Author: Bitcoin Magazine Pro

Compiled by: Felix, PANews

Bitcoin Magazine Pro published a review of Bitcoin in October, discussing several key topics. These include the decline in Bitcoin exchange balances, ETF inflows exceeding $5 billion, and optimistic predictions that could redefine Bitcoin's value in the coming quarter. Below are the details of the report.

Key Highlights:

- On-chain analysis of Bitcoin: Bitcoin exchange balances are at historical lows, indicating increasing confidence among holders who are increasingly opting for self-custody.

- Surge in Bitcoin ETFs: In October, ETF inflows exceeded $5.4 billion, with BlackRock's IBIT leading the market. This reflects the growing acceptance of Bitcoin in mainstream financial markets.

- Mining dynamics: Russia and China are expanding their mining influence, while the United States still maintains the largest share of hash power.

- Bullish price predictions: Bitcoin analyst Tone Vays predicts that by mid-2025, supported by strong technical indicators, Bitcoin's potential price range will be between $102,000 and $140,000.

On-Chain Bitcoin

Highlights

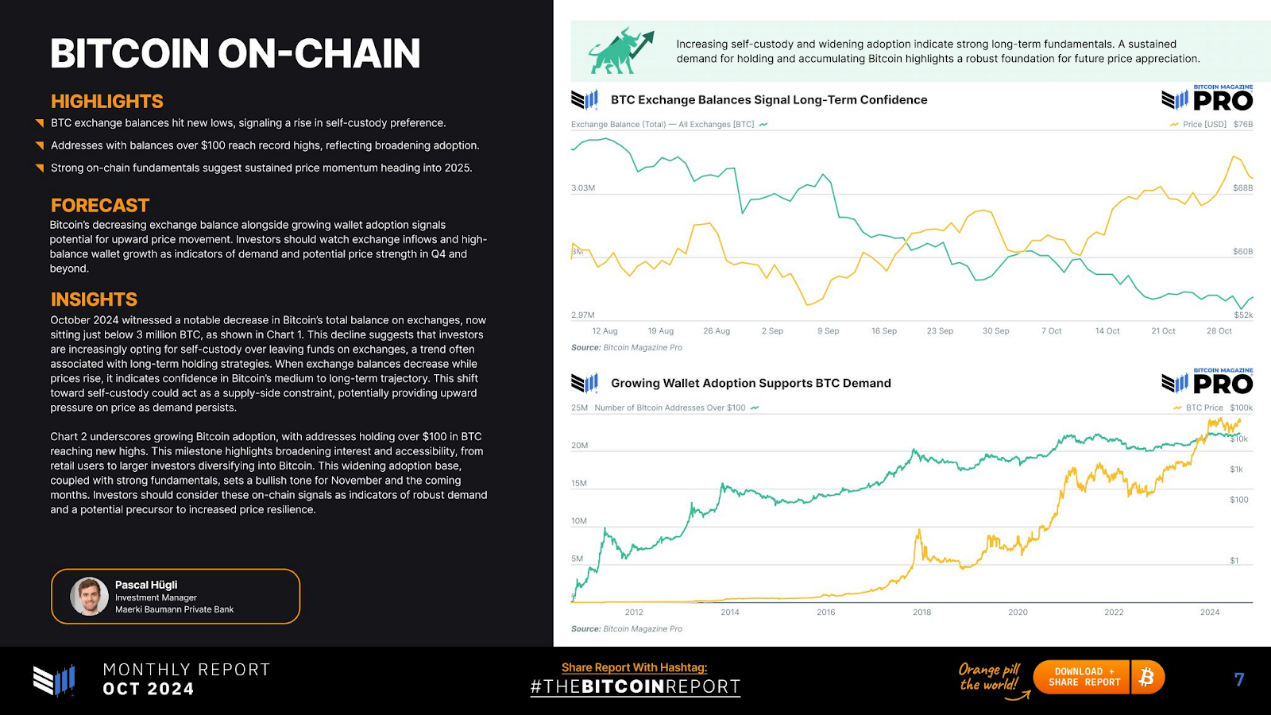

- BTC exchange balances hit a new low, indicating a rise in self-custody preference.

- Addresses holding over 100 BTC reached an all-time high, reflecting an expansion in adoption.

- Strong on-chain fundamentals suggest that price momentum will continue into 2025.

Predictions

The decrease in Bitcoin exchange balances and the continuous growth in wallet adoption signal the potential for price increases. Investors should pay attention to exchange inflows and the growth of high-balance wallets as indicators of demand and potential price strength for Q4 and beyond.

