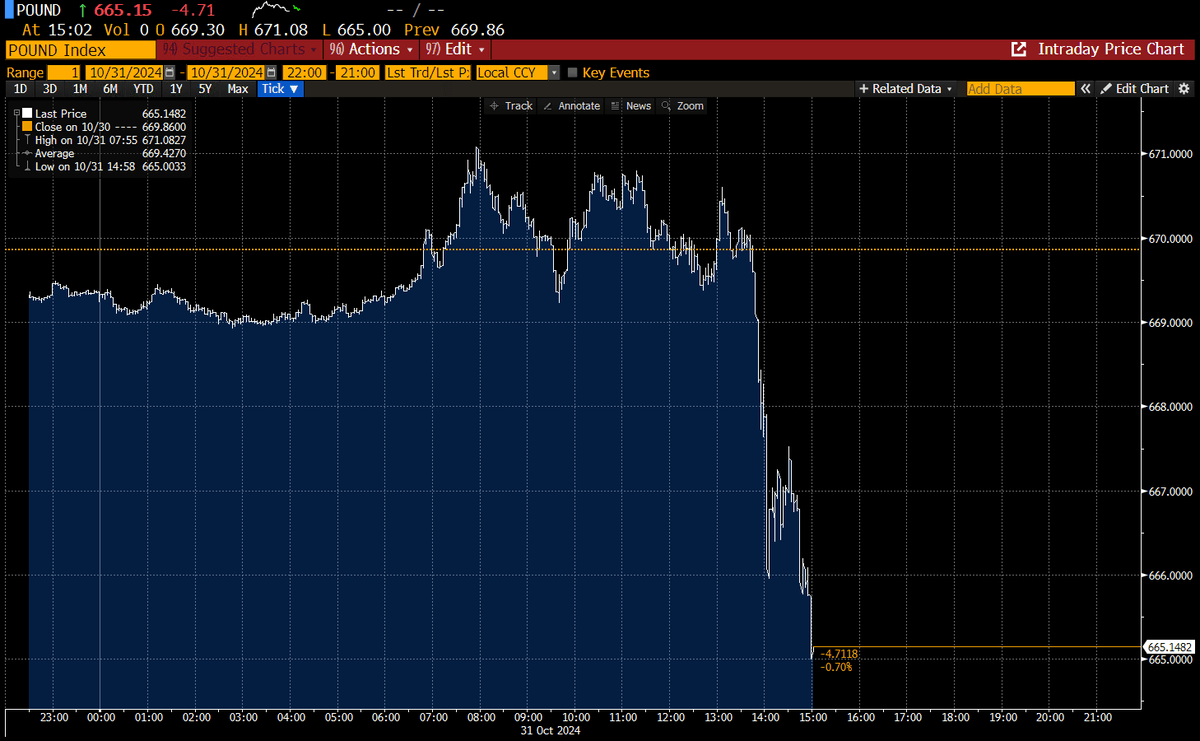

Following the latest budget reveal, the pound sterling has taken a sharp tumble, fueled by mounting worries about the U.K.’s fiscal outlook. Chancellor Rachel Reeves’ decision to pump £70 billion into government spending—funded through additional borrowing—has stirred up significant unease among investors. They’re concerned this move could lead to higher inflation and escalating interest rates.

As a result, yields on 10-year government bonds jumped to 4.56%, edging past levels seen during the 2022 Liz Truss episode, highlighting a rising aversion to risk among investors. The pound shed 1.2% over three days, dipping to a two-month low, while its exchange rate dropped to 1.1868 euros and $1.2897 against the U.S. dollar. The decay of the pound sterling reflects not an isolated economic incident, but rather a systemic consequence of government arrogance—the notion that bureaucrats force can manufacture prosperity through debt and fiat manipulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。