Author: Alex Xu, Mint Ventures

Ethena is one of the few phenomenal DeFi projects in this cycle. After its token launch, its circulating market value once exceeded $2 billion (with a corresponding FDV of over $23 billion). However, since April this year, its token price has rapidly declined, with Ethena's circulating market value dropping more than 80% from its peak, and the token price falling as much as 87%.

Since September, Ethena has accelerated its collaboration with various projects, expanding the use cases for its stablecoin USDE. The scale of the stablecoin has also begun to rebound from its low point, with its circulating market value recovering from $400 million in September to around $1 billion currently.

In an article I published in early July titled “Altcoins Keep Falling, It’s Time to Refocus on DeFi”, I also mentioned Ethena, and my view at that time was:

“… Ethena's business model (a public fund focused on perpetual contract arbitrage) still has a clear ceiling. The large-scale expansion of its stablecoin (which had reached $3.6 billion at the time) relies on secondary market users being willing to buy its token ENA at a high price, providing high yield subsidies for USDE. This somewhat Ponzi-like design can easily lead to a negative spiral in business and token price when market sentiment is poor. The key point for Ethena's business turnaround is whether USDE can one day truly become a stablecoin with a large number of 'natural holders', thus completing its transformation from a public arbitrage fund to a stablecoin operator.”

Since then, the price of ENA has continued to drop by 60%, and even though the current price has rebounded nearly twice from its low, it is still over 30% lower than the price at that time.

I am reassessing Ethena at this moment, focusing on the following three questions:

Current business level: Ethena's core business indicators, including scale, revenue, comprehensive costs, and actual profit levels.

Future business outlook: The narratives and future developments worth looking forward to for Ethena.

Valuation level: Is the current price of ENA in an undervalued zone?

This article represents my interim thoughts as of the time of publication, which may change in the future. The views expressed are highly subjective and may contain errors in facts, data, or reasoning logic. Criticism and further discussion from peers and readers are welcome, but this article does not constitute any investment advice.

The following is the main text.

1. Business Level: Current Core Business Situation of Ethena

1.1 Ethena's Business Model

Ethena positions itself as a synthetic dollar project with "native yield," meaning its track is in the same lane as MakerDAO (now SKY), Frax, crvUSD (Curve's stablecoin), and GHO (Aave's stablecoin) — stablecoins.

In my view, the business models of current stablecoin projects in the crypto space are fundamentally similar:

Raise funds, issue debt (stablecoins), and expand the project's balance sheet.

Utilize the raised funds for financial operations to obtain financial returns.

When the returns generated from the project's operational funds exceed the comprehensive costs of raising funds and running the project, the project is profitable.

Taking the centralized stablecoin project — USDT's issuer — Tether as an example, Tether raises US dollars from users, issues debt (USDT) certificates to users, and then invests the raised funds in government bonds, commercial paper, and other interest-bearing assets to obtain financial returns. Considering the wide usage of USDT, its perceived value is equivalent to that of the US dollar in users' minds, yet it can do many things that traditional dollars cannot (such as instant cross-border transfers), so users are willing to provide Tether with US dollars in exchange for USDT without compensation. Moreover, when you want to redeem USDT from Tether, you also need to pay a certain redemption fee.

As a latecomer in the stablecoin space, Ethena is clearly at a disadvantage compared to established projects like USDT and DAI in terms of network effects and brand credibility, which is specifically reflected in its higher fundraising costs. Users are only willing to provide their assets to Ethena in exchange for USDE when there are high yield expectations. Ethena's approach is to incentivize users with project tokens ENA and provide yields from stablecoins (derived from the financial income of project operational funds) to raise funds.