Insights

In October, the total balance of Bitcoin on exchanges significantly decreased, currently slightly below 3 million, as shown in Figure 1. This decline indicates that investors are increasingly choosing self-custody over leaving funds on exchanges, a trend typically associated with long-term holding strategies. When exchange balances decrease while prices rise, it indicates confidence in Bitcoin's medium to long-term trajectory. This shift towards self-custody may become a supply-side constraint, potentially putting upward pressure on prices if demand remains strong.

Mining

Highlights

- Russia and China currently contribute significantly to global Bitcoin hash power.

- The United States remains in the lead in terms of hash power, but Russia holds the second position, while China, despite a mining ban, is quietly increasing its activities.

- Emerging markets like Ethiopia and Argentina are also seeing growth, which may affect hash power distribution.

Predictions

If hash power from China and Russia continues to grow, U.S. miners may face new global competition next year.

Insights

Recently, Russia and China are becoming key players in the global Bitcoin mining sector. Russia is now the second-largest contributor to global hash power, leveraging its abundant natural resources to provide cost-effective energy for miners. This expansion is driven by regional support for mining as a profitable strategic economic activity. Meanwhile, despite an official ban, underground mining in China continues to grow, with increasing activities in recent years. This dual development suggests a shift in mining power that could affect market dynamics, especially as global hash power distribution is no longer dominated by the U.S.

While the U.S. still leads in Bitcoin hash power, the rapid rise of Russia and the resilience of China pose challenges for U.S. miners, with emerging markets like Ethiopia and Argentina ramping up mining activities, creating a more decentralized global mining network. This diversification may enhance the security and operational stability of the Bitcoin network, making it less susceptible to regional disruptions. As these trends continue, U.S. Bitcoin miners may face more intense competition, both in securing energy resources and maintaining profitability under volatile market conditions.

ETFs

Highlights

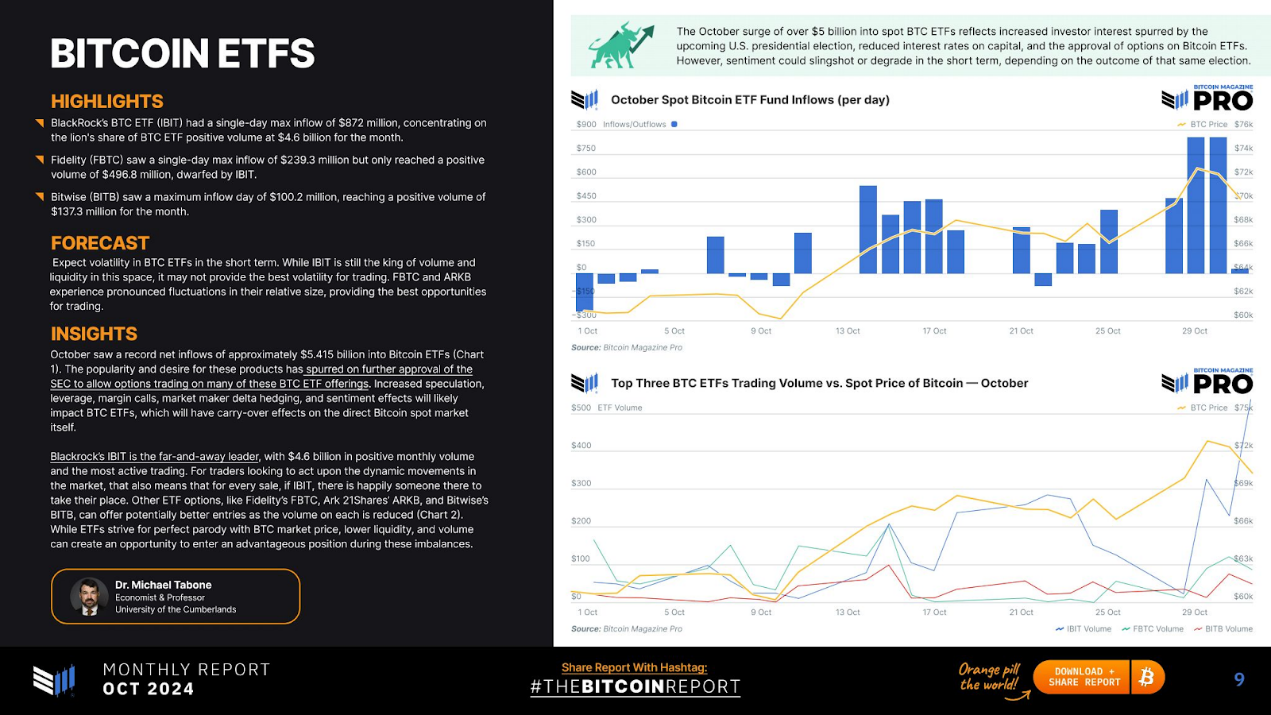

- BlackRock's BTC ETF (IBIT) saw a maximum single-day inflow of $872 million, with a net trading volume of $4.6 billion for the month.

