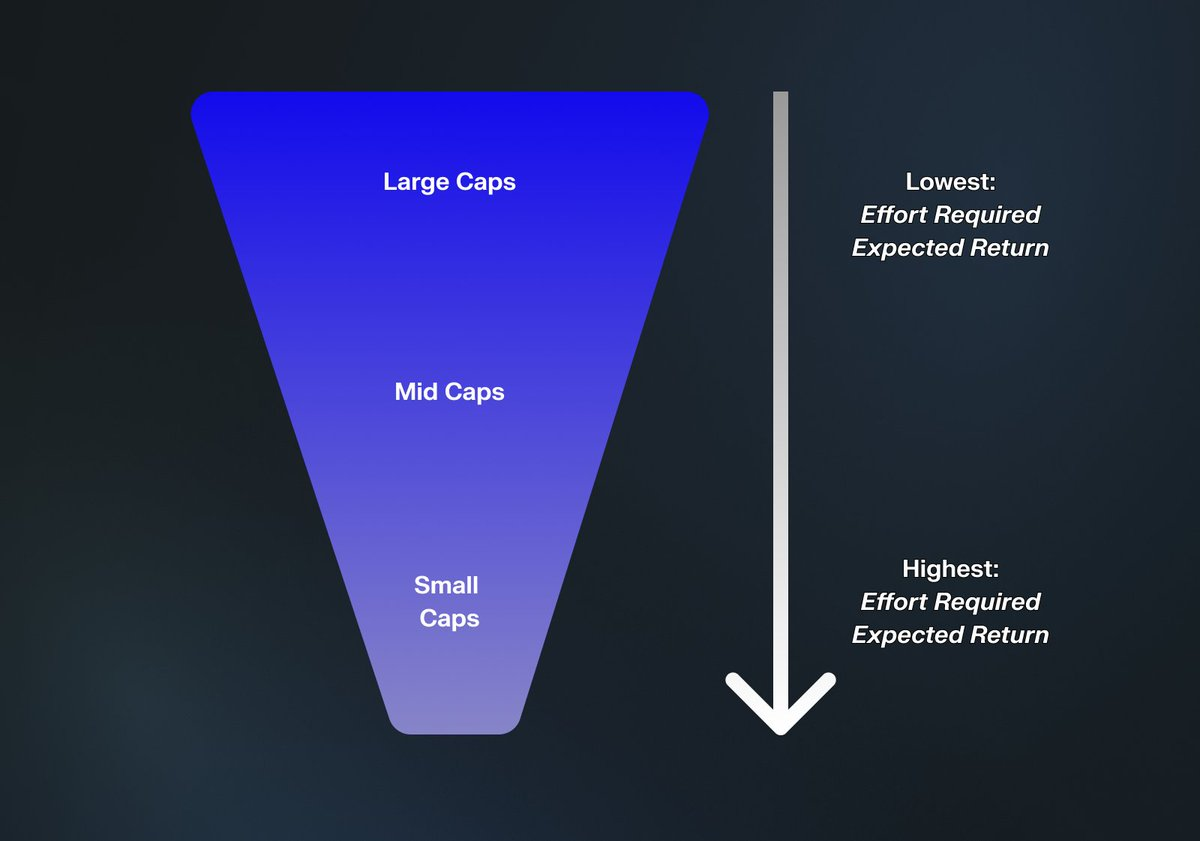

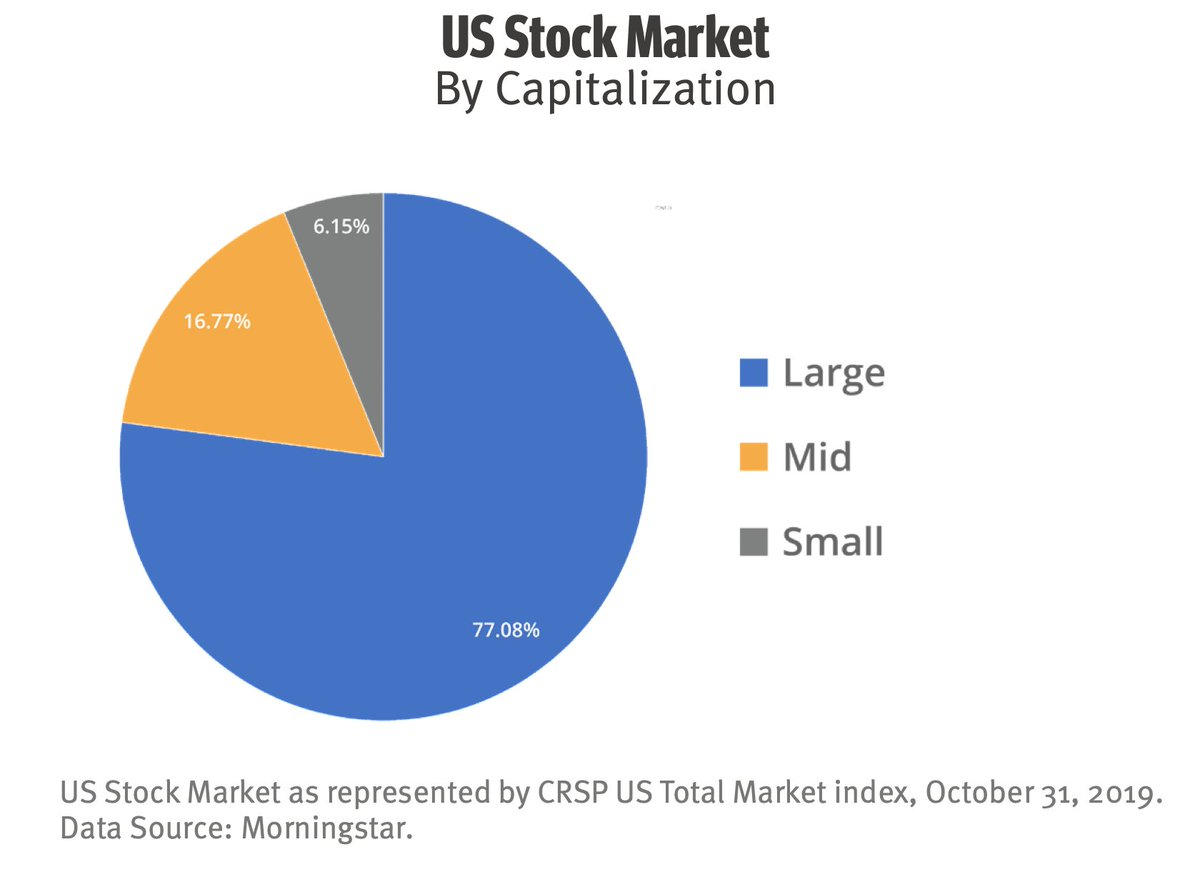

Capital will naturally concentrate disproportionately on high market cap assets, as investors are mostly lazy and prefer to seek confirmation bias.

Author: MONK

Translation: Deep Tide TechFlow

- $DOGE -> Mid-cap Meme Coin Rotation

In my opinion, the performance of Meme coins is closely tied to DOGE. With the elections approaching, $DOGE is back in the spotlight, and I think it will be interesting to analyze how value is dispersed within the Meme coin category. Here are my thoughts. Discussion as follows:

