Written by: Maia, BeWater Venture Studio

TL; DR

- In terms of the issuance and application of BTC-backed assets, centralized wrapped BTC still dominates with over 75% market share. However, in recent months, BTC LSTs represented by LBTC and SolvBTC.BBN have rapidly grown alongside the launch of Babylon, becoming a new emerging force in the BTC-backed asset market, with the current market size of BTC LSTs reaching 25.6K BTC. Driven by the demand for yield from underlying assets, BTC liquid staking and points derivative markets are gradually becoming new growth points in the BTCFi space.

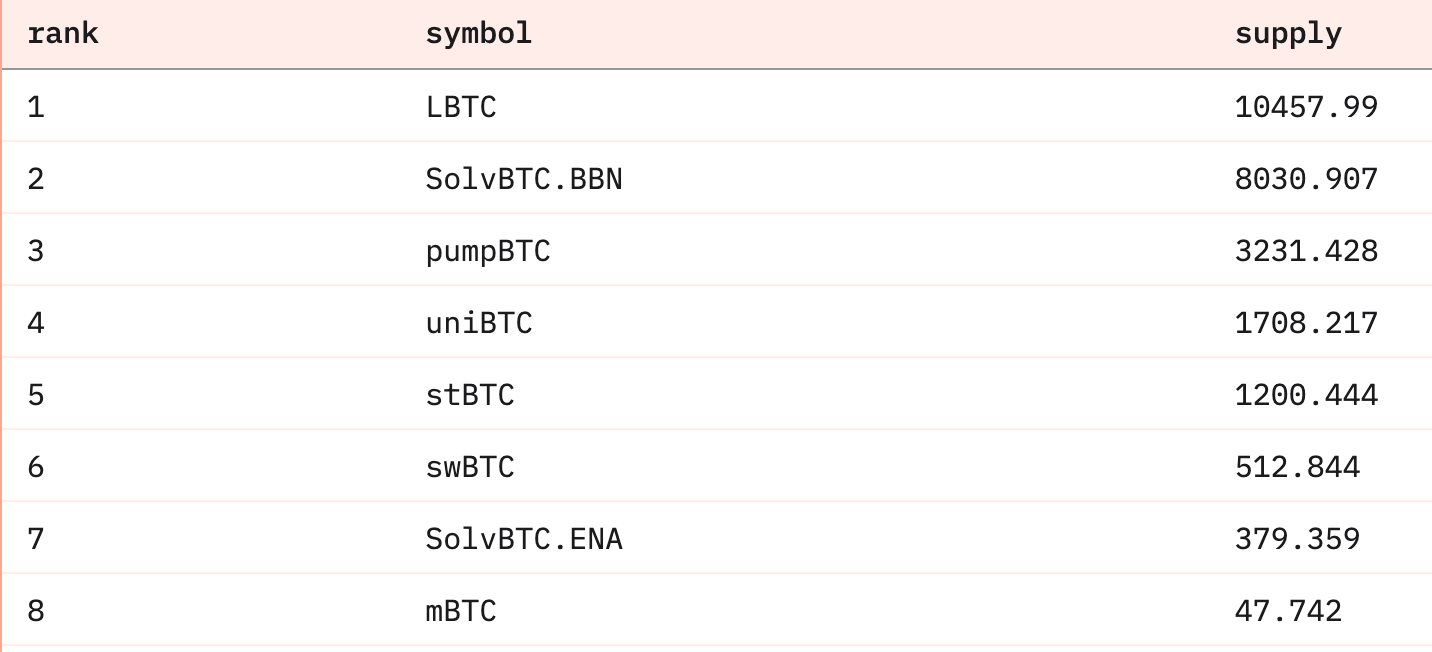

- @Coredao_Org is a BTC-driven L1 network that provides robust yields to users through a non-custodial staking solution and dual staking mechanism. Its TVL has grown by 4757.9% in six months, reaching $591.5M. Core's growth strategy includes: (1) focusing on the incremental market of BTC-backed assets to enhance ecosystem liquidity and attract rapidly growing BTC LST assets; (2) building supporting native protocols and quickly integrating with BTCFi projects to establish a complete ecosystem of applications; (3) utilizing the airdrop and market performance of the native token $CORE to support the incentive structure, further driving participation and asset retention.

- @use_corn is an emerging ETH L2 network, currently with a cumulative TVL of $425.9M from Corn Kernels activities, laying the foundation for the mainnet launch. Corn's rapid growth is attributed to its effective capital accumulation in the incremental market of BTC LSTs. By focusing on the yield attributes of liquid staking tokens and points derivative gameplay, Corn has attracted a total of $290.3M TVL through five pools launched in collaboration with Pendle, capturing 11.4% of the total BTC LST market.

