In the current context of global economic uncertainty, every policy move by the Federal Reserve sends ripples through the world. On November 7, local time, the Federal Reserve announced a 25 basis point reduction in the federal funds rate to 4.5%-4.75%. This follows a significant 50 basis point cut on September 18, marking the second time since March 2020 that the Federal Reserve has demonstrated its commitment to maintaining a robust U.S. economy through concrete actions.

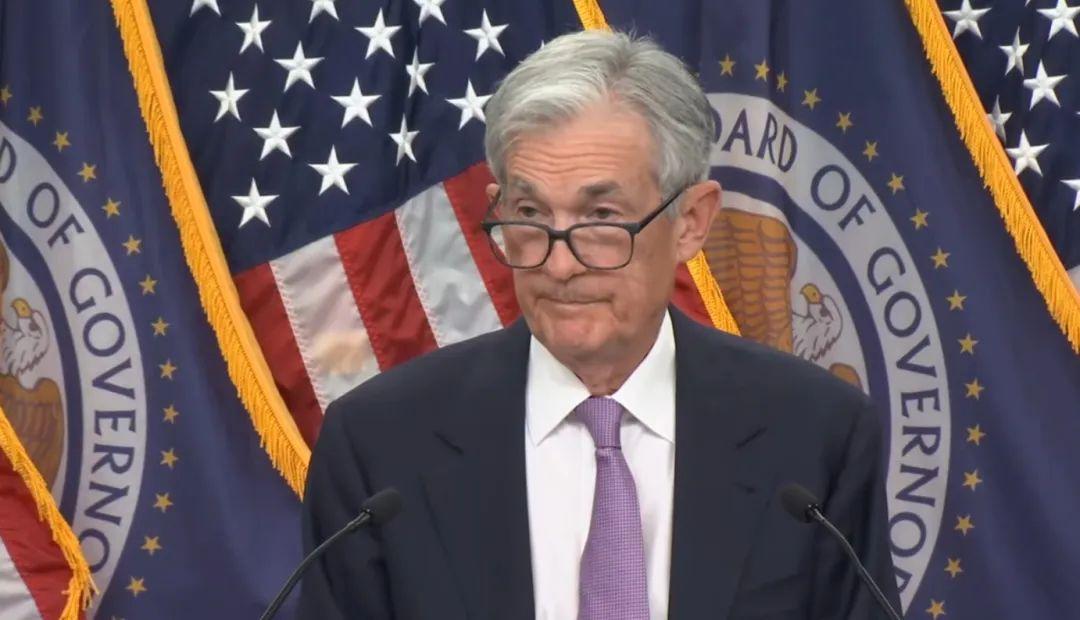

Powell Reiterates That Trump's Election Will Not Affect Monetary Policy

In his speech following this decision, Federal Reserve Chairman Powell clearly stated that the outcome of the presidential election would not directly impact monetary policy in the short term. He emphasized that the Fed's policy adjustments would be entirely based on the actual economic and inflation conditions, remaining flexible without a predetermined path. Powell candidly noted that if the economy remains strong and inflation does not fall back to 2%, a slower adjustment of policy would be considered; conversely, if the labor market weakens or inflation declines faster than expected, action may be accelerated.

Although Powell's remarks aimed to clarify the boundary between politics and monetary policy, market concerns about potential political interference have not completely dissipated. After Trump announced his election as the 2024 president, market analysts pointed out that his policy proposals, such as tax cuts, immigration restrictions, and increased tariffs, could exert greater pressure on inflation and potentially force the Fed to adjust monetary policy in response to rising inflation.

U.S. Media: Trump May Allow Fed Chair Powell to Serve Out His Remaining Term

According to CNN, a senior advisor to Trump revealed that Trump might allow Powell to continue serving until the end of his term in May 2026, but warned that "Trump could change his mind at any time." This indicates that, under the impetus of the rate cut policy, Powell's leadership position currently seems unaffected. Powell also stated that he would not resign at the president's request, as the law does not permit the president to dismiss the Fed chair.

Wall Street Journal noted that Trump's control over the Federal Reserve is quite limited. While the president has the power to nominate candidates for the Fed chair, the final appointment decision rests with the Senate. However, the president can indirectly influence monetary policy by nominating the seven members of the Federal Reserve Board, which will be Trump's most direct way to impact the Fed in the coming years. It is important to note that these nominations also require Senate confirmation, and the process for replacing board members is intentionally designed to be quite lengthy.

It is understood that the current Fed Chair Powell's term will end in May 2026, while his board position will expire in January 2028. Additionally, board member Kugler's term will also end in January 2026. This means Trump will have the opportunity to nominate and appoint candidates for these key positions in the next four years.

Furthermore, the term of the Fed's Vice Chair for Supervision, Barr, will also end in July 2026, providing Trump with another appointment opportunity.

Public records show that Trump frequently criticized the Federal Reserve and its chair Powell during his presidency, even threatening to remove him, as he believed Powell was not loosening monetary policy quickly enough, hindering the prosperity of the U.S. economy. According to Bloomberg, several sources close to Trump's campaign team revealed that Hassett might be Trump's ideal candidate for the next Fed chair.

J.P. Morgan pointed out that Trump's influence on reshaping the Federal Reserve will take time to manifest, but it undoubtedly highlights the potential challenges that political factors pose to independent monetary policy. The Federal Reserve must maintain a delicate balance in a complex economic and political environment, as defending its independence is not only crucial for U.S. financial stability but also has far-reaching implications for the global economy.

Amidst strong economic performance and policy uncertainty, every decision made by the Federal Reserve is akin to walking on a narrow tightrope, where a slight misstep could trigger market turmoil. The political undercurrents behind this rate cut may become the focal point of financial market attention in the near future. How to uphold the neutrality and effectiveness of monetary policy amidst the whirlpool of political forces tests the wisdom and resolve of the Federal Reserve.

The challenges facing the Federal Reserve lie not only in the dynamic adjustments of economic data but also in how to maintain policy independence and execution under political pressure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。