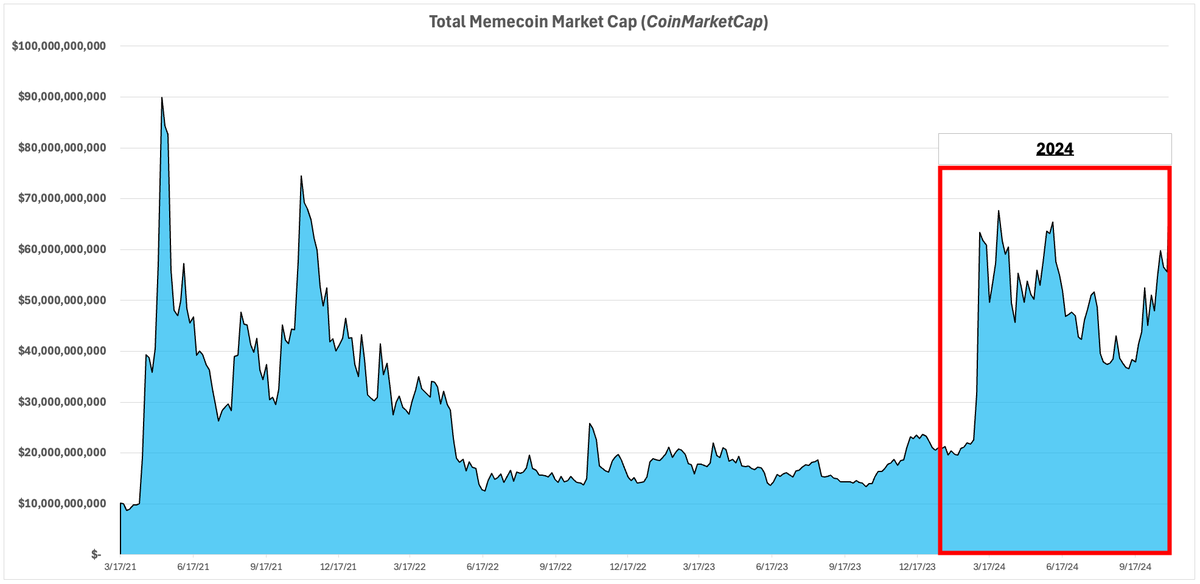

- I believe that without a significant rise in $DOGE / $SHIB, it is becoming increasingly difficult to drive market share for Meme coins. In 2024, the total market cap of the overall Meme coin market has risen significantly, nearing the historical peak (ATH) of 2021:

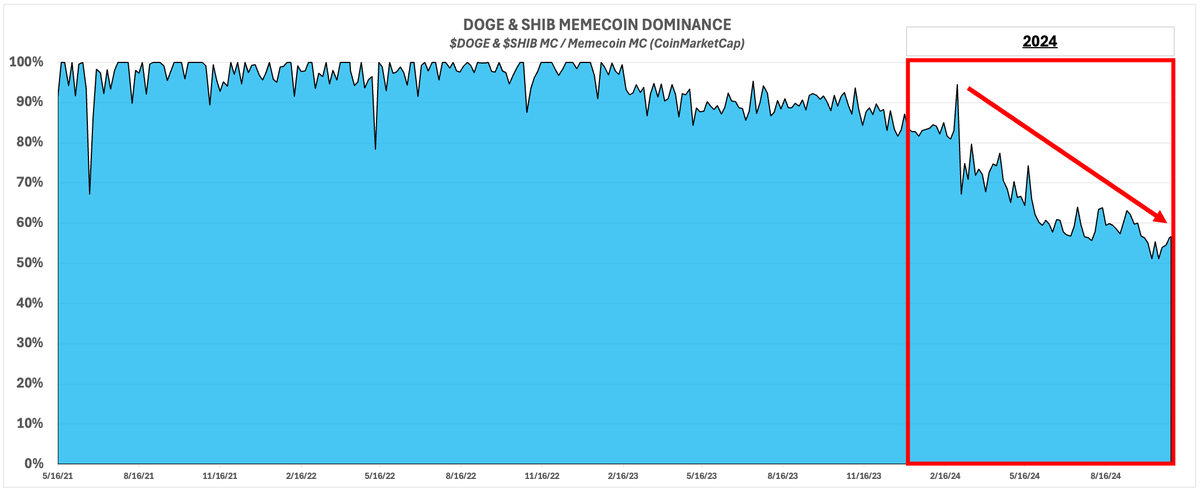

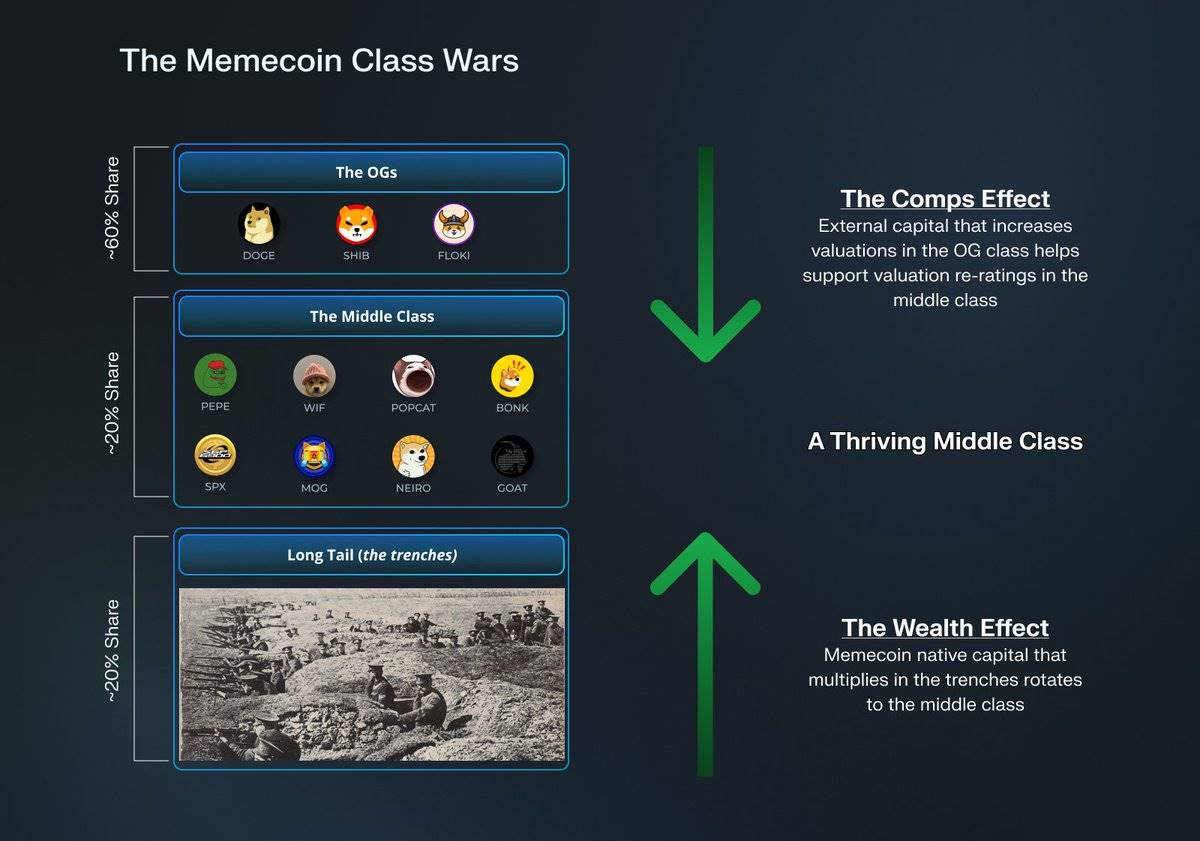

- Most of this year's value growth has come from explosive growth in non-$DOGE / $SHIB Meme coins. Currently, the market dominance of DOGE and SHIB has dropped to about 57%:

- Nevertheless, the market share of Meme coins in cryptocurrency is still below the level when $DOGE reached its ATH in 2021. The influence of DOGE cannot be ignored; this week, the total market cap of this asset increased by $7 billion, roughly equivalent to one $PEPE + $WIF.

I find the outlook for $DOGE quite interesting, even without new retail interest. I expect the dominance of $DOGE / $SHIB to gradually rebound. Currently, there is a lot of capital on the sidelines in this round of Meme coin rebound…

…these are middle investors who are skeptical about the legitimacy, sustainability, and impact of this category. Or they may not want to participate in trades with low liquidity and high turnover. As a result, many have missed the opportunities presented by $WIF, $PEPE, and $BONK.

However, sentiment around Meme coins has changed significantly. Interest in this category is far greater than it was a few months ago, with reports on $GOAT being a great example. Even self-proclaimed middle investors are starting to change their attitudes:

I believe these participants may bid for a new round of rebounds for $DOGE. This is a trend I see pushing Meme coins and the cryptocurrency market share to new heights. Any news could act as a catalyst, whether it be new government agencies, Elon Musk, Trump, or other factors.

Most of the funds may come from other crypto sectors. Retail investors could help, as I believe $DOGE is even more recognized among the general public than $SOL, but the current liquidity environment has changed significantly compared to 2021.