- @build_on_bob is a hybrid L2 network combining BTC and ETH, attracting significant assets through extensive BTCFi project integration and one-click liquid staking services. Currently, BOB's TVL stands at $65.7M, primarily composed of the existing portion of BTC-backed assets $WBTC. BOB's performance is mainly due to: (1) a trust-minimized bridging architecture that opens asset channels from most networks, solving the problem of liquidity fragmentation; (2) a one-click liquid staking entry and a strong supporting ecosystem, establishing a convenient staking entry and a complete application scenario.

This year, as the BTCFi narrative continues to evolve, the on-chain liquidity of BTC assets has gradually become the focus of major ecosystems and protocols. With the launch of BTC scaling solutions and the rise of BTC LSTs, BTC is transforming from a static store of value into an asset that can participate in more on-chain yield scenarios, enhancing its application potential within the entire DeFi ecosystem.

@Coredao_Org, @build_on_bob, and @use_corn are representative growth cases in the BTCFi space for the second half of the year: Core focuses on leveraging large BTC LST assets during the growth phase; Corn quickly captures the incremental market by introducing points derivative gameplay in collaboration with Pendle; BOB attracts liquidity through a rich ecosystem and liquid staking services; various ecosystems' series of actions around "yield" have greatly activated the liquidity of BTC assets. In the future, as BTC liquidity is gradually released, the on-chain accumulation scale of assets in the BTCFi ecosystem still has significant growth potential.

1 Background

1.1 On-chain Liquidity Pathways for BTC Assets

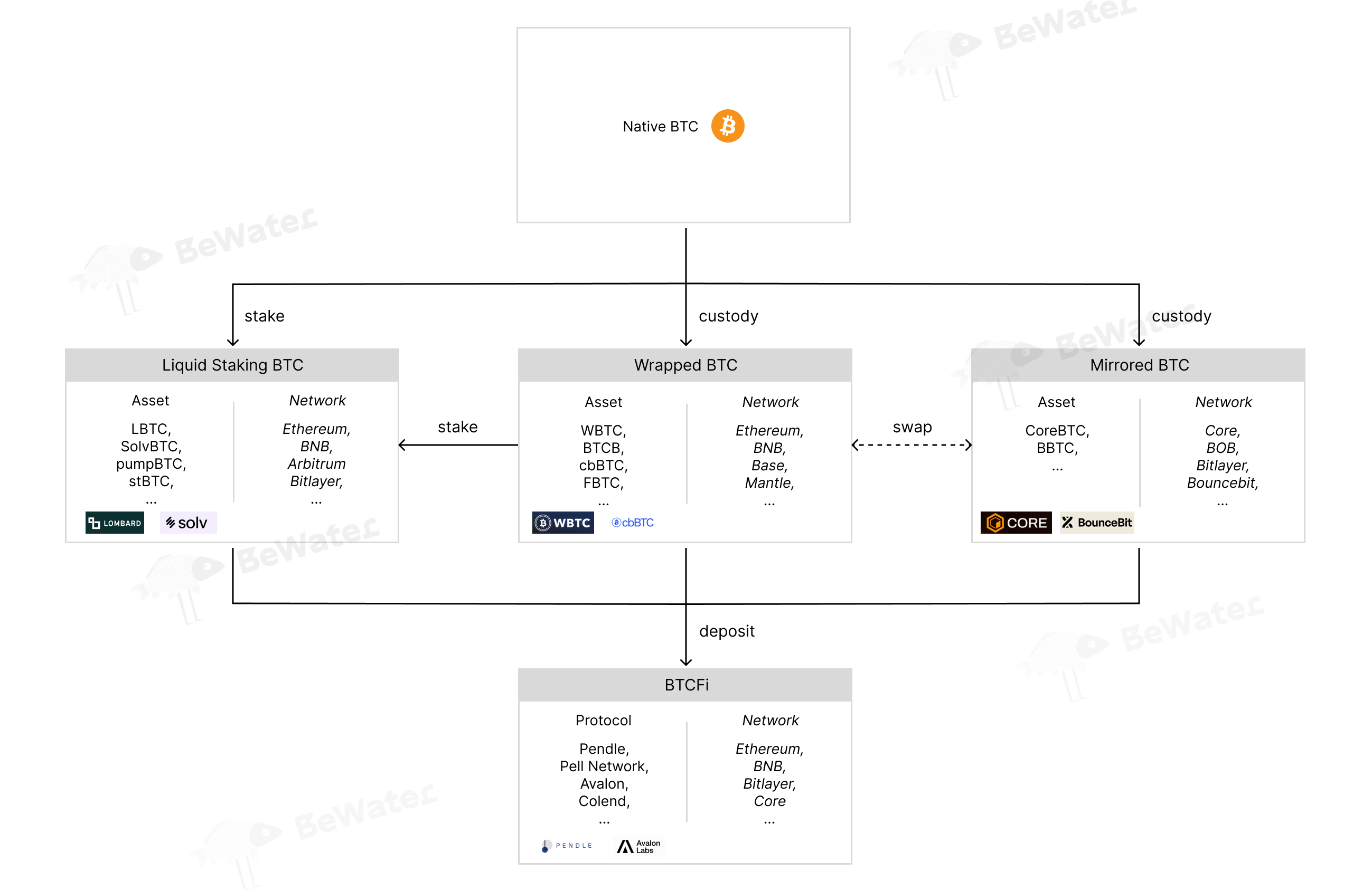

The on-chain flow direction of BTC and its backed assets can be divided into the following three layers:

- First Layer: Native BTC

- Second Layer: (1) Centralized custodial issued wrapped BTC (2) Mapped assets running on BTC L2 and SideChain (3) Liquid staking BTC

- Third Layer: Various BTC derivative assets in downstream DeFi scenarios

1.2 Current Market Status of BTC Assets

Overview of BTC-backed Asset Issuance and Application

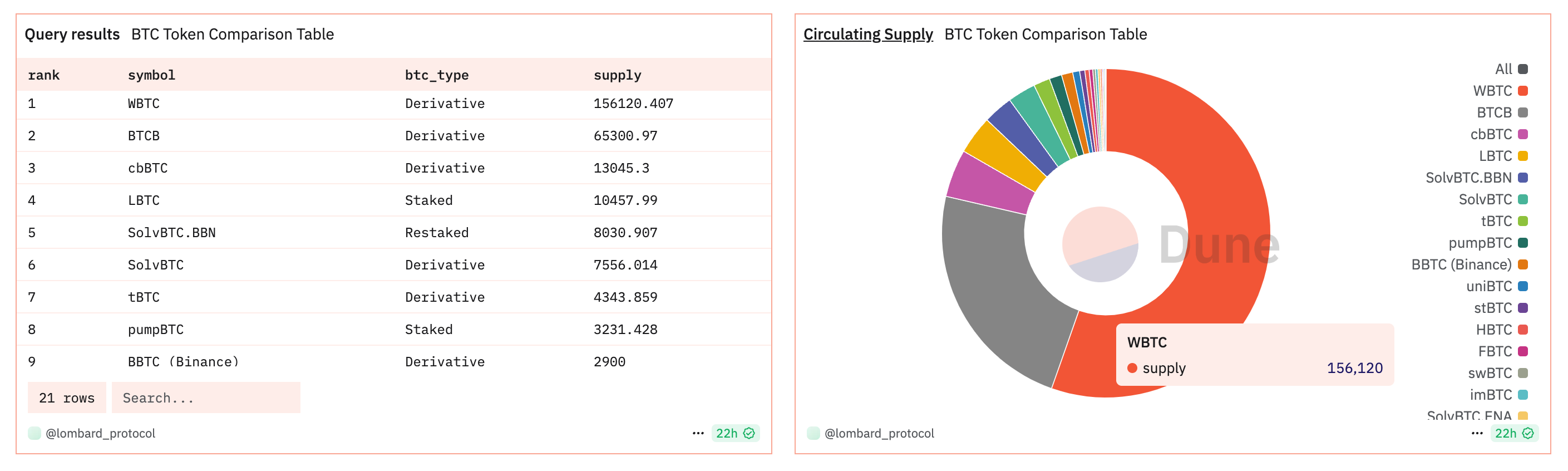

From the issuance of BTC-backed assets on the three major networks of Ethereum, Arbitrum, and BNB, it can be seen that centralized custodial issued wrapped BTC still occupies the vast majority of market share, with $WBTC (156.1K supply) and $BTCB (65.3K supply) together accounting for over 75% of the total circulation of BTC-backed assets. Additionally, BTC LSTs such as $LBTC (10.5K supply) and $SolvBTC.BBN (8K supply) have rapidly grown in recent months driven by the BTC (re)staking narrative, becoming another emerging force in the BTC-backed asset market.

As the most consensus-driven and largest market cap asset, the main application scenarios for BTC-backed assets are concentrated in lending protocols. For the largest $WBTC and $BTCB, their biggest downstream applications are in Aave v3 and Venus protocols, respectively, with TVL accounting for over 20% of their total supply, reflecting the demand for relatively stable yields in the BTCFi space.

*https://dune.com/optimus/lombard*

Overview of BTC LST Issuance and Application

Currently, the total market size of BTC LSTs is approximately 25.1K BTC, with the two major protocols Lombard and Solv Protocol accounting for over 70% of the market share. The absorption and issuance of BTC LSTs directly impact the flow and accumulation of BTC assets across various chains. Notably, Solv has had a significant impact on the TVL of various chains, bringing in net inflows of $309.7M and $177.8M to Core and Scroll, respectively, significantly enhancing the asset scale of these two chains.