1.2 Core Business Data of Ethena

1.2.1 USDE Issuance Scale and Distribution

Data Source: https://app.ethena.fi/dashboards/solvency

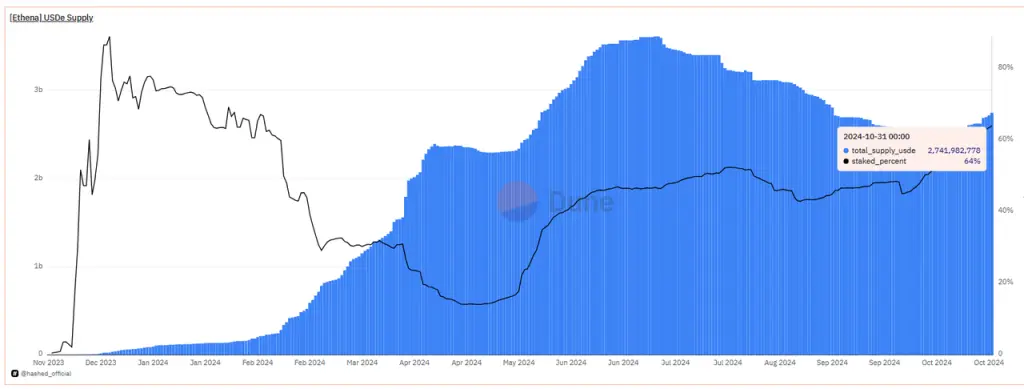

After reaching a new high of $3.61 billion in USDE issuance scale in early July 2024, its scale continued to decline to $2.41 billion by mid-October, where it has since begun to gradually recover, reaching approximately $2.72 billion as of October 31.

Of the more than $2.72 billion, 64% of USDE is currently staked, with a corresponding APY of 13% (according to official website data).

Data Source: https://dune.com/queries/3456058/5807898

It can be seen that the primary purpose for most users holding USDE is to obtain investment income, with 13% being the "risk-free yield" in USDE terms, which is also Ethena's current financial cost for raising user funds.

At the same time, the yield on short-term US government bonds during the same period was 4.25% (data from October 24), while the deposit rate for USDT on the largest DeFi lending platform Aave was 3.9%, and for USDC, it was 4.64%.

We can see that Ethena is still maintaining a relatively high fundraising cost to expand its fundraising scale.

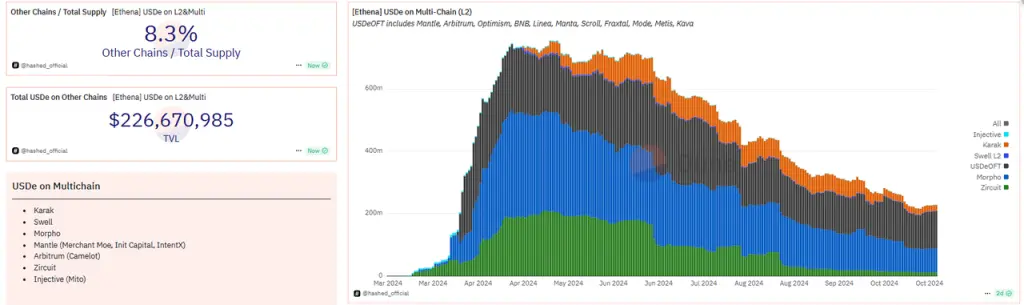

USDE is issued not only on the Ethereum mainnet but also expanded across multiple L2 and L1 networks. Currently, the scale of USDE issued on other chains is $226 million, accounting for about 8.3% of the total.

Data Source: https://dune.com/hashedofficial/ethena_

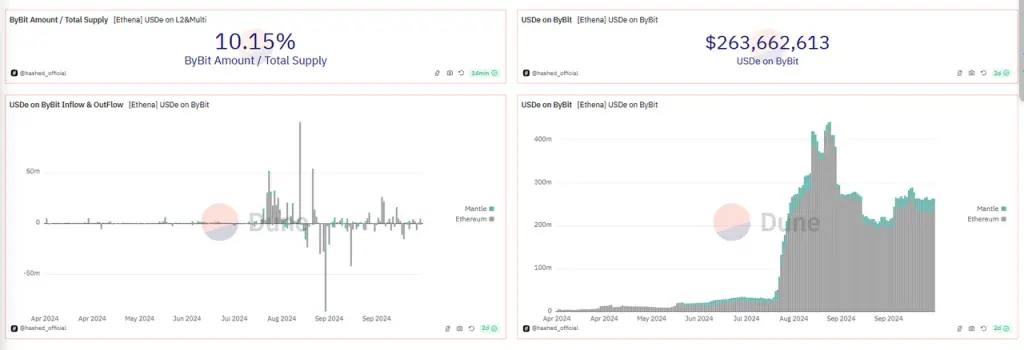

Additionally, Bybit, as an investor and important partner of Ethena, not only supports USDE as collateral for derivatives trading but also offers yields of up to 20% (reduced to a maximum of 10% in September) for USDE held on Bybit. Therefore, Bybit is also one of the largest custodians of USDE, currently holding $263 million in USDE (with a peak of over $400 million).

Data Source: https://dune.com/hashedofficial/ethena_

1.2.2 Protocol Revenue and Underlying Asset Distribution

Ethena's current protocol revenue comes from three sources:

Earnings from staked ETH in the underlying assets;

Funding rates and basis income generated from derivatives hedging arbitrage;

Investment income: holding in stablecoin form to earn deposit interest or incentive subsidies, such as receiving rewards from holding USDC on Coinbase's loyalty program (approximately 4.5% annualized) and holding sUSDS (formerly sDAI) in Spark.

