Cryptocurrency is seen as a game, where the temptation of trading and profiting coexists with the potential for significant losses. Therefore, maintaining rationality, understanding the rules, and focusing on specific areas are key to participating in this game.

Author: Ignas | DeFi Research

Translation: Blockchain in Plain Language

Cryptocurrency is like a game: trading tokens, making (and losing) money, and accumulating followers on X.

Don't you feel the same way?

But unlike real games, losses in the cryptocurrency space can have serious consequences.

After the Terra collapse, it was reported that a South Korean family of three may have committed suicide due to financial losses, including their 10-year-old daughter—according to the father's online search history.

So, publicly admitting that cryptocurrency is a game makes me feel a bit uneasy. Too many people have been scammed and lost their life savings.

However, viewing cryptocurrency as a game helps me stay rational and motivated to continue "playing." Because the craziness we experience in this industry is indeed unique.

Nevertheless, the huge rewards of this game make it worth participating: achieving financial freedom. As DegenSpartan once posted:

“In the brief time after you graduate, either go all in to enter the elite class or work hard for the rest of your life.” - @DegenSpartan (now deleted tweet)

In this article, I want to share my cryptocurrency gaming strategy, my mindset framework, and tips on how to choose and win your crypto game.

1. Rules of the Crypto Game

Once you see the analogy between cryptocurrency and games (especially MMORPGs), you can no longer ignore it.

In tough times, when there is no new capital inflow, we trade in “PvP—Player vs. Player” mode; while during a bull market, as retail capital enters, we switch to “PvE—Player vs. Environment” mode.

If you don’t like being harvested by opinion leaders, we often comfort ourselves with “Don’t hate the player, hate the game.”

We even design token economics through various game theories, trying to prevent people from selling their tokens.

Just like every game upgrade, the crypto game is constantly evolving, with new narratives emerging and fading.

For example, the former top NFT player Pranksy is now completely out of touch with the memecoin trend. The gameplay has changed, while he is still playing an old version that few are interested in.

Of course, memecoins can be terrible, but people who didn’t understand how to mint and trade NFTs a few years ago said the same about NFTs.

In this game, you have two choices: either adapt and participate, or wait for the gameplay to change.

Of course, there is a harder choice—directly changing the game rules.

For example, Cobie launched the Echo platform, allowing retail investors to participate in token purchases alongside VCs like in the ICO era. Step by step, those determined to change the game will gradually push out the memecoin narrative.

However, it is worth acknowledging that memecoins have indeed rewritten the game rules.

For about the past year, we have been playing a “points” game: you deposit funds into protocols, accumulate points, and hope for generous airdrops. I know everyone loves this gameplay because my “DeFi Bull Market Player’s Manual” is still the most popular post.

However, it turns out that many people have become the ones being played.

Due to higher TVL supporting higher valuations, tokens are issued at extremely high FDVs, which benefits VCs, teams entering at low valuations, and those who ultimately sell airdrops for profit.

Tired of this routine, many turned to memecoins, which possess the qualities that VC-backed tokens lack.

Just as Pranksy chose to exit (or no longer participate), the stars of memecoins, Ansem, Murad, and the players joining their ranks are reaping victories.

2. “Don’t Hate the Player, Hate the Game”

In this overarching gameplay, we continuously introduce new mini-games.

You need to decide whether to participate. If you do, make sure to understand the rules, as opponents are always present.

