The three major U.S. stock indices rose over 1%; Tesla closed up 3.5%, Nvidia rose nearly 3%, surpassing Apple in market value; Trump Media rose nearly 19% in early trading but fell over 4% in the afternoon; Palantir, a high-performing stock, closed up 23%; AMD fell nearly 20% after hours; Chinese new energy vehicle stocks surged, with Xpeng Motors rising over 6%. U.S. Treasury yields rose and then fell back. The U.S. dollar index hit a nearly three-week low, and the offshore yuan rose over 100 points to break 7.11 during trading. Bitcoin rose nearly $4,000 to break the $70,000 mark, then fell back nearly $2,000. Crude oil rose for five consecutive days. Gold hit a one-week low before turning up.

Written by: Fang Jiayao, Li Dan, Du Yu, Bu Shuqing, Li Xiaoyin

Source: Wall Street Journal

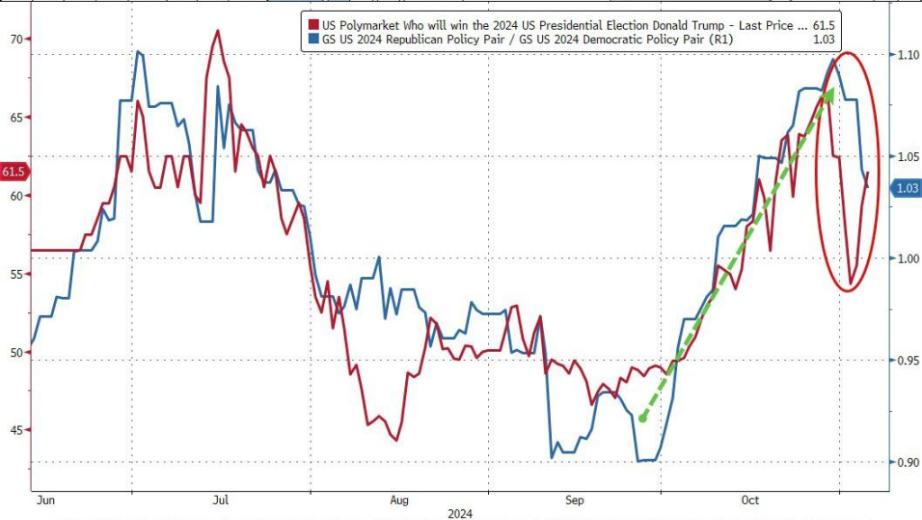

The 60th U.S. presidential election voting has officially begun, with the winner set to take office in January 2025 for a four-year term. Risk appetite increased on U.S. election day, with European and American stock markets rising, and all major U.S. stock indices gaining over 1%, with the Chinese concept index outperforming the U.S. market. Trump Media Technology rose over 18.6% during the day but closed down 1.16%. Investors closed their bullish positions on the dollar, causing the dollar to fall to a three-week low. The weakening dollar, combined with the impact of hurricanes in the Gulf of Mexico, led to a slight increase in oil prices.

The UK bond auction was disappointing, while the U.S. October ISM services index rose more than expected. U.S. Treasury yields continued to rise during the day, reaching a daily high, but in the U.S. stock market, the strong auction of 10-year U.S. Treasuries and profit-taking from Trump trades caused Treasury yields to fall back at the end of the day. Due to the uncertainty of the election, there was a flight to safety, leading to a slight increase in gold prices.

According to the latest report from CCTV News, on November 5 local time, the small town of Dixville Notch in New Hampshire announced the voting results of six registered voters, with Harris and Trump tied at 3 votes each. Polls on the 4th showed that Harris and Trump had similar support rates in key "swing states" for the U.S. election. Trump is expected to take two to three days to count votes in the key swing state of Pennsylvania.

The final value of the U.S. October Markit services PMI was 55, the lowest since July 2024. The U.S. October ISM services expansion rate was the fastest in over two years, exceeding expectations and previous values. After the data was released, economic resilience supported the rise of U.S. stocks, and Treasury yields reached a daily high, with the two-year Treasury yield rising about 5 basis points, approaching 4.24%. Internationally, the Bank of Canada's meeting minutes indicated concerns that a significant rate cut could change market expectations.

