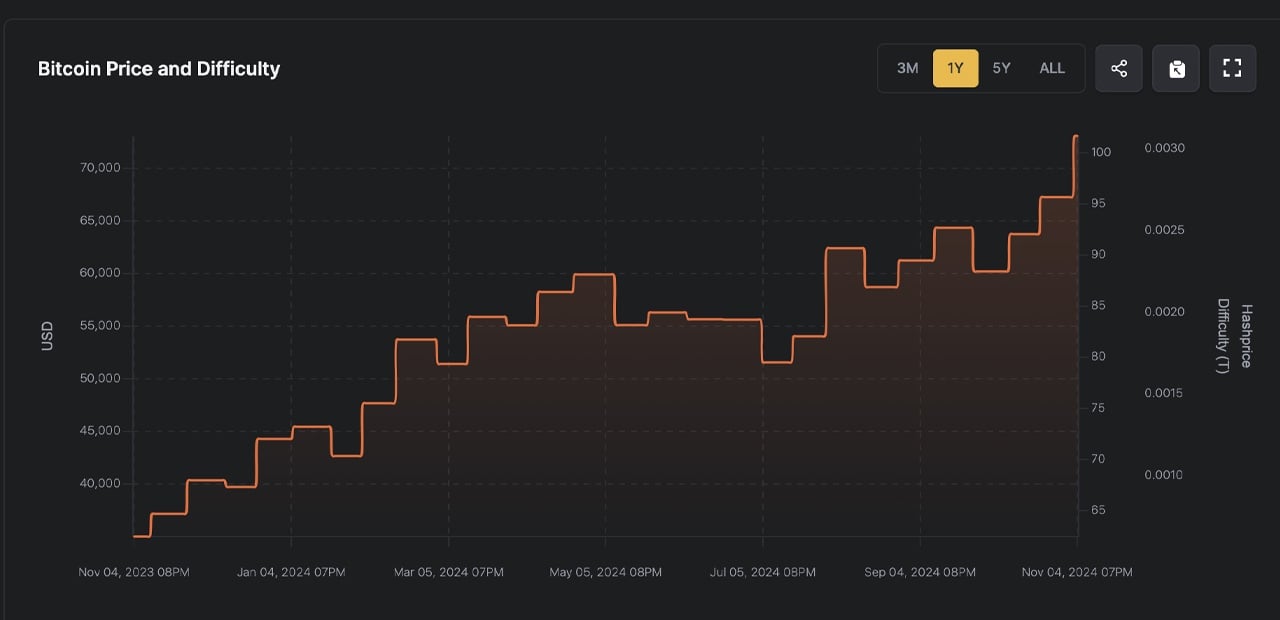

The difficulty level increased by 3.94%, now sitting at 101.65 trillion. Essentially, this metric gauges the challenge of adding a new block to the Bitcoin blockchain. Adjusted dynamically around every two weeks, or after 2,016 blocks, the difficulty level is based on how quickly miners completed the previous set. Ideally, each block is discovered roughly every 10 minutes.

If miners add blocks faster than the target during a 2,016-block cycle, the difficulty rises; if they’re slower, it drops. This system keeps the bitcoin supply flowing consistently and fortifies network security. The 101.65 trillion figure exemplifies the immense computational load currently required, indicating that miners must perform over 101 trillion hashes to discover a single block.

This increase reflects the escalating computational power of miners and the intense competition among them. The difficulty scale also provides security, as it creates a high barrier for any attempt to manipulate the blockchain, requiring substantial computational effort for block addition. Yesterday, the hashprice—or anticipated value per petahash per second (PH/s) of hashpower—dipped to a low of $42.50.

Currently, however, as of 1 p.m. EDT Tuesday, hashprice has edged up to $44.03, with bitcoin’s price holding just a hair above the $70K mark. The network’s hashrate has stabilized at 724.07 exahash per second (EH/s) on Nov. 5 after reaching an all-time high of 766 EH/s on Nov. 1, 2024, according to the seven-day moving average. This represents a decline of about 42 EH/s, signaling a tougher setting for bitcoin miners following the latest difficulty adjustment above the 100 trillion mark.

As bitcoin’s mining landscape intensifies, miners are forced to innovate, maximizing efficiency and adapting swiftly to stay competitive. The new difficulty level signals a critical juncture for participants in the mining industry, where only the most resilient will thrive. While the network’s stability appears well-rounded, the escalating challenge illustrates a relentless drive shaping the future of Bitcoin’s decentralized infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。