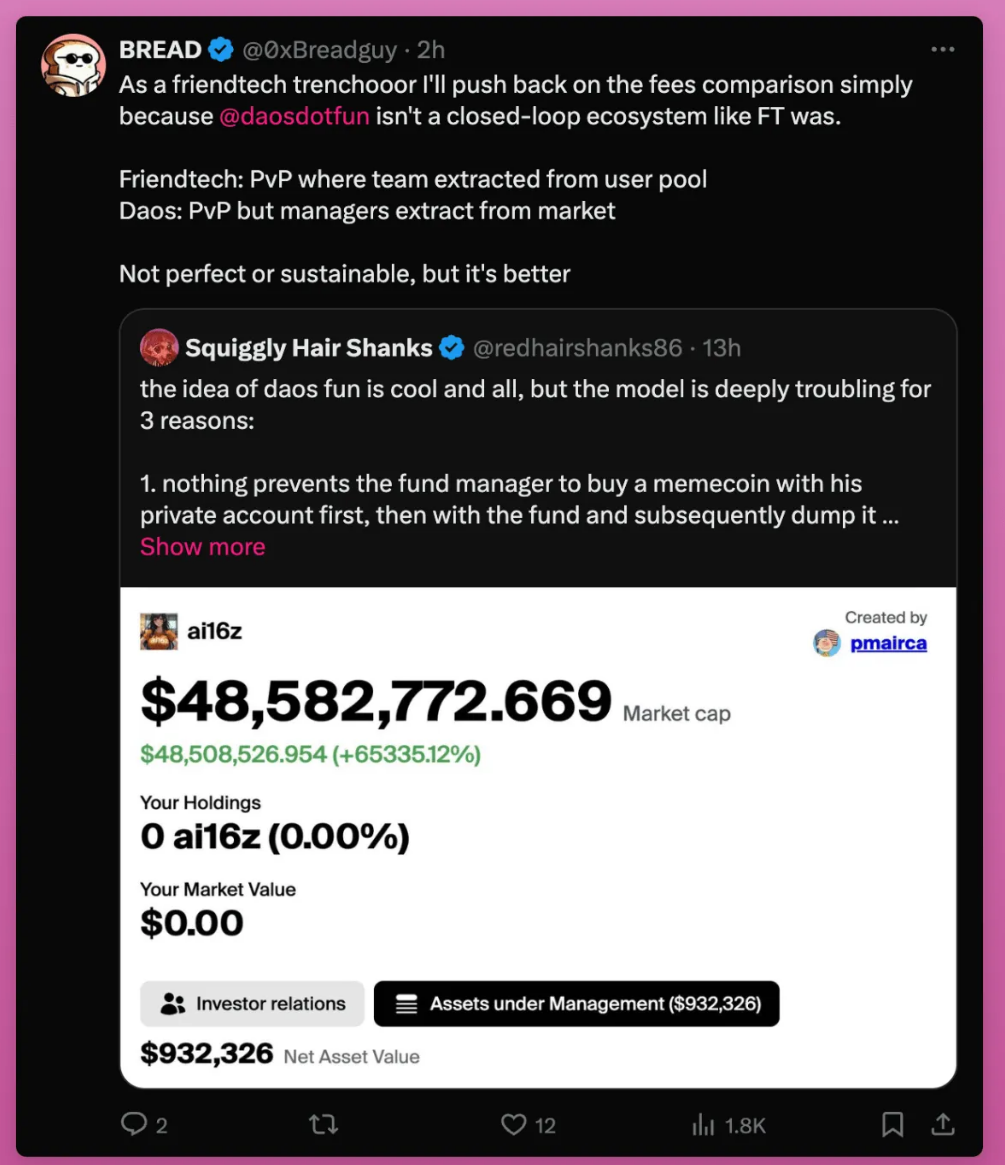

For example, DAOS FUN allows trading tokenized funds. But confusingly, the top-ranked “fund” ai16z trades at 52 times its net asset value (NAV), and the trading method is similar to that of memecoins.

Players are trying to understand this phenomenon. Squiggly likened the fund to a “Grayscale structure” or a Ponzi scheme of Friendtech, while BREAD disagreed with parts of FT.

Who is right?

The same product, but different players have their interpretations. Find your gaming advantage, and you can profit from it.

Sometimes the method is simple. When the team announced that they would add a “fund” whitelist on the website, I guessed that players holding other “fund tokens” might sell their old tokens to buy the new ones, leading to a price drop. Sure enough, after the new fund launched, all old fund prices dropped by about 50%.

Typically, the more complex the gameplay, the greater the knowledge gap, and the larger the profit margin.

The interesting thing about crypto is that there are always people chasing new trends without doing their homework, and as long as you do a little basic research, you can find profit opportunities.

That said, I often “go all in” with a small amount of money on popular new projects first, and then study their actual operations—learning as I go. When you know whether you can win, you can invest more funds.

Ton’s “click-to-earn” gameplay has gained popularity because it is completely different from complex DeFi games—you just need to click a button on the screen to make money.