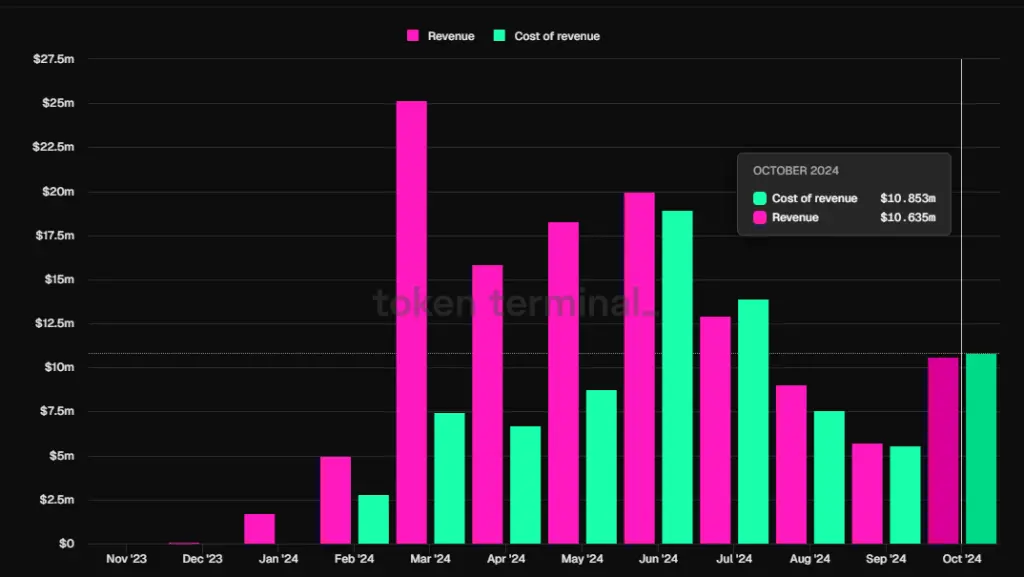

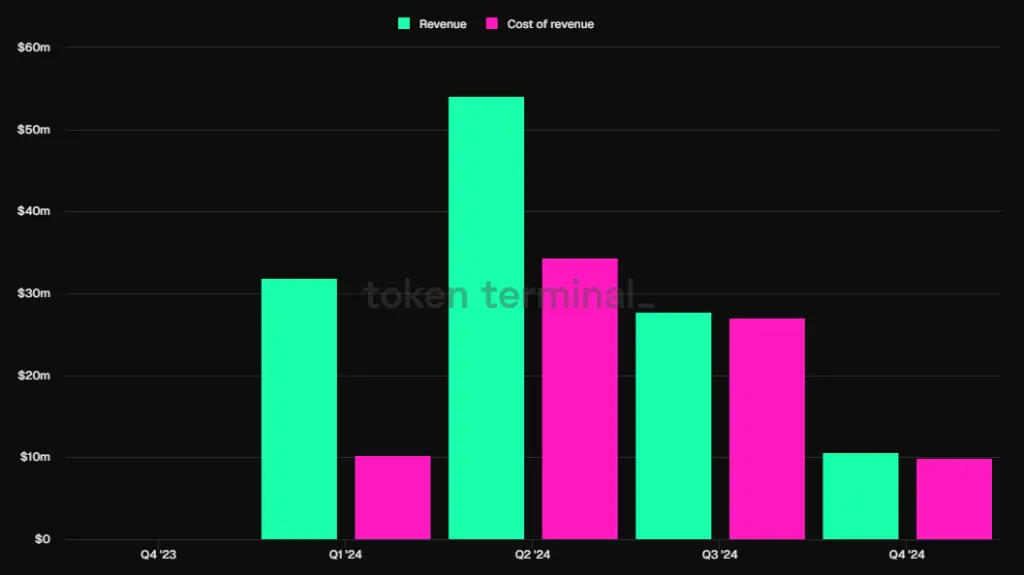

According to data approved by Ethena's official sources from Token Terminal, Ethena's revenue has rebounded from last month's low, with October's protocol revenue reaching $10.63 million, a month-on-month increase of 84.5%.

Data Source: Tokenterminal, Ethena protocol revenue and revenue allocated to USDE (cost of revenue)

Currently, a portion of the protocol revenue is allocated to USDE stakers, while another portion goes into the protocol's reserve fund to cover expenses when funding rates are negative and various risk events.

