In the U.S., the season of corporate earnings reports for the third quarter continues, which means we can receive some information about the crypto market from companies like Coinbase, the leading crypto exchange out there. The information is interesting, especially when it comes to Bitcoin and Ethereum, two of the biggest assets on the crypto market.

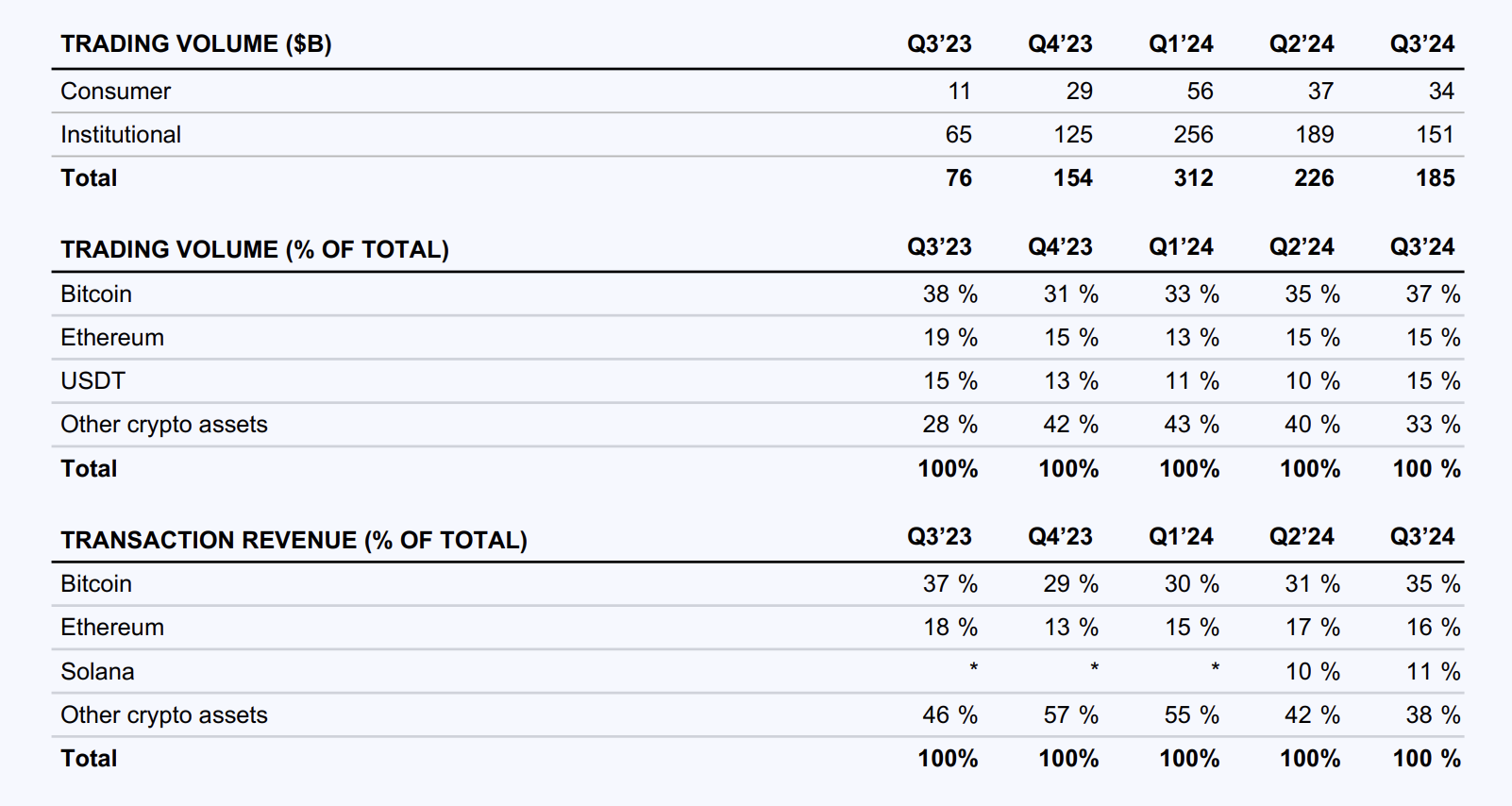

According to the quarterly report for the last period from July to September, the trading volume of Bitcoin on Coinbase increased by 2% to 37%, while the trading volume of Ethereum remained unchanged at 15%. The trading volume of the USDT stablecoin also increased by 5% to 15%.

Related

Thu, 10/31/2024 - 07:19 “Rich Dad, Poor Dad” Author Reveals Why He “Loves” Bitcoin

Alex Dovbnya

HOT Stories Shytoshi Kusama Responds to Critic About SHIB’s $0.01 Target: Details BlackRock’s Bitcoin ETF Records Biggest Inflows of All Time Dogecoin (DOGE) Price Explosion: What's Happening? XRP's Weakness Caused by This Factor, Is Ethereum (ETH) Ready to Join Massive Rally? XRP ETF Race: New Filing Acknowledged by SEC

All of this was financed by a decrease in the trading volume of other crypto assets, which naturally fell from 40% to 33%. In total, the trading volume on Coinbase amounted to $185 billion, of which 81.62% was accounted for by institutional clients.

Source: Coinbase

In terms of transaction revenue, Bitcoin once again reigned supreme. Thus, the main cryptocurrency in this indicator grew over the three months from 31% to 35% of the total revenue. Ethereum cannot boast the same and had to move its share to 16%, which is 1% less than in the second quarter.

Interestingly, however, the same 1% was gained by Solana, which is one of the leaders of this cycle. In terms of size, Coinbase's transaction revenue amounted to $572.5 billion last quarter, down 26.68% from the previous quarter.

Related

Thu, 10/31/2024 - 06:04 BlackRock’s Bitcoin ETF Records Biggest Inflows of All Time

Alex Dovbnya

Thus, it can be said that Bitcoin continues to hold the attention of the public, while Ethereum, despite the general doubts about its validity in this cycle, is still dear to the hearts of crypto enthusiasts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。