- Fidelity's maximum single-day inflow was $239 million, but its net trading volume was only $496.8 million, which pales in comparison to IBIT.

- Bitwise (BITB) had a maximum single-day inflow of $100.2 million, with a net trading volume of $137.3 million for the month.

Predictions

Short-term volatility is expected for BTC ETFs. While IBIT remains the leader in trading volume and liquidity, it may not provide the best trading volatility. The relative scale of FBTC and ARKB has shown significant fluctuations, providing optimal trading opportunities.

Insights

In October, net inflows into Bitcoin ETFs reached a record approximately $5.415 billion (Figure 1). The popularity and demand for these products prompted the U.S. SEC to further approve options trading on many BTC ETF products. Speculation, leverage, margin calls, market maker delta hedging, and sentiment effects may influence BTC ETFs, which will have a continuing effect on the direct Bitcoin spot market itself.

BlackRock's IBIT is far ahead, with a monthly trading volume of $4.6 billion, making it the most actively traded. For traders looking to act based on market dynamics, this also means that for every trade, if it is IBIT, there will be someone willing to take it on. Other ETF options, such as Fidelity's FBTC, Ark 21Shares' ARKB, and Bitwise's BITB, can provide better entry opportunities as the trading volume for each option has decreased (Figure 2). While ETFs strive to perfectly track BTC market prices, lower liquidity and trading volume can create opportunities to enter favorable positions during these imbalances.

Stocks

Highlights

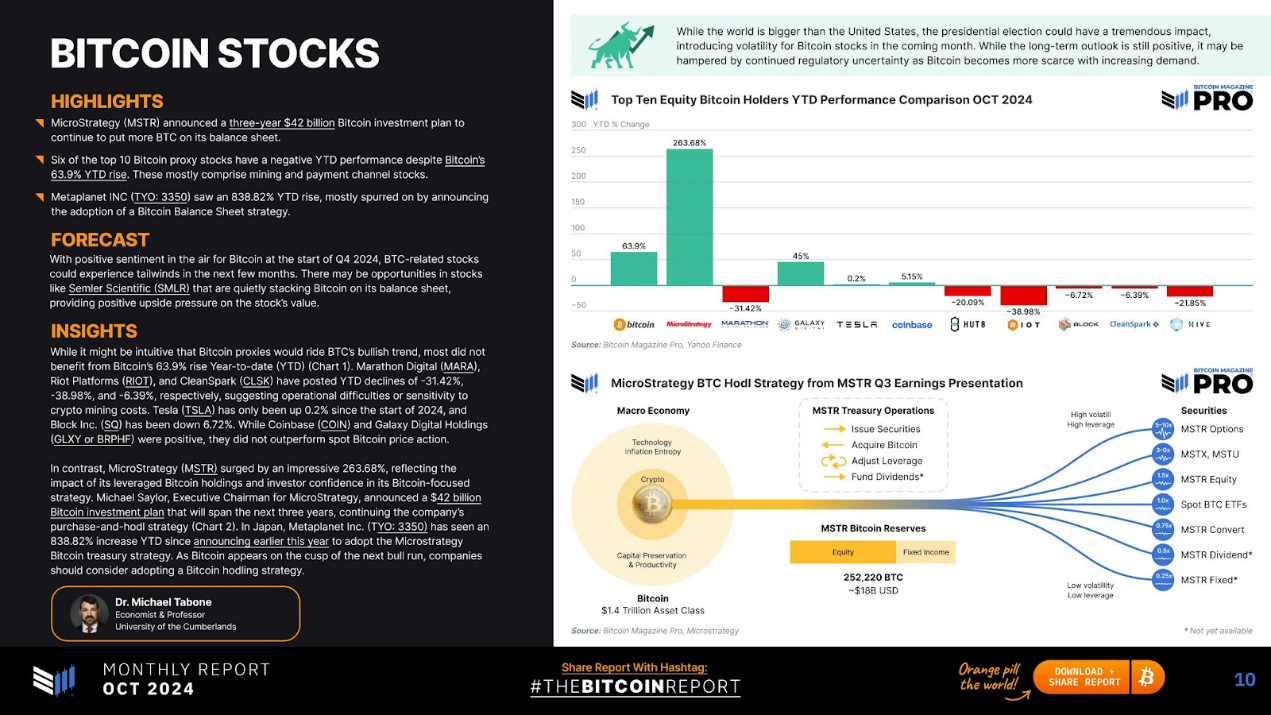

- MicroStrategy (MSTR) announced a three-year, $42 billion Bitcoin investment plan aimed at increasing its BTC holdings on its balance sheet.

- Despite Bitcoin's 63.9% increase year-to-date, six of the top ten Bitcoin-related stocks have underperformed (negative returns).