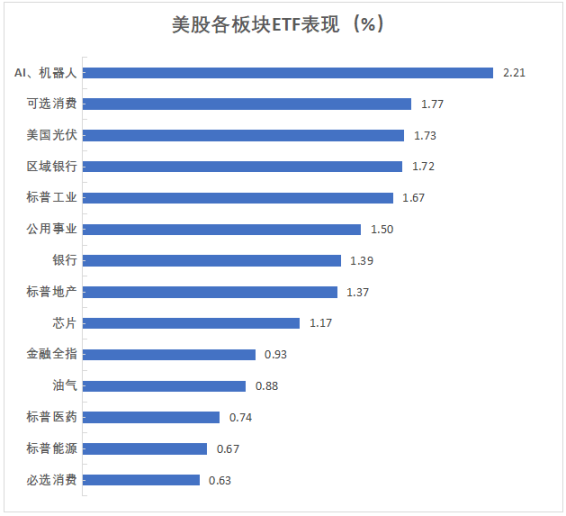

On November 5, Tuesday, risk appetite increased on U.S. election day, with all three major U.S. indices rising over 1%. The Dow Jones Industrial Average rose over 1.1% or 464 points at one point, the Nasdaq rose nearly 1.5%, the S&P rose over 1.2%, and the Russell small-cap index rose nearly 1.9%, leading the gains. All sectors closed up, with consumer discretionary, industrials, and utilities leading the way, while technology and telecommunications sectors also saw significant increases, and materials, energy, and consumer staples lagged behind. Nvidia's market value surpassed Apple's, becoming the world's largest:

All three major U.S. indices rose. The S&P 500 index closed up 70.07 points, an increase of 1.23%, at 5782.76 points. The Dow, closely related to the economic cycle, closed up 427.28 points, an increase of 1.02%, at 42221.88 points. The Nasdaq, which is heavily weighted in technology stocks, closed up 259.19 points, an increase of 1.43%, at 18439.17 points. The Nasdaq 100 index closed up 1.32%. The Nasdaq Technology Market Capitalization Weighted Index (NDXTMC), which measures the performance of Nasdaq 100 technology stocks, closed up 1.36%. The Russell 2000 small-cap index, which is more sensitive to the economic cycle, closed up 1.88%. The VIX, a measure of market volatility, fell 6.78% to 20.49.

U.S. stocks rose, with small-cap stocks leading the gains

All U.S. industry ETFs closed up. The global airline industry ETF rose over 2%, while the consumer discretionary ETF and regional bank ETF rose nearly 2%. The semiconductor ETF, banking ETF, biotechnology index ETF, and utilities ETF each rose at least 1.5%, while the technology industry ETF, global technology stock ETF, and internet stock index ETF also rose at least 1%.

All 11 sectors of the S&P 500 index rose. The materials sector rose 0.20%, the energy sector rose 0.57%, the consumer staples sector rose 0.69%, the healthcare sector rose 0.75%, the financial sector rose 0.98%, the telecommunications sector rose 0.99%, the real estate sector rose 1.36%, the information technology/technology sector rose 1.46%, the utilities sector rose 1.48%, the industrial sector rose 1.67%, and the consumer discretionary sector rose 1.83%.

In terms of investment research strategy: Goldman Sachs strategists believe that the likelihood of the U.S. stock market entering a bear market in the next 12 months is very low, as a strong economy will continue to support the stock market. They estimate that even considering election risks, the probability of a decline of more than 20% (i.e., entering a technical bear market) is only 18%. Goldman Sachs' report points out that as long as economic growth remains strong, the stock market should be able to absorb rising bond yields. However, Goldman Sachs warns that market volatility may occur after the election.

The "Tech Seven Sisters" all rose. Google A rose 0.3%, Amazon closed up 1.9%. Apple closed up 0.65%, as it is advancing its smart glasses development, with a project called "Atlas" launched last week. Although the actual product may take years to come to market, analysts say Apple's smart glasses could challenge Meta's smart glasses Ray-Ban. There are also reports that Apple will face its first fine under the EU Digital Markets Act, which could amount to €1.8 billion (equivalent to $2 billion). Microsoft closed up 0.73%, Meta closed up 2.1%. Nvidia closed up 2.84%, with its market value again surpassing Apple, becoming the world's largest company by market value. Tesla closed up 3.54%.