However, because the game is too simple, the rewards are also minimal, unless you use hundreds of phones and “human fingers” to click.

This is where cryptocurrency becomes ten times more interesting and complex: you can choose from various levels, roles, and strategies, just like side quests.

Let me give you an example.

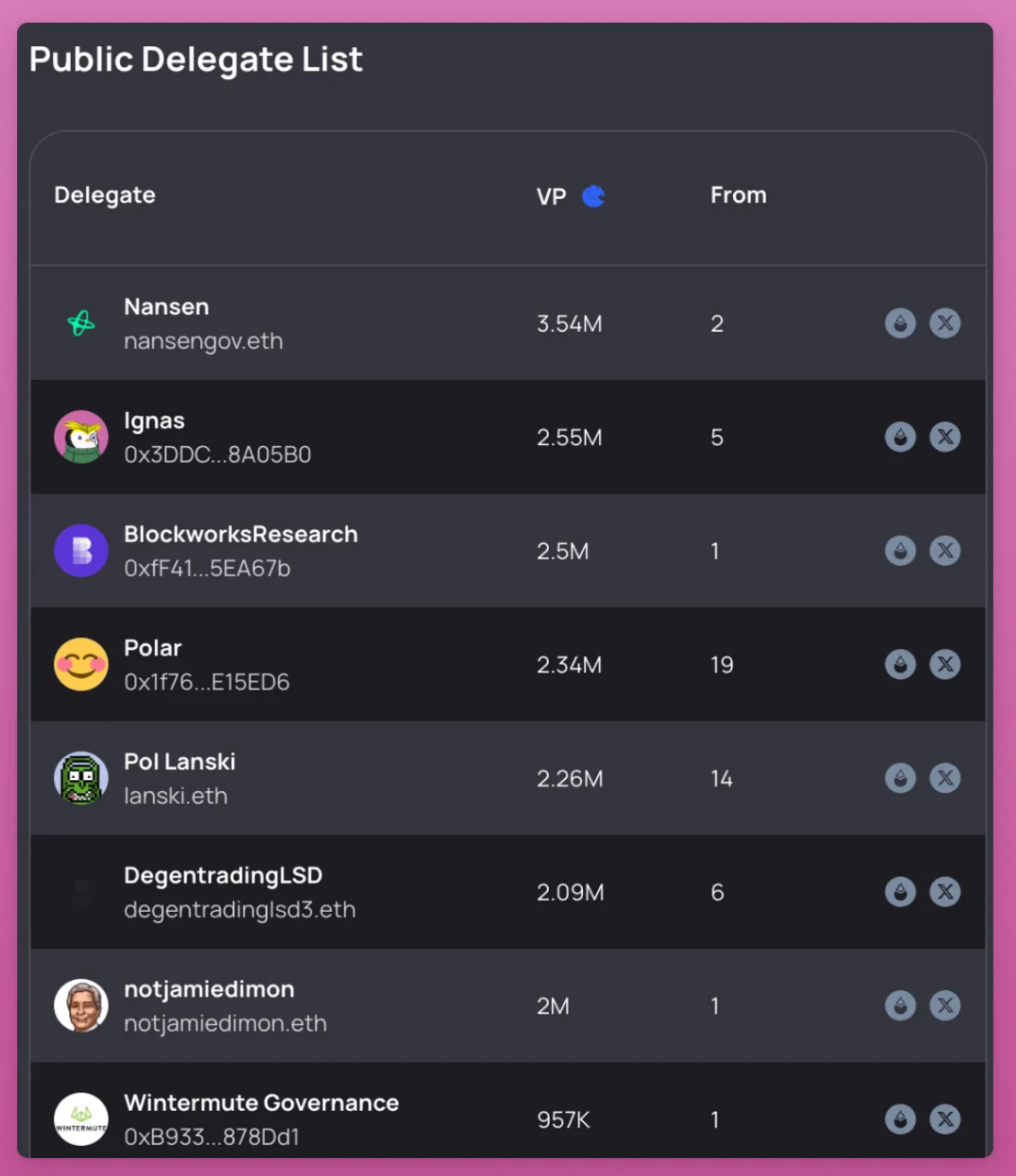

Recently, I have been striving to become an active representative in multiple DAOs, particularly Lido, Arbitrum, and Uniswap.