- Metaplanet INC (TYO: 3350) has surged 838.82% year-to-date, primarily due to its announcement of adopting a Bitcoin balance sheet strategy.

Predictions

Driven by positive sentiment around Bitcoin in early Q4, Bitcoin-related stocks may rise in the coming months. Stocks like Semler Scientific (SMLR) may present opportunities as they quietly incorporate Bitcoin into their balance sheets, providing positive upward momentum for the stock's value.

Insights

While intuitively, Bitcoin-related stocks should follow BTC's bullish trend, most have not benefited from Bitcoin's 63.9% year-to-date increase (Figure 1). Marathon Digital (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) have seen year-to-date declines of -31.42%, -38.98%, and -6.39%, respectively, indicating operational difficulties or sensitivity to crypto mining costs. Tesla (TSLA) has only risen 0.2% since the beginning of 2024, while Block Inc. (SO) has dropped 6.72%. Although Coinbase (COIN) and Galaxy Digital Holdings (GLXY or BRPHE) have performed positively, their performance has not outpaced the spot Bitcoin price movements.

In contrast, MicroStrategy (MSTR) has soared 263.68%, reflecting the impact of its leveraged Bitcoin holdings and investor confidence in its Bitcoin-focused strategy. MicroStrategy's Executive Chairman Michael Saylor announced a three-year, $42 billion Bitcoin investment plan, continuing the company's buy-and-hold strategy (Figure 2). In Japan, Metaplanet Inc. (TYO: 3350) has grown 838.82% year-to-date since announcing its Bitcoin reserve strategy earlier this year. As Bitcoin enters the next bull market, companies should consider adopting a Bitcoin holding strategy.

Derivatives

Highlights

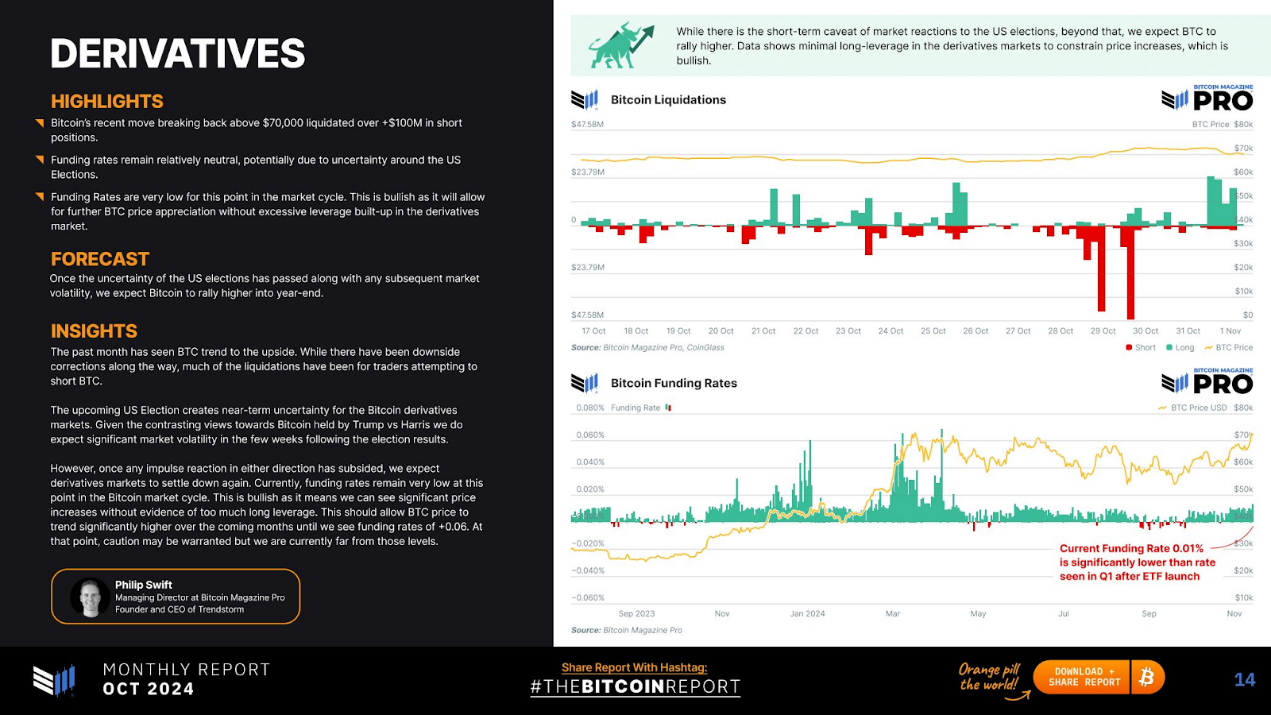

- Bitcoin recently broke through $70,000, with short positions liquidated exceeding $100 million.