Nvidia surpasses Apple again to become the world's largest company by market value

Most chip stocks rose. The Philadelphia Semiconductor Index closed up 1.69%. The industry ETF SOXX closed up 1.17%. Nvidia's double-leveraged ETF closed up 5.47%. AMD closed up 0.68%, Broadcom closed up 3.17%, KLA closed up 1.05%, and ON Semiconductor closed up 1.01%. Arm Holdings closed up 2.27%, Qualcomm closed up 0.44%. ASML ADR closed up 0.79%. TSMC ADR closed up 2.19%, and Micron Technology closed up 3.7%. Applied Materials closed up 2.56%. Intel closed up 3.55, with reports that the U.S. government is considering further assistance for Intel.

AI concept stocks mostly rose. AMD closed up 6.42%, with disappointing guidance for the season, unable to predict when it would release its annual report, increasing delisting risks, and plunging nearly 20% after hours. Palantir closed up 23.47%, raising its full-year revenue guidance, reaching an intraday historical high since its IPO in the U.S. Dell Technologies closed up 2.78%. SoundHound AI, an AI voice company in which Nvidia holds shares, closed up 5.5%, CrowdStrike closed up 2.91%, C3.ai closed up 7.05%, Snowflake closed up 2.43%, Oracle closed up 1.29%, BullFrog AI closed up 1.75%, and BigBear.ai closed up 9.32%, while Serve Robotics closed up 3.81%.

The Chinese concept index outperformed the U.S. market. The Nasdaq Golden Dragon China Index closed up 1.63%, marking two consecutive days of gains over 1%. Among ETFs, the China Technology Index ETF (CQQQ) closed up 4.67%. The Chinese Internet Index ETF (KWEB) closed up 2.24%. The FTSE China 3x Long ETF (YINN) closed up 7.01%. The FTSE A50 futures index closed down 0.22% in the overnight session, at 13785.000 points.

Among popular Chinese concept stocks, new energy vehicle stocks generally rose and led the gains, with Xpeng Motors closing up 6.13%, NIO closing up 2.72%, Li Auto closing up 3.61%, and Zeekr closing up 5.05%; among other Chinese concept stocks, Fangdd closed up 1.67%, Trip.com closed up 1.75%, Alibaba closed up 0.82%, Baidu closed up 1.57%, Bilibili closed up 5.55%, Tiger Brokers closed up 3.39%, NetEase closed up 1.44%, JD.com closed up 0.43%, New Oriental closed down 0.85%, while Pinduoduo closed down 0.14%, and Vipshop closed down 0.07%.

Other key individual stocks: (1) Trump Media Technology (DJT) rose over 18.6% in early trading but turned down, falling over 4% at one point, and ultimately closed down 1.16%. The company reported net sales of $1 million in the third quarter, a net loss of $19.2 million, and a loss of $0.10 per share. (2) Boeing rose nearly 1.7% in early trading but closed down 2.62%, as the union ended a strike lasting over seven weeks, with 30,000 mechanics receiving a 38% pay raise. (3) Ferrari's U.S. stock closed down 7.36%, with a decline in third-quarter deliveries.

