On Oct. 31, one petahash per second (PH/s) of computing power was valued at $54.52 per PH/s, the highest hashprice in 30 days. As of today, however, the spot market hashprice stands at roughly $46.55 per PH/s after bitcoin slipped below $70,000 to the $69,400 range. Data also shows that on Oct. 17, hashprice edged past the $53 mark as well.

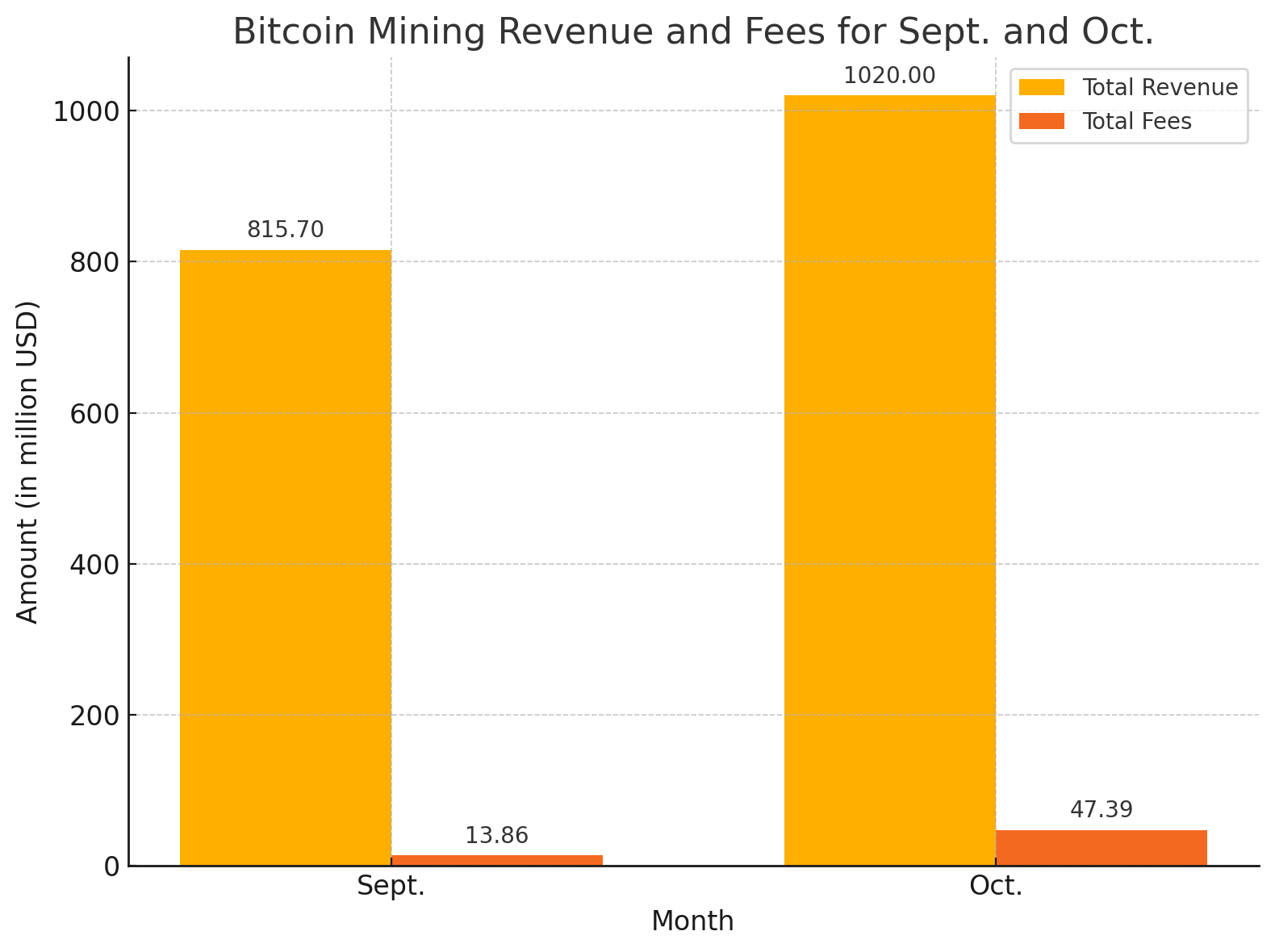

In total, bitcoin miners earned 25.05% more in October compared to September. That month, miners generated $815.7 million from fees and bitcoin’s subsidy combined. October saw a jump to $1.02 billion in revenue, with $975.22 million from block rewards and $47.39 million from onchain fees.

The leap from September’s $13.86 million in onchain fees to October’s $47.39 million marks a 241.91% growth. At the same time, bitcoin’s total computational power is at an all-time high. Stats from Nov. 1, 2024, show Bitcoin’s seven-day simple moving average (SMA) hashrate at a whopping 765 exahash per second (EH/s).

Current block intervals are moving faster than the usual 10-minute average, sitting at 9 minutes and 18 seconds. This faster pace points toward a probable 7.5% jump in difficulty, with an update expected around Nov. 4, 2024, as more than 340 blocks remain to be mined before the retarget.

As October closed with bitcoin miners seeing a strong revenue boost and rising hashrates, the mining sector now faces both potential challenges and opportunities. With computational power at unprecedented levels and quicker block intervals, a difficulty increase appears imminent—setting the stage for a new phase in the network’s evolution come early November.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。