BlackRock's iShares Bitcoin Trust (IBIT) has set a new record for its largest single daily inflow since it was listed in January as demand for U.S. spot Bitcoin exchange-traded funds experience surging trading activity amid heightened investor interest.

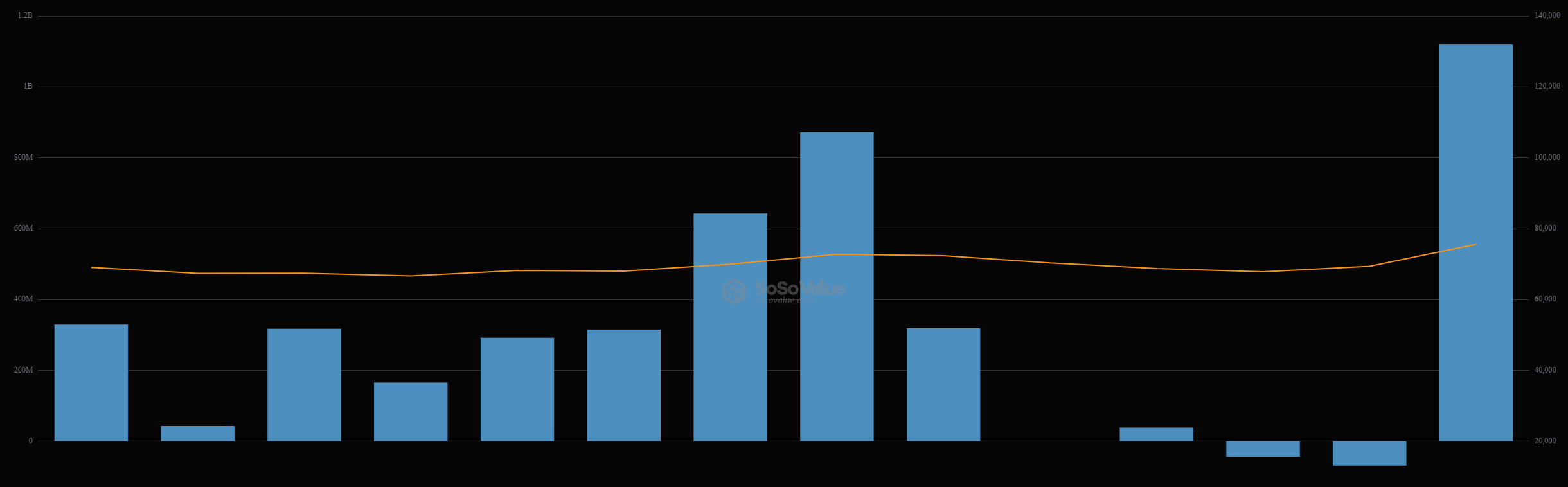

IBIT pulled in a total of $1.12 billion, beating out its prior October 30 record of $872 million, data from SoSoValue shows. The fund, which has emerged as a dominant force among its 10 other rivals, has a net asset value of $34.2 billion, bolstered by Bitcoin’s record price highs.

The surge in ETF demand coincides with Bitcoin's record-setting highs, suggesting traditional finance is continuing to embrace crypto exposure through regulated vehicles.

“We're in a goldilocks scenario right now of monetary easing, political certainty, and robust US data,” Pav Hundal, lead market analyst at crypto exchange Swyftx, told Decrypt. “Capital is everywhere, and right now, it’s flooding into the ETFs at an extraordinary velocity.”

IBIT has smashed its previous record set at the end of October. Credit: SoSoValue.

“The ETFs are accumulating Bitcoin faster than it can be created by a factor of two to one,” Hundal added. “Sooner or later, this will tip across into a broad-based crypto rally. Probably sooner.”

It comes as IBIT posted a record $4 billion in trading volume on Wednesday, vastly exceeding its nearest rival, Fidelity, after President-elect Donald Trump secured a second term as president of the U.S.

Trump’s Whitehouse win is viewed by many in the industry as a boon for digital assets. He has promised to protect crypto mining interests, establish a Bitcoin reserve, and usher in favorable policy.

The ascent of IBIT as a top Bitcoin ETF comes amid shifting sentiment over investments in institutionalized crypto. The fund has maintained steady inflows since inception, while traditional competitors such as Grayscale's GBTC has faced negative outflows due to its high fees.

BlackRock charges a 0.25% fee, waived until January, while GBTC charges significantly higher at 1.5%. Fidelity’s FBTC, meanwhile, also charges 0.25%, though its waiver ended in July.

Edited by Sebastian Sinclair

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。