In the official documentation, it states that "the amount of protocol revenue allocated to the reserve fund must be decided through governance." However, I did not find any specific proposals regarding the distribution ratio of the reserve fund in the official forum, and changes in the specific ratio were only announced in the official blog at the beginning. The actual situation is that the distribution ratio and logic of Ethena's protocol revenue have undergone multiple adjustments after the launch, with the official initially listening to community opinions during the adjustment process, but the specific distribution plan is still subjectively decided by the official and has not gone through a formal governance process.

From the data in the above Token Terminal chart, it can also be seen that the division ratio of Ethena's revenue between USDE staker income (the red bars in the chart, i.e., cost of revenue) and the reserve fund has fluctuated significantly.

During the early stages of the project when protocol revenue was high, most of the protocol revenue was allocated to the reserve fund, with 86.7% of the protocol revenue allocated to the reserve fund account in the week of March 11. However, after entering April, as the price of ENA began to decline rapidly, the income from the ENA token was insufficient to stimulate demand for USDE. To stabilize the scale of USDE, the distribution of Ethena's protocol revenue began to tilt towards USDE stakers, with most of the revenue allocated to USDE staked users. It was only in the last two weeks that Ethena's weekly protocol revenue began to significantly exceed the expenses allocated to USDE staked users (not considering ENA token incentives).

Ethena's underlying asset situation, data source: https://app.ethena.fi/dashboards/transparency

From the current underlying assets of Ethena, 52% are BTC arbitrage positions, 21% are ETH arbitrage positions, 11% are ETH staking asset arbitrage positions, and the remaining 16% are stablecoins. Therefore, Ethena's main source of income currently comes from BTC-dominated arbitrage positions, while the previously emphasized ETH staking income contributes very little due to its small asset proportion.

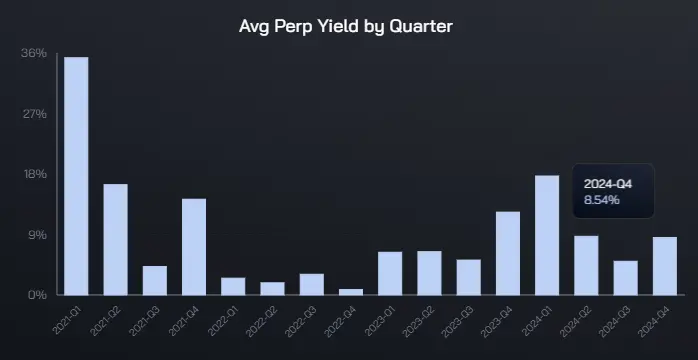

BTC and ETH perpetual contract arbitrage quarterly average yield, data source: https://app.ethena.fi/dashboards/hedging

From the trend of average yield in BTC perpetual contract arbitrage, the average yield for the fourth quarter has already moved out of the sluggish range of the third quarter and returned to the level of the second quarter of this year. As of now, the average annualized yield for this quarter is over 8%, but even in the sluggish market of the third quarter, the overall average annualized yield for BTC arbitrage was still above 5%.

The annualized yield for ETH perpetual contract arbitrage is also similar to BTC, currently back to over 8%.

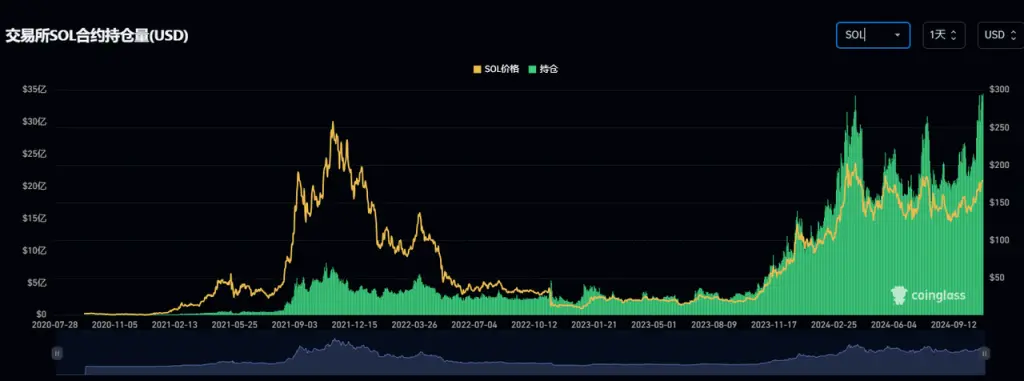

Next, let's look at the market contract scale of Sol, which is about to be included in Ethena's underlying assets. Even with the price increase of Sol this year, the contract open interest has significantly risen, currently reaching $3.4 billion, but it still has a considerable gap compared to ETH's $14 billion and BTC's $43 billion (both excluding CME data).

