According to QCP Capital’s latest market updates, Donald Trump’s success in the 2024 presidential race has sparked notable financial shifts. The dollar experienced a 1.2% increase, climbing to levels not seen since July, as investors reacted to anticipated economic expansion under Trump’s policies. This spike in the dollar was accompanied by a substantial increase in Treasury yields, with the 10-year yield rising 15 basis points and the 2-year yield gaining 8 basis points, signaling market expectations of stronger economic growth. However, QCP’s analysts caution that while Trump’s policy proposals might temper the likelihood of aggressive rate cuts, the market still expects two rate cuts within the year.

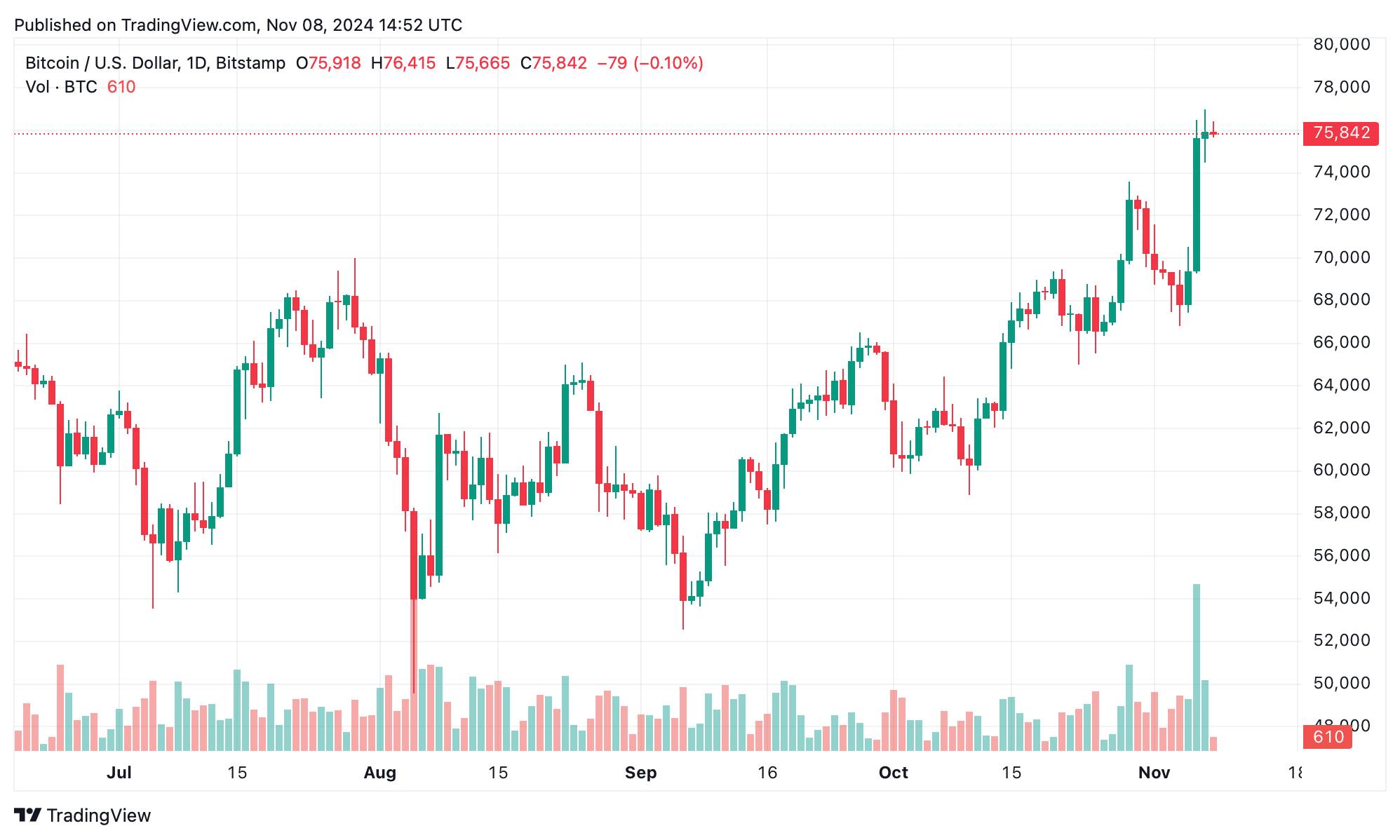

QCP researchers highlight the immediate impact on bitcoin (BTC), which reached an all-time high in the wake of the election results. This surge follows a period of stability. QCP’s report notes that BTC’s response aligns with historical patterns seen in previous election cycles, with each election triggering new highs. The market update suggests this trend may persist as BTC capitalizes on Trump’s proposed economic policies, particularly as investors look to hedge against potential equity volatility. Unprecedented inflows into BTC spot ETFs—totaling $1.38 billion—are further fueling bullish sentiment within the crypto market.

However, in another update, QCP Capital emphasizes caution, as certain “Trump trades” are already showing signs of reversal. Both the dollar and Treasury yields have retracted some post-election gains, indicating investor uncertainty around Trump’s fiscal agenda, especially regarding proposed tariffs on China and rising U.S. debt levels. According to QCP, BTC may emerge as a less risky asset than equities in this environment, potentially benefiting from sustained demand. If inflows continue, QCP anticipates a feedback loop, with rising BTC prices attracting more retail investors and institutional capital as volatility remains contained.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。