By providing seamless, permissionless data flows across chains, Pyth enhances the interoperability of DeFi applications.

Author: Bradley Peak

Compiled by: Deep Tide TechFlow

1. What is Pyth?

Pyth Network is a decentralized oracle, simply put, it is a service that connects blockchain with real-world data. It can bring real-time financial indicators such as stock, cryptocurrency, and commodity prices onto the blockchain.

Pyth was launched on Solana in 2021, with the mission of providing high-quality data for blockchain applications, especially in decentralized finance (DeFi). In these applications, accurate data input is crucial for asset pricing and preventing erroneous pricing trades.

Unlike some oracles that obtain data through multiple intermediaries, Pyth sources data directly from top financial institutions (such as exchanges and trading firms), which not only speeds up data transmission but also enhances its reliability.

2. How Pyth Network Innovates Real-Time Data Feeds

Pyth Network innovates the way blockchain systems access real-time market data by directly connecting to high-quality data sources, such as trading firms, major financial institutions, and exchanges.

Pyth does not rely on intermediaries but instead obtains asset prices directly from first-party providers, which include companies from both traditional finance and the crypto market. This allows decentralized applications (DApps) to access accurate and low-latency pricing information, which is essential for tools such as lending platforms, trading protocols, and asset tokenization systems.

What sets Pyth apart is its strong commitment to reliability and accuracy. Unlike many oracles, Pyth employs a unique data aggregation method that collects data points from multiple providers and generates a single, reliable price feed that can withstand market fluctuations or data manipulation. This is particularly important in decentralized finance (DeFi), as any delay or inaccuracy in price data can lead to issues such as liquidation errors or arbitrage opportunities from market damage.

Did you know? Pyth Network publishes data on its proprietary blockchain Pythnet, enhancing transparency and security in the blockchain oracle space.