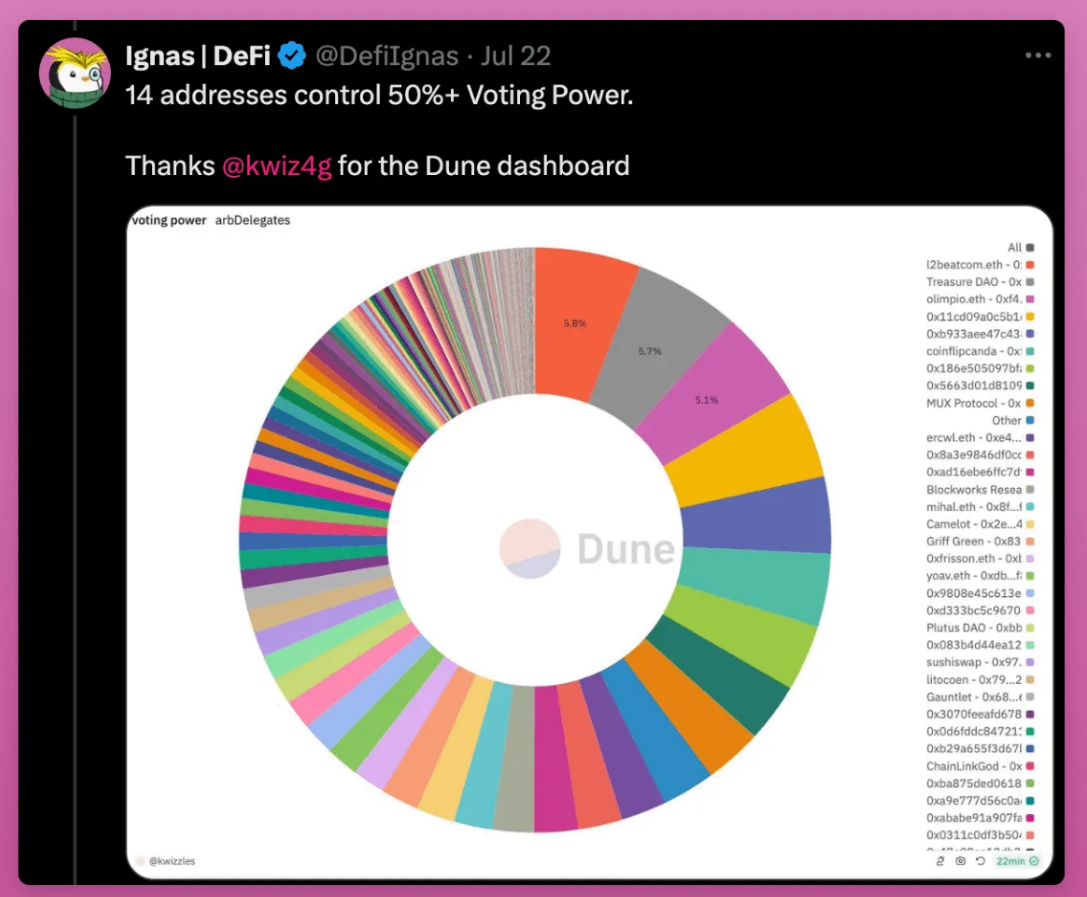

DAOs** advocate for decentralization, but everyone knows that most DAOs are still far from true decentralization.** For example, in the Arbitrum DAO, only 14 addresses control over 50% of the voting power, and the situation is similar in other DAOs.

Uniswap DAO was unaware that Unichain would launch a project with UNI staking features. This also explains why the fee switch for UNI has not been activated for months—insiders already knew that once UNI staking was implemented, the fee switch would be unnecessary, while the DAO was completely unaware.

DAOs* realize that* voting** concentration is a major issue. To address this, they initiated representative incentive activities to attract new members. Once you become an active representative, you can earn between $3,000 to $10,000 in each DAO.**

However, this is not an easy task.

You need to actively follow forum discussions, write comments, and vote on proposals. The hardest part is obtaining token delegations, which involves political maneuvering.