Compared to wrapped BTC issued through centralized custodial models, BTC LSTs as yield-generating assets have expanded into richer application scenarios. In addition to lending protocols, the points trading market has become another important downstream application for BTC LSTs. Avalon and Pendle are the protocols with the most capital accumulation in the "lending" and "points derivative market" segments, achieving win-win growth alongside the development of the BTCFi and BTC staking narratives.

https://dune.com/optimus/lombard

2 Asset Accumulation Strategies in the BTCFi Ecosystem

2.1 Core: Focusing on Incremental Assets and Token Incentives to Drive Ecosystem Growth

Basic Information

Core is a BTC-driven L1 scaling solution that allows users to earn passive income through non-custodial Bitcoin staking without needing to transfer or wrap BTC. Since its launch in April 2024, over 7,500 BTC have been staked on Core, with the network's security protected by the security of BTC. In July 2024, Core introduced a dual staking mechanism for BTC and CORE. Users can stake BTC to earn risk-free basic yields and also stake the native token CORE for additional rewards, with the distribution of rewards linked to the amount and duration of CORE staked. The introduction of the dual staking mechanism has further driven the growth of Core's TVL.

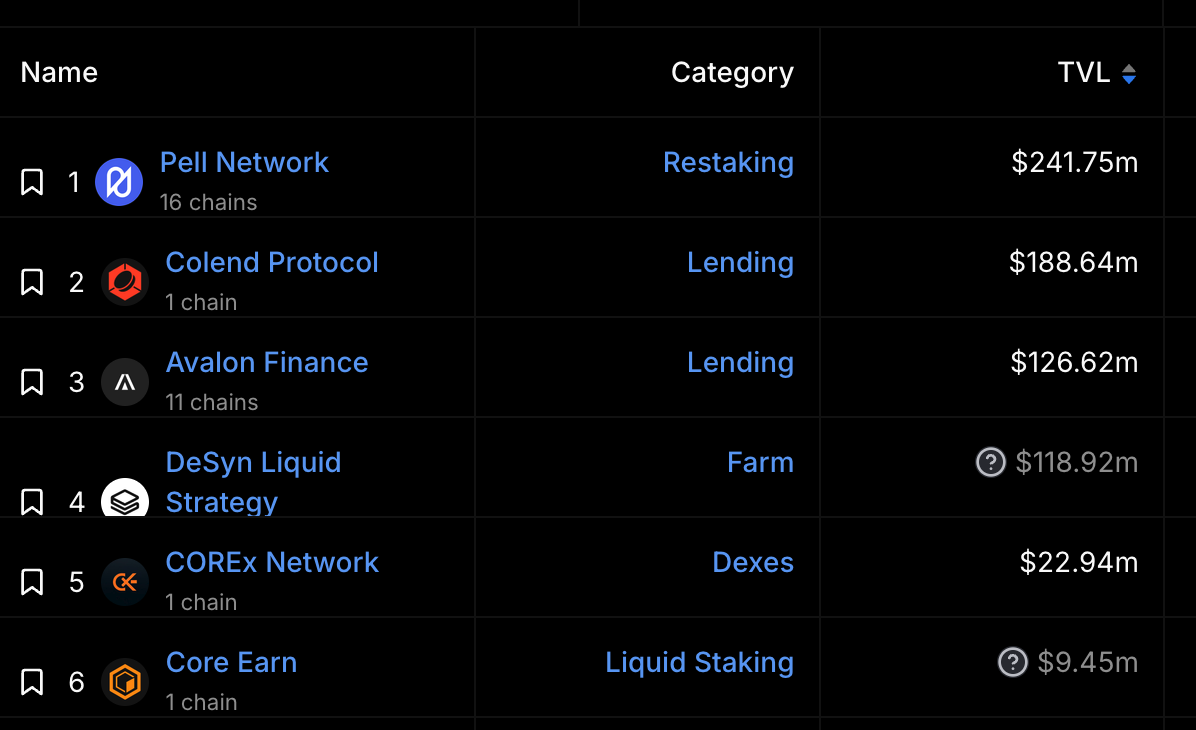

Currently, Core's TVL has reached $591.5M, growing 4757.9% in six months, ranking it as the 16th largest blockchain by TVL. The growth of Core's TVL has shown several key milestones: In June, the launch of the native lending protocol @colend_xyz and integration with @SolvProtocol's derivative assets drove a TVL increase of $51.1M that month, a growth rate of 202.2%. In July, the introduction of the dual staking mechanism attracted new capital inflows, leading to a TVL increase of $92.6M that month, a growth rate of 121.3%. In August, the integration of the leading BTC Restaking protocol @Pell_Network further triggered larger-scale capital accumulation on Core.

https://defillama.com/chain/CORE?volume=true

Growth Strategy

The growth of Core's TVL is primarily driven by the following factors: (1) focusing on the incremental market of BTC-backed assets to enhance ecosystem liquidity and absorb rapidly growing Solv derivative assets; (2) building supporting native protocols such as Colend and quickly integrating with projects like Pell Network to establish a complete ecosystem of applications; (3) utilizing the airdrop and market performance of the native token $CORE to support the incentive structure, creating a multi-dimensional ecosystem synergy.