3. How Pyth Network Ensures the Accuracy of Crypto Data

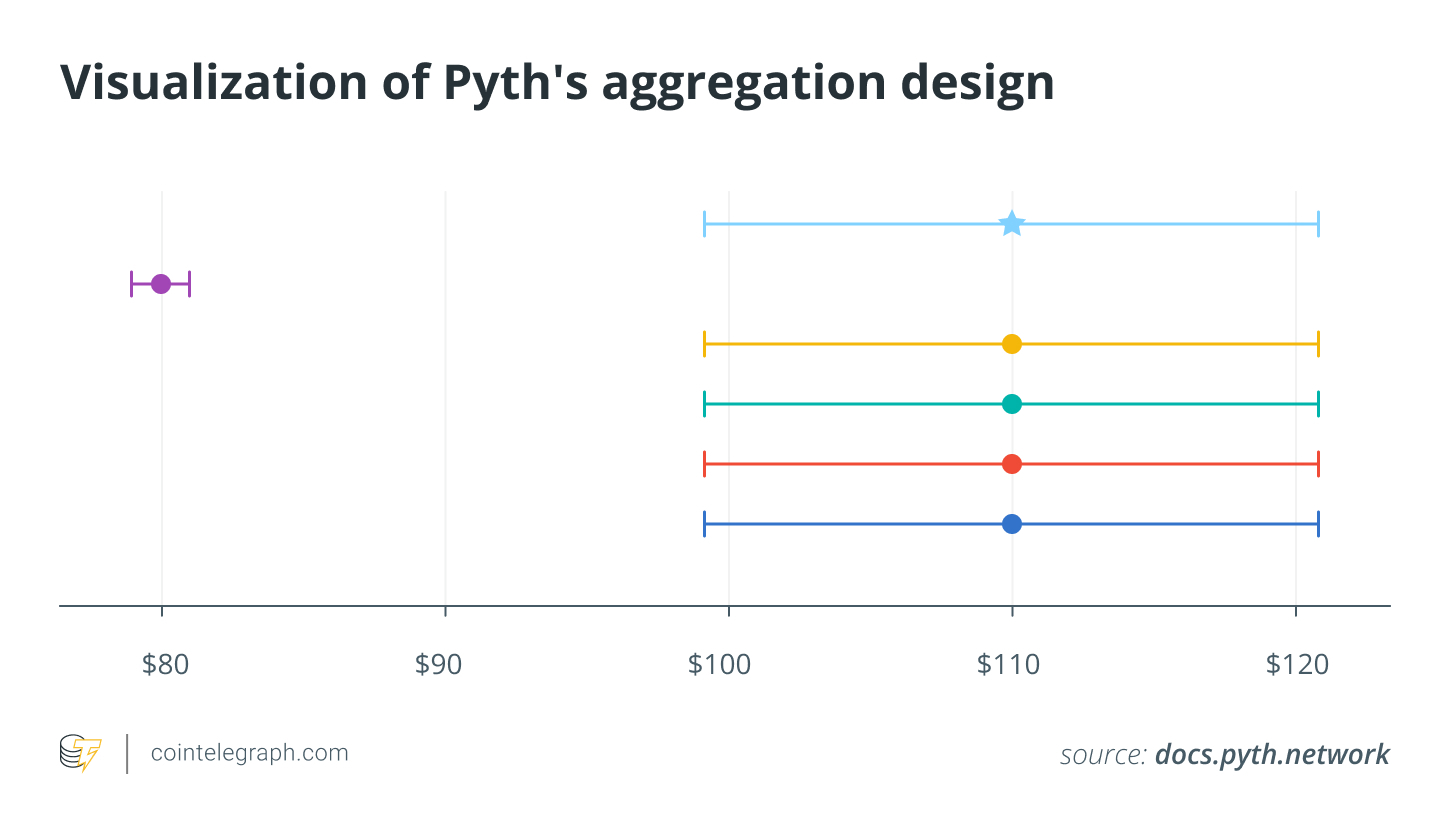

The accuracy of Pyth Network is attributed to its robust validation processes and aggregation model, which rely on its extensive network of data publishers.