After discussing the alignment of token holders and protocol incentives on Twitter, an anonymous whale delegated 2.5 million LDO to me. Honestly, I received this delegation because I am relatively active on X, and everyone knows me. Playing the popularity game indeed opens more opportunities for me in the crypto space, and many people are unaware of these opportunities.

Now, many protocols contact me, thanking me for my votes on their proposals or requesting my support for future proposals. Each DAO has an important relationship-building process that is not visible on X's dynamics or DAO forums. To be honest, I really enjoy this game.

I truly believe in a decentralized future and hope to contribute. So, if you hold LDO, UNI, OP, ARB, or AAVE, feel free to delegate these tokens to me.

This is my address for all DAOs: 0x3DDC7d25c7a1dc381443e491Bbf1Caa8928A05B0

3. Player Mindset

Did you know that Vitalik Buterin started building Ethereum shortly after “Blizzard removed the damage component of the beloved Warlock's life siphon spell”?

“I cried myself to sleep that day when I realized how terrible the consequences of centralized services could be. So I decided to quit.” —Vitalik (his personal profile has since been removed from the about.me page).

Vitalik decided to quit World of Warcraft because he felt he had no influence over the game rules.

One appealing aspect of cryptocurrency is that each of us has the opportunity to participate and influence the game rules.

Like blockchain, crypto games are also decentralized. Venture capitalists, retail investors, developers, and KOLs—all of us have our roles, with some roles having greater influence.

Ansem, Murad, and other influencers of memecoins are driving the memecoin cycle, but you can choose not to participate in their game. Just refrain from discussing or buying memecoins.

Slightly off-topic, but I am really surprised at how little influence venture capitalists have in shaping narratives. Crypto venture capitalists should speak up for their investments, yet their presence on X is minimal.

Do they really care? Or are they playing another game?

Take Kyle from Mult1C0in, for example, who is speaking up for his investments. More venture capitalists should share their vision for the industry, advocate for their portfolio protocols, and provide in-depth research to help everyone understand current developments.

According to my interviews with crypto venture capitalists, one possible explanation is that they are also retail "sheep," just with more money in hand.

In a wonderful coincidence, while Vitalik was playing World of Warcraft (2007-2010), I was playing another MMORPG—Dragon Nest 2.

In Dragon Nest 2, you can choose a race (human, elf, orc, etc.) and a class (warrior, mage, etc.).

By completing quests and defeating enemies, you can earn experience points (XP) to level up. After leveling up, you can unlock new skills, obtain better equipment, and access more challenging content.

I spent two years grinding monsters, sleeping only a few hours a day. Those memories are deeply rooted in my mind and have influenced my perspective on crypto trading.

Just like gaining XP in a game, in the cryptocurrency space, you gain XP by learning about blockchain, understanding decentralized finance (DeFi), and studying token economics. The harder you work, the more you can master this knowledge. In the process, you must pay attention to your health points (HP) and mana points (MP).

HP and MP are like your health, financial stability, and emotional resilience. In both cryptocurrency and gaming, continuous effort is required, and this effort can lead to fatigue. In the crypto space, the pressure to stay ahead, constantly monitor the market, and not miss trends creates a high-pressure environment, akin to being in an endless game with no option to quit.

During the last bull market cycle, I felt extremely fatigued, so now I take a break every three months to maintain my “HP.”

Am I really the one who views crypto this way?

This similarity is also evident among different demographics: most cryptocurrency participants are male, while the proportion of female players in MMORPGs is only about 35%.

Koreans' enthusiasm for cryptocurrency is as intense as their obsession with esports (like League of Legends), even surpassing their love for "real sports." No wonder the GameFi narrative has so many supporters in the crypto space.

What I want to say is that the gamer mindset can help you succeed in cryptocurrency. Just choose the right game and understand your role in it.

In his famous short essay "How to Get Rich (without Being Lucky)," Naval mentioned "game" and "gameplay" 15 times! His advice is:

“Ignore those playing identity games. They gain identity by attacking those playing wealth creation games.”

“Choose an industry where you can play a long game with someone for the long term.”

“Play repeated games. All gains in life, whether wealth, relationships, or knowledge, come from compound interest.”