Trend of Sol's contract open interest, data source: Coinglass

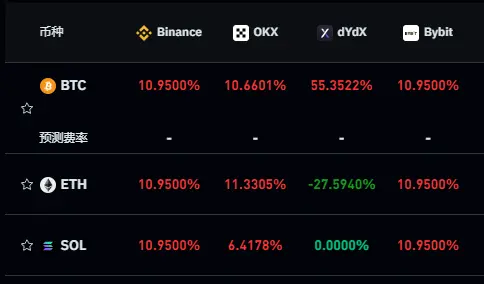

As for Sol's funding costs, looking at the largest positions on Binance and Bybit, the recent annualized funding rates are similar to those of BTC and ETH, currently around 11%.

Annualized funding rates of current mainstream cryptocurrencies

Data source: https://www.coinglass.com/zh/FundingRate

This means that even if Sol is subsequently included as a contract arbitrage target for Ethena, its scale and yield do not have a significant advantage compared to BTC and ETH, and it cannot bring much incremental income in the short term.

1.2.3 Ethena's Protocol Expenditures and Profit Levels

Ethena's protocol expenditures are divided into two categories:

Financial expenditures, paid in USDE, directed to USDE stakers, with income sourced from Ethena's protocol revenue (derivatives arbitrage, ETH staking, and stablecoin investment).

Marketing expenditures, paid in ENA tokens, directed to users participating in various growth activities (Campaigns) of Ethena. These users earn points by participating in activities (different phases of the Campaign have different point names, such as initially called Shards, later called Sats), and at the end of each seasonal activity, they can exchange points for corresponding ENA token rewards.

Financial expenditures are relatively easy to understand; for users staking USDE, they have clear yield expectations, and the official website clearly indicates the current yield rate for USDE:

The current yield rate for USDE staking is 13%, source: https://ethena.fi/

The complexity arises from the continuous various marketing Campaigns that Ethena has initiated since its launch, which have different rules, incentivize specific user behaviors with points, and introduce a weighting mechanism that involves comprehensive calculations across multiple partner platform activities.

Let’s briefly review the series of growth activities Ethena has conducted since its launch:

1. Ethena Shard Campaign: Epoch 1-2 (Season 1)

Time: 2024.2.19-4.1 (less than one and a half months)

Main incentivized behavior: Providing stablecoin liquidity for USDE on Curve.

Secondary incentivized behaviors: Minting USDE, holding sUSDE, depositing USDE and sUSDE into Pendle, holding USDE on various partner L2s.

Scale growth: During this period, the scale of USDE grew from less than $300 million to $1.3 billion.

Amount of ENA spent, i.e., marketing expenditure for the activity: A total of 750 million, accounting for 5%. Among them, the top 2000 wallets can immediately claim 50%, while the remaining 50% is linearly distributed over the next 6 months. Smaller wallets have no unlocking restrictions. According to data from the Dune dashboard created by @sankin, nearly 500 million ENA had been claimed by June, with the highest price of ENA before June being about $1.5 and the lowest about $0.67, averaging around $1; after early June, ENA began to drop rapidly from $1, reaching a low of about $0.2, with an average price of about $0.6, and the remaining 250 million ENA was mostly claimed during this period.

We can roughly estimate that the corresponding value of 750 million ENA = 5 * 1 + 2.5 * 0.6, approximately $650 million.

In other words, the scale of USDE grew by about $1 billion in less than 2 months, with corresponding marketing expenditures reaching $650 million, not including the financial expenditures paid for USDE.

Of course, as the first airdrop of ENA, this massive marketing expenditure during this phase is unique.

2. Ethena Sats Campaign: Season 2

Time: 2024.4.2-9.2 (5 months)

Main incentivized behaviors: Locking ENA, providing liquidity for USDE, using USDE as collateral for loans, depositing USDE into Pendle, depositing USDE into Restaking protocols, depositing USDE into Bybit.

Secondary incentivized behaviors: Locking USDE on the official platform, holding and using USDE on partner L2s, using sUSDE as collateral for loans, etc.

Scale growth: During this period, the scale of USDE grew from $1.3 billion to $2.8 billion.