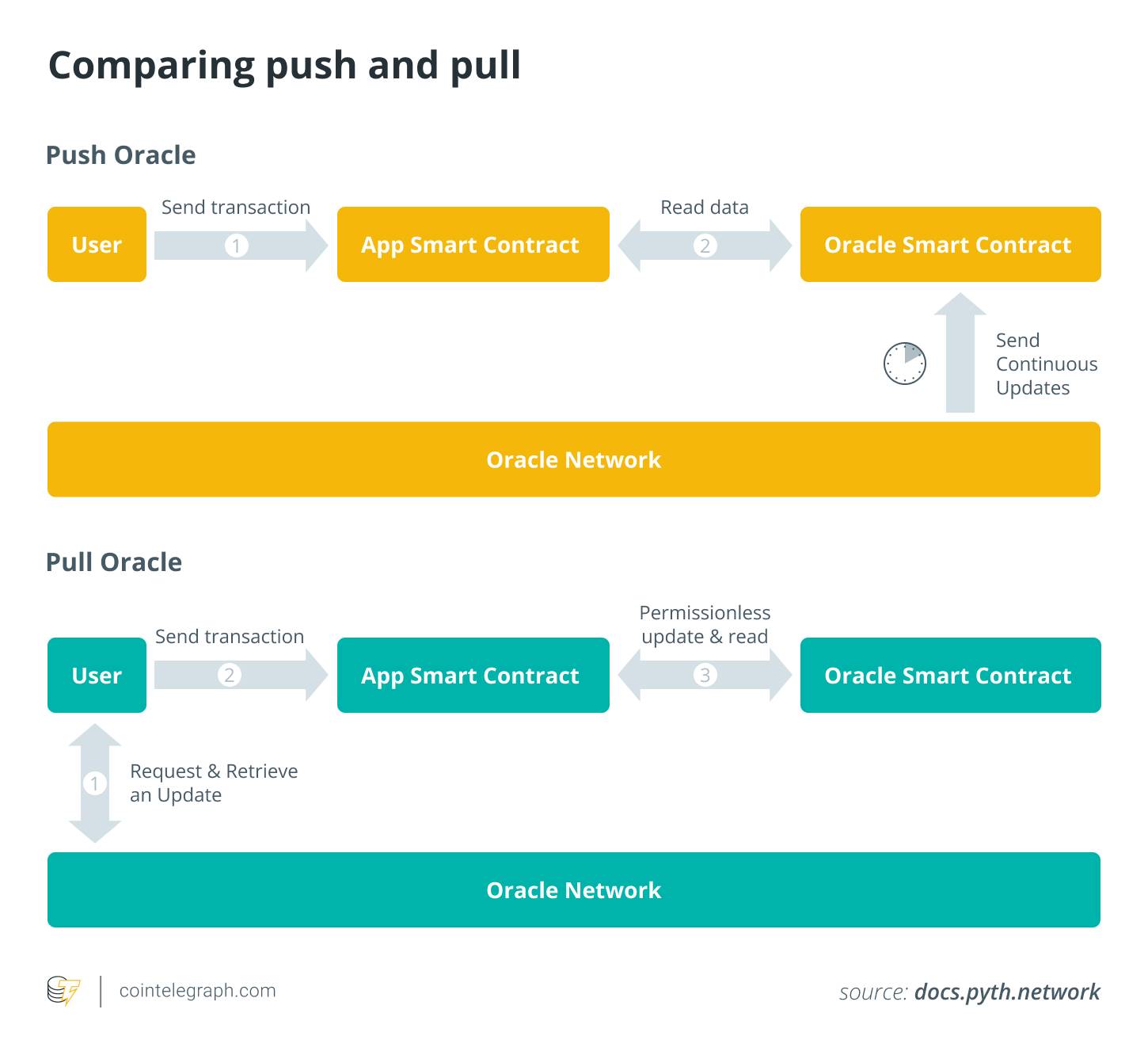

Each data provider, including trading platforms and financial institutions, submits asset prices to Pyth along with a confidence interval indicating the accuracy of the prices they provide. Pyth's protocol integrates these multiple data points into a single price feed for each asset, updating every 400 milliseconds. Through its "pull oracle" design, Pyth reduces blockchain congestion and lowers costs by updating data only when requested by users, rather than continuously pushing data.

To ensure data integrity, Pyth employs a weighted aggregation method that filters out extreme outliers and assigns higher weights to more reliable data sources. This approach significantly reduces the risk of data being tampered with or manipulated. Ultimately, it forms a secure and accurate system where asset prices are cross-verified among multiple independent sources, ensuring that DeFi applications can rely on the precision and stability of this data.

Did you know? The first blockchain oracle, Reality Keys, was developed to overcome the inherent limitations of smart contracts. While blockchain systems are self-contained and highly secure, they cannot directly access external information such as market prices, weather conditions, or event outcomes—data that is crucial for many real-world applications.

4. Key Use Cases of Pyth Network

The real-time data streams from Pyth Network significantly enhance the functionality of DeFi applications, including decentralized exchanges (DEXs), lending platforms, stablecoins, derivatives, and yield optimization.

By providing accurate and decentralized pricing, Pyth supports flexible trading, efficient liquidation, stablecoin value anchoring, risk management derivatives, and optimized yields, thereby ensuring the stability and transparency of the DeFi ecosystem. Let’s take a closer look at some specific applications:

Decentralized Exchanges (DEXs): Pyth's real-time data streams support decentralized exchanges, allowing assets traded across multiple chains to receive accurate price updates. For example, in the Drift Protocol on Solana, Pyth's low-latency data helps maintain efficient price discovery and risk management. Drift utilizes Pyth's rapid update capabilities to facilitate trading of perpetual futures and other derivatives, enabling traders to effectively respond to market fluctuations while maintaining transparency and security in trading.