And my favorite:

“Building specific knowledge will feel like play to you, but to others, it will look like work.”

So, what game are you playing in cryptocurrency?

What is your role in cryptocurrency?

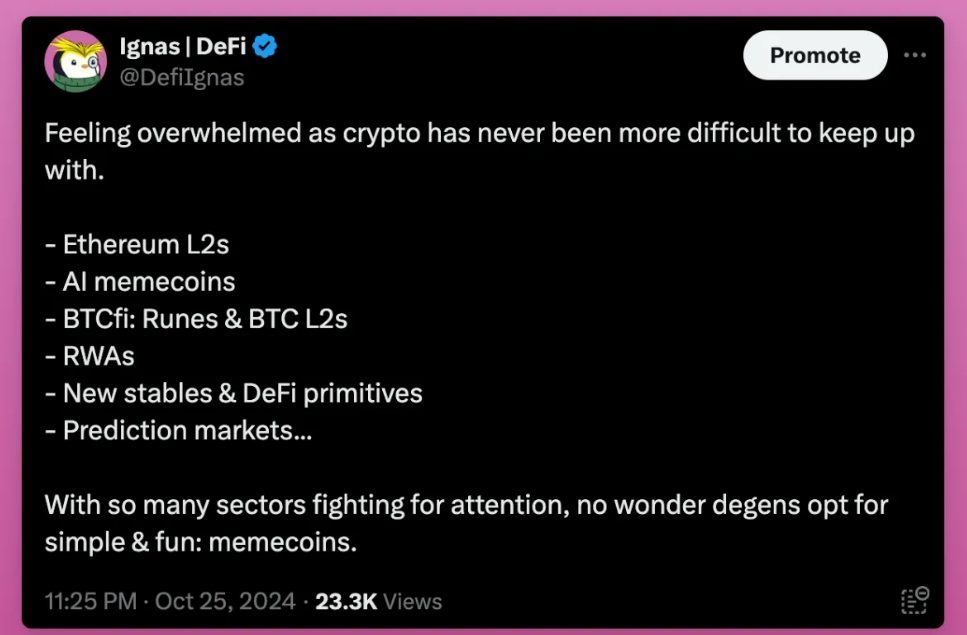

In recent years, cryptocurrency has become more complex. Before 2020, success often boiled down to simply investing in ICOs and trading on centralized exchanges (CEX). But since then, the crypto space has seen a surge in niche industries: decentralized finance (DeFi), layer 2 solutions (L2), non-fungible tokens (NFTs), real-world assets (RWA), runes, memecoins, and more.

How are you keeping up?

Are you focusing on a specific area, or are you trying to “catch them all”?

