Bitcoin (BTC) traders are seeking protection against price weakness amid projections of a U.S. election-induced volatility boom.

That's according to CME's bitcoin options market, where put options, offering protection against price drops and expiring within a week, were pricier relative to calls on Monday, according to data source CF Benchmarks and QuickStrike.

The so-called 25-delta risk reversal for contracts expiring Friday (P2XE24) was -1.3% on Monday, showing a bias for puts. The metric measures the difference in implied volatility between out-of-the-money higher strike calls and lower strike OTM puts, providing an easy to read picture of the market sentiment.

A call option gives the purchaser the right but not the obligation to buy the underlying asset at a predetermined price at a later date. A put options gives the right to sell.

"It looks like bitcoin options traders appear to be hedging their bets to the downside ahead of the U.S. election this week. Through a .25 delta risk reversal we can see that contracts expiring within a week are slightly negative – meaning puts more expensive than calls – compared to longer-dated maturities of either 2 weeks or 30 days, where the skew reverts to being positive again," researchers at CF Benchmarks told CoinDesk in an email.

Bitcoin's price has pulled back to $68,000 from near record highs above $73,500 in one week, alongside a drop in the more pro-crypto Donald Trump's chances of election victory.

The pricing for longer-duration options was positively skewed in favor of calls, indicating a broader constructive outlook, consistent with the consensus analysts' expectations for a year-end rally to $80,000 and higher.

The latest polls show that Democrat Kamala Harris and her rival Republican candidate Donald Trump, perceived as crypto-friendly, are running neck and neck in most swing states, including Pennsylvania and nationally.

Per some observers, the 50-50 odds mean the eventual outcome, expected Friday, could lead to a BTC price swing of $6,000-$8,000.

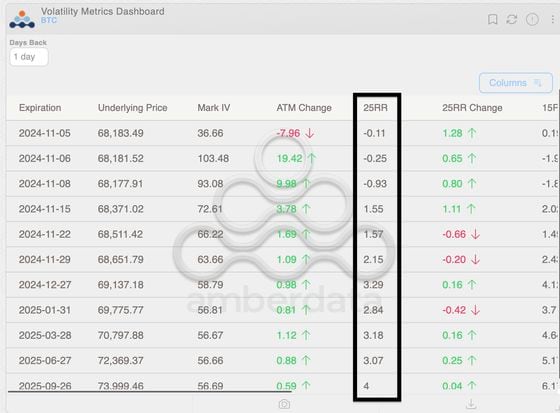

Options trading on the leading exchange Deribit also show a broader bullish outlook with a largely neutral bias for this week, according to data source Amberdata.

The 25-delta risk reversals show barely a difference between pricing for calls and puts expiring this week. The sentiment is decisively bullish from the Nov. 15 expiry and beyond.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。