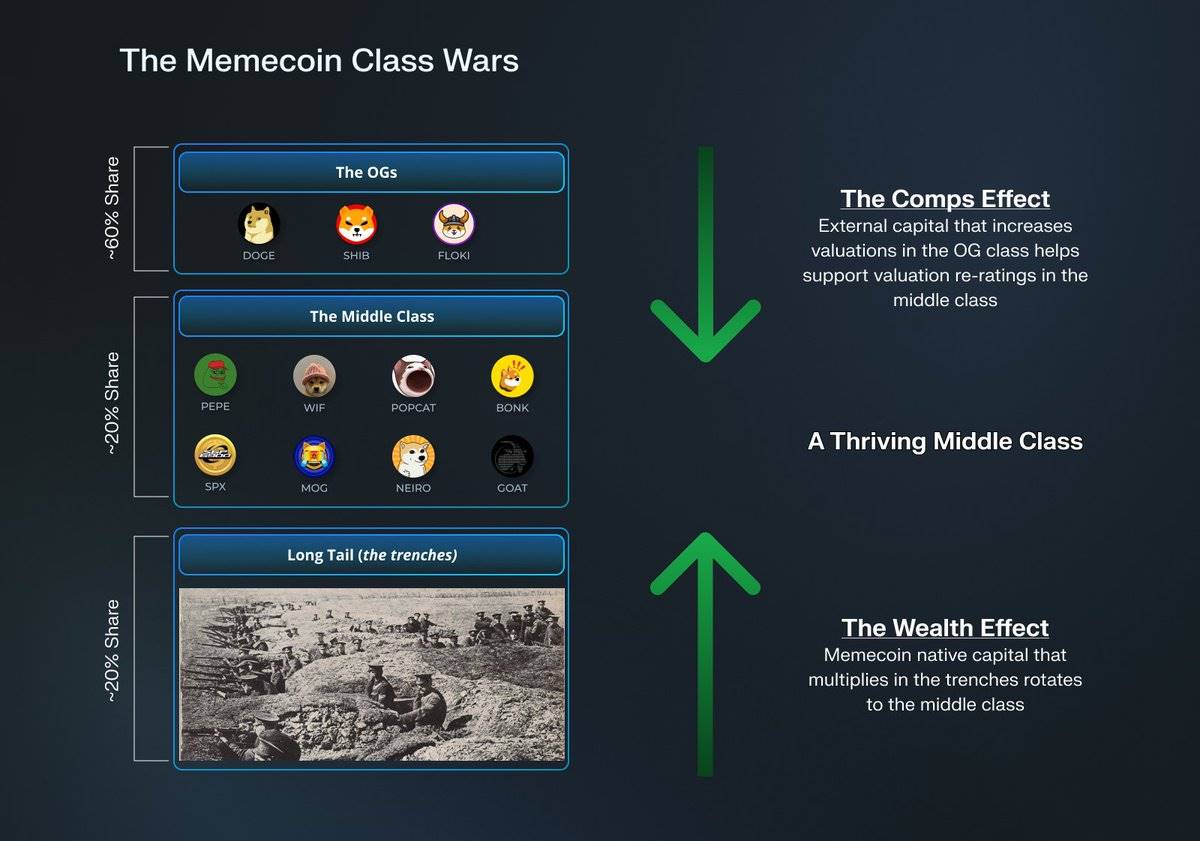

- So, what will happen after the $DOGE rebound? I believe any strong movement in $DOGE / $SHIB will bring additional value to the new "Meme coin middle class" and unlock potential for assets like $WIF, $PEPE, and $POPCAT.

For middle investors, the relative attractiveness will be higher. When the market cap of $DOGE is $100 billion, the appeal of $WIF will be greater than when it is $30 billion. As the number of Meme coins with investable assets over $1 billion increases, in this post-$DOGE scenario, the risk-reward ratio of stablecoins also seems less attractive.

As Meme coins gain greater recognition as a field, the theory of middle-class re-rating will also attract new potential buyers. These assets ($PEPE, $WIF, etc.) are more liquid, less volatile, and easier to manage compared to small-cap coins.

After the $DOGE rebound, they also have greater upside potential. I believe middle investors will ultimately seize the opportunity to drive up the prices of these assets, which is necessary in the current situation. I do not believe that $PEPE can reach a market cap of $10 billion in a stagnant $DOGE market.

Therefore, viewing $DOGE as the $BTC of Meme coins, further increases in assets like $PEPE, $WIF, and $POPCAT require a rebound in $DOGE first. I believe there is no obvious benefit for stablecoin investors, and due to the high entry barriers, small-cap coins are still in a rotation phase.

I also see some middle-class investors potentially upgrading to the large-cap category (with $PEPE basically already at this level). Capital will naturally concentrate disproportionately on high market cap assets, as investors are mostly lazy and prefer to seek confirmation bias.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。