On the 1-hour chart, bitcoin is facing resistance at $69,444, with support near recent lows of $67,459. This range, paired with low volume, signals a period of consolidation. Traders might consider buying around $67,500 if support holds or waiting for a breakout above $69,500. A stop-loss slightly under $67,400 is suggested to manage potential risks in this narrow trading band.

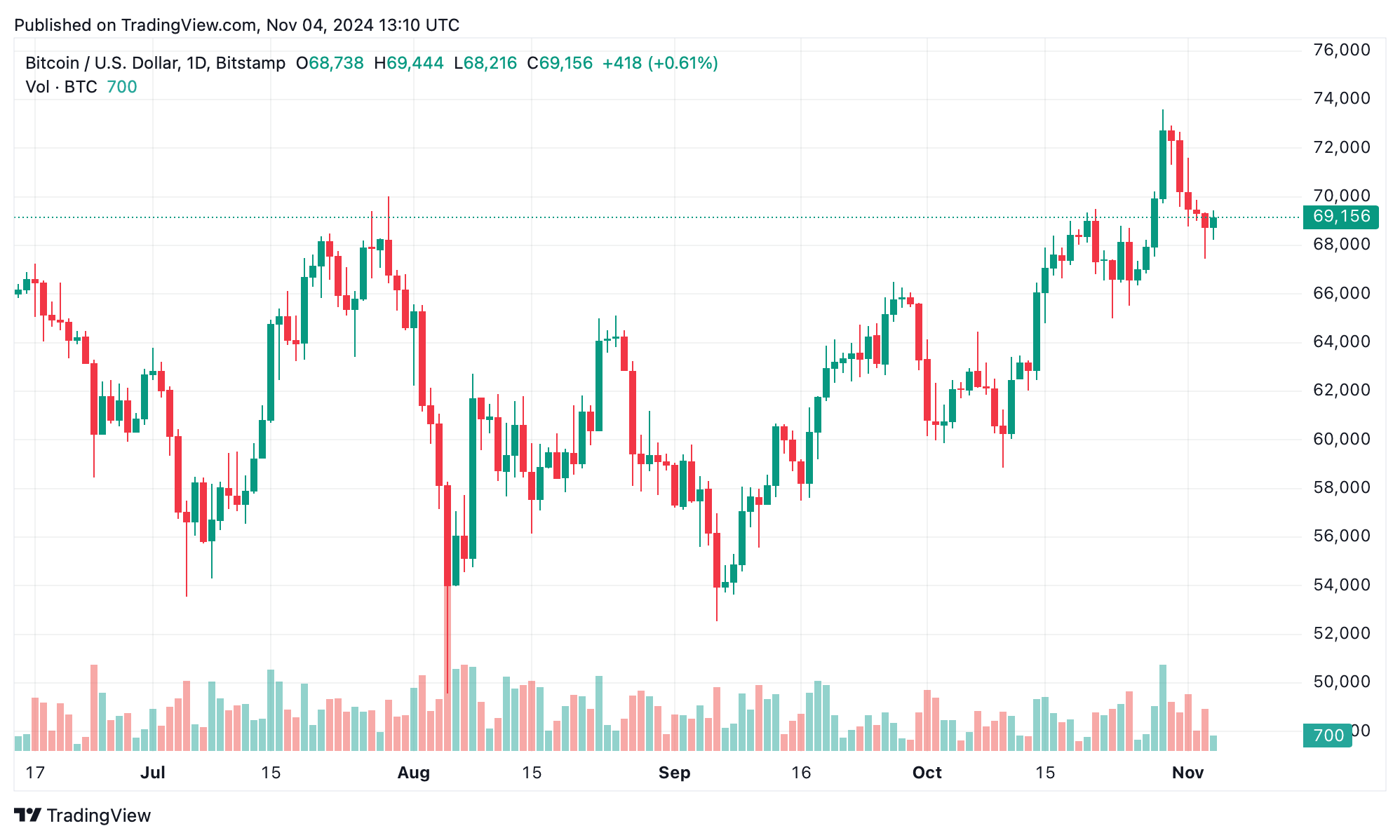

BTC/USD daily chart on Nov. 4.