- Funding rates remain relatively neutral, possibly due to the uncertainty surrounding the U.S. elections.

- At this stage of the market cycle, funding rates are very low. This is bullish as it will allow BTC prices to rise further without accumulating excessive leverage in the derivatives market.

Predictions

Once the uncertainty surrounding the U.S. elections and the subsequent market volatility pass, Bitcoin is expected to rise before the end of the year.

Insights

Over the past month, BTC has been on an upward trend. Although there have been downward corrections along the way, most liquidations have targeted traders attempting to short BTC.

The U.S. elections have introduced short-term uncertainty into the Bitcoin derivatives market. Significant volatility is expected in the market in the coming weeks.

However, once any directional impulse reactions fade, the derivatives market is expected to stabilize again. Currently, at this stage of the Bitcoin market cycle, funding rates remain very low. This is favorable and should allow Bitcoin prices to rise significantly in the coming months until we see funding rates at +0.06. By then, caution may be necessary, but we are far from those levels at present.

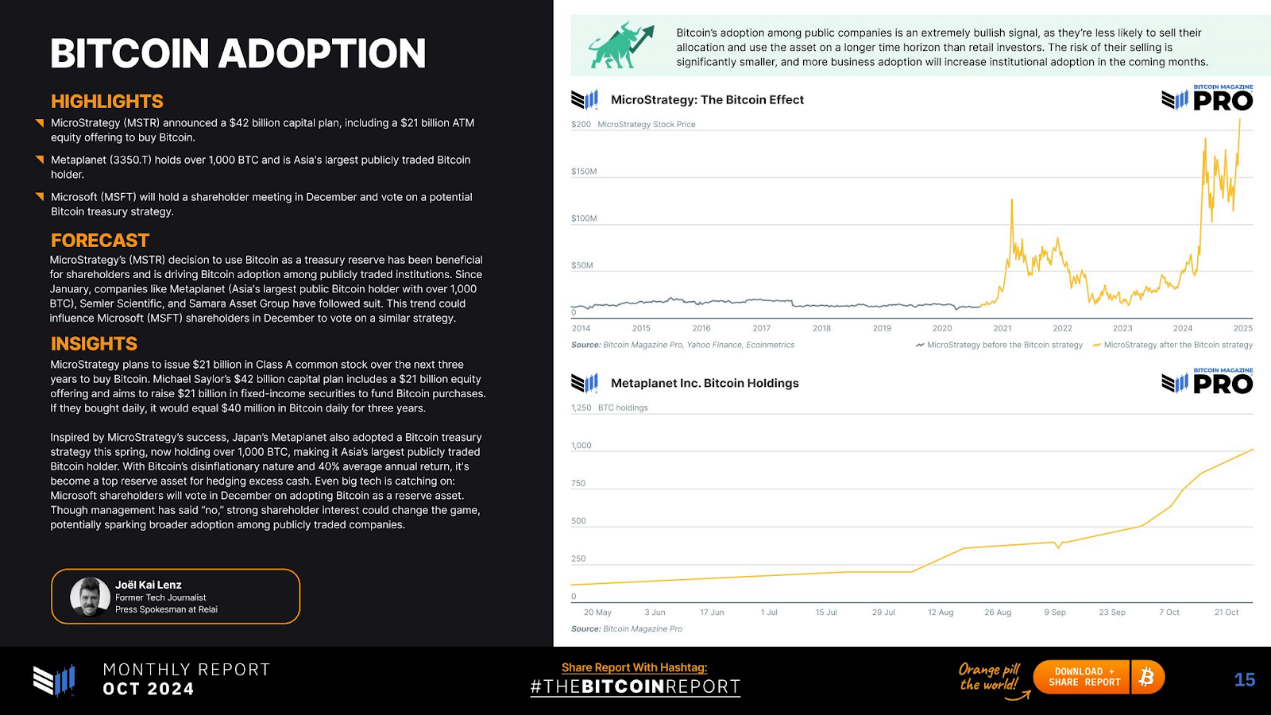

Adoption

Highlights

- MicroStrategy (MSTR) announced a $42 billion capital plan, which includes a $21 billion ATM stock issuance to purchase Bitcoin.

- Metaplanet (3350.T) holds over 1,000 BTC, making it the largest publicly traded Bitcoin holder in Asia.

- Microsoft (MSFT) will hold a shareholder meeting in December to vote on a potential Bitcoin financial strategy.

Predictions

MicroStrategy's (MSTR) decision to use Bitcoin as a financial reserve is beneficial for shareholders and drives the adoption of Bitcoin among publicly traded companies. Since January, companies like Metaplanet (the largest publicly traded Bitcoin holder in Asia with over 1,000 BTC), Semler Scientific, and Samara Asset Group have followed suit. This trend may influence Microsoft (MSFT) shareholders to vote on a similar strategy in December.