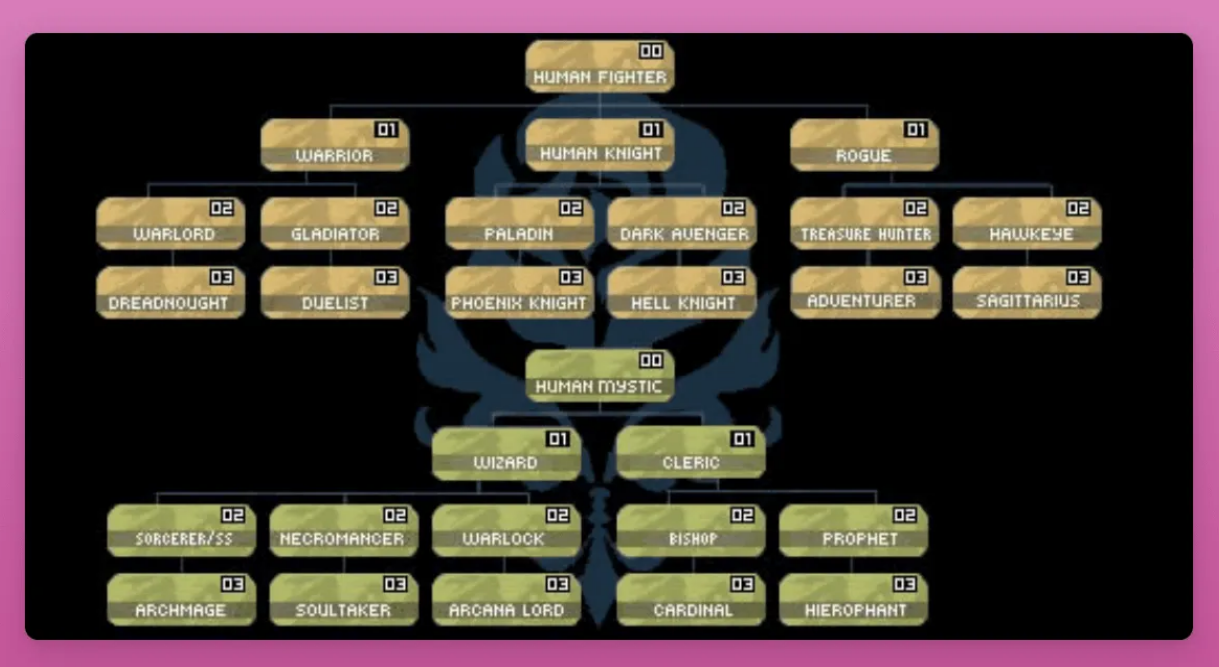

In MMORPGs, you first choose a race and then a class. In Lineage 2, I decided to choose the least popular option because I wanted to stand out and increase my chances of becoming a “hero.”

I chose a human mystic, and as I gained experience points, I focused on becoming a warlock, eventually becoming an archmage. This class is the least popular because it relies on pets to defeat enemies.

Similarly, in the crypto space, you first learn the basics, then you can focus on active trading, DeFi yield farming, meme coins, DAO representation, etc.

Many people lack the confidence to learn specific skills, often jumping between different narratives without truly understanding them. This causes them to miss out on the knowledge needed to master the complex mechanisms behind specific gaming theories, ultimately becoming exit liquidity.

In fact, jumping between different narratives while earning yields can also become a skill. In this case, you can recognize the capital rotation game and manage to sell at the highest price before the funds shift to other narratives. Are you good at this?

However, I believe that at this stage of the market, focus can yield exceptional results.

The focus can be in any direction:

Crypto Koryo excels at creating and monetizing works using Dune dashboards.

USD Denominated focuses on the stablecoin market on X, adept at navigating the market's complexities to extract maximum yields.

Andy is all in on modular narratives, even though this is one of the most questioned areas in crypto.

wale.moca is an account focused on NFTs (what a strong belief!).

Bold Leonidas publishes crypto comics daily.

But always pay attention to what influencers are saying, as their motivations often differ from what you might imagine. The game they are playing is different from the one they publicly promote. You don’t want to participate in games that are detrimental to you. For example, Ansem guides celebrities into the space and profits in some way.

Why do you think I post on X?

I post on X to:

1) Stay informed about the market,

2) Attract clients to my DeFi creator studio Pink Brains,

3) Build my influence and gain token votes.

This strategy allows me to explore multiple topics, even if I am not an expert in any one area.

But when you start growing your followers on X, you will choose a niche you love. As your followers increase, begin diversifying your topics. Posting will enhance your leverage, so everyone should do this.

Becoming an influencer is like becoming a hero in Lineage 2. Your character gains a special aura that not only boosts your attributes but also spreads your message across the entire server. In fact, I chose the least popular character to reduce competition in becoming a hero.

Many people work in crypto companies, which forces you to focus on roles like marketing, market making, or private sales. This gives you an advantage in the industry over those who view crypto as a hobby, as you can leverage industry relationships, gain deep insights, and even influence the game rules.

Now, the real opportunities are hidden within this focus.

While holding BTC or ETH is a safe choice, achieving 100x returns today requires deeper digging, like searching for gold in a fully developed mine. As Naval said, find work that feels like a game to you.

Whether it’s DeFi, on-chain wallet tracking, or opportunity mining in DAO forums, let your curiosity lead you. By building expertise, you will discover opportunities that others miss.

This niche—small enough to avoid the attention of big players yet large enough to achieve success—could be your gold mine in the crypto game.

Article link: https://www.hellobtc.com/kp/du/10/5505.html

Source: https://www.ignasdefi.com/p/the-crypto-game-how-to-play-and-win

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。