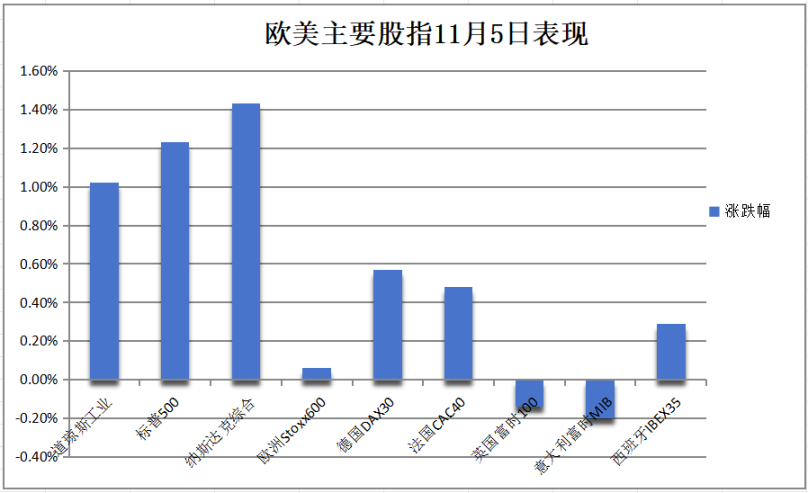

Traders focused on U.S. election day, with European stocks slightly higher, but the automotive sector fell over 1.8%, with Ferrari down over 7%:

The pan-European STOXX 600 index closed up 0.06%. The Eurozone STOXX 50 index closed up 0.38%. The FTSE Europe 300 index closed up 0.05%. Sectors saw mixed performance, with industrial stocks rising 1.2% and automotive stocks falling 1.82%. Among the constituents, Ferrari fell 7.06%, while Standard Chartered Bank announced a partnership with the UK payment company Wise, causing Wise to rise 8.52%.

The German DAX 30 index closed up 0.57%. The French CAC 40 index closed up 0.48%. The Dutch AEX index closed up 0.37%. The Italian FTSE MIB index closed down 0.20%. The UK FTSE 100 index closed down 0.14%. The Spanish IBEX 35 index closed up 0.29%.

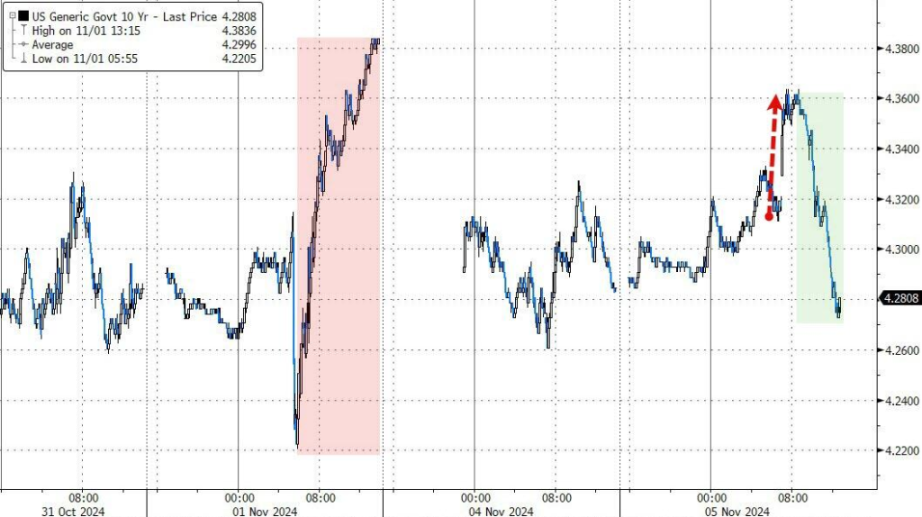

U.S. Treasury yields experienced significant fluctuations during the day, initially influenced by the disappointing results of the UK government bond auction, followed by a strong U.S. ISM services report that pushed Treasury yields higher, reaching a daily high. However, due to the strong results of the U.S. Treasury's 10-year bond auction, medium- to long-term Treasury yields retreated and turned negative. The winning yield of the 10-year UK bond auction hit a new low since December, with UK bond yields rising over 7 basis points:

U.S. Treasuries: At the end of the day, the yield on the benchmark 10-year U.S. Treasury turned negative, refreshing the daily low to 4.2808%. At 23:29 Beijing time, after the release of the U.S. ISM non-manufacturing data, it had previously reached a daily high of 4.3636%, stabilizing below 4.4% in recent days, the highest level since July 3. The two-year U.S. Treasury yield rose by 3.52 basis points to 4.1951%, experiencing a significant surge when the U.S. ISM non-manufacturing data was released at 23:00, rising to 4.2366% at 23:07, a new high since August 1.

