With the U.S. election just hours away, bitcoin (BTC) faces heightened volatility as the market anticipates a sharp reaction to the presidential outcome. Traders are watching closely, as some analysts speculate that a win by Donald Trump may lead to a price surge, while a Kamala Harris victory could trigger caution, if not bearish sentiment. As BTC trades around $68,178 after a recent low of $67,549 on Nov. 3, the crypto market braces for potentially significant price swings.

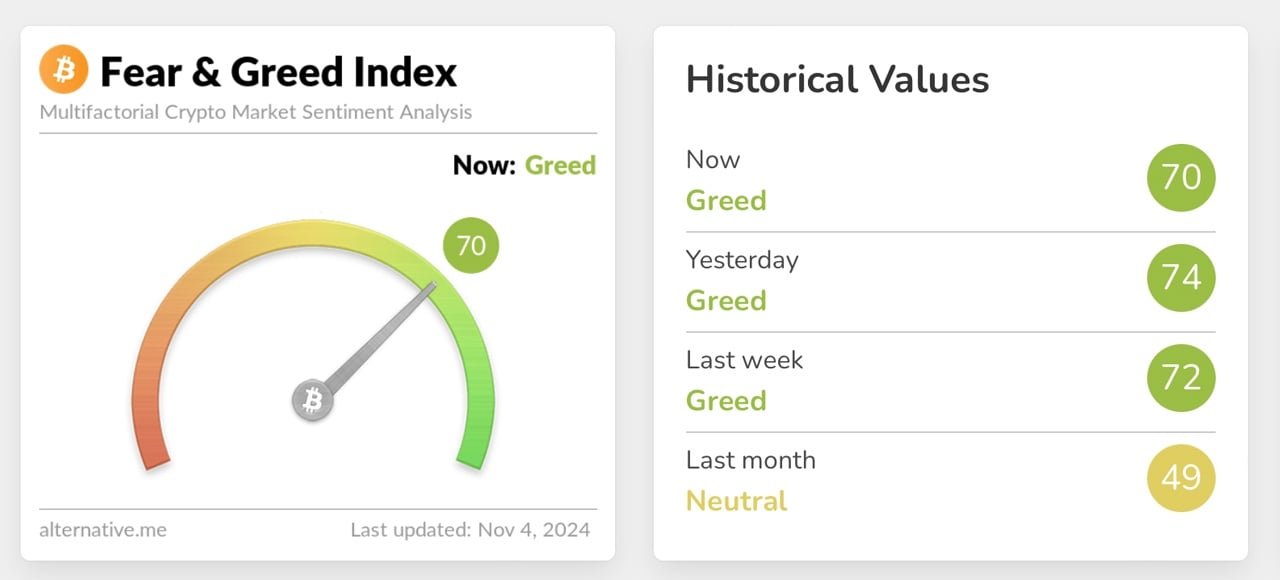

Crypto Fear and Greed Index.

The core of this volatility rests on the candidates’ differing stances toward cryptocurrency. Trump, who has previously shown support for digital assets, is seen by many as a favorable choice for crypto. A Trump win, some believe, could result in reduced regulatory pressures, encouraging higher investments in the space. In contrast, Vice President Harris’s approach is viewed as likely to extend current regulatory efforts, following President Biden’s policies, which many interpret as stricter on the cryptocurrency industry.

Harris’s administration is expected to continue emphasizing oversight, potentially deterring new crypto investment or sparking sell-offs among cautious investors. This speculation around regulatory shifts underscores the crypto market’s susceptibility to “fear and greed.” These powerful forces amplify price volatility, particularly when major news events or policy changes loom. Fear-driven sell-offs and greed-fueled buying sprees are common responses to political outcomes that could shape the regulatory landscape.

In this case, market sentiment fluctuates between optimism for a crypto-friendly administration and concerns over tighter restrictions. The election also introduces the possibility of a classic “sell the news” event—a common market occurrence where prices initially rise in anticipation of news and then fall when the event materializes. If the crypto community buys heavily on the belief of a Trump win boosting bitcoin, BTC’s price may spike before ultimately correcting as the excitement wanes post-election.

Alternatively, the opposite can occur, with a significant uptick in BTC’s price following either candidate’s win if broader market optimism prevails, driving a rally. Both scenarios—sharp rises and potential corrections—highlight the current influence of external events on bitcoin’s trajectory. As the world waits for U.S. election results, bitcoin’s price remains subject to sentiment-driven forces and the unique intersection of politics and cryptocurrency regulation. For investors, the stakes are high, as post-election shifts could bring volatility, presenting both risks and opportunities in the days to come.

In any case, the outcome of the U.S. election will be a pivotal moment for bitcoin, illustrating once again how political events can ripple across crypto markets, stirring volatility and reshaping the price landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。