In just 293 days, the 12 U.S. spot bitcoin ETFs have accumulated more than 1 million BTC, totaling nearly $71 billion. Since Jan. 11, 2024, these funds have collectively added 1,007,705 BTC, valued at about $70.995 billion as of 12:45 p.m. ET on Oct. 31. Historically, Grayscale’s GBTC led the pack, initially holding 620,000 BTC at its launch.

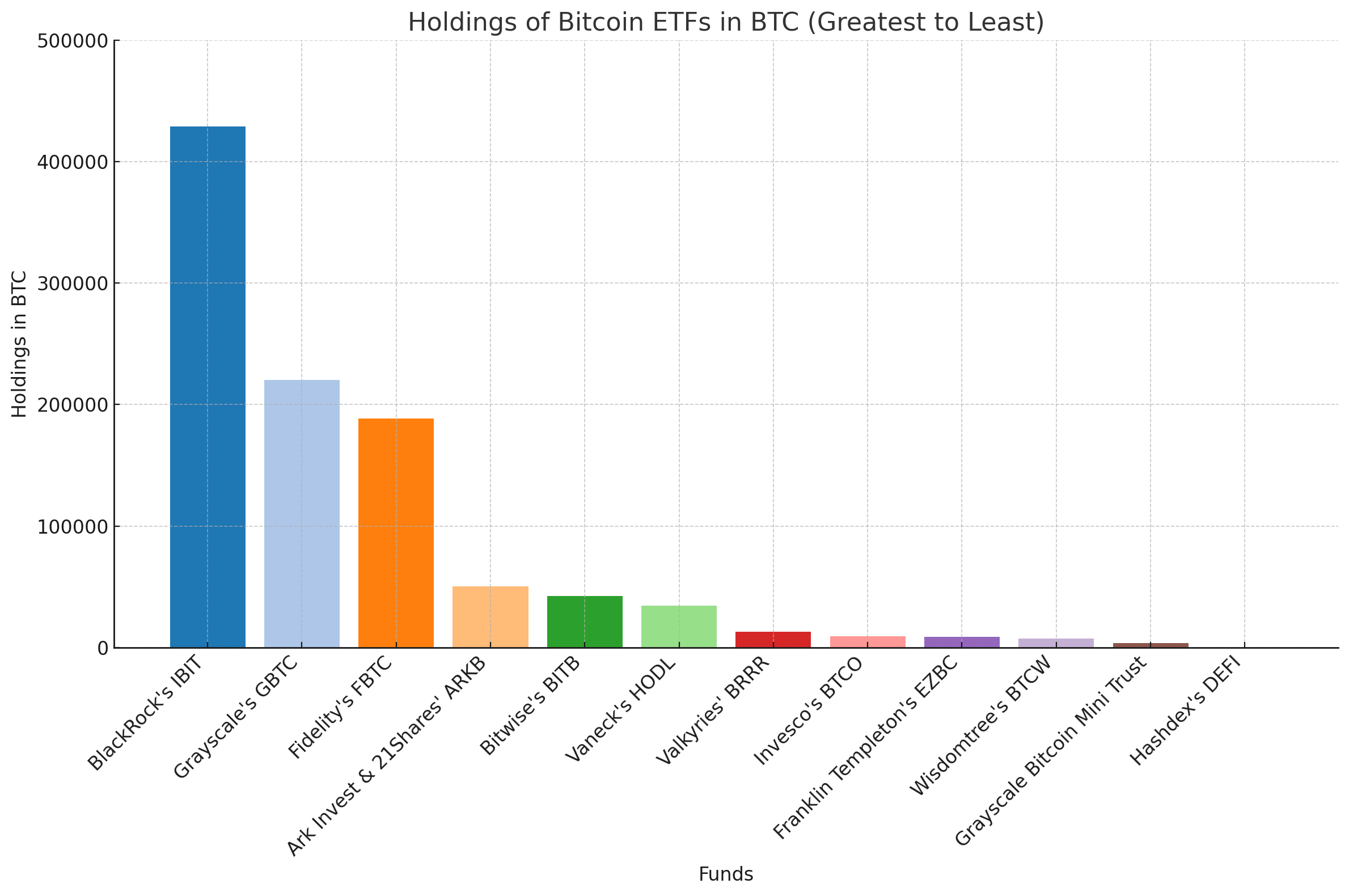

Today, GBTC’s holdings have decreased to 220,299.21 BTC, with the Grayscale Bitcoin Mini Trust adding another 34,536.41 BTC. Together, these funds now hold a combined 254,835 BTC, valued at $17.95 billion. Currently, Blackrock’s IBIT takes the top spot, with 429,112 BTC worth $30.23 billion. Fidelity’s FBTC holds 188,588 BTC, while Ark Invest and 21Shares’ ARKB secure 50,379 BTC, and Bitwise’s BITB rounds out with 42,507 BTC.

BTC reserves of the 12 U.S. bitcoin ETFs as of Oct. 31, 2024.

Vaneck’s HODL controls 13,152 BTC, followed by Valkyrie’s BRRR with 9,193 BTC, and Invesco’s BTCO now holds 8,679 BTC. Meanwhile, Franklin Templeton’s EZBC secures 7,360 BTC, Wisdomtree’s BTCW holds 3,749, and Hashdex’s DEFI fund is the smallest, with 151 BTC in reserves. According to sosovalue.com, these BTC ETFs have posted stellar market performances.

Since Jan. 11, BlackRock’s IBIT has drawn in a total of $25.82 billion in net inflows, while Grayscale’s GBTC has seen outflows amounting to $20.13 billion since its debut on NYSE Arca. Of the million BTC held across all funds, IBIT claims 42.58% of the total, with GBTC and the Grayscale Bitcoin Mini Trust together holding 25.29%. FBTC accounts for 18.71%, and all other funds hold 5% or less each. Altogether, these ETFs hold 5.10% of the 19,775,630.49 BTC in circulation as of block height 868,271.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。