Deep integration and collaboration with Solv derivative assets

SolvBTC.BBN and SolvBTC are currently the fifth and sixth largest BTC derivative assets in the market, with a total issuance of 15.6K BTC, and are still in a stable growth phase. Since June, SolvBTC has expanded into the Core ecosystem and has been deeply integrated with the two major protocols, Colend and Pell Network, driving a TVL increase of $51.1M that month. Currently, Solv derivative assets account for 65% of Core's TVL, which is not only due to the stable yield scenarios provided by the DeFi module construction of the Core ecosystem for underlying assets but also includes the high incentives provided by Core for the application of SolvBTC and the airdrop expectations supported by the performance of the $CORE token. This indicates that Core's ecosystem development is not limited to its own native BTC staking mechanism but focuses more on introducing and incentivizing high-quality large BTC assets to enhance the overall network's activity and locked value. Through deep integration and collaboration with Solv Protocol, Core has not only increased its TVL but also provided diversified liquid asset support for on-chain DeFi scenarios.

BTCFi ecosystem construction led by Colend and Pell Network

Colend is the native lending protocol on Core, responsible for most of the asset accumulation in the ecosystem. Since introducing SolvBTC in June and providing maximum incentives, its TVL has grown significantly. Currently, 85% of the TVL in the Colend protocol comes from the inflow of Solv Protocol derivative assets, demonstrating its strong synergy with Solv. Additionally, Colend is also the core application scenario for CORE token derivative assets, absorbing $17.4M of wCORE and $5.2M of stCORE. The yield scenarios provided by Colend for CORE LST have boosted users' willingness to stake CORE while supporting its value.

Furthermore, BTC Restaking has become a stable yield scenario for BTC derivative assets. In August, the leading BTC Restaking project Pell Network quickly drove ecosystem TVL growth after launching on Core, with inflow assets still primarily coming from Solv Protocol, accumulating $108.3M in Solv derivative assets. In terms of project incentives, Pell Network provides the highest multiplier of points rewards support for SolvBTC on Core, while Core also offers a 5X Ignition Drop reward for Pell Network, further enhancing the participation and application of BTC LST in the Pell Network protocol within the Core ecosystem. As of now, Pell Network's cumulative TVL has reached $271.7M, with nearly half of the contribution coming from the Core ecosystem.

*https://defillama.com/chain/CORE*

Incentive structure supported by the airdrop and market performance of the native token $CORE