On the news front, on U.S. election day, the Treasury market was on edge, with the 10-year Treasury yield rising by 8 basis points to 4.36%, nearing a three-month high. The ICE Bank of America Merrill Lynch MOVE index, which measures implied volatility of yields, reached its highest level in a year. At the same time, exchange rate volatility also surged, with the cost of hedging the euro against the dollar rising to its highest level in over four years. A survey by JPMorgan of U.S. Treasury clients showed that as of the week ending November 4, the net long position of Treasury clients reached a new high since August 12.

European Bonds: At the end of the day, the yield on the 10-year German bond rose by 3.0 basis points to 2.425%. The two-year German bond yield rose by 3.8 basis points to 2.303%. The 10-year UK bond yield rose by 7.2 basis points. The two-year UK bond yield rose by 7.9 basis points. The 10-year French bond yield rose by 1.8 basis points, and the 10-year Italian bond yield rose by 0.2 basis points.

U.S. Treasury yields surged and then retreated

On U.S. election "voting day," the dollar fell again by over 0.4% to a three-week low. The yen broke above 151.40 against the dollar during trading. The offshore yuan rose for the second consecutive day, with short-term implied volatility continuing to soar:

Dollar: The dollar index DXY fell by 0.42% at the end of the day, reporting 103.451 points, with an intraday trading range of 103.956-103.373 points. The Bloomberg dollar index fell by 0.37% to 1253.94 points, with an intraday trading range of 1259.23-1253.41 points.

Some hedge funds adjusted their investment strategies at the last moment before the U.S. presidential election, starting to bet that if Harris wins, the dollar will fall. This is because polls showed Harris unexpectedly leading in Iowa, where Trump was originally thought to have an advantage. As a result, some funds began to close their bullish positions on the dollar and buy bullish options on the euro and Australian dollar.

Non-U.S. Currencies: The euro rose by 0.43% against the dollar to 1.0926, breaking above the 200-day moving average for four consecutive trading days (currently reported at 1.0870), approaching the 100-day moving average (currently reported at 1.0941). The pound rose by 0.61% against the dollar to 1.3035, continuing to hover around the 100-day moving average since October 22 (currently reported at 1.2985). The dollar fell by 0.13% against the Swiss franc. Among commodity currencies, the Australian dollar rose by 0.78% against the dollar, the New Zealand dollar rose by 0.59%, and the dollar fell by 0.53% against the Canadian dollar. The Swedish krona rose by 0.23% against the dollar, and the Norwegian krone rose by 0.46% against the dollar.

Yen: The yen rose by 0.35% against the dollar at the end of the day, reporting 151.60 yen, with an intraday trading range of 152.54-151.34 yen. Japan's largest industrial union, UA ZENSEN, plans to set a target of 6% overall wage growth in the spring wage negotiations of 2025.

Offshore Yuan (CNH): The offshore yuan rose by 104 points against the dollar at the end of the day, reporting 7.1017 yuan, with an overall trading range of 7.1173-7.1010 yuan during the day. The short-term implied volatility of the dollar/offshore yuan continued to soar, with overnight implied volatility rising to nearly 30% on Tuesday, setting a new closing record high, highlighting ongoing tension.