Amount of ENA spent, i.e., marketing expenditure for the activity: Similar to the first season, the second season's rewards are also 5% of the total, which is 750 million ENA (with the top 2000 wallets receiving the largest airdrop facing the same 50% TGE and subsequent unlocking over 6 months). Based on the current price of ENA at $0.35, the value corresponding to 750 million ENA is approximately $260 million.

3. Ethena Sats Campaign: Season 3

Time: 2024.9.2 to 2025.3.23 (less than 7 months)

Main incentivized behaviors: Locking ENA, holding USDE in officially designated partner protocols (mainly DEX and lending), depositing USDE into Pendle.

Scale growth: As of now, despite the plans for the third season, the scale growth of USDE has encountered a bottleneck, with the current scale of USDE around $2.7 billion, still slightly down from the $2.8 billion at the start of the third season.

Amount of ENA spent: Considering that the third season is nearly 7 months long, which is longer than the second season, and that the ENA reward incentives are likely to continue to decrease, the total incentive amount for ENA in the third season is still likely to remain at 5%, which means 750 million ENA is a strong possibility.

Thus, we can roughly calculate the total protocol expenditures of Ethena since its launch this year (up to October 31):

Financial expenditures (paid in stablecoin to USDE stakers): $81.647 million

Marketing expenditures (paid in ENA tokens to participating users): $650 million + $260 million = $910 million (this does not yet include potential expenditures after September)

Ethena's quarterly protocol revenue and financial expenditure trends, source: tokenterminal

Meanwhile, the total protocol revenue during the same period: $124 million

In other words, contrary to the impression that "Ethena is very profitable," Ethena's income, after deducting financial and marketing expenditures, has resulted in a net loss of $868 million by the end of October this year. Here, I have not considered the ENA token expenditures from September to October, so the actual loss amount may be even higher.

A net loss of $868 million is the price of achieving a market cap of $2.7 billion for USDE within a year.

In fact, like many DeFi projects in the previous cycle, Ethena is following a path of boosting core business metrics and increasing protocol revenue through token subsidies. However, Ethena has adopted a unique points system in this cycle, delaying the issuance of tokens and involving more partners as participation channels, making it difficult for participating users to intuitively assess their final financial returns from participating in Ethena's activities, which in a sense enhances user stickiness.

2. Future Business Outlook: Narratives and Future Developments Worth Looking Forward to for Ethena

In the past two months, ENA has rebounded nearly 100% from its low, even with the rewards for Season 2 opening at the beginning of October. These two months have also been filled with news and positive developments for Ethena, such as:

October 28: On-chain options and perpetual contract project Derive (formerly Lyra) includes sUSDE as collateral.

October 25: USDE is included as collateral for OTC trading by Wintermute.

October 17: Ethena proposes to integrate "Ethena liquidity and hedging engine into Hyperliquid."

October 14: The Ethena community proposes to include SOL in the underlying assets of USDE.

September 30: The first project in the Ethena ecosystem, the derivatives exchange Ethereal, is launched, promising a 15% token airdrop to ENA users. Subsequently, Ethena Network announced that it would release more information about product launch timelines and new ecosystem applications based on USDE in the coming weeks.

September 26: Plans to launch USTB—the so-called "new stablecoin launched in collaboration with BlackRock." In reality, USTB is a stablecoin backed by the on-chain national debt token BUILD issued by BlackRock, with limited direct relationship to BlackRock.

September 4: In collaboration with Etherfi and Eigenlayer, the first stablecoin AVS collateral asset—eUSD—was launched, which can be obtained by depositing USDE in Etherfi. eUSD went live on September 25.

It can be said that in these two months, the scenarios for USDE and sUSDE have increased significantly, although the demand stimulus for USDE may not be obvious. For example, the stablecoin AVS collateral asset eUSD launched in collaboration with Etherfi and Eigenlayer currently has a scale of only a few million.

In fact, what truly drove the recent surge in ENA prices was a strong promotional article about Ethena published by well-known trader and crypto KOL Eugene @0xENAS on October 12: “Ethena: The Trillion Dollar Crypto Opportunity”.

This article, which garnered nearly 400 shares, over 1800 likes, and more than 700,000 views, caused the price of ENA to rise from $0.27 to $0.41 in just four days, an increase of over 50%.

In the article, Eugene not only reviewed some of Ethena's product features but also emphasized three reasons. However, in my view, apart from the first reason, the remaining two are full of flaws:

The U.S. interest rate cuts have led to a decrease in global risk-free rates, making USDE's APY appear more attractive and attracting more capital inflow.

The newly launched USTB stablecoin, "in collaboration with BlackRock," is an "absolute gamechanger" that will significantly increase the adoption of USDE because when the market's perpetual arbitrage yield is negative, the underlying assets can be switched to USTB to obtain risk-free returns from government bonds.

