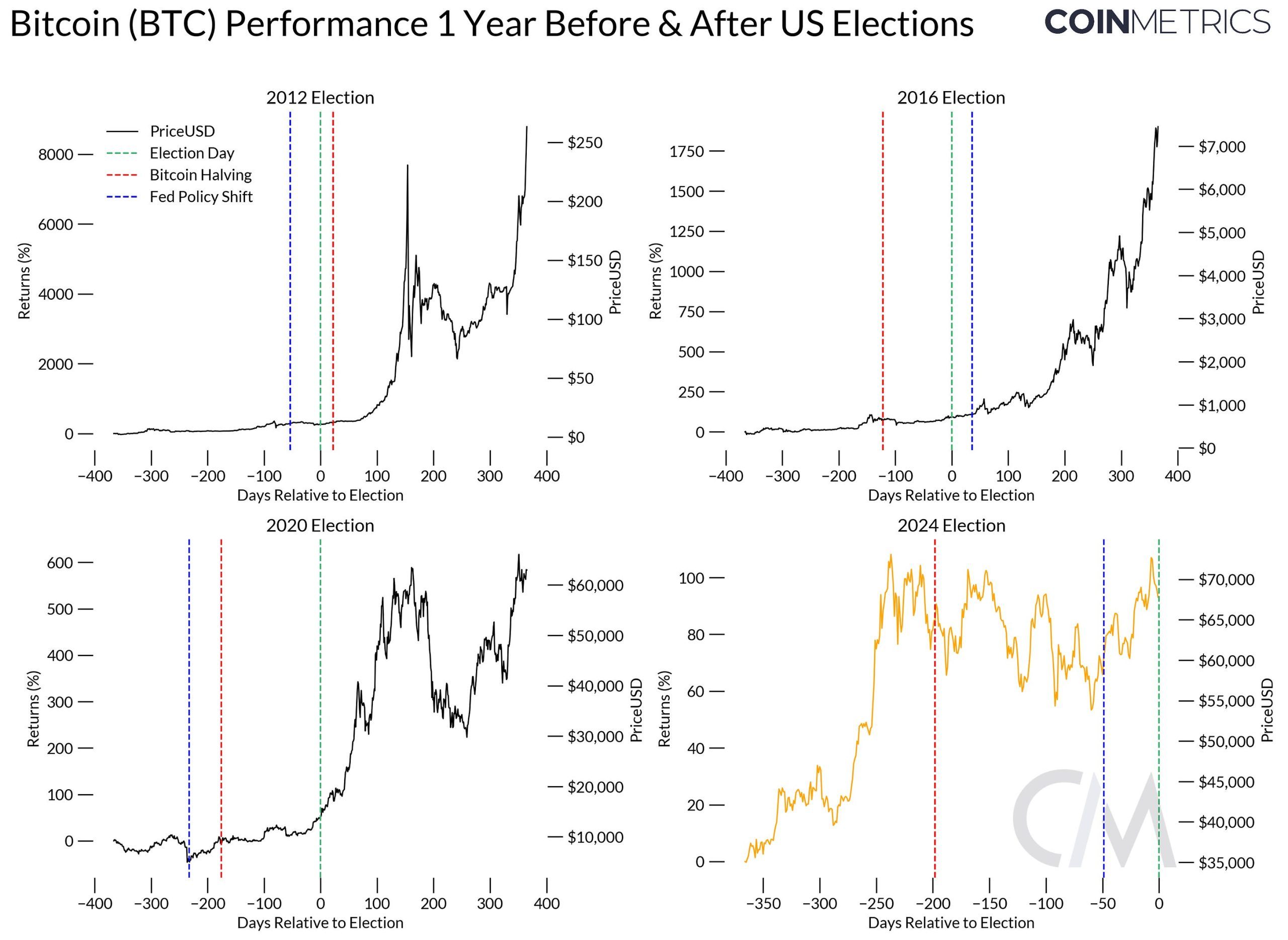

Coin Metrics’ latest report, authored by researchers Tanay Ved and Matías Andrade Cabieses, analyzes the potential effects of the 2024 U.S. presidential election on crypto markets, with particular emphasis on bitcoin (BTC). The Coin Metrics’ report highlights that bitcoin has historically seen price surges following previous elections, though the scale of these gains has diminished over time.

The authors emphasize that these shifts often coincide with Bitcoin halving events and major Federal Reserve policy changes, creating a confluence of events that can reduce market uncertainty and stimulate bullish sentiment. The report delves into volatility patterns, noting that bitcoin’s realized volatility has typically risen around election periods, staying elevated for approximately 30 days post-election.

The Coin Metrics report states:

Bitcoin’s realized volatility has historically increased around U.S. elections, typically remaining elevated for approximately 30 days post-election.

This trend reflects market adjustments as participants react to evolving political conditions. Coin Metrics points out that while volatility levels ahead of the 2024 election are relatively calm, the days leading up to and following the event are likely to see increased fluctuations. This potential volatility surge highlights the sensitivity of digital assets to external geopolitical factors.

Coin Metrics also examines Polymarket, a popular prediction market platform, and its role in shaping investor sentiment around the election. According to the report, Polymarket odds for key political figures have experienced significant shifts in recent months, reflecting global trading behaviors and sentiments on the U.S. political landscape.

Notably, the report finds that much of Polymarket’s trading volume occurs outside typical U.S. trading hours, suggesting a high level of international interest in the election’s outcome and its potential impact on crypto markets. Looking ahead, Coin Metrics highlights key indicators for investors to monitor, including trading volumes of major cryptocurrencies like bitcoin, ether (ETH), and solana (SOL), as well as the ETH/BTC ratio and open interest levels for bitcoin futures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。