Insights

MicroStrategy plans to issue $21 billion of Class A common stock over the next three years to purchase Bitcoin. Michael Saylor's $42 billion capital plan includes a $21 billion stock issuance and aims to raise $21 billion in fixed-income securities to fund Bitcoin purchases.

Inspired by MicroStrategy's success, Japan's Metaplanet adopted a Bitcoin reserve strategy this spring and currently holds over 1,000 BTC, becoming the largest publicly traded Bitcoin holder in Asia. Due to Bitcoin's deflationary nature and an average annual return of 40%, it has become the preferred reserve asset to hedge against excess cash. Even large tech companies are starting to follow suit: Microsoft shareholders will vote in December on whether to adopt Bitcoin as a reserve asset. Despite management's stated "rejection," strong shareholder interest may change the decision, potentially triggering broader adoption of Bitcoin among publicly traded companies.

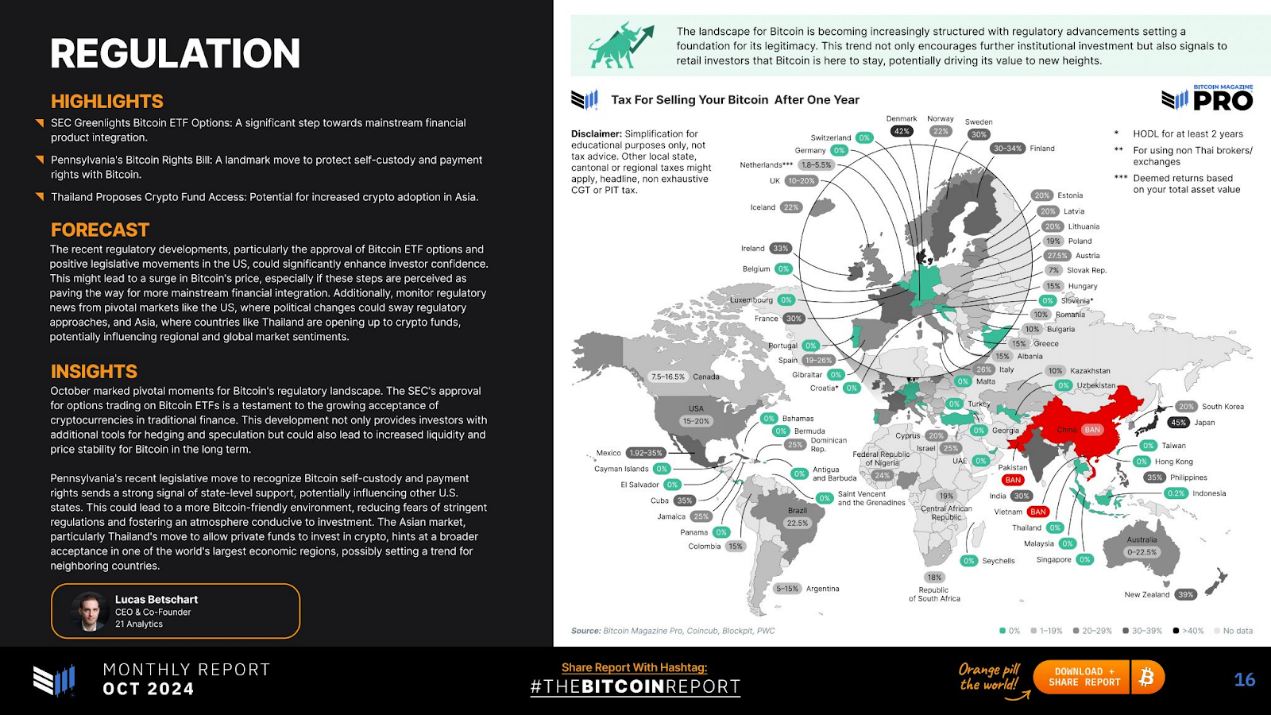

Regulation

Highlights

- SEC approves Bitcoin ETF options: an important step towards the integration of mainstream financial products.

- Pennsylvania's Bitcoin Rights Bill: a milestone in protecting Bitcoin self-custody and payment rights.

- Thailand proposes access to crypto funds: potentially increasing crypto adoption in Asia.

Predictions

Recent regulatory developments, particularly the approval of Bitcoin ETF options and proactive legislative movements in the U.S., may significantly boost investor confidence. This could lead to a surge in Bitcoin prices, especially if these initiatives are seen as paving the way for more mainstream financial integration. Additionally, monitoring regulatory dynamics from key markets like the U.S. is essential, as political changes in the U.S. may affect regulatory approaches, while countries like those in Asia are opening up to crypto funds, which could influence regional and global market sentiment.

