Republican Donald Trump's historic reelection as U.S. president brought to a close Polymarket's contract asking users to predict the outcome of the 2024 election, which saw more than $3.6 billion in volume flow through its virtual pipes.

The contract was resolved just before 11 a.m. ET, when the Associated Press and NBC called the election for Trump. Fox News was the first major network to project Trump as the winner, a little after 1:45 a.m. ET, after he won the swing states of North Carolina, Wisconsin, Pennsylvania, and Georgia.

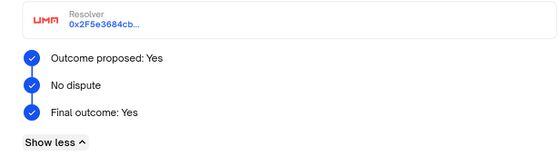

The gap between the time when the market conditions were met and when the contract was resolved was because a resolution had to be proposed on UMA, Polymarket's current oracle and resolution source. UMA's dispute resolution system allows anyone to challenge a proposed market outcome by posting a bond during a 2-hour challenge period. If disputed, UMA token holders vote to determine the final resolution.

On-chain data shows that a French financial services professional, who is offering only the name Theo as a means of identification, was the largest winner of the evening with a profit of over $47.5 million across the Presidential election contract, the popular vote contract, and various swing state markets.

This French whale's method of registering multiple accounts on the site, all with pro-Trump positions, was a brief source of controversy as critics of prediction markets believed it was a form of dark money trying to influence mindshare.

In an interview with the Wall Street Journal in early November, Theo sought to debunk such claims by saying they were engaging in "high-conviction" trades by putting the majority of their available liquid assets on the line. The reluctance to go public, they explained to the Journal, was to keep it secret from friends and family.

Aside from Theo's multiple accounts, Polymarket bettor 'zxgngl,' who joined the platform just last month, won the second most out of any user on the platform, with an $11.4 million gain.

While the success of Polymarket's presidential election contract is credited with raising mainstream awareness of prediction markets in general, and many see it as a more accurate form of forecasting rather than traditional polling, Rajiv Sethi, Professor of Economics at Columbia's Barnard College, and author of the blog Imperfect Information, calls for caution.

"The question of whether prediction markets are more accurate on average than statistical models can only be answered with data, it cannot be answered by logic alone," he wrote in an email to CoinDesk. "We need to look at individual state outcomes, the popular vote, congressional races, and all other events for which models and markets were simultaneously generating forecasts. And we also need to compare markets with each other to discover what designs work best."

Sethi suggests that factors like transaction observability, KYC requirements, participation restrictions, and position limits impact prediction markets, and that analyzing these effects will require careful, ongoing data study.

On-chain data via Dune shows that, as of early November, 73.8% of Polymarket's volume had come from election-related betting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。