The following guest post comes from Bitcoinminingstock.io, providing comprehensive data, in-depth research, and analyses on Bitcoin mining stocks. Originally published on Oct. 30, 2024, it was penned by Bitcoinminingstock.io author Cindy Feng.

With the U.S. election only days away, are you wondering which party might be better for Bitcoin mining stocks? In fact, there is a few popular research pieces about the broader stock market and U.S. elections.

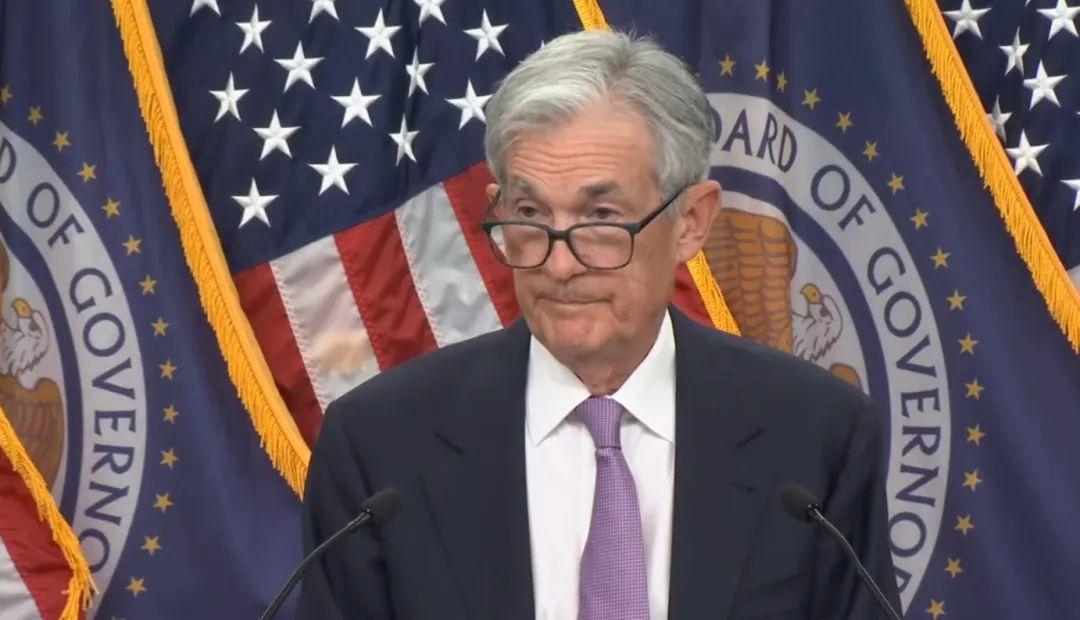

S&P 500’s “Predictive” Power in U.S. Elections

The S&P 500 has had an uncanny ability to “predict” presidential election outcomes. According to LPL Financial, this index has accurately forecasted the winner in 20 out of the last 24 elections. Here’s how this pattern has worked: when the S&P 500 posted a positive return in the three months leading up to election day, the incumbent party won the White House 12 out of 15 times. Conversely, when the index showed negative returns during that period, the incumbent party lost 8 of the last 9 times.

This year, with the S&P 500 showing positive performance, historical patterns would suggest a win for the incumbent party if the trend continues. However, caution is advised: the political landscape we are living in is more unpredictable than ever. The 2020 election, for example, broke this pattern when Donald Trump lost to Joe Biden despite the S&P 500 gaining 2.3% in the months before the election.