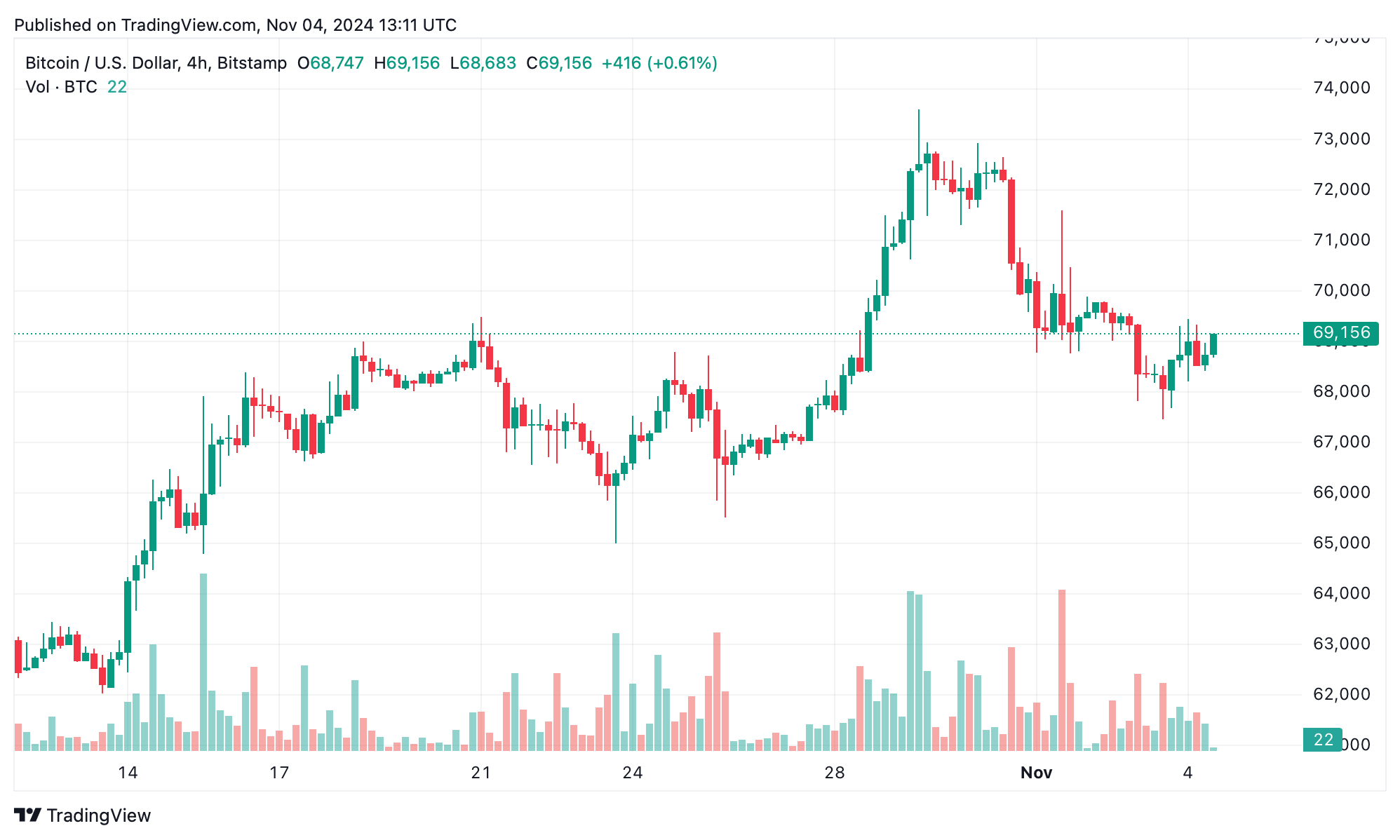

Zooming out to the 4-hour chart, bitcoin’s trend remains bearish from a high of $72,928, with support forming near $67,459. Sellers are holding an upper hand, although reduced sell pressure hints at market stabilization. A break past $69,000 could potentially drive the price toward $70,000, particularly if buying volume rises. Short-term traders may look to enter between $67,500 and $68,000, with a stop-loss under $67,000 to hedge against downward shifts.

BTC/USD 4-hour chart on Nov. 4.

On the daily chart, bitcoin recently peaked at $73,600 before pulling back. Strong resistance sits near $73,000, with support around $67,000. High sell volume in prior sessions indicates potential for more consolidation unless a volume-backed move over $70,000 materializes. Swing traders might watch for stability near $67,000 as a low-risk entry or wait for a solid push above $70,000.

From a technical standpoint, oscillators show neutrality: the relative strength index (RSI) is at 56, Stochastic at 46, and commodity channel index (CCI) at 14. The average directional index (ADX) at 20 reinforces this lack of trend strength, though a momentum indicator at 2,371 offers a subtle buy signal, suggesting latent upward potential.

Regarding moving averages (MAs), the shorter-term exponential moving average (EMA 10) at 69,233 and simple moving average (SMA 10) at 69,663 signal selling pressure, while the EMA 20 and SMA 20, at 68,271 and 68,674, offer some buying support. Long-term MAs, including the EMA 50 at 65,759 and SMA 50 at 65,186, lean bullish, hinting at a positive long-term outlook. Traders are advised to weigh these mixed indicators when shaping short-term strategies.

Bull Verdict:

With a steady push in buyer interest around the $67,000 support, bitcoin shows signs of gearing up for a potential rally. Should it break past the $69,500 mark with solid volume, this move could pave the way toward $70,000 and beyond. Long-term moving averages also favor bullish sentiment, suggesting the market may be primed for upward movement.

Bear Verdict:

Despite holding above $67,000, bitcoin faces significant resistance near $69,444, with strong selling pressure looming from previous highs. Consolidation and reduced volume indicate a cautious market, and without a convincing break above $69,500, bears may continue to control the trend. Short-term traders may consider downside risks if key supports falter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。