Flaw: USTB is backed by BUILD, which does not mean that USTB is a stablecoin jointly launched by BlackRock and Ethena. It is similar to how Dai has a large amount of USDC as its underlying asset, but Dai is not a stablecoin jointly launched by Circle and MakerDAO. In fact, to obtain government bond returns during periods of negative perpetual yields, USDE can directly close positions and allocate to Build or sDAI, or convert to USDC and hold it on Coinbase to earn a 4.5% annualized subsidy, without the need to issue another USTB for holding. USTB seems more like a gimmick product to ride on BlackRock's traffic, and calling such a mediocre product an "absolute gamechanger" raises doubts about the author's understanding or writing motivation.

- The future emission rate of ENA will decrease, reducing the selling pressure compared to before.

Flaw: In reality, the rewards for Season 2 still have a total of 5% of ENA, meaning that 750 million tokens will enter circulation over the next six months, which is not significantly less than the total incentives of the previous season. Moreover, in March next year, ENA will face a massive unlocking for the team and investors, and the inflation expectations for ENA in the next six months are not optimistic.

However, there are still promising narratives for Ethena in the coming months to a year.

First, with the rising expectations of Trump's return to power and the Republican victory (results will be seen in a few days), the warming crypto market will benefit the perpetual arbitrage yields and scales of BTC and ETH, increasing Ethena's protocol revenue.

Second, more projects may emerge within the Ethena ecosystem after Ethereal, increasing ENA's airdrop income.

Third, the launch of Ethena's self-operated public chain could also bring attention and nominal scenarios such as staking for ENA, although I expect this to be launched after more projects accumulate in the second point.

However, the most important thing for Ethena is that USDE can be accepted as collateral and trading assets by more leading CEXs.

Among the leading exchanges, Bybit has already established deep cooperation with Ethena.

Coinbase has its own USDC to operate, and considering the complexity of regulations as a U.S. domestic company, the possibility of it supporting USDE as collateral and stablecoin trading pairs is virtually zero.

Among the two major CEXs, Binance and OKX, there is a possibility that OKX will include USDE in stablecoin trading pairs and contract collateral, as it participated in two rounds of Ethena's financing, aligning financial interests to some extent. However, this possibility is not very high, as this move would also expose OKX to operational and endorsement risks related to Ethena. Compared to OKX, Binance, which only participated in one round of investment in Ethena, has an even lower likelihood of including USDE in stablecoin trading pairs and collateral, especially since Binance itself has its own supported stablecoin project.

The belief that USDE will become a margin asset for contracts on major exchanges is also one of the reasons Eugene is optimistic about Ethena in his previous article, but I am not very optimistic about this.

3. Valuation Level: Is ENA's Price Currently in an Undervalued Zone?

We will analyze ENA's current valuation situation from both qualitative analysis and quantitative comparison perspectives.

3.1 Qualitative Analysis

Events that are likely to be favorable for the ENA token price in the coming months and have a high probability of occurring include:

- An increase in arbitrage yields due to a warming crypto market, reflected in improved protocol revenue expectations, leading to an increase in ENA prices and promoting the growth of USDE scale.

- Including SOL as an underlying asset, which can attract the attention of SOL ecosystem investors and project parties.

- More projects similar to Ethereal may emerge in the Ethena ecosystem in the coming months, bringing more airdrops for ENA.

- Before the next wave of ENA unlocking, the project team has an incentive to raise the token price, both to facilitate a positive spiral for business and token price and to provide themselves with a higher exit price.

Additionally, based on Ethena's performance over the past six months, the Ethena project team has demonstrated very strong business capabilities, arguably the best among many stablecoin projects in terms of external cooperation and expansion, even more aggressive and efficient than the leading stablecoin project MakerDAO.

Currently, factors that are unfavorable to the value of the ENA token and suppress its price include:

- ENA lacks real monetary profit distribution, relying more on somewhat nebulous staking scenarios (such as securing Ethena's multi-chain security as AVS assets) and self-mining.

- The actual profitability of the Ethena project is poor, with massive subsidies implemented to open up the market, leading to significant net losses for the project, which are ultimately borne by ENA token holders.

