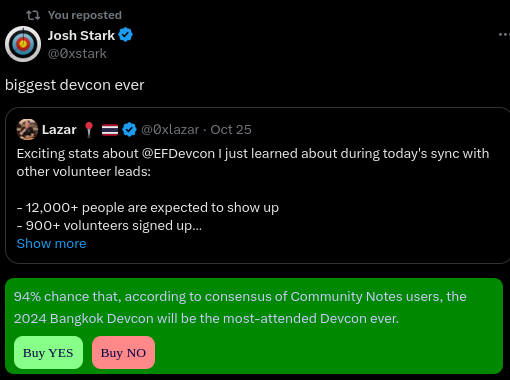

Mockup of possible prediction markets + Community Notescombo.

This has applications not just in social media, but also forDAOs. A major problem of DAOs is that there is such a largenumber of decisions that most people are not willing to participate inmost of them, leading to either widespread use of delegation, with riskof the same kinds of centralization and principal-agent failures we seein representative democracy, or vulnerability to attack. A DAO whereactual votes only happen very rarely, and most things are decided byprediction markets with some combination of humans and AI predicting thevotes, could work well.

Just as we saw in the decision markets example, info finance containsmany potential paths to solving important problems in decentralizedgovernance. The key is the balance between market andnon-market: the market is the "engine", and some other non-financializedtrustworthy mechanism is the "steering wheel".

Other use cases of infofinance

Personal tokens - the genre of projects such as Bitclout (now deso), friend.tech and many others thatcreate a token for each person and make it easy to speculate on thesetokens - are a category that I would call "proto info-finance". They aredeliberately creating market prices for specific variables - namely,expectations of future prominence of a person - but the exactinformation being uncovered by the prices is too unspecific and subjectto reflexivityand bubble dynamics. There is a possibility to create improved versionsof such protocols, and use them to solve important problems like talentdiscovery, by being more careful about the economic design of a token,particularly where its ultimate value comes from. Robin Hanson's ideaof prestige futures is one possible end state here.

Advertising - the ultimate "expensive buttrustworthy signal" is whether or not you will buy a product. Infofinance based off of that signal could be used to help people toidentify what to buy.

Scientific peer review - there is an ongoing "replicationcrisis" in science where famous results that have in some casesbecome part of folk wisdom end up not being reproduced at all by newerstudies. We can try to identify results that need re-checking with aprediction market. Before the re-checking is done, such a market wouldalso give readers a quick estimate of how much they should trust anyspecific result. Experiments of this idea have beendone, and so far seem successful.

Public goods funding - one of the main problems withpublic goods funding mechanisms used in Ethereum is the "popularitycontest" nature of them. Each contributor needs to run their ownmarketing operation on social media in order to get recognized, andcontributors who are not well-equipped to do this, or who haveinherently more "background" roles, have a hard time getting significantamounts of money. An appealing solution to this is to try to track anentire dependency graph: for each positive outcome, whichprojects contributed how much to it, and then for each of thoseprojects, which projects contributed how much to that, and soon. The main challenge in this kind of design is figuring out theweights of the edges in a way that is resistant to manipulation - afterall, such manipulation happensall the time already. A distilled human judgement mechanism couldpotentially help.

Conclusions

These ideas have been theorized about for a long time: the earliestwritings about prediction markets and even decision markets are decadesold, and theory of finance saying similar things is even older. However,I would argue that the current decade presents a unique opportunity, forseveral key reasons:

- Info finance solves trust problems that people actuallyhave. A common concern of this era is the lack of knowledge(and worse, lack of consensus) about whom to trust, in political,scientific and commercial contexts. Info finance applications could helpbe part of the solution.

- We now have scalable blockchains as the substrate.Up until very recently, fees were too high to actually implement most ofthese ideas. Now, they are no longer too high.

- AIs as participants. Info finance is relativelydifficult to make work when it must depend on humans to participate oneach question. AIs greatly improve this situation, enabling effectivemarkets even on small-scale questions. Many markets will likely have acombination of AI and human participants, especially as volume onspecific questions suddenly switches from small to large.

To take full advantage of this opportunity, it's time to go beyondjust predicting elections, and explore the rest of what info finance canbring us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。