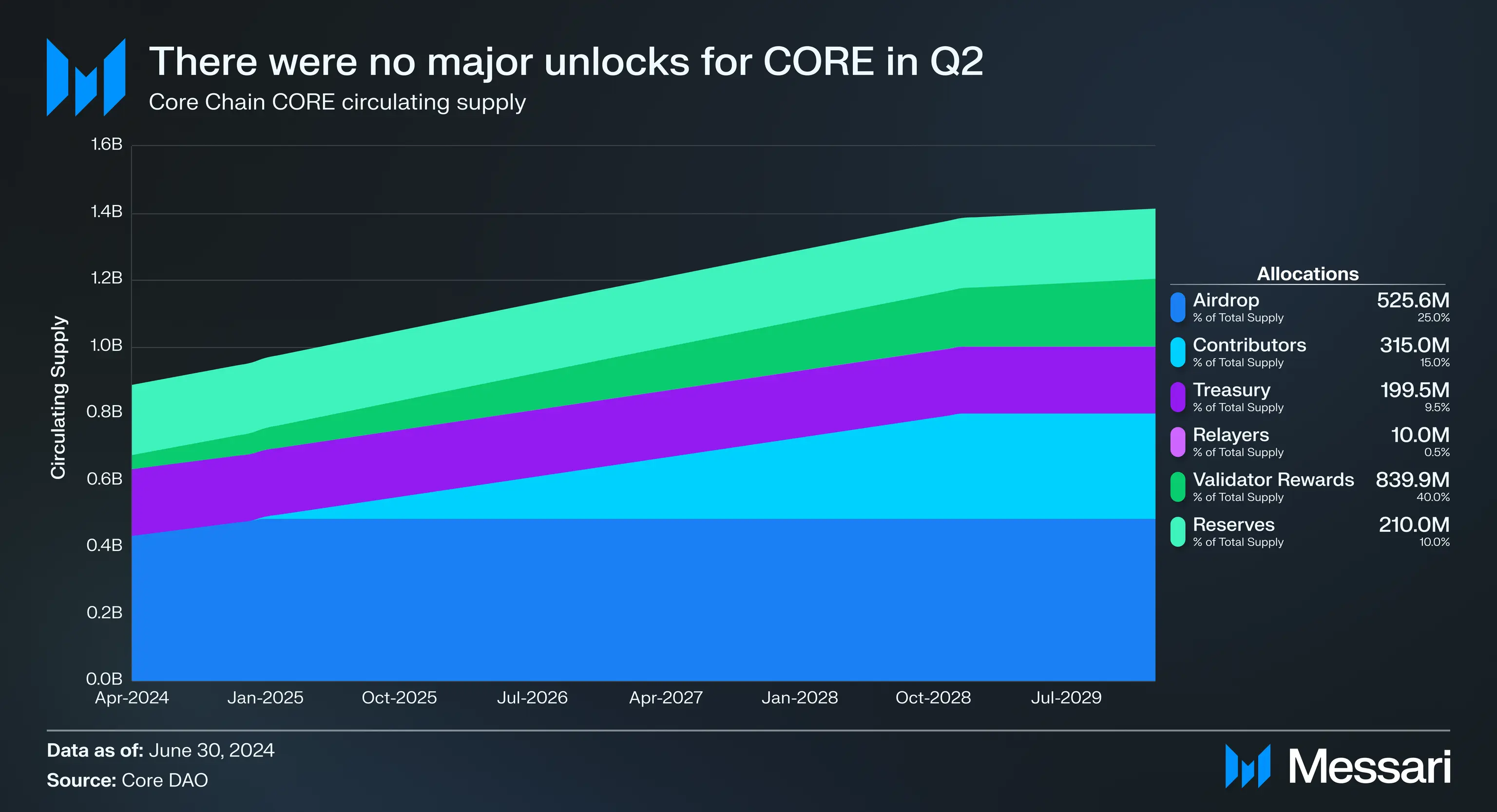

In May 2024, Core launched the Sparks incentive program aimed at accelerating ecosystem adoption and expansion by rewarding on-chain contributors, currently in its second season. Unlike projects that rely on point incentives and have unclear token issuance expectations, Core launched its native token $CORE as early as 2023 and successfully completed its initial airdrop, laying a solid community foundation. $CORE, as the ecosystem's native token, is primarily used for paying transaction fees, network staking, earning rewards, and participating in on-chain governance. According to the Tokenomics design, user rewards account for 25.029% of the total supply of $CORE, totaling 525.6 million tokens. Previously, the airdrop activity conducted by Core through the Satoshi App distributed a large number of tokens to ecosystem participants, increasing users' long-term attention and continuous contribution to its ecosystem. The second season airdrop plan will unlock 24.7 million $CORE, of which 17 million will be used to reward participants, continuously driving user enthusiasm for participation in the Core ecosystem.

2.2 Corn: Efficiently Attracting BTC LST Market Liquidity through Points Derivative Gameplay

Basic Information

Corn is a recently launched ETH L2 network that uses tokenized Bitcoin (BTCN) as gas fees and economic incentive tools, aiming to unify the interests of users, developers, and liquidity providers. The core of Corn's incentive mechanism is the veCHAIN model, where stakers of the CORN token will determine the distribution of network rewards.