Insights

October marked a critical moment in the regulatory landscape for Bitcoin, with the SEC's approval of Bitcoin ETF options trading demonstrating increasing acceptance of cryptocurrencies in traditional finance. This development not only provides investors with additional hedging and speculative tools but may also enhance Bitcoin's liquidity and price stability in the long run.

Pennsylvania's recent legislation recognizing Bitcoin's self-custody and payment rights may influence other U.S. states. This could create a more Bitcoin-friendly environment, reducing concerns about stringent regulations and fostering an investment-friendly atmosphere. In Asia, particularly Thailand's move to allow private funds to invest in cryptocurrencies, suggests widespread acceptance of cryptocurrencies in one of the world's largest economic regions, potentially driving trends in neighboring countries.

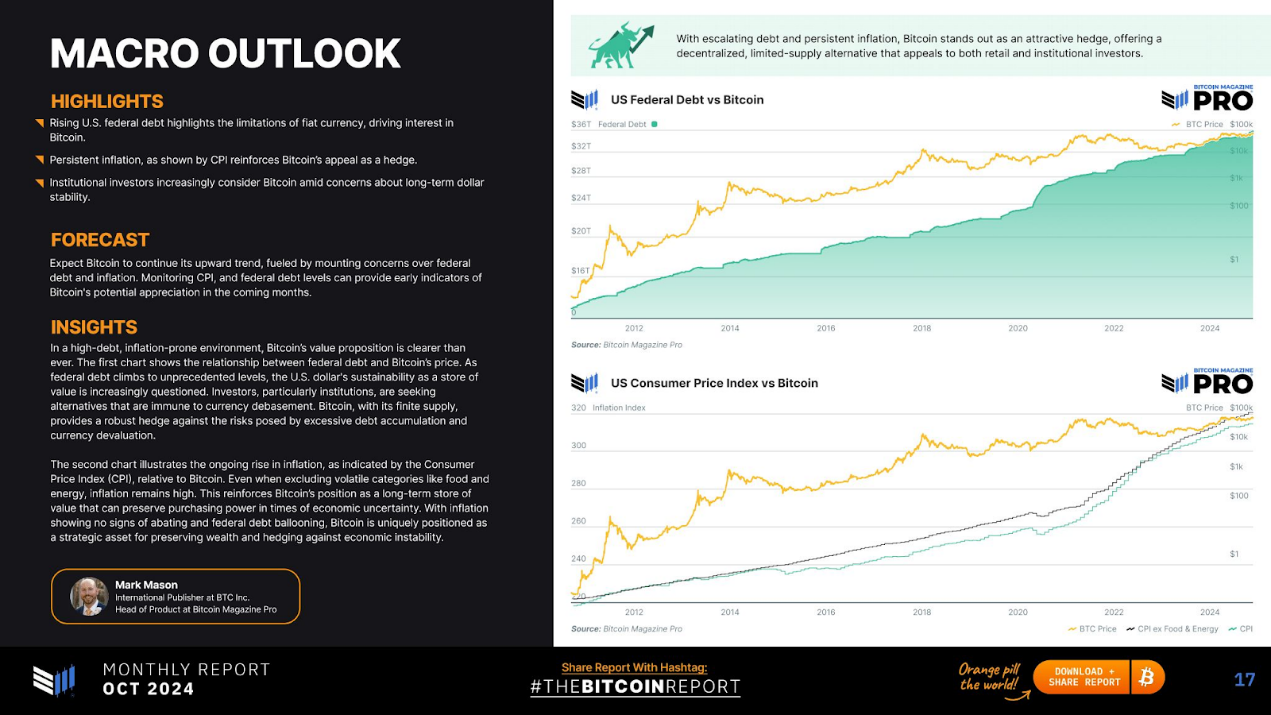

Macroeconomic Outlook

Highlights

- The rising U.S. federal debt highlights the limitations of fiat currency, driving interest in Bitcoin.

- Persistent inflation indicated by CPI enhances Bitcoin's appeal as a hedging tool. Amid concerns about the long-term stability of the dollar, institutional investors are increasingly considering Bitcoin.

Predictions

Bitcoin is expected to continue its upward trend, driven by growing concerns over federal debt and inflation. Monitoring CPI and federal debt levels can provide early indicators for Bitcoin's potential appreciation in the coming months.

Insights

In a market environment characterized by high debt and inflationary tendencies, Bitcoin's value proposition is clearer than ever. The first chart below shows the relationship between federal debt and Bitcoin prices. As federal debt reaches unprecedented levels, the sustainability of the dollar as a store of value is increasingly questioned. Investors, particularly institutional ones, are seeking alternatives that are not affected by currency devaluation. Bitcoin's limited supply effectively hedges against the risks posed by excessive debt accumulation and currency depreciation.

