Bitcoin (BTC) surged to an all-time high above $75,000 as Republican Donald Trump looked set to clinch the U.S. presidency. It was recently trading around $74,000 on major crypto exchanges.

The election result was the news bitcoin needed to break through March's record, and the U.S. market's opening could propel the largest token by market cap to even greater heights.

Crypto was one of the biggest winning industries on the Trump triumph, with total market capitalization hitting $2.45 trillion, the highest since June, according to the TradingView metric TOTAL.

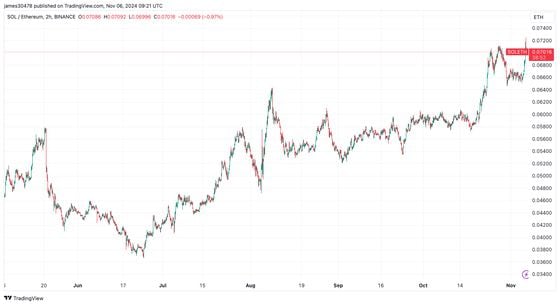

The widely watched ratio tracking the relative price strength of ether (ETH) against bitcoin dropped to its lowest level since April 2021, suggesting a fallout in investor demand for the world’s second-largest token.

The ether-bitcoin trading pair fell under 0.035 early Wednesday, extending year-to-date losses to more than 34%. Although colloquially called a ratio, ETH/BTC is simply the trading pair of ether against bitcoin on crypto exchanges, which attracts hundreds of millions in daily volumes.

An increase indicates that ether is outperforming bitcoin and vice versa. When the price rises, traders consider a preference for ETH beneficial for riskier assets and Ethereum ecosystem bets. A slide indicates a preference for Bitcoin and blockchains other than Ethereum.

Over the past five years, the ratio has risen from 0.02 to a peak of above 0.08 in early 2022, meaning ETH quadrupled in value relative to BTC at the time. Since then, it's been on decline. Even as BTC set a lifetime high, ether has yet to break through its high from 2021 and is down 46% from its peak.

Year-to-date, bitcoin has returned over 75% to investors, while ether holders have gained just over 14%, according to MarketWatch data.

In addition, bitcoin's market cap approached $1.5 trillion at the high and continues to widen and outperform ether. The spread between bitcoin and ether's market cap hit a new high of $1.16 trillion, which coincided with the ETH/BTC ratio continuing to make new lows.

Solana (SOL) also flexed its muscles against ether. The token is up 10% in the past 24 hours, and also made new cycle highs against ether at 0.072. The Solana market cap dominance approached 3.70%, though it has yet to break into new all-time highs.

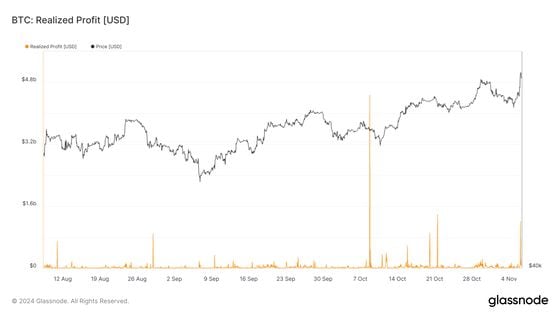

Bitcoin has been climbing higher throughout September, October and into November. CoinDesk research has observed a lot of profit-taking over the past month. As bitcoin made new all-time highs, CoinDesk observed a notable amount of profit-taking, $1.5 billion worth, which coincided with bitcoin's slight pullback from all-time highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。