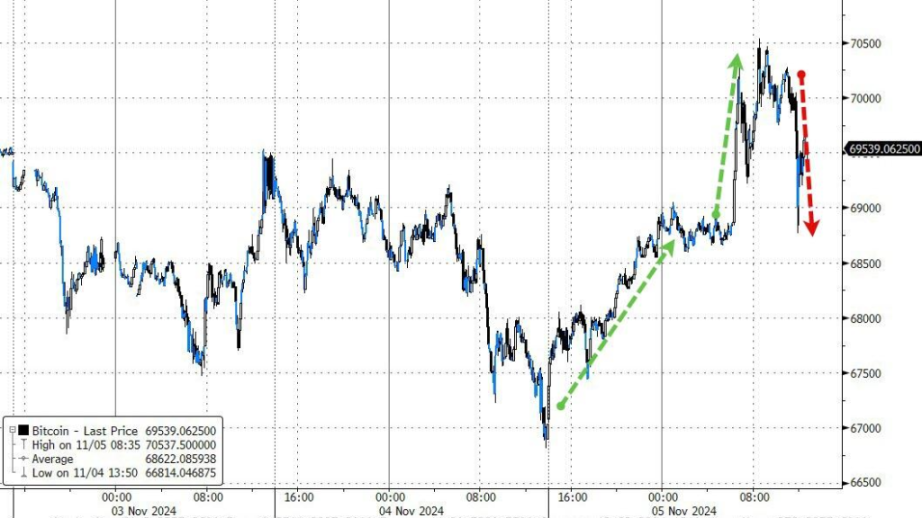

Cryptocurrency: The largest cryptocurrency, Bitcoin futures, rose by 2.88% at the end of the day, reporting $69,630.00. The spot trading price of Bitcoin briefly broke above $70,500, while U.S. stocks fell back below $69,000 during the midday session. The second-largest cryptocurrency, Ethereum futures, rose by 1.83% to $2,424.00.

On the day before the official start of voting in the U.S. election, net outflows from U.S. Bitcoin ETFs reached a historical high. The pricing of Bitcoin options on the CME indicates that the 30-day implied volatility of Bitcoin has reached its highest level since August (when the "Black Monday" in the Japanese stock market triggered a market crash). Option pricing suggests that the expected market volatility of Bitcoin on the day after the election will reach 8%, four times the normal level.

Bitcoin briefly broke above $70,000 during trading but later retraced its gains

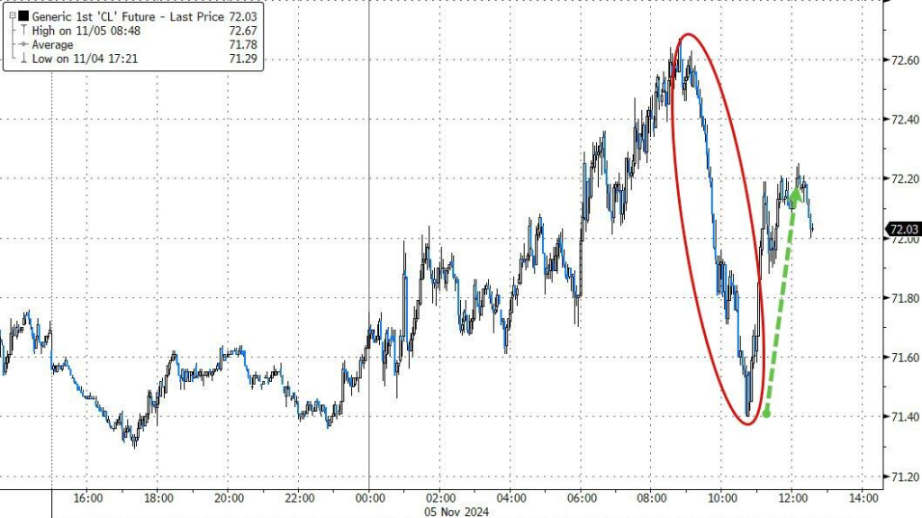

Following OPEC+'s announcement to delay production increases by one month, the dollar index fell to a three-week low as traders closed positions ahead of the U.S. election on Tuesday. The weakening dollar caused oil prices in other countries to decline, stimulating fuel demand. At the same time, analysts expect that the tropical storm Rafael in the Gulf of Mexico, which is expected to upgrade to a hurricane, could lead to a reduction of about 4 million barrels in U.S. oil production. These factors collectively supported oil prices, which rose by over 1.5% during trading, with U.S. oil approaching $73 and Brent oil above $76:

U.S. Oil: WTI December crude oil futures closed up $0.52, an increase of nearly 0.73%, reporting $71.99 per barrel. U.S. oil fell nearly 0.3% in early Asian trading, breaking below $71.30, but then continued to rise, reaching a high of nearly 1.7% during the early U.S. stock market session, approaching $72.70.

Brent Oil: Brent January crude oil futures closed up $0.45, an increase of about 0.60%, reporting $75.53 per barrel. Brent oil fell over 0.2% in early Asian trading, breaking below $74.90, but then continued to rise, reaching a high of over 1.5% during the early U.S. stock market session, breaking above $76.20.