Lending Platforms: For DeFi lending protocols, accurate asset pricing is crucial for ensuring the accuracy of loan-to-value (LTV) ratios and enabling automatic liquidations. By providing real-time data to lending platforms, Pyth supports collateral valuation and liquidation processes, protecting lenders' interests and maintaining platform stability. On ZKsync, the ReactorFusion protocol efficiently manages loan values using Pyth's pricing mechanism, while on Solana, Solend relies on Pyth to monitor collateral risk and trigger automatic liquidations, minimizing losses during market fluctuations.

Stablecoins: Stablecoin platforms heavily rely on Pyth to anchor their value to currencies like the US dollar, euro, and commodities. By integrating with Pyth, stablecoins like Tether's USDt USDT can maintain their value through frequent and accurate price data, which is crucial for stablecoin reserves and preventing users from facing de-pegging risks. This stable connection to fiat or crypto collateral assets ensures smooth and trustworthy DeFi transactions during market volatility.

Derivatives and Structured Products: In the derivatives market, Pyth enables platforms to develop complex financial instruments such as perpetuals, options, and structured product libraries. For instance, Kwenta and other Synthetix projects utilize Pyth's data streams to provide exposure to digital assets and real-world markets, ensuring positions are well-hedged and reducing the risk of liquidation mismatches. Pyth's high-frequency data also supports unique options products, such as leveraged positions, further driving DeFi trading options with decentralized price integrity.

Yield Optimization and Other DeFi Applications: Yield farming and liquidity protocols leverage Pyth's price data to optimize reward mechanisms and manage risks when staking or providing liquidity. Yield farming tracks asset performance through real-time data to maximize their returns. Additionally, cross-chain ecosystem applications like Mantle's Lendle integrate Pyth to support dynamic yield assets and liquidity pools, driving innovation and user engagement in DeFi.

Did you know? The largest project using Pyth Network on the Optimism blockchain is Synthetix, which heavily relies on Pyth's low-latency price data to support its Synthetix Perpetuals (Perps) v2. This integration has enabled Synthetix to create 40 new perpetual markets, processing nearly $15 billion in trading volume and generating substantial staking rewards for users.

5. Timeline: The Development History of Pyth Network

Over the years, Pyth Network has been dedicated to its mission of decentralized financial data, continuously enhancing its infrastructure and driving the evolution of DeFi through precise high-frequency market data streams.

2021: Launch on Solana and First Price Data Release

In April 2021, Pyth Network announced its establishment, initially supported by Jump Crypto. Pyth officially launched in August on Solana's high-performance blockchain, providing high-speed, low-latency price data for over 30 cryptocurrency assets.

By the end of the year, Pyth had sourced data from approximately 40 major financial institutions, including exchanges and market makers, supporting its goal of providing reliable real-time data for DeFi applications.

2022: Expansion through Pythnet and Cross-Chain Capabilities

In 2022, Pyth Network achieved significant expansion by launching its proof-of-authority blockchain, Pythnet, which is forked from Solana. Pythnet offers faster data aggregation and more frequent updates.

In August of the same year, Pyth integrated with the Wormhole bridge, expanding to other blockchains and enabling support for price data from Ethereum, BNB Smart Chain, and others. This year marked Pyth's cross-chain expansion, aimed at providing high-frequency data for a broader DeFi ecosystem.

2023: Governance Mechanism Launch and PYTH Token Airdrop

In November 2023, Pyth launched its governance token PYTH. To incentivize community participation, Pyth implemented an airdrop, distributing PYTH tokens to early users and active DeFi participants, allowing holders to vote on protocol changes and developments.

This release is an important step for Pyth in achieving governance decentralization, enabling the community to participate in decisions regarding fee structures, network updates, and ecosystem development.

