In the past week, the market experienced significant fluctuations due to the U.S. elections. When the odds of Trump winning on Polymarket rose to 67%, the BTC price briefly surpassed $73,620. However, as weekend polls showed a tight race between Trump and Harris, the odds of Trump winning fell to 55%. On November 5, the BTC price also temporarily retreated, hitting a low of $67,059, with $70,000 becoming the latest resistance level for BTC. As of the publication of this article, the BTC price fluctuated around $68,800 (data sourced from Binance spot market, November 5, 15:00).

With the U.S. elections nearing conclusion, the market is awaiting the election results. On November 4, Eastern Time, the three major U.S. stock indices closed lower. The U.S. elections, the Federal Reserve's monetary policy, and U.S. corporate earnings reports became the main focus of the macro market this week.

Market Analysis

First Voting Point Results Released, Trump and Harris Each Received 3 Votes

The small town of Dixville Notch in New Hampshire announced the voting results of 6 voters, with Harris and Trump each receiving three votes. Four Republicans and two unaffiliated voters participated in the voting.

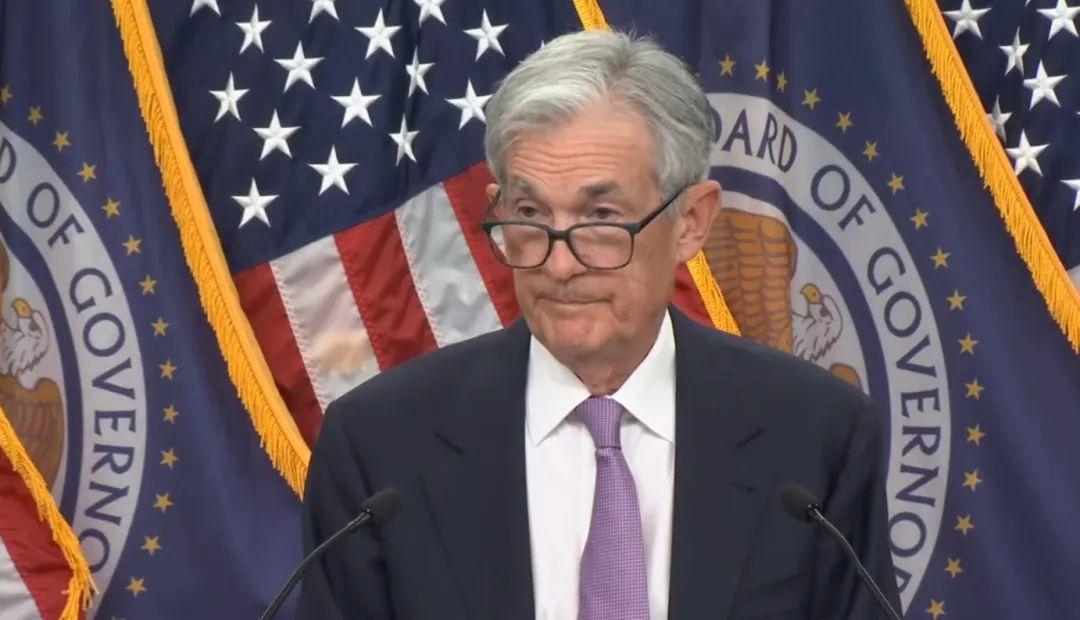

Due to the U.S. Elections and Daylight Saving Time, the Federal Reserve's Meeting is Delayed by One Day

Due to the U.S. elections and Daylight Saving Time, the Federal Reserve will announce its interest rate decision at 3:00 AM Beijing time on November 8 (Friday). Traditionally, the Federal Reserve holds its meetings on Tuesday and Wednesday and announces the results on Thursday morning Beijing time, but this time coincides with the U.S. election voting, leading to a one-day delay in the meeting.

Microstrategy Announces $42 Billion BTC Investment Plan, Potentially Catalyzing Long-Term BTC Development

Last week, Microstrategy announced a three-year $42 billion BTC investment plan, primarily raising funds through stock and convertible bond issuance to increase its BTC holdings. In the long run, this plan may drive up BTC prices.

Investment Recommendations

With election data in a deadlock, the market remains uncertain about the election results, and traders have lost their trading direction. Data from the Chicago Mercantile Exchange's BTC options show an increase in hedging demand against price declines, indicating traders' concerns about BTC price drops during the election week. However, many analysts believe that BTC's upward trend will not change regardless of the presidential candidate.

Whether Trump or Harris is elected, the potential asset movements resulting from their economic policies, as well as the U.S. economy's soft landing, hard landing, or no landing, will be significant. Additionally, October data indicates that expectations of "tax cuts" and "U.S.-China decoupling" in Trump's economic policies will inevitably lead to a further increase in U.S. debt, with severe selling of U.S. bonds.

In the current context, reasonable asset allocation and ensuring a stable return with a certain capital ratio is a good choice. For example, structured products like shark fins or trend smart yield products can provide cost protection, and if one judges that the market trend can yield relatively good incremental returns, they are suitable for investors who are optimistic about BTC and ETH trends in the long term. Meanwhile, Matrixport's RWA platform, Matrixdock, has recently launched the gold token XAUm, providing a new crypto investment option for gold. XAUm is fully backed by physical gold bars with a purity of no less than 99.99% according to LBMA specifications and offers physical redemption services in Hong Kong and Singapore.

As a leading one-stop crypto financial service platform, Matrixport offers users a variety of asset management products, including dual currency investments, snowballs, shark fins, trend smart yield, and seagull structured products; quantitative strategies, passive strategies, and other strategic investments. These products support multi-currency investments with a wide range of investment periods to choose from.

Disclaimer: The above content does not constitute investment advice, sales offers, or purchase offers to residents of the Hong Kong Special Administrative Region, the United States, Singapore, or other countries or regions where such offers or invitations may be prohibited by law. Digital asset trading may involve significant risks and volatility. Investment decisions should be made after careful consideration of personal circumstances and consultation with financial professionals. Matrixport is not responsible for any investment decisions made based on the information provided in this content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。