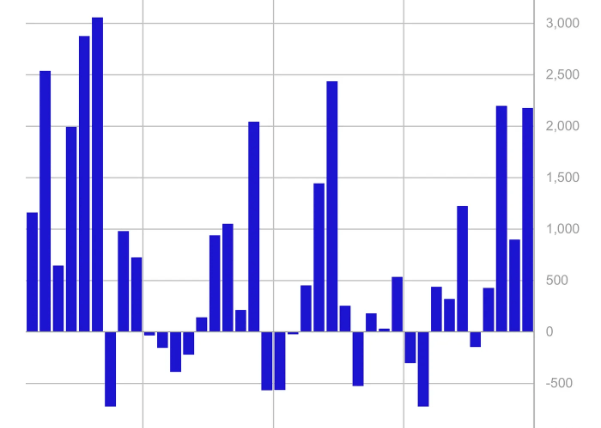

With $2.2 billion in inflows, bitcoin (BTC) was identified in Coinshares’ analysis as the main asset fuelling the spike.

Due to the past week’s inflows and previous price increases, total assets under management (AUM) have already surpassed $100 billion for the second time in history, reaching levels that were last observed in early June 2024 at $102 billion. Weekly trade volumes increased by 67% to $19.2 billion, amounting to 35% of all bitcoin transactions on reliable exchanges.

The United States produced a majority of the inflows with moderate contributions from Germany ($5.1m), Australia ($2.1m), and Hong Kong ($0.7m), highlighting a diverse global investment landscape.

Ethereum (ETH) experienced a sharp contrast to bitcoin’s bullishness with modest inflows of $9.5 million. On the other hand, Solana witnessed an additional $5.7 million in inflows last week. There were also small inflows into a variety of altcoins, with Polkadot ($0.67m) and Arbitrum ($0.2m) standing out.

This rise in digital asset investments could be indicative of the growing possibility of a Republican victory in the U.S. elections. Donald Trump‘s pro-crypto stance has seen investors use digital assets as an investment hedge against the turbulent global political and economic landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。