2024: Multi-Chain Development and Institutional Growth

Pyth continues its expansion in the multi-chain space, strengthening collaborations with DeFi platforms such as Drift Protocol and ReactorFusion, and integrating price data.

By mid-2024, Pyth reported that its total value had exceeded $5 billion, claiming nearly 10% of the oracle market share, highlighting its increasingly important role as a trusted source of real-time data for DeFi across various blockchain networks.

6. Pyth Network vs. Chainlink: What’s the Difference?

Choosing between Pyth and Chainlink depends on project needs: Pyth is suitable for high-speed financial data focused on DeFi, while Chainlink is better for a wide range of use cases requiring data diversity and strong ecosystem support.

When it comes to oracles, you may be familiar with Chainlink, which is currently the most widely used decentralized oracle, supporting over 1,600 projects. So why is Pyth still needed?

First, there are significant differences in data sources between Pyth Network and Chainlink. Pyth sources data directly from financial institutions, exchanges, and trading firms, ensuring that information comes from organizations like Jane Street and Binance, guaranteeing high-quality first-party data. This first-party data approach contrasts with Chainlink, which typically obtains data through independent node operators that often source information from data aggregators like CoinMarketCap and BraveNewCoin.

This reliance on intermediaries makes Chainlink's data sources more diverse, but it may not match the stability of Pyth's direct data for high-frequency financial data. Additionally, there are some other key differences; let’s take a closer look.

Cost-Effectiveness and Data Update Models

Pyth employs an efficient pull model, allowing users to request data updates as needed, significantly reducing transaction costs. As a result, Pyth's data updates are nearly instantaneous, with a latency of about 300-400 milliseconds, making it particularly suitable for latency-sensitive DeFi applications.

In contrast, Chainlink typically uses a push model, updating prices periodically based on specific conditions (such as price fluctuations or time intervals), which can be more costly and slower. For example, Chainlink updates data every few seconds or minutes based on preset conditions, suitable for applications that prioritize reliability over speed.

Target Audience and Use Cases

Pyth focuses on the DeFi space and financial data applications, such as decentralized exchanges, lending, and derivatives platforms. Its data streams are optimized for real-time financial trading, where precise and high-frequency data is crucial.

On the other hand, Chainlink supports a broader range of use cases, including non-financial sectors such as insurance, gaming, and supply chains, which require diverse types of external data.

Transparency and Governance

Both have governance mechanisms, but Pyth embodies the spirit of Web3 more strongly.

Pyth is managed by a Decentralized Autonomous Organization (DAO), directly incorporating community input into decisions regarding protocol changes and updates, ensuring transparency.

Chainlink also has community involvement, but due to its multi-signature contract system, there are still concerns about centralization, as this system grants significant control over data streams to a few individuals.

Pyth's comprehensive on-chain transparency further enhances user trust in the authenticity of its data, while Chainlink's data remains off-chain, requiring users to verify its sources independently.

7. The Future Development of Pyth

Pyth Network's development roadmap indicates a strong focus on expanding cross-chain compatibility, planning to support over 50 blockchains, including Near and Arbitrum, to further enhance its influence in the DeFi space.

By providing seamless, permissionless data flows across chains, Pyth enhances the interoperability of DeFi applications.

Future plans also include expanding asset coverage, not limited to cryptocurrencies but also encompassing commodities, stocks, and foreign exchange, making it a versatile oracle in both digital and traditional finance.

Technical improvements are also underway, aiming to reduce latency by 20% and increase the number of data providers for each data stream to enhance the reliability of data for high-frequency trading and derivatives platforms.

Additionally, Pyth's community-driven DAO model will allow stakeholders to guide its strategic direction on key issues such as fees and data integrity.

These initiatives position Pyth as a foundational oracle for secure, real-time data solutions in the DeFi and Web3 spaces, continuously evolving alongside the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。