The asset management scale of liquid cryptocurrencies will surpass that of cryptocurrency venture capital.

Author: rennick

Translation: Deep Tide TechFlow

The performance of crypto venture capital has significantly lagged behind Bitcoin. Is crypto venture capital facing a crisis? We analyzed data since 2015 to find answers.

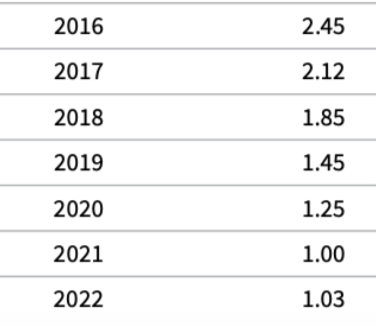

In short, the entire industry is in a state of loss. From 2015 to 2022, the $49 billion invested in token projects generated less than $40 billion in value, resulting in a return of -19% (before fees and expenses).

Meanwhile, Bitcoin is on the verge of breaking its historical high, having increased 2.3 times since its peak in November 2021 based on the 200-day moving average (see the golden line). How did we arrive at these conclusions?

We analyzed all venture capital rounds up to January 1, 2023. Of the total $88 billion invested in crypto venture capital, $70 billion (80%) was invested before this date. Why?

Because any more recent investments are not suitable for inclusion in the analysis, as they have had too short a time to realize value.

Typically, it takes 3 years from the seed round to the token generation event (TGE), while later-stage investments take less than a year. Therefore, excluding data from within two years seems reasonable. Of course, there are exceptions, but they are not enough to change the overall analysis. Thus, from 2015 to 2022, about $70 billion was invested, of which we assume 70% was invested in token projects. This is an empirically based estimate.

Clearly, not all crypto venture capital flowed into token projects. However, aside from the recent acquisition of Bridge and Coinbase's IPO, there have been almost no other liquidity events in the market, making it difficult to accurately value these investments at present.

From 2015 to 2022, venture capital invested $49 billion in token projects.

The fully diluted valuation (FDV) of these venture-backed projects reached $439 billion.

Notably, $100 billion of that value comes from SOL.

It is evident that the returns from venture capital are primarily driven by a few exceptional projects, but aside from these specific funds, the entire industry has not widely participated in this value creation.

Therefore, we can consider the remaining value to be $339 billion.

So, what share does the entire venture capital industry hold in these projects?

Assuming that venture capitalists collectively hold 15% of these token FDVs.

Each round of venture capital typically purchases about 7% of the network, and there are usually 2 rounds of investment before the token generation event (TGE) (sometimes fewer).

Thus, a 15% holding ratio seems reasonable.

Based on the current market value, the venture capital industry theoretically holds tokens worth $66 billion.

If we exclude SOL, this value is $51 billion.

Therefore, the overall investment of the entire industry before 2022 (before fees and expenses) grew by 34%, including SOL.

If SOL is excluded, it is essentially flat.

We know there is a significant difference between liquid value (i.e., circulating market value) and fully diluted valuation (FDV).

This data is based on the assumption that the FDV of locked tokens can be sold at current prices.

If we consider a standard discount for market illiquidity (DLOM) of 40% (which can vary significantly in the cryptocurrency space), then the project value including SOL is about $40 billion, and excluding SOL is about $30 billion.

Adding fees and expenses would further reduce this figure.

At current prices, the entire industry is actually at a loss.

However, as the saying goes, a 6-foot tall person can still drown in a river with an average depth of 5 feet.

These are all rough averages used to get a general understanding of the industry's overall condition.

There are indeed some extreme success cases.

If you invested in the seed round of SOL or made a sufficiently large investment in a small fund in a project with a market cap over $1 billion, your performance would exceed that of Bitcoin and the average of the entire industry.

It is worth noting that the value of most altcoins comes from projects launched in the early part of the previous cycle or even earlier.

Recent projects are still developing, so there may still be room for growth in the future.

Of the $70 billion invested from 2015 to 2022, most was invested in the latter half of this period.

These projects are often investments made by larger venture capital firms at higher valuations.

Therefore, it remains uncertain whether the success of recent projects can yield strong investment returns.

One last point—how does this compare to the returns of Web 2 venture capital in the same years?

According to the TVPI (Total Value to Paid-In Capital Ratio) reported by managers, the total returns after fees and expenses appear roughly comparable.

So, how should I view all of this?

When comparing venture capital to liquid assets, the vast majority of funds underperform Bitcoin, especially since the low point.

Even when calculated on a moving average basis, the performance remains poor.

This is actually similar to the experience of traditional venture capital compared to the Nasdaq.

Thomas Laffont of Coatue gave an excellent report on this at the All In Summit:

Why is this the case, and why are there similarities between Web2 and cryptocurrency?

Venture capital is indeed not easy! Low hit rates, poor liquidity, high fees.

But other factors are at play—economies of scale and network effects.

The "Magnificent Seven" tech stocks driving Nasdaq returns all benefit from network effects.

So do Bitcoin, Ethereum, and SOL.

This means that as these large platforms/networks expand, their returns are actually increasing.

At the same time, as the user base grows, the value of the products is also increasing.

This makes it difficult for small startups to compete, at least from an investment return perspective, on average.

Will this situation change?

The cryptocurrency venture capital industry may need to adjust in terms of total fundraising and fund sizes (or TOTAL3 needs to grow threefold quickly).

The growth rate of the Mag7 may not continue indefinitely—they can only capture a limited share of global GDP.

Interestingly, the growth rates of BTC, ETH, and SOL may slow down less than that of the Mag7.

It can be argued that currency is the most network-effect-driven "technology."

BTC clearly fits this. The value of ETH and SOL lies in people's hope that they can also become some form of internet currency.

In other words, the adoption curve of cryptocurrencies today is similar to that of the Mag7 in the early 2010s (or even earlier), so there is still a large market to be developed.

Currently, the scale of funds in cryptocurrency venture capital is 20 times that of mature institutional liquid crypto funds (over $88 billion compared to about $4 billion).

Therefore, if things develop as I expect, the asset management scale of liquid cryptocurrencies will surpass that of cryptocurrency venture capital.

After all, this also aligns with trends in other parts of the world.

Disclaimer:

Several individuals have contacted us to point out that some data seems to be missing. We used existing data cited in the report and did not make any changes or interpretations to the data. Our aim is to provide facts and offer some food for thought for the industry.

If you believe there is missing or inaccurate data, please feel free to contact us. We may update in the future and hope to improve in the process.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。