Natural Gas: U.S. December natural gas futures closed down 3.99%, reporting $2.6700 per million British thermal units. European benchmark TTF Dutch natural gas futures fell 0.19%, reporting €40.400 per megawatt-hour. ICE UK natural gas futures rose 0.14%, reporting 102.600 pence per kilocalorie.

Oil prices rose slightly

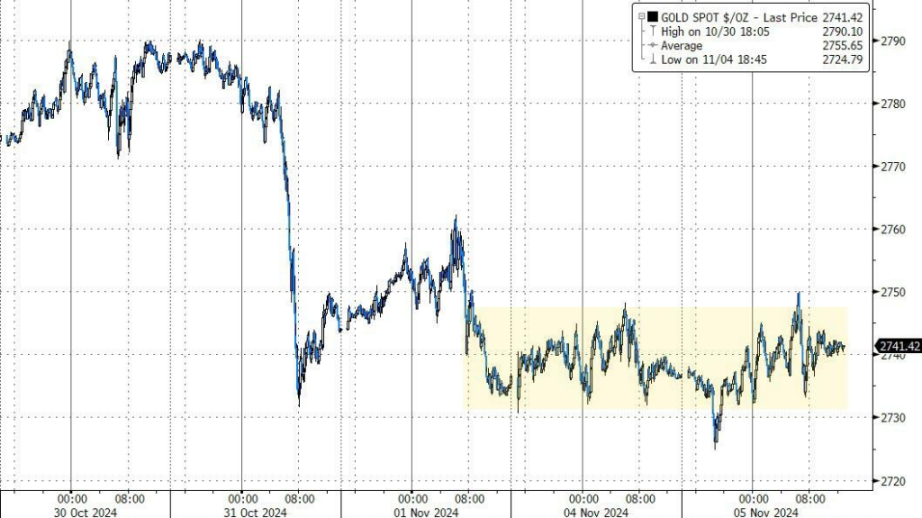

Polls show that Trump and Harris are evenly matched in the U.S. presidential election, with a high possibility of a controversial outcome. The "uncertainty of the election" has triggered a flight to safety, and the expectation of a rate cut by the Federal Reserve is favorable for gold prices, with spot gold rising nearly 0.5% during trading, breaking above $2,750:

Gold: COMEX December gold futures closed slightly up 0.25% to $2,753.00 per ounce. Spot gold fell over 0.4% in early Asian trading, breaking below $2,720, but then fluctuated higher, reaching a high of nearly 0.5% before breaking above $2,750 during the pre-U.S. stock market session, closing up 0.27% at $2,744.10 per ounce.

Silver: COMEX December silver futures closed up 0.54% to $32.7850 per ounce. Spot silver fell over 0.6% in early Asian trading, breaking below $32.20, but then fluctuated higher, reaching a high of over 1.4% before breaking above $32.90 during the pre-U.S. stock market session, closing up 0.64% at $32.6593 per ounce.

On the news front, RJO Futures analyst Daniel Pavilonis stated that due to the close competition between former Republican President Trump and Democratic Vice President Harris, and the precarious control of the U.S. Congress, investors are particularly uneasy about unclear or controversial results, especially as the election outcome may exacerbate turmoil. Deutsche Bank pointed out that if the election results remain uncertain for days or even weeks, gold will benefit from the resulting uncertainty. Exinity Group analyst Han Tan stated that after the election, once "the dust settles," gold prices should ultimately reach $2,800. Additionally, the market generally expects the Federal Reserve to cut rates by 25 basis points on Thursday, which also supports higher gold prices.

Among London industrial metals, zinc rose over 2.2%, aluminum rose over 1.5%: Copper rose by 0.43%, reporting $9,738 per ton. COMEX copper futures rose by 0.70%, reporting $4.4630 per pound. Aluminum rose over 1.52%. Zinc rose by about 2.24%. Lead fell by $5, reporting $2,028 per ton. Nickel rose over 0.72%. Tin rose by about 0.62%. Cobalt remained flat, reporting $24,300 per ton.

Alumina futures' main contract briefly rose over 4%, reaching a new high since its listing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。