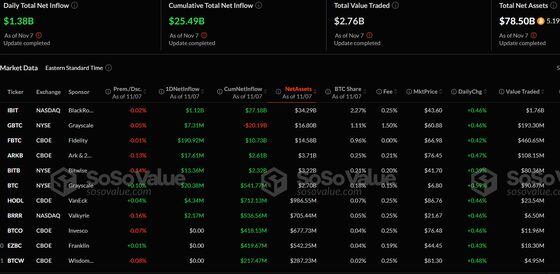

Bitcoin (BTC) exchange-traded funds (ETFs) listed in the U.S. logged a record $1.38 billion in net inflows on Thursday, a day after Republican Donald Trump won the U.S. presidency.

BlackRock’s IBIT took on over $1.1 billion in net inflows, the most among all products, and its highest-ever since going live in January. Cumulative net inflows across all products crossed $25 billion for the first time. None of the twelve ETFs showed any net outflows.

Ether (ETH) ETFs logged $78 million in net inflows on renewed bullishness for the decentralized finance (DeFi) space following Trump’s victory. ETH rose more than 10% on Thursday as expectations of pro-crypto policies and deregulation in a Trump regime boosted investor confidence in the asset.

BTC trades above $76,000 in Asian morning hours Friday, up nearly 10% over the past week. In line with analyst expectations, the Federal Reserve cut rates by 25 basis points on Thursday in a move that typically supports risk assets like bitcoin by increasing liquidity and weakening the dollar.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。