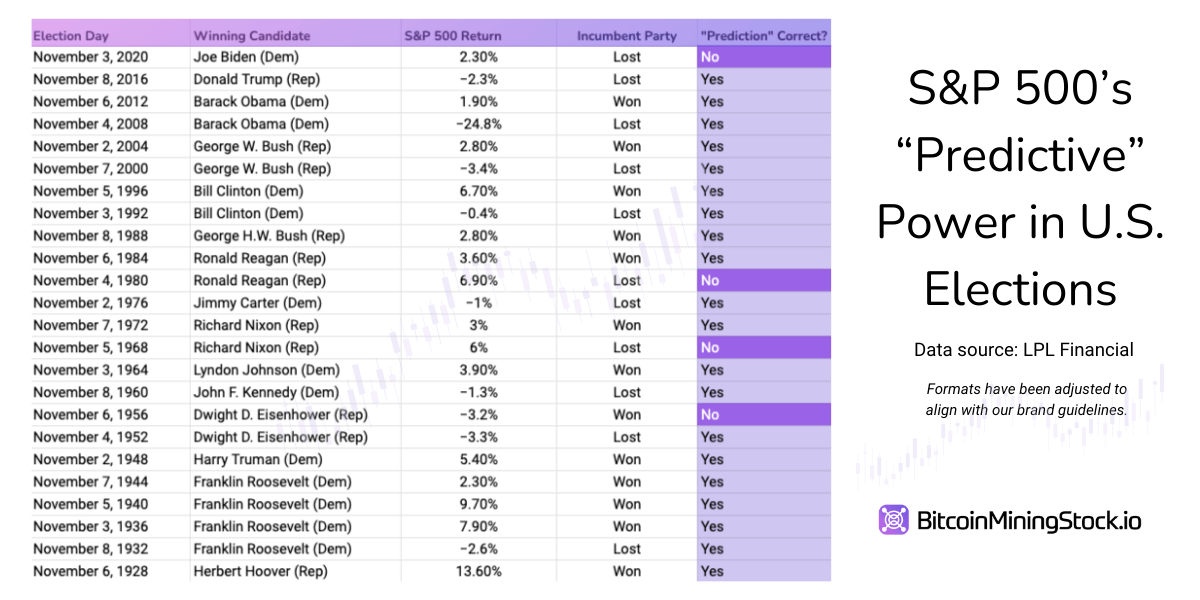

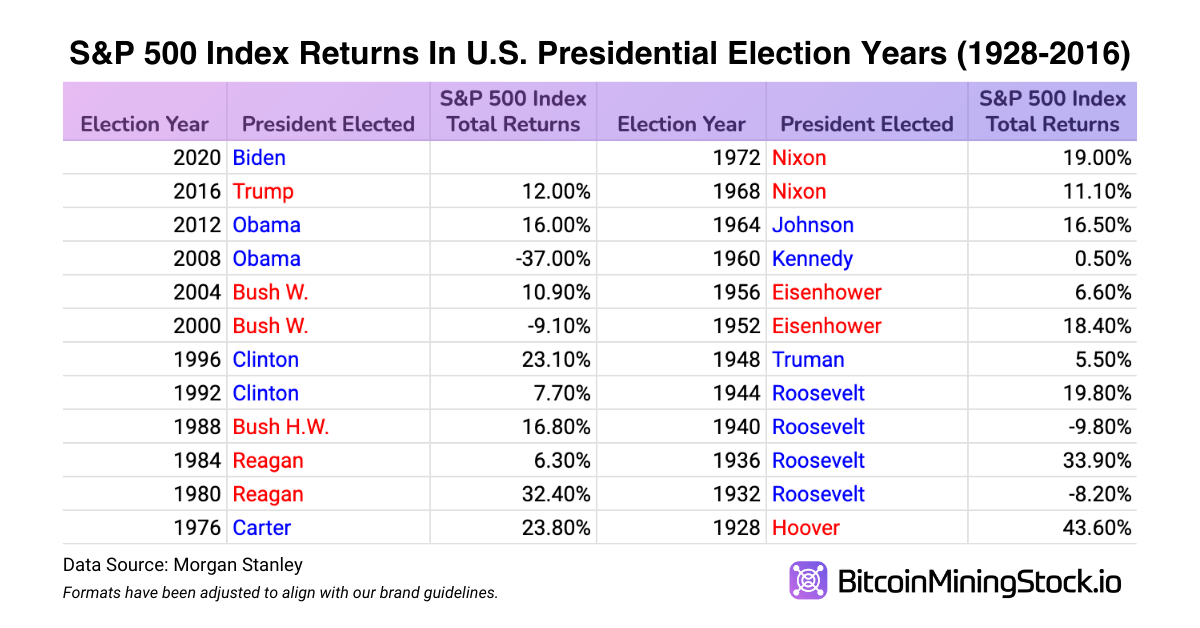

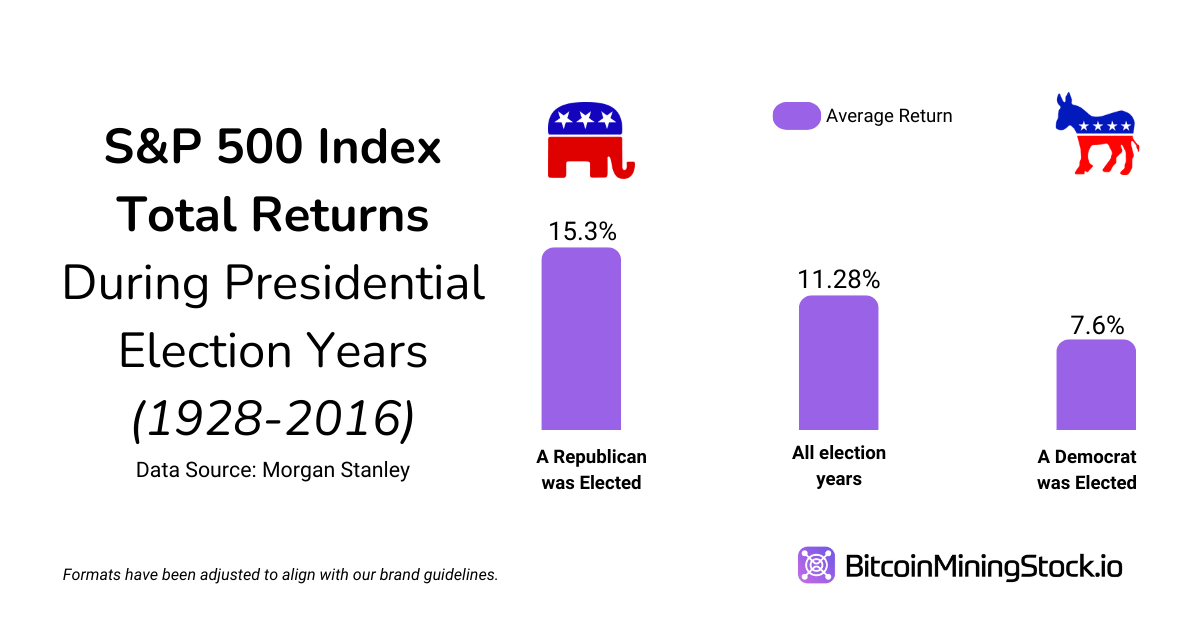

S&P 500 Index Returns in U.S. Presidential Election Years

Based on Morgan Stanley’s report, the S&P 500 historically has delivered gains in most election years, with 83% of the 23 election years since its inception showing positive returns.

Notable insights include:

- General Positive Performance: The S&P 500 posted gains in 83% of presidential election years, suggesting a trend of stability and growth regardless of the political landscape.

- Returns by Party Transition: When a Democrat was in office and another Democrat won, the S&P 500’s average return for the year was 11.0%. When a Democrat was in office and a Republican took over, the average return increased to 12.9%.

This data reveals that regardless of which party wins, election years tend to foster positive S&P 500 performance. However, much like the cautionary note on predictive power, this historical return trend is not guaranteed. The market’s reaction depends heavily on specific economic conditions, policy changes, and external factors in any given year.