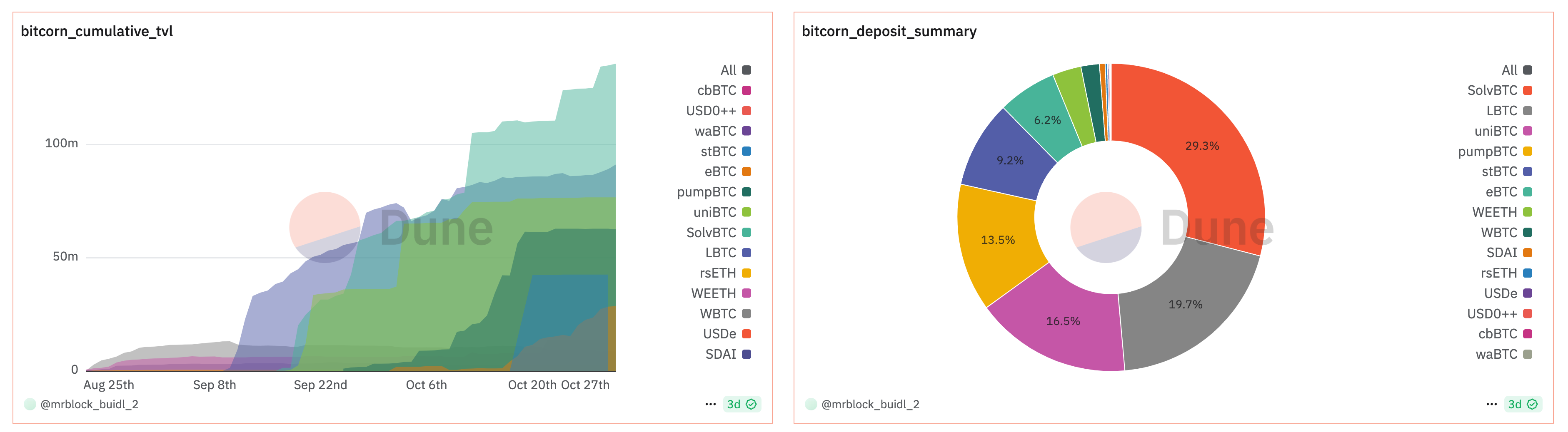

Currently, Corn has not launched its mainnet but has effectively absorbed $425.8M in funds through deposit activities launched in collaboration with multiple parties, significantly surpassing already launched BTC scaling layers like Merlin and BSquared. These deposits are primarily concentrated in pools jointly launched with several BTC LSTs, including LBTC, SolvBTC.BBN, eBTC, PumpBTC, and uniBTC on Pendle, accounting for 85% of the current total TVL.

https://dune.com/mrblock_tw/corn

Growth Strategy

- Leading BTC LST points derivative gameplay in collaboration with Pendle

The points derivative market is one of the key strategic scenarios for BTC LSTs as yield-generating assets. As the leading protocol in this sector, Pendle began integrating various BTC LSTs at the beginning of September. Currently, the collaboration between Corn, Pendle, and BTC LSTs supports five major BTC LST assets: LBTC ($41.5M TVL, $1.1M 24h Volume), SolvBTC.BBN ($97.5M TVL, $300K 24h Volume), eBTC ($20.2M TVL, $658.4K 24h Volume), PumpBTC ($60.5M TVL, $437K 24h Volume), and uniBTC ($70.6M TVL, $20.8K 24h Volume), capturing 11.4% of the total BTC LST market. The multi-party collaboration has generated a positive synergistic effect:

For BTC LST holders, the points leverage market provides diverse strategic gameplay, with Pendle becoming a major application scenario for 10%-30% of the total supply of BTC LSTs. In addition, Corn also provides the maximum multiplier of points incentives for these pools, further attracting more holders to participate. For Corn, BTC LSTs are the core contributing factor to driving TVL growth in its early stages. Currently, these pools are the only applications generating external benefits in Corn's points mining activities, laying the foundation for its future mainnet launch.

*https://app.pendle.finance/trade/points*

TVL BootStrap Campaign

In Corn's existing points mining design, users earn 1 Kernel point for every $1 worth of assets deposited every 210 minutes. These deposits can be withdrawn at any time without incurring any penalties or fees, providing great flexibility. The goal of this campaign is to attract initial liquidity through Kernel point incentives. However, currently, apart from the actual benefits generated by the BTC LST pools in collaboration with Pendle, other deposits have not brought more value to the network. The flexibility of withdrawing deposits at any time also poses risks for short-term mining, which may lead to the inflation of Corn points and dilute the expected value allocated to individuals.

2.3 BOB: Secure Bridging and Strong Ecosystem Boost Asset Aggregation

Basic Information

BOB is an innovative hybrid Layer2 network that combines the advantages of Bitcoin and Ethereum. It utilizes Ethereum smart contracts and EVM features, employing rollup technology to enhance transaction processing capacity and scalability. At the same time, BOB's final transaction confirmations are completed on the Bitcoin blockchain, benefiting from the high security provided by the BTC PoW consensus mechanism. Currently, BOB's total TVL has reached $65.7M, with assets primarily composed of $WBTC.

*https://defillama.com/chain/BOB?volume=true*

Growth Strategy

Based on the bridging architecture that addresses trust and liquidity fragmentation issues, BOB's ecosystem growth over the past six months has also benefited from the narrative of BTC (re)staking, launching one-click liquid staking services and leveraging strong market power and ecosystem collaboration to collectively drive ecosystem growth.

Liquid Staking Services and Ecosystem Integration

BOB Stake integrates multiple liquid staking service providers and DeFi platforms, allowing users to complete multi-protocol staking with a single Bitcoin transaction through BOB Gateway. With BOB Stake, users can stake BTC to multiple LST protocols with one click, reducing time and costs. Additionally, BOB Stake deeply integrates the LST staked by users with DeFi protocols, making BOB a convenient entry point for BTC liquid staking and DeFi applications.