The second chart below shows the rising inflation relative to Bitcoin, even when excluding volatile categories like food and energy, indicating that inflation rates remain high. This solidifies Bitcoin's position as a long-term store of value that can maintain purchasing power during periods of economic uncertainty. With no signs of inflation abating and federal debt continuing to swell, Bitcoin holds a unique position as a strategic asset for preserving value and hedging against economic instability.

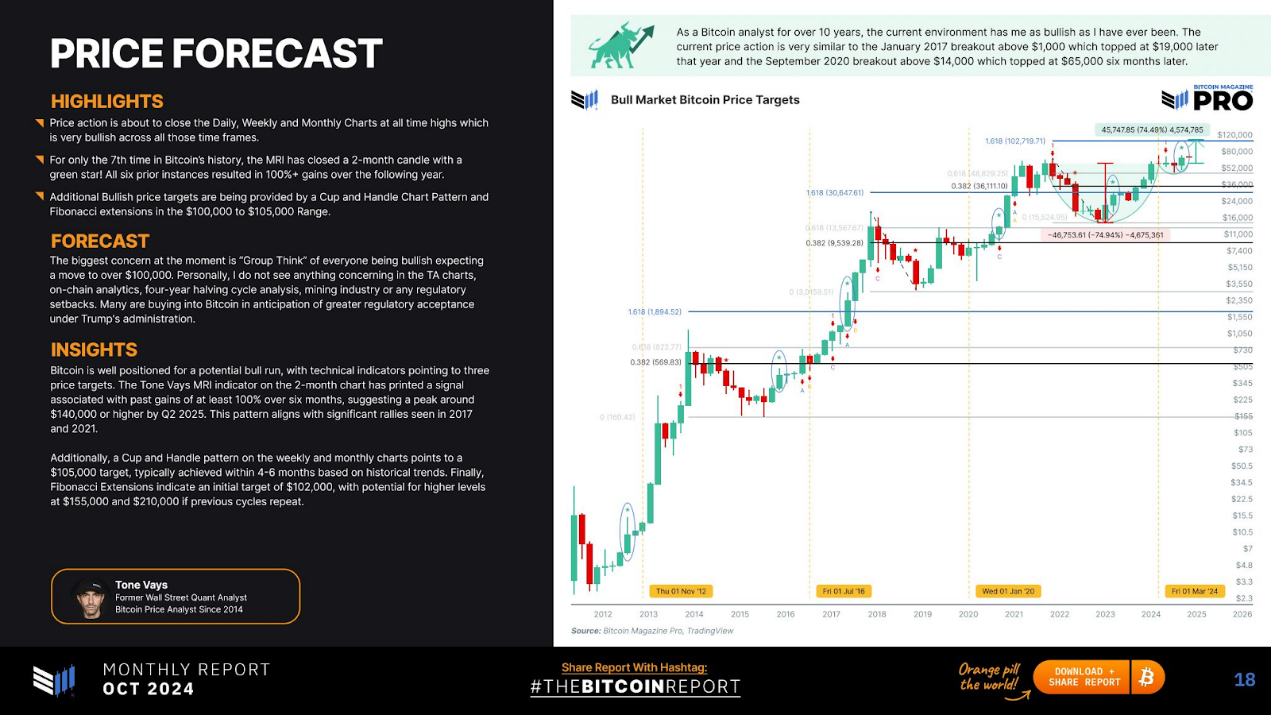

Price Predictions

Highlights

- Price trends are set to close at historical highs on daily, weekly, and monthly charts, which is bullish across all these time frames.

- In Bitcoin's history, the MRL has only closed with a green star on the 2-month histogram for the 7th time. All six previous instances led to gains exceeding 100% in the following year.

- The cup and handle pattern and Fibonacci extension provide additional bullish price targets in the $100,000 to $105,000 range.

Predictions

The biggest concern currently is "herd mentality," with everyone expecting prices to exceed $100,000. Personally, I have not seen anything concerning in the TA charts, on-chain analysis, four-year halving cycle analysis, mining industry, or any regulatory setbacks. Many are buying Bitcoin in anticipation of greater regulatory recognition under a Trump administration.

Insights

Bitcoin is poised for a potential bull market, with technical indicators pointing to three price targets. The Tone Vays MRL indicator on the 2-month chart shows that the past six months have seen gains of at least 100%, suggesting a peak of around $140,000 or higher by Q2 2025. This pattern aligns with significant rebounds in 2017 and 2021.

Additionally, the cup and handle formations on the weekly and monthly charts point to a target of $105,000, which historically tends to be achieved within 4-6 months. Finally, Fibonacci extensions indicate an initial target of $102,000, with the potential to reach higher levels of $155,000 and $210,000 if previous cycles repeat.

Related Articles: Trump 2.0: Are We Entering a "Golden Age" for Crypto?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。