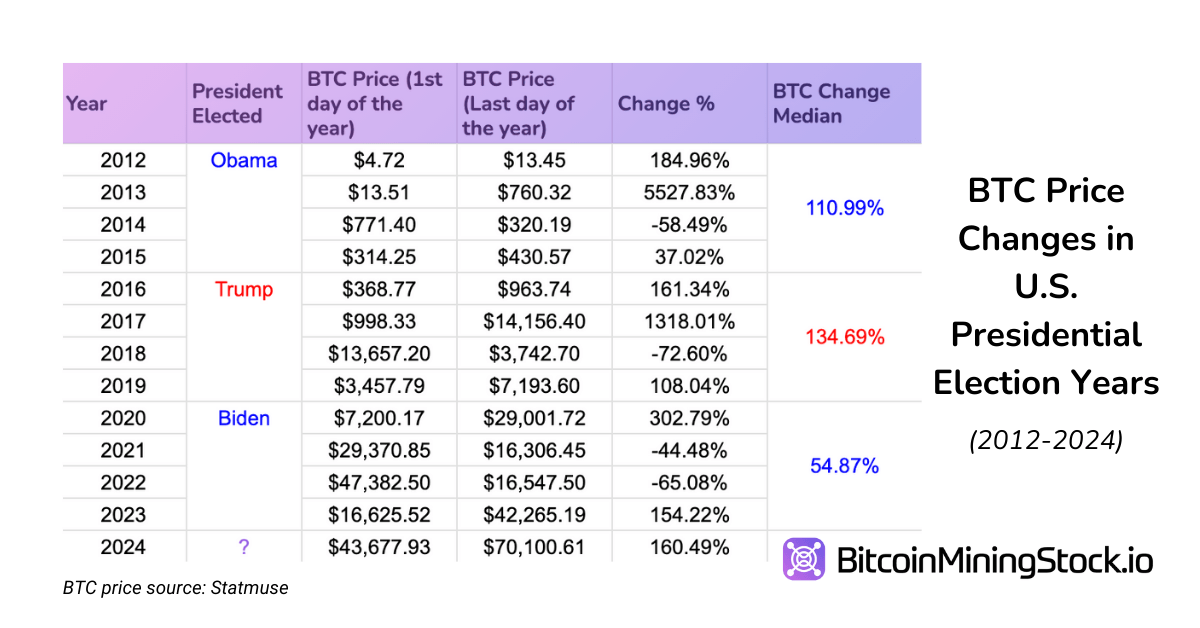

BTC Price Changes in U.S. Presidential Election Years

Inspired by the S&P 500’s historical election year returns, I examined Bitcoin’s price changes across past election cycles. The reason for examining Bitcoin’s price is that Bitcoin mining stocks are highly correlated with it. While both are volatile, mining stocks tend to experience more amplified price swings than Bitcoin.

Key BTC election year trends include:

- 2012 Election (Obama): Bitcoin started at $4.72 that election year and climbed to $430.57 by December 31, 2015, with a median price change of 110.99%.

- 2016 Election (Trump): Bitcoin started at $368.77 that election year and rose to $7,193.60 by December 31, 2019, with a median price change of 134.69%.

- 2020 Election (Biden): Bitcoin started at $7,200.17 that election year and climbed to $42,265.19 by December 31, 2023, with a median price change of 54.87%.

While Bitcoin has shown substantial gains in these years, attributing this solely to election outcomes or party control oversimplifies the picture. Bitcoin’s growth is driven by global adoption, technological advancements, and decentralized market dynamics, which makes it less dependent on specific political administrations compared to traditional stocks.

Limitations of Using Election Data to Predict Bitcoin Trends

Bitcoin’s decentralized nature limits the predictive power of U.S. election cycles. With no direct ties to any nation’s political system, Bitcoin grows according to global demand, technology, and macroeconomic factors. As a result, while election years can bring volatility to Bitcoin’s price and by extension, Bitcoin mining stocks, the cryptos’ growth trend is minimally impacted by political changes in the long run.

A Long-Term View: Zoom Out and Let Markets Do Their Thing

Let’s be real: predicting the market based on election outcomes can be as reliable as predicting the weather a year in advance. Historically, the U.S. stock market tends to rise during most presidential terms, regardless of party. Darrow Wealth Management finds that political gridlock—when different parties control the presidency, Senate, and House—is typically the best for markets. Why? Because it limits big policy shifts, allowing businesses to carry on without the huge uncertainty.

In fact, stock returns generally go up over time- unless a financial crisis or other major shock intervenes. So, while election years add extra excitement, the best approach is to stay focused on the big picture.

Bitcoin and its mining stocks add a unique layer to this. Unlike traditional stocks, Bitcoin isn’t directly tied to the U.S. political structure, and its decentralized nature allows it to grow regardless of the political climate. This resilience highlights the importance of taking a birds eye view. Bitcoin’s price will undoubtedly fluctuate, and Bitcoin mining stocks will follow, but the long-term trend has been positive.

Final Thoughts

Election-year speculation can be fun and political figures come and go. But markets are here to stay—and they have a long-term track record of resilience. Whether it’s Bitcoin or the stock market, they will follow their own path regardless of who sits in the Oval Office.

Outside of the investment space, go out and vote if you can. Each vote shapes not only the present but also the future—the culture and values that you, your children, and grandchildren will inherit.

The original version of this article can be read here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。