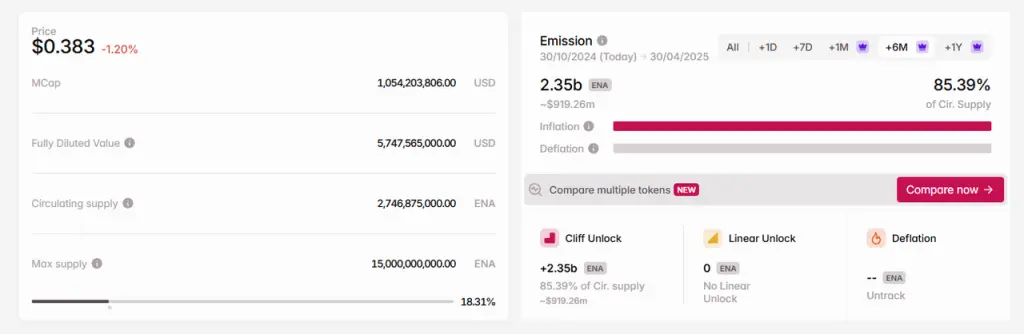

- ENA will still face significant inflation pressure in the next six months, partly due to ENA token expenditures in marketing activities, and in late March next year, it will face unlocking for the core team and investors after a year. According to Tokenomist data, ENA tokens will face an inflation pressure of 85.4% of the current circulating supply in the next six months.

Data source: https://tokenomist.ai/

3.2 Quantitative Comparison

Ethena's business model is essentially no different from other stablecoin projects; its innovation lies in the use of raised assets to profit through perpetual contract arbitrage.

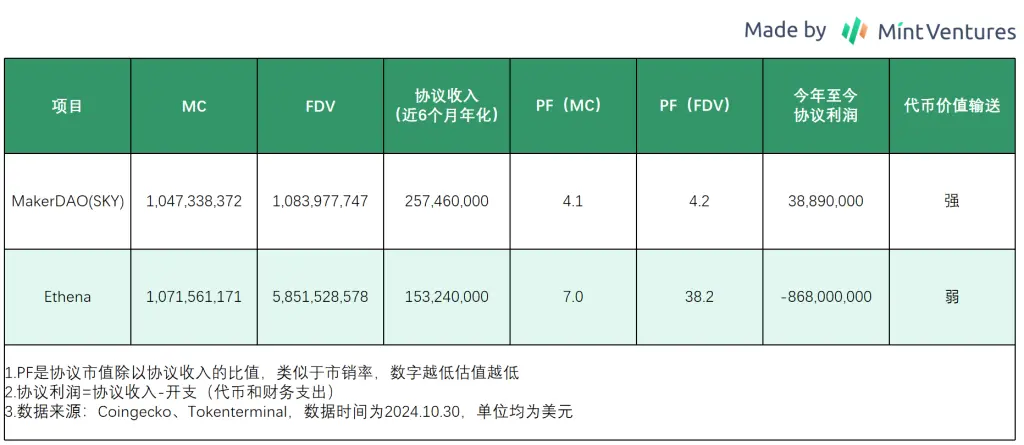

Therefore, we will use MakerDAO (currently SKY), the largest stablecoin project by circulating market value, as a benchmark for comparison.

It can be seen that compared to the established protocol MakerDAO, Ethena's token ENA currently does not offer good value in terms of protocol revenue or profit.

Conclusion

Although many people refer to Ethena as a highly representative innovative project in this cycle, its core business model is no different from other stablecoin projects, all of which aim to raise funds for financial operations and profit, while striving to promote the use cases and acceptance of their bonds (stablecoins) to minimize their fundraising costs.

At the current stage, Ethena, which is still in the early promotion phase of stablecoins, remains in a significant loss stage and is not as "very profitable" as many KOLs claim. Its valuation is not undervalued compared to the representative stablecoin project MakerDAO.

However, as a new player in this space, Ethena has demonstrated very strong business development capabilities, being more aggressive than other projects. Like many DeFi projects in the previous cycle, rapid scale expansion and more project adoption will enhance investors' and researchers' optimistic expectations for the project, thereby driving up the token price, which in turn will lead to higher APY, further increasing the scale of USDE, creating a self-reinforcing upward spiral.

Eventually, such projects will face a critical point where people begin to realize that the project's growth is driven by token subsidies, and the price increase of newly issued tokens seems to be supported only by optimistic sentiment, lacking a connection to value.

Thus, a fast-paced game begins.

Ultimately, only a few projects can rise from such a downward spiral. The previous cycle's stablecoin star Luna (UST issuer) has already been buried, Frax's business has significantly shrunk, and Fei has ceased operations.

As a product with a clear Lindy effect (the longer it exists, the stronger its vitality), Ethena and its USDE still need more time to validate the stability of its product architecture and its survival capability after subsidies decrease.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。