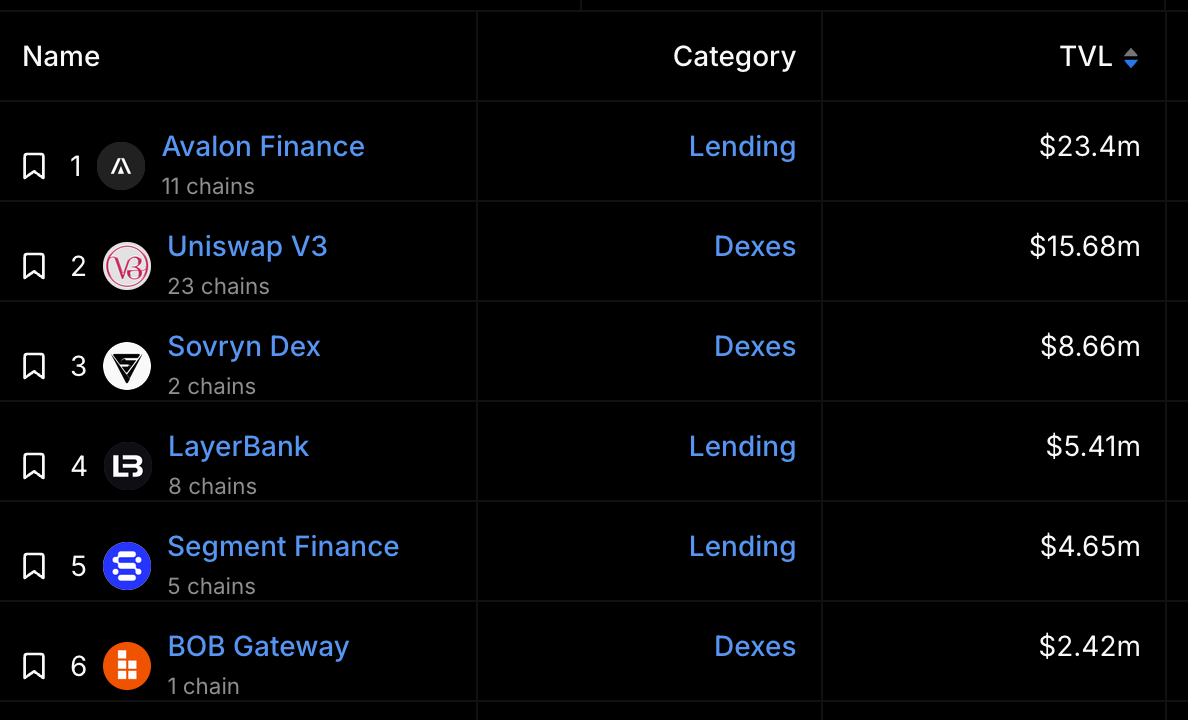

In terms of ecosystem development, BOB Stake integrates various staking protocols centered around Babylon staking, supporting liquid staking tokens (LST) including SolvBTC.BBN, uniBTC, and PumpBTC. BOB has also become the preferred BTC staking platform for multiple aggregators and wallets, attracting over 3 million users on the Staking Rewards platform. Furthermore, BOB has integrated with dozens of DeFi protocols such as Avalon, Layerbank, and Segment, providing diverse yield application scenarios for BTC LST while continuously strengthening market influence. Currently, Avalon, as the main lending protocol within the BOB ecosystem, attracts 35.6% of on-chain asset accumulation, almost entirely composed of SolvBTC.BBN's supply. However, the utilization rate is only 8.9%, indicating that the actual borrowing demand in the BOB ecosystem is low, and liquidity aggregation and ecosystem protocols need to be strengthened.

*https://defillama.com/chain/BOB*

Incentive Program BOB Fusion

BOB Fusion is the core incentive program within the BOB ecosystem, aimed at incentivizing users to earn points through cross-chain assets, locked participation, ecosystem project interactions, and referral mechanisms. Supported deposit assets include BTC-backed assets, stablecoins, and ETH LSTs. In the current third season of BOB Fusion, behaviors such as holding, lending, and trading yield-generating assets like SolvBTC.BBN receive the highest multipliers compared to other assets. This incentive program has significantly propelled the development of the BOB ecosystem, attracting over 147,000 users, more than 100 partners, and 60 ecosystem projects to launch.

3 Summary

By observing the emerging forces of the BTC ecosystems in Core, BOB, and Corn, we can see the differentiated strategies in asset accumulation. Core has successfully attracted a large inflow of assets through deep integration with the growing Solv Protocol derivative assets and the innovative introduction of dual staking mechanisms to provide stable yields. Corn has successfully absorbed a large amount of BTC LST funds through the points derivative gameplay launched in collaboration with Pendle, laying the foundation for its future mainnet launch. BOB has attracted significant assets through extensive BTCFi project integration and one-click liquid staking services.

From the perspective of the liquidity of BTC-backed assets on-chain, the key to effectively achieving ecosystem capital accumulation lies in connecting and incentivizing large-scale incremental anchored assets, forming combinable yield strategies through diversified DeFi applications, and providing multi-faceted incentive expectations. The synergistic effect will drive the activity and liquidity of BTC-backed assets across various chains. Currently, the TVL of BTC-backed assets in L2 and sidechain expansion networks is approximately $1.6 billion, accounting for only 0.14% of the total market capitalization of BTC. As BTC liquidity is gradually released in the future, there remains significant growth potential for the accumulation of BTC assets across various chains